Good Things Come To Those Who Wait

CRISPR technology has been receiving so much hype over the past years. However, the promise of this gene editing platform has yet to be realized.

Crispr gene-editing therapies can apply permanent modifications to our DNA by zeroing in on specific genes and then incapacitating them or reworking harmful segments of their genetic instructions.

While this could change in the coming years, investors have become impatient with the progress and lack of any major breakthrough in genomics. Some are losing confidence that this sector could experience explosive growth.

This is what happened with Intellia Therapeutics (NTLA).

Earlier this week, the company showed data that patients who received a one-time gene-editing infusion exhibited sustained improvement in a genetic condition that can result in fatal swelling when left untreated.

To be more specific, Intellia’s update means it could deliver a potentially permanent solution for hereditary angioedema. In this condition, a patient has a miswritten gene in their liver cells that produces a specific protein that triggers a dangerous swelling throughout the body.

Applying the treatment to 6 patients, Intellia’s one-time treatment lowered blood levels of the harmful proteins by more than 90% and decreased the swelling.

This is a more notable effect than the results from existing drugs like Takhzyro from Ionis Pharmaceuticals (IONS) and Takeda Pharmaceutical (TAK).

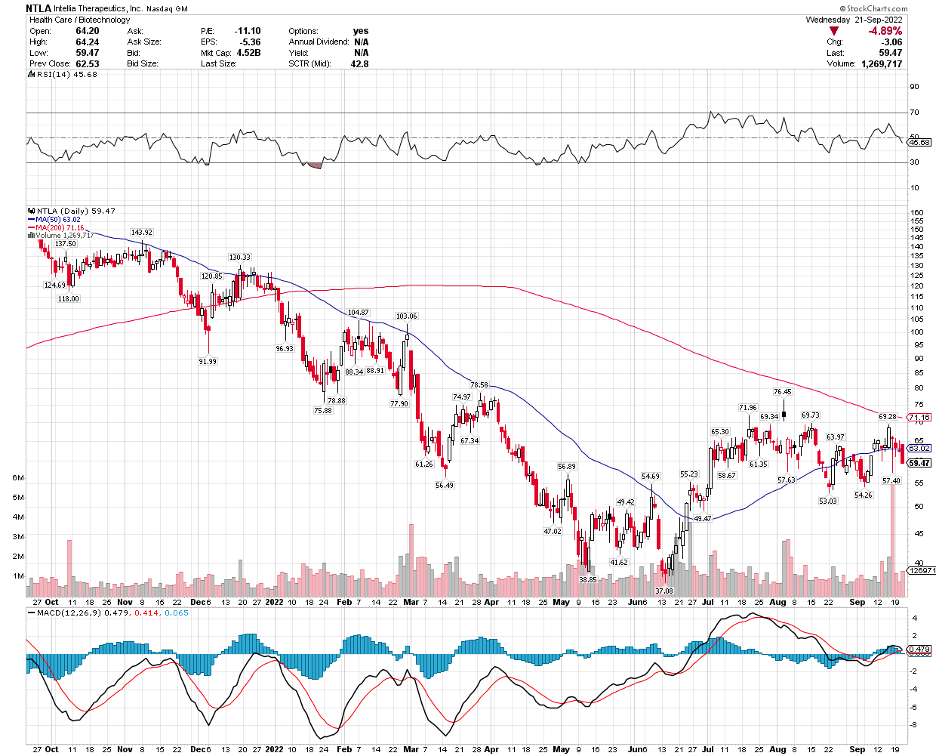

Despite the encouraging update, Wall Street still spurned the stock, and its price fell.

It looks like investors have lost patience with the slow progress of clinical studies in genetic treatments, pushing some to take advantage of the positive news from Intellia to abandon their positions.

Actually, it’s not only Intellia that suffered from this mistreatment by the market. Investors have also been dumping other stocks utilizing the Nobel-prize-winning technology, Crispr-Cas9, including CRISPR Therapeutics (CRSP), Editas Medicine (EDIT), Caribou Biosciences (CRBU), and Beam Therapeutics (BEAM).

Intellia was hailed the top CRISPR stock in 2021 when the company and its co-collaborator, Regeneron (REGN), shared their promising interim results from a Phase 1 study assessing NTLA-2001, a treatment for a rare genetic disease called transthyretin (ATTR) amyloidosis.

This Crispr infusion candidate managed to knock out rogue genes in the liver cells of 12 patients, halting ATTR’s poisonous effects on their hearts or nerves. Based on clinical data, Intellia’s therapy caused an over 90% drop in the fatal protein triggered by the genetic condition.

If successful, this one-and-done ATTR treatment from Intellia would go head-to-head against other chronic drug therapies like Onpattro by Alnylam Pharmaceuticals (ALNY) or Pfizer’s (PFE) Vyndagel, which generates $2 billion in sales every year.

Many companies use Crispr technology to edit human genomes in an effort to treat and possibly even cure rare genetic diseases. Their treatments typically utilize either an ex vivo or an in vivo approach. With ex vivo therapies, the genes are altered outside the patient’s body.

However, Crispr’s use is not only limited to targeting genetic conditions. There are also gene-editing companies that are working on leveraging the technology to come up with treatments for various kinds of cancer.

In particular, Crispr technology has been a biotech favorite in the development of chimeric antigen receptor T-cell or CAR-T therapies. There are used to genetically engineer immune cells to target specific tumors.

Apart from these, some biotech companies are using Crispr technology to conduct screening. This is different from genetic testing, though.

When using Crispr for screening, the genes are modified in a manner that makes them nonfunctional or inoperative. Crispr screening allows biotechs to explore which genes take on particular functions, which can be critical in the development of drugs and treatments.

Intellia’s recent updates are clear indications that Crispr technology works. Since this will be applied to humans, we should expect the timeline and adaptation to take longer.

I have become more and more thrilled with developments in the gene editing space. Moreover, I believe it’s no longer about “if” but when it will happen.

Overall, the gene editing sector is not for fast-paced investors. This is for those willing to wait for a very long time, particularly for stocks like Intellia Therapeutics.