January 27, 2025

(EARNINGS AND THE FED WILL TAKE CENTRE STAGE THIS WEEK)

January 27th, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY JAN. 27

8:00 a.m. Building Permits final (December)

8:30 a.m. Chicago Fed National Activity Index (December)

10:00 a.m. New Home Sales (December)

10:30 a.m. Dallas Fed Index (January)

10:35 a.m. Euro Area ECB Speech

Earnings: AT&T, Nucor

TUESDAY JAN. 28

8:30 a.m. Durable Orders (December)

9:00 a.m. FHFA Home Price Index (November)

10:00 a.m. Consumer Confidence (January)

10:00 a.m. Richmond Fed Index (January)

7:30 p.m. Australia Inflation Rate

Previous: 2.8%

Forecast: 2.5%

Earnings: Starbucks, Boeing, Lockheed Martin, Royal Caribbean Group, Kimberly-Clark, General Motors, RTX, Synchrony Financial

WEDNESDAY JAN. 29

2:00 p.m. FOMC Meeting

2:00 p.m. Fed Funds Target Upper Bound

Earnings: ServiceNow, International Business Machines, Meta Platforms, Lam Research, Western Digital, Tesla, Microsoft, Hess, Corning, T-Mobil, Norfolk Southern, Raymond James Financial, Automatic Data Processing

THURSDAY JAN. 30

8:15 a.m. Euro Area Rate Decision

Previous: 3.00%

Forecast: 2.75%

8:30 a.m. Continuing Jobless Claims (01/18)

8:30 a.m. GDP first preliminary (Q4)

8:30 a.m. Initial Claims (01/25)

10:00 a.m. Pending Home Sales (December)

Earnings: Baker Hughes, Apple, Visa, Deckers Outdoor, Intel, PPG Industries, KLA, Sherwin-Williams, Altria Group, Comcast, Southwest Airlines, Quest Diagnostics, Valero Energy, Pulte Group, Caterpillar, United Parcel Service, Thermo Fisher Scientific, Tractor Supply, Northrop Grumman, Mastercard, Blackstone, L3Harris Technologies.

FRIDAY JAN. 31

8:30 a.m. ECI Civilian Workers (Q4)

8:30 a.m. PCE Deflator (December)

8:30 a.m. Core PCE Deflator (December)

8:30 a.m. Personal Consumption Expenditures price index (December)

8:30 a.m. Personal Income (December)

9:45 a.m. Chicago PMI (December)

Earnings: Phillips 66, Colgate-Palmolive, Exxon Mobil, Chevron, AbbVie

It’s a mega week for earnings this week. Expect volatility. Investors will be watching closely to see if earnings can measure up to expectations. Among the many companies reporting this week, Tesla is one to watch. The stock has a history of volatility around earnings, and I expect this time to be no different. Margins will be important for the fourth quarter. Wall Street expects operating profit margins of about 10.5%, up from about 8% in 2023’s fourth quarter. Investors have their eyes on the company’s growth and will be wanting to hear that the lower-priced new model – Model 2 – is on track for a launch in the coming six months. Additionally, investors are keen to hear that orders for the updated Model Y are looking strong in the U.S. and China. Self-driving cars have also become important. Since Tesla’s Oct 10 robo-taxi event, the stock is up around 70%. Over the previous 12 months, Tesla is up some 122%. Tesla remains in our portfolio. It was recommended on September 27, 2024, at $260.46.

We’ve now seen the end of Trump’s first week as President. He has made some sweeping changes already. But the big unknown is still tariffs. Even though he has threatened several countries with tariffs, nothing concrete has been forthcoming yet. This week, inflation and interest-rate outlooks are in the spotlight for the financial markets. Fed Chair Jerome Powell steals the spotlight on Wednesday when he delivers his press conference. Trump and Powell appear to be at loggerheads as to who controls the stock market.

Disney has been named a top pick by Morgan Stanley for 2025. The bank rates the stock overweight and expresses in a December note that it expects substantial streaming profits in the future. The bank went on to say that Disney is also likely to benefit from another strong year of advertising growth in the U.S. Disney shares have soared 22% over the past six months.

We have 105/110 LEAPS on Disney that are due to expire around mid-year. I recommended the stock on June 21st, 2024 when it was sitting at $101. 52.

MARKET UPDATE

S&P500 broke above the Dec. 6th high at 6100. Despite an overbought market, there is still no confirmation of a short-term top in the chart patterns, so, for now, the trend remains on the upside. We should note that a close back below the 6090/6100 area may argue at least a near-term top. A topping pattern can show some volatile trading. Support = ~6030/40 and below that = ~5970.

GOLD has been rallying and there is still no sign of a confirmation of even a short-term top. Having said that gold is close to resistance in the $2790/95 area, and there is potential for gold to form a peak here for a few months. Again, this could be part of a larger topping playing out. Support = $2735/40 area.

BITCOIN is moving sideways and could be in the middle of a topping process. In other words, we could see consolidation to downside movement for the next month or so. The longer Bitcoin observes a tight range without making any sizeable new highs, the more likely we are seeing a topping play out.

Support: 99,500/100,000. Any break/close below the rising trend line at around 91,500/92,000 would be a bigger-picture bearish sign. (That is not to say that is the end of the Bitcoin rally altogether, but rather a consolidation at a lower level before moving higher in the future).

TRADE ALERT

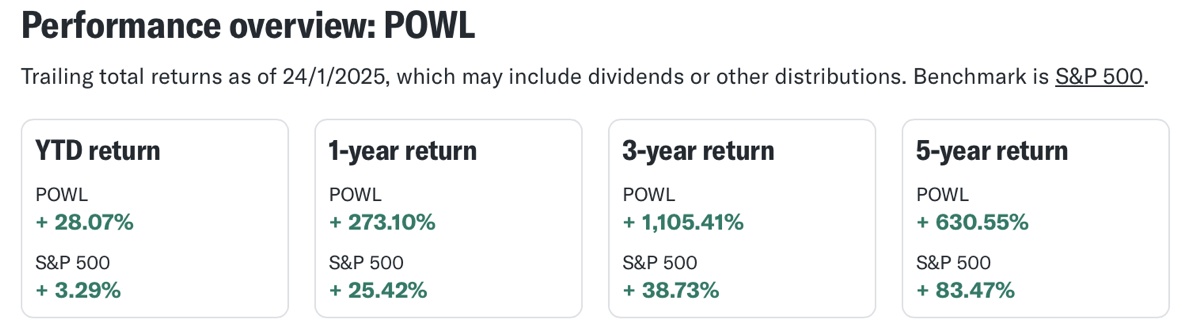

Powell Enterprises (POWL)

(POWL) designs develops, manufactures, sells, and services custom-engineered equipment and systems. The company’s principal products include integrated power control room substations, custom-engineered modules, electrical houses, medium-voltage circuit breakers, monitoring and control communications systems, motor control centres, switches, and bus duct systems, as well as traditional and arc-resistant distribution switchgears and control gears. The company serves onshore and offshore production, liquified natural gas facilities and terminals, pipelines, refineries, and petrochemical plants, as well as electric utility, light rail traction power, mining and metals, pulp and paper, data centres and other municipal, commercial, and industrial markets. The company has operations in the United States, Canada, the Middle East, Africa, Europe, Mexico, and Central and South America. Powell Industries – originally a metal-working shop - was founded in 1947 and is headquartered in Houston, Texas.

Powell Enterprises reported revenue of $275.06 million in the last reported quarter, which represented a year-over-year change of +31.8%. EPS of $3.77 for the same period compares with $1.95 a year ago. Next reported earnings are on Feb. 6.

Recommendation: Scale into/Buy the stock.

Powell Enterprises (POWL) Daily Chart $290.80

Powell Industries (POWL) Weekly Chart $290.80

QI CORNER

HISTORY CORNER

On January 27

1945 -Soviet Troops liberated the Nazi concentration camps Auschwitz and Birkenau in Poland.

Cheers

Jacquie