January 3, 2025

(THE GLOBAL FINANCIAL SYSTEM COULD BE REVOLUTIONIZED WITHIN THE NEXT DECADE)

January 3, 2025

Hello everyone,

In the NYSE, investors make upwards of 1 billion trades per day. Many of those trades appear to happen in milliseconds, except when you investigate further, that’s not the reality.

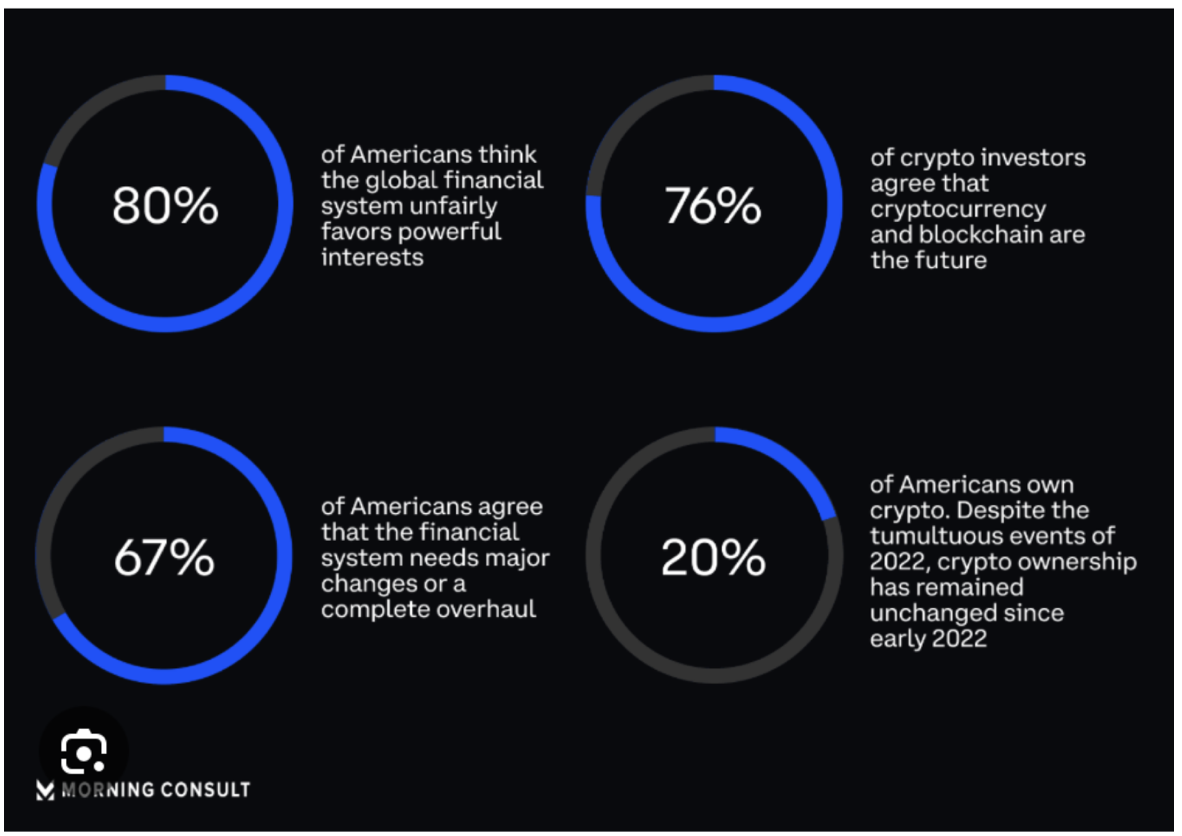

Trades on Wall Street take days to settle, and lots of people to make them happen. Take market makers, for example. They are the middlemen handling all those trades on Wall Street, and the top 5% of market makers handle nearly 30% of all trades. The fact is these intermediaries help with volatility, but they create a gap between buyers and sellers in the markets, and there are a lot of gaps in the financial system (which are beyond our control.)

Have you ever noticed how long some bank transfers take?

Some of the big banks think they may have a solution. JP Morgan, Citibank, and Goldman Sachs want to push the financial system into the next generation and to do that, they need to borrow a tool from crypto – blockchain. Presently all large-scale global financial infrastructure is highly warehoused or functions through different silos. In other words, money moves on one set of rails, assets move on a different set of rails. They operate independently, and information cannot be shared because of system limitations.

But being able to move money 24/7 365 is what we are moving towards.

These banks believe it could become a 5 trillion-dollar industry. In other words, we could see 5 trillion in combined tokenized asset-trading volume by 2030.

Why do these big banks think blockchain can turbo-charge the financial system?

Wall Street still operates in T+2. Trade + two days. That’s how long it takes for the standard securities settlement – for cash and assets to change hands. So, for instance, if you sell some stock on Tuesday, the cash won’t hit your bank until Friday.

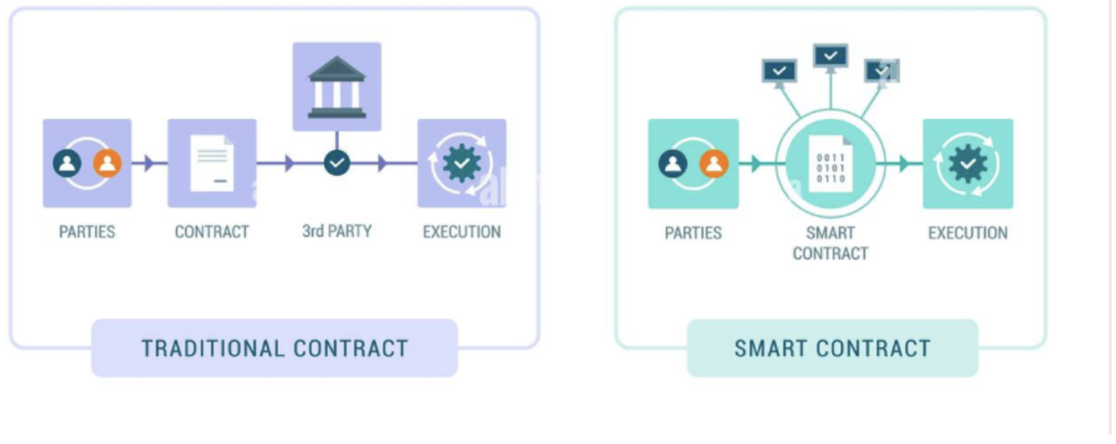

Electronic trading and modern payment processing have accelerated the global financial system to move assets much faster. You don’t have to be an investment banker to feel the lag in the financial system. ACH transfers, credit card refunds, and all kinds of money that move in our economy take time to go from one person to another. Part of the slowness is how many steps and people are involved. On Wall Street, for example, brokers help set up a transaction, and they can charge a commission. Then market makers connect brokers to the assets they are trying to buy or sell. They charge a fee, too, on the difference or spread of the asking price of an asset and what someone is willing to pay. Very large transactions will need to go through even more steps for security and fraud prevention.

Some big banks are hoping that tokenization on blockchains can streamline the process of trading assets and maybe make it cheaper. It would revolutionize and rewrite financial market infrastructure.

To understand how tokenization works, we need to talk about ownership in the digital era. Right now, it’s hard to transfer ownership of real-world items over the web.

We all know that you can buy a car through an online marketplace, but the title that proves your ownership of this car only arrives in the mail a few weeks later. Inefficient in the modern world, wouldn’t you say? In the hope of bringing ownership online, developers are creating tokens that represent real-world items. You can do this with any kind of asset: stocks, bonds, or a token that could represent ownership of a building or a car. Banks backing this believe that it may create new investments altogether, and that’s why they are putting their money behind it. For example, JPMorgan has Onyx, a blockchain platform they launched in 2020. In the short time since then, it’s handled 700 billion in short-term loans through its private blockchain. JPMorgan describes it as a “killer app” for the future of finance. Larry Fink, the CEO of BlackRock, called digital asset innovation and tokenization the next generation for markets.

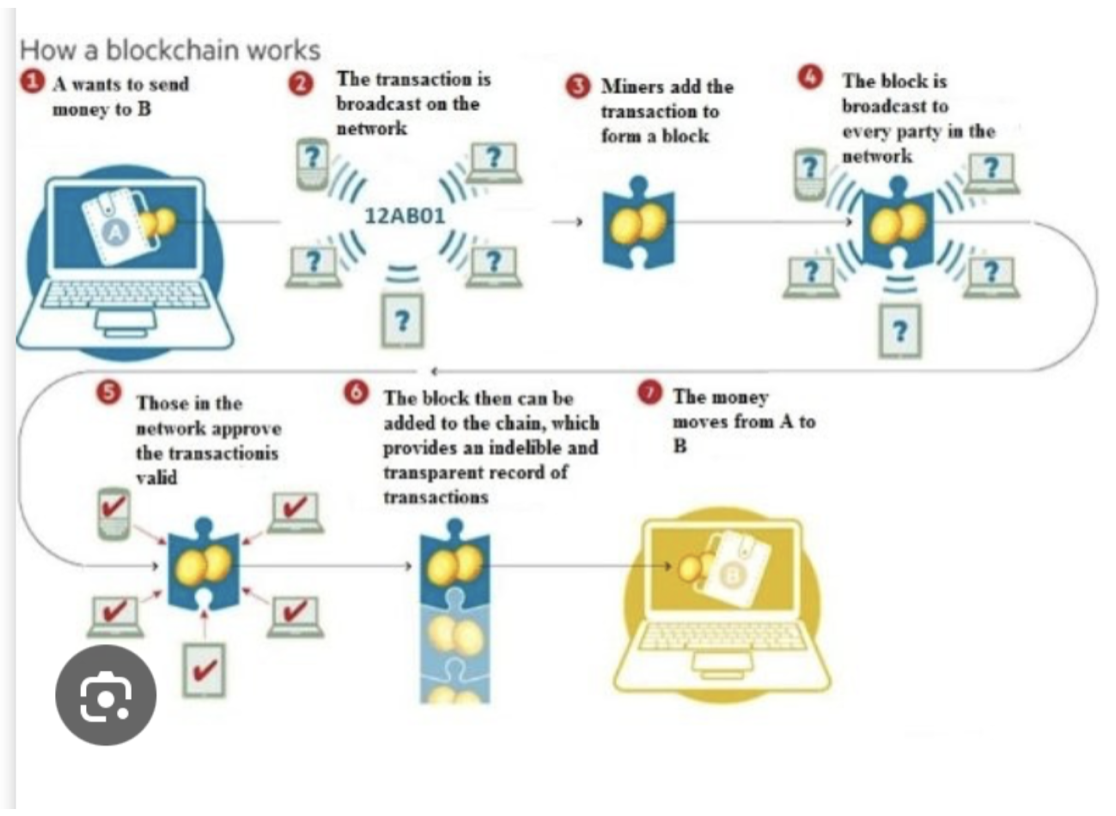

A blockchain is basically a database of all the transactions. There are many copies of the database, which helps to keep it secure. Each block is cryptographically signed so that any tampering is immediately evident. Additionally, you have a consensus mechanism to control how you update that database.

If technology provides you with the capability to use one rail line to transfer value, assets, and information, a lot of the inefficiencies and friction that exist in the regular financial infrastructure start to disappear.

Blockchains are meant to be transparent, cutting down the need for intermediaries that could charge fees or the need for extra due diligence. Proponents say it could enable P2P transactions across many parts of the economy.

In addition, this technology would allow for brand new forms of ownership, like splitting, fractionalizing ownership of property through real estate tokens, or tokenized deposits in bank accounts to allow for quick transfer of money between people using P2P transactions.

The IMF said in February that tokenising stocks and bonds could cut trading costs but requires the money paying for those assets to be tokenised as well, which would lead banks to make tokenised cheque accounts for faster payments.

The global financial system is one of the most regulated systems in the world and making any changes will be slow going. There will be a gradual movement forward in small steps.

Citibank has recently introduced Citi Token Services, which is a new blockchain-based service that will transform how institutional clients deposit and trade assets. In the evolving world of blockchains and smart contracts, Citibank has enhanced its products and services, including digital money, trade, securities, custody, asset servicing, and collateral mobility.

Cheers

Jacquie