January 29, 2024

(A WEALTH OF NEWS WILL HIT WALL STREET THIS WEEK)

January 29, 2024

Hello everyone,

Welcome to the last few days of January 2024. Hope you are all doing well.

Calendar for the week ahead

ET Times

Monday, Jan 29.

10:30 a.m. Dallas Fed Index

Japan Unemployment Rate

Previous: 2.5%

Time: 6:30 pm ET

Earnings: Whirlpool

Tuesday, Jan 30

9:00 a.m. FHFA Home Price Index (November)

9:00 a.m. S&P/Case Shiller comp. 20 HPI (November)

10:00 a.m. Consumer Confidence (January)

10:00 a.m. JOLTS Job Openings (December)

Australia Inflation Rate

Previous: 5.4%

Time: 7:30 pm ET

Earnings: Marathon Petroleum, United Parcel Service, General Motors, Pfizer, Advanced Micro Devices, Alphabet, Starbucks, Microsoft.

Wednesday, Jan 31

8:15 a.m. ADP Employment Survey (January)

8:30 a.m. ECI Civilian Workers (Q4)

9:45 a.m. Chicago PMI (January)

2:00 p.m. FOMC Meeting: Previous 5.5%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: Boeing, Mastercard, Qualcomm

Thursday, Feb 1

8:30 a.m. Continuing Jobless Claims (1/20)

8:30 a.m. Initial Claims (1/27)

8:30 a.m. Unit Labour Costs preliminary (Q4)

8:30 a.m. Productivity preliminary (Q4)

9:45 a.m. Markit PMI Manufacturing final (January)

10:00 a.m. Construction Spending (December)

10:00 a.m. ISM Manufacturing (January)

UK Interest Rate Decision

Previous: 5.25%

Time: 7:00 am ET

Earnings: Meta Platforms, Amazon, Apple, Royal Caribbean, Clorox.

Friday, Feb 2

8:30 a.m. Jobs report (January) Previous: 216k.

10:00 a.m. Durable Orders (December)

10:00 a.m. Factory Orders (December)

10:00 a.m. Michigan Sentiment final (January)

Earnings: Chevron, Exxon Mobil

All eyes will be on Wall Street this week.

Earnings season is well and truly upon us and most of the so-called Magnificent Seven are reporting this week. (Alphabet, Apple, Amazon, Meta Platforms, Microsoft)

The latest Federal Reserve monetary policy decision is heard on Wednesday. Investors believe the Fed will keep rates on hold, and there now seems to be an expectation that any rate cut won’t be delivered until June. By that time, we are likely to have softer inflation numbers and even more softening in the labor market. The data is continuing to confirm the downside trend in inflation.

Jobs Report on Friday. This will clue us all in on whether the labor market is continuing to cool, and Friday’s report is expected to confirm this. The unemployment rate is expected to have ticked up to 3.8%, from 3.7% previously.

Investors are seeking signs of a broadening rally this year, and there seems to be some palpable concern. What if the broader market doesn’t catch up to the mega-cap stocks? Is this an indication that the rally won’t last? Have the mega-caps run too hard too fast on artificial intelligence dreams? Let’s patiently wait for the reports. I am still confident in the bull market – long-term.

All eyes on the earnings picture.

Earnings aside for a moment.

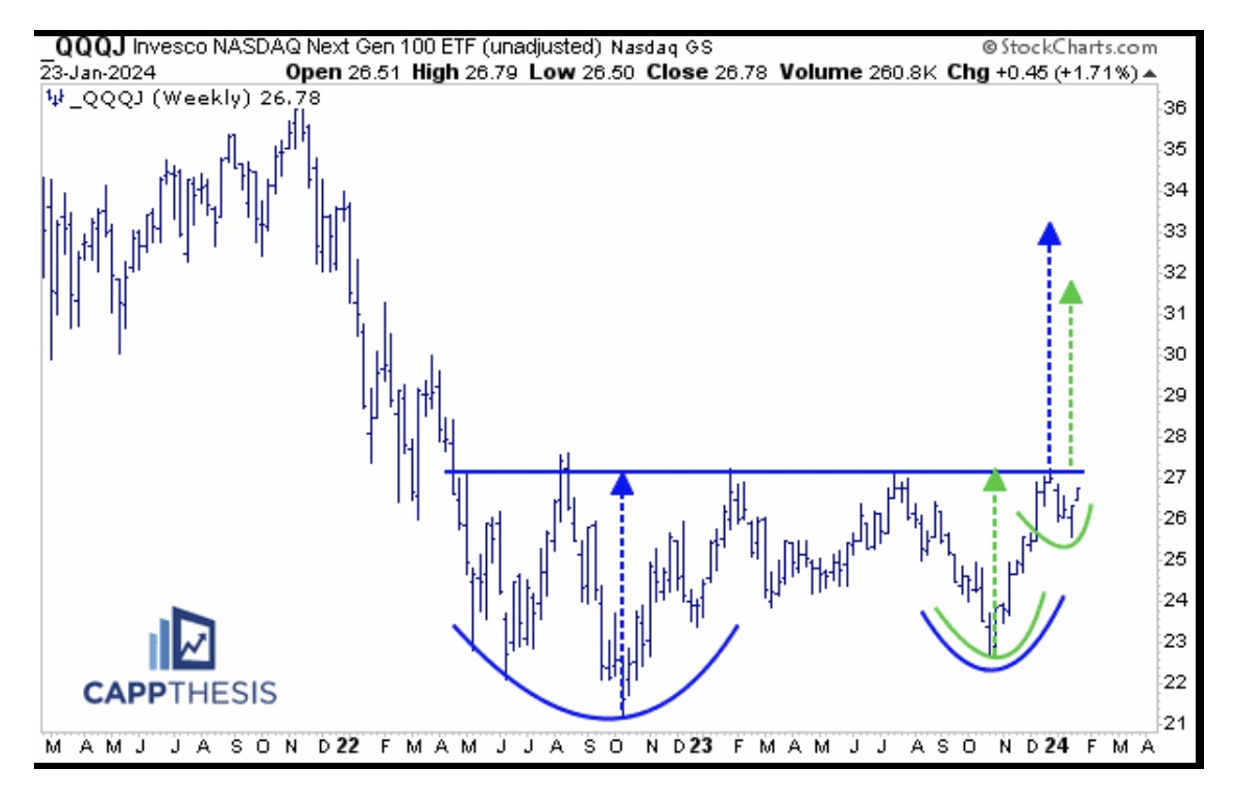

We all know the Magnificent 7 has been all the rage lately. But there are other technology stocks worthy of our attention. The Invesco NASDAQ Next Gen 100 ETF (QQQJ) tracks the next biggest 100 Nasdaq stocks after the Nasdaq 100 – Nasdaq stocks Nos: 101 to 200. This ETF shows a good technical setup.

If stocks are to track higher from here, the areas that haven’t broken out yet could very well play catch up. I’m talking about areas within technology, but also other sectors as well.

Let’s look at the (QQQJ) holdings and see how it compares to the Nasdaq 100 (NDX)

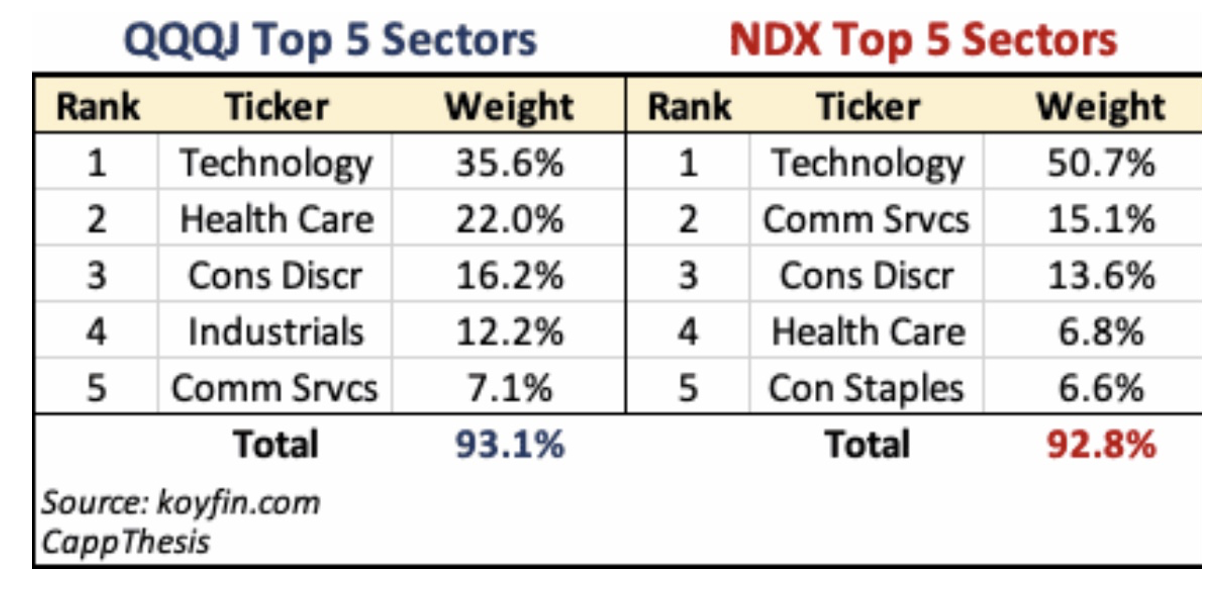

The QQQJ and the NDX (Nasdaq 100) are similar in a few ways.

# Technology is their biggest weight for both.

# The top five sectors represent 90% of both.

But as you can see from the chart here the NDX is very top-heavy and the QQQJ is not.

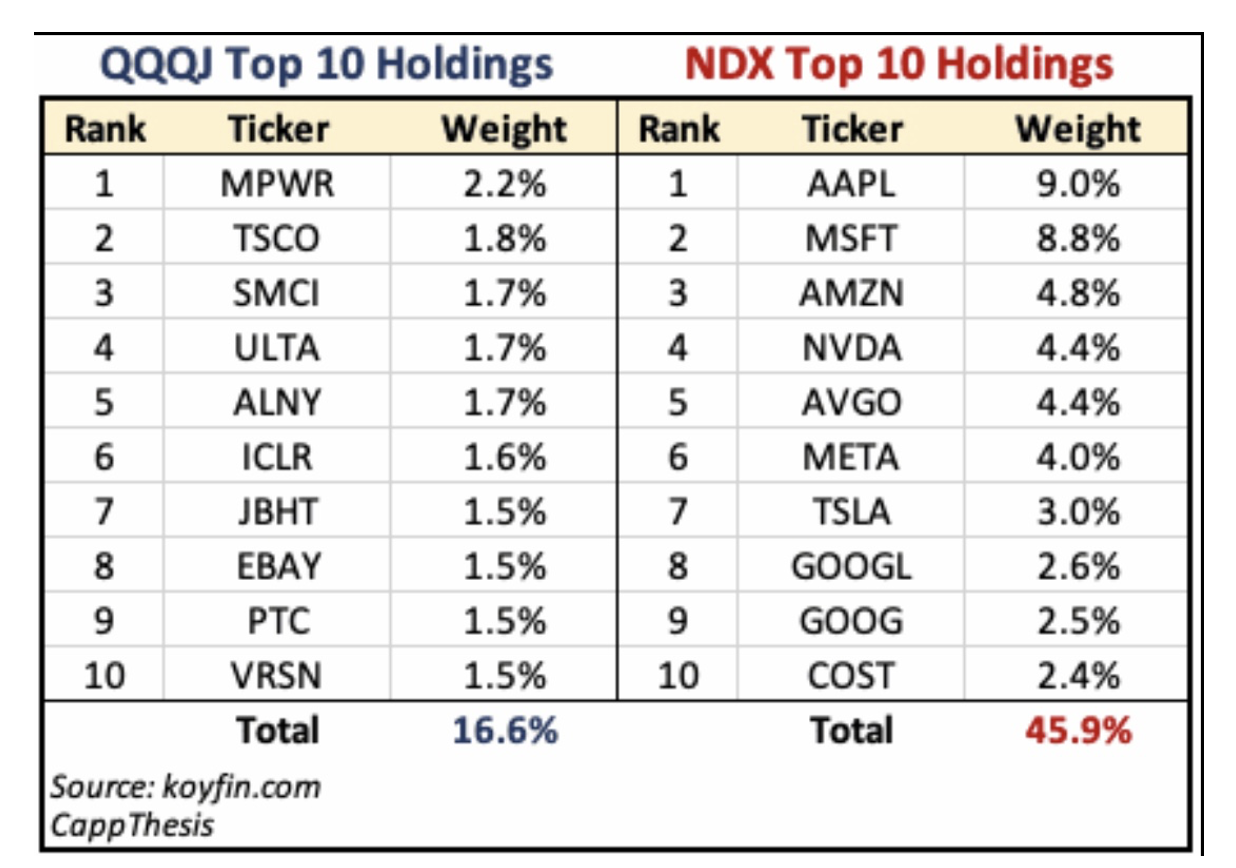

Six stocks in the NDX have weightings of at least 4%, while the biggest weight in QQQJ is MPWR at 2.2%. The top 10 NDX stocks represent nearly 46% of the entire index. The top 10 within QQQJ are just 16%. So, we could easily argue that QQQJ gives investors a more balanced exposure to its holdings than QQQ does.

OK, I imagine some of you might not know what the QQQJ ticker symbols stand for, so here is a quick brief.

MPWR Monolithic Power Systems

TSCO Tractor Supply Co.

SMCI Super Micro Computer Inc.

ULTA Ulta Beauty Inc. (largest beauty retailer in the U.S.)

ALNY Alnylam Pharmaceuticals Inc.

ICLR ICON PLC. (Irish headquartered Nasdaq listed multinational healthcare intelligence and clinical research organization that provides consulting, clinical development, and commercialization services for the pharmaceutical industry.)

JBHT J.B. Hunt Transport Services

EBAY eBay Inc.

PTC PTC Inc. (helps companies achieve their digital transformation goals)

VRSN Verisign Inc. (based in Virginia U.S. & operates a diverse array of network infrastructure & is a provider of domain name registry services.

So, now we have a bit of background, let’s talk about the chart patterns – the technical setup.

The QQQJ is looking very attractive here and could be close to a breakout through a multi-year trading range. This pattern – which represents a bullish cup and handle – dates all the way back to the spring of 2022 (blue). Because of the range being so extended, another bullish formation has taken shape within it: a second cup and handle pattern that started at the July ’23 high (green). On the chart here the upside targets are near 33 and 32, respectively. Buy a small parcel of the ETF and hold for an upside breakout.

A Mackay patrolled beach.

A Coolangatta (Gold Coast) patrolled beach

Cheers,

Jacquie

“Success is not to be pursued; it is to be attracted by the person you become.” - Jim Rohn