Issuance Constraints Elevate Ether

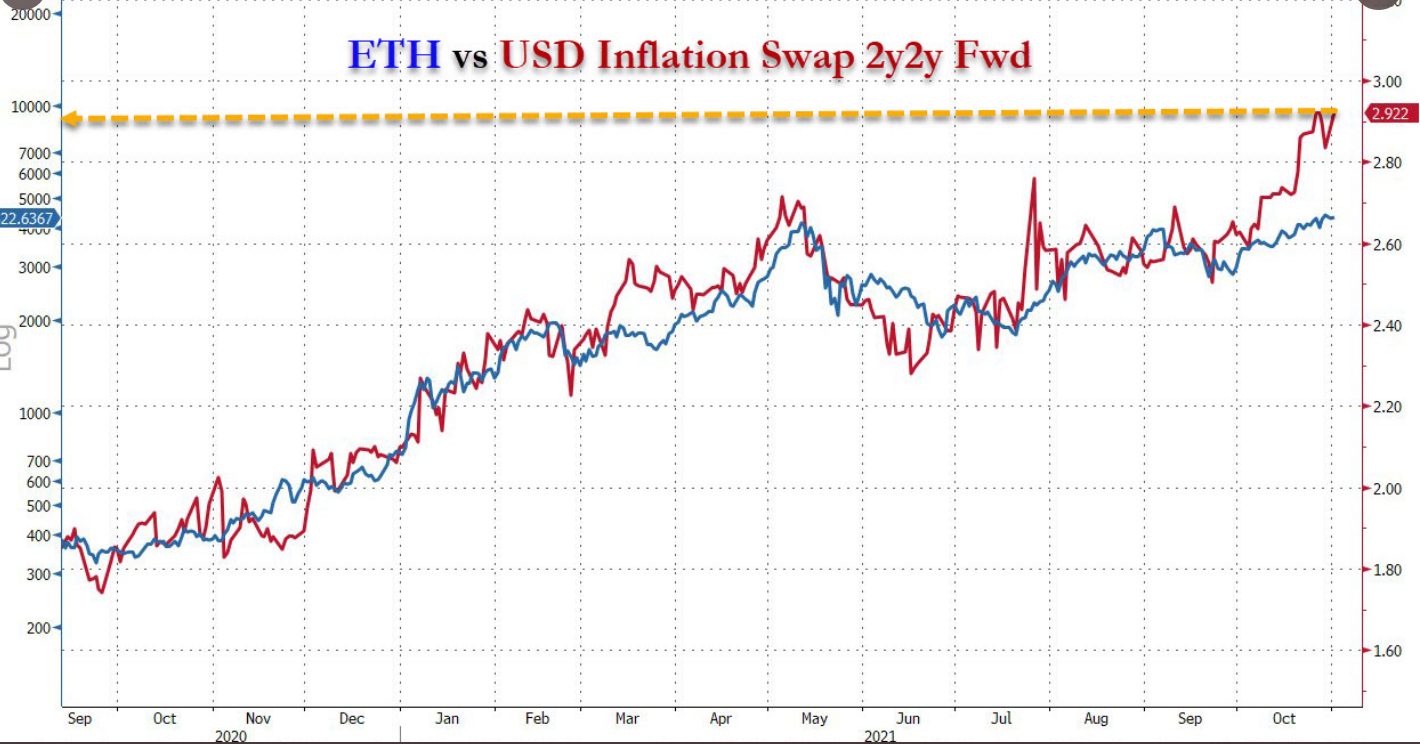

We are at the point where sure Bitcoin will go higher and I fully expect it to be close to $100,000 next year, but Ether will outgain Bitcoin by percentage points.

And it’s no shocker that Ethereum (ETH) has already climbed above $4,000 for the 3rd time this year.

Talk about a 2-foot putt.

In the last five months, the supply of ETH has shrunk meaningfully from 22 million tokens to 18 million today.

Dwindling supply intersected with higher demand means higher prices no matter what asset you’re talking about.

The tape shows that retail and institutional money piling into ETH in the last few months means fewer sellers looking for short-term smash and grab type of profits.

I do believe this is a legitimate reason why we are seeing the volatility of crypto settling down the last month as nobody is willing to take profits when they know more profits are on the table for next year.

In total, the Ethereum network has seen its first consecutive week of negative supply issuance as frothy markets drive persistently high transaction fees.

The London upgrade introduced a burn mechanism into Ethereum’s fee market in early August, meaning a small quantity of Ether (ETH) has since been destroyed with every transaction executed on the network.

The Ethereum London Hard Fork upgrade is a set of five improvement proposals.

Unlike Bitcoin, there is no limit to mining Ether coins, which makes it an inflationary cryptocurrency which is why development understood installing a deflationary mechanism would do wonders for the price of ETH.

Miners are paid new coins for validating each block of information. They are compensated with transaction fees that are paid by users.

One of the biggest benefits of the London upgrade is that it has enabled the Ethereum network to handle a higher transaction load per second. It will help with scalability and tackle the high transaction fees — one of the biggest complaints of small investors or those who make frequent transactions.

Since the London upgrade, more than 724,400 ETH worth $3.1 billion has been permanently destroyed.

Truth be told, ETH has not experienced lower transaction fees, or gas price.

Yet, the upgrade has not increased gas prices but has made them more predictable and stable.

This has led to a smoother network overall during peak hours.

Transaction volumes are 400% higher since the same period last year and Ethereum needs to handle the higher workload to legitimize itself into a solid cryptocurrency.

The inability to function properly as a network could cause a massive sell-off that would spill into more mature Bitcoin.

ETH simply won’t be attractive relative to other crypto if they can’t put a lid on transaction costs.

The reason equities are so attractive is not only because they are fully insured by the federal government, but because liquidity and costs are minimal.

Thwarting this underlying issue of a bloated supply, six times larger than Bitcoin's, should act as a major catalyst in awakening the price action of ETH and that’s what we are currently seeing.

In total, there's been a 57% reduction in cumulative ETH issuance to date and it’s hard for me to envision a scenario in which ETH is not over $8,000 per unit next year.

Generally speaking, after the transition to proof of stake, the supply of ETH will decline 2% annually.

The scarcity value that will hit next year will easily cause the asset to double quickly.

I predict a rapid run-up in ETH prices leading up to the December debt ceiling triggering new all-time highs in BTC and ETH.

Jump on the bandwagon while it’s still rolling!