How To Play Crypto Using an ETF

Don’t get me wrong — I understand the precarious nature of Bitcoin today and we could be set for a bear market rally for an asset class that has been much maligned.

Cryptocurrencies have a reputation for being difficult to understand, so don’t be embarrassed if you’re befuddled — I felt the same way the first day I tried to understand this stuff.

The Harris Poll earlier this year found that 61% of people who had heard of cryptocurrencies still had little or no understanding of how they work.

How Do I Buy Bitcoin?

Conventional wisdom has it that the most likely route is a Bitcoin online exchange.

Create an account — enter a payment method.

Reputable exchanges will require information such as bank account details or a debit or credit card.

Then proof of identity is required such as a driver’s license, ID or passport.

After verification, purchase Bitcoin by transferring it to a personal hot wallet and buy and sell the asset!

Remember that these accounts coming directly from bitcoin brokers aren’t insured and aren’t secure.

Therefore, a better way to mitigate risk is by going through a Bitcoin ETF on the U.S. public markets with an official broker registered with the Security and Exchange Commission (SEC).

Not only do public stocks provide additional security as a bitcoin trading vehicle, but ETFs are an aggregation of crypto asset tracking data points reducing the volatility even more.

Unregulated crypto exchanges come with a higher understanding of operational and systemic risk and not everyone wants to venture into the arid Wild West without a horse or water.

If you trade with an official brokerage registered with the SEC, you are covered by Federal Deposit and Insurance Corporation (FDIC) insurance for up to $250,000 per account holder in a financial institution.

If there are joint owners, then the account is insured for up to $500,000 ($250,000 for each owner).

The FDIC is a U.S. government agency so, in effect, these accounts are federally insured.

There is also another layer to this — you are covered by Securities Investor Protection Corporation (SIPC).

SIPC is a U.S. government creation but not an agency of the U.S. and insures all brokerage accounts up to $500,000, but only up to $250,000 for cash in such accounts that are intended to be used for securities transactions.

Cash in brokerage accounts only for the purpose of earning interest is not protected. While SIPC has been established by Congress, it is funded by all of its member brokers/dealers.

In many cases, SIPC protects against unauthorized trading or theft in the account.

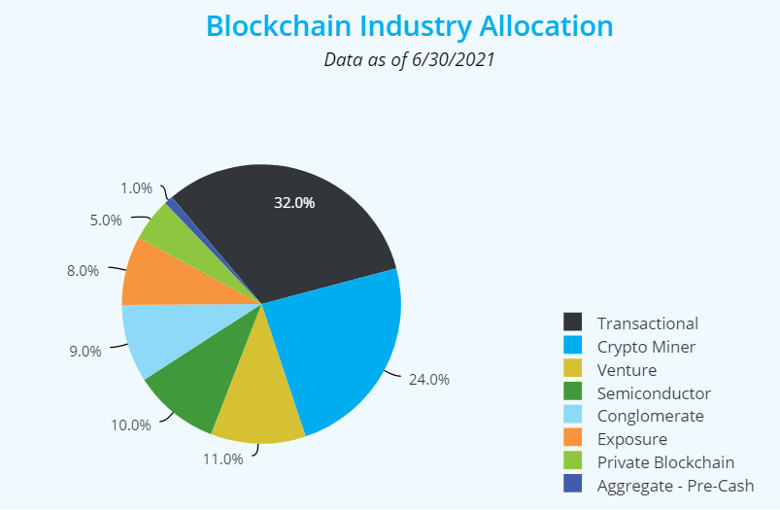

My favorite crypto ETF is Amplify Transformational Data Sharing ETF (BLOK) which has morphed into one of the best crypto ETFs on the market since its inception.

BLOK is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies.

BLOK’s biggest two positions are Bitcoin proxy MicroStrategy (MSTR) and a Canadian crypto mining company called Hut 8 Mining Corp (HUT).

I have already shot out a MicroStrategy trade alert to new readers and am incredibly bullish on the company.

However, this ETF encompasses more than MSTR offering broader exposure to firms related to Bitcoin, crypto miners, and software companies that are heavily into crypto.

Hut 8 engages in industrial-scale bitcoin mining operations. It also owns and operates 38 BlockBoxes in Drumheller, Alberta, and 56 BlockBoxes in Medicine Hat, Alberta.

BlockBoxes are one of the most powerful and cost-effective bitcoin mining units available on the market.

BLOK doesn’t track bitcoin 1:1, but it does mimic the price action relatively closely albeit with less extreme swings.

Controlling excess volatility is something you should be happy about.

BLOK also has an expense ratio of 0.71% which isn’t too expensive for those who want to buy and hold the ETF and not trade the derivative.

Buying BLOK is most likely the best way to ensure safe trading under the framework of the SEC, but I understand others have a higher risk profile which is also welcome.

To understand more about the ETF BLOK, click here.

(https://amplifyetfs.com/blok.html)

Although crypto has entered a crypto winter of sorts, it should be worth a trade from low levels. At least BLOK guarantees that you will be liquidated from your position and not frozen like some of these unregulated crypto exchanges.