January 31, 2024

(THE RISE OF BIOTECHNOLOGY WILL BE A GAME CHANGER FOR THE HEALTHCARE INDUSTRY)

January 31, 2024

Hello everyone,

I’m going to dive into the Healthcare Industry today. It may have done poorly in the last couple of years, but analysts are bullish on it right now. By 2050 biotechnology and artificial intelligence will lead to advances in genetic engineering that could lead to an era of personalized medicine, facilitating customized treatments based on each person’s genetic makeup. No more one-size-fits-all medical care. So, it’s an area that deserves our attention.

I believe healthcare investors may be able to climb the wall of worry in 2024.

Citibank, among others, expects the Federal Reserve to ease its restrictive monetary policies over time. Growth stocks such as those in tech and biotech usually benefit from rate cuts.

Stocks dialed into the trends of longevity and innovation saw a downturn in 2023. This gives us opportunities now.

Analysts have cited biotech, in particular, as one of a few areas to watch.

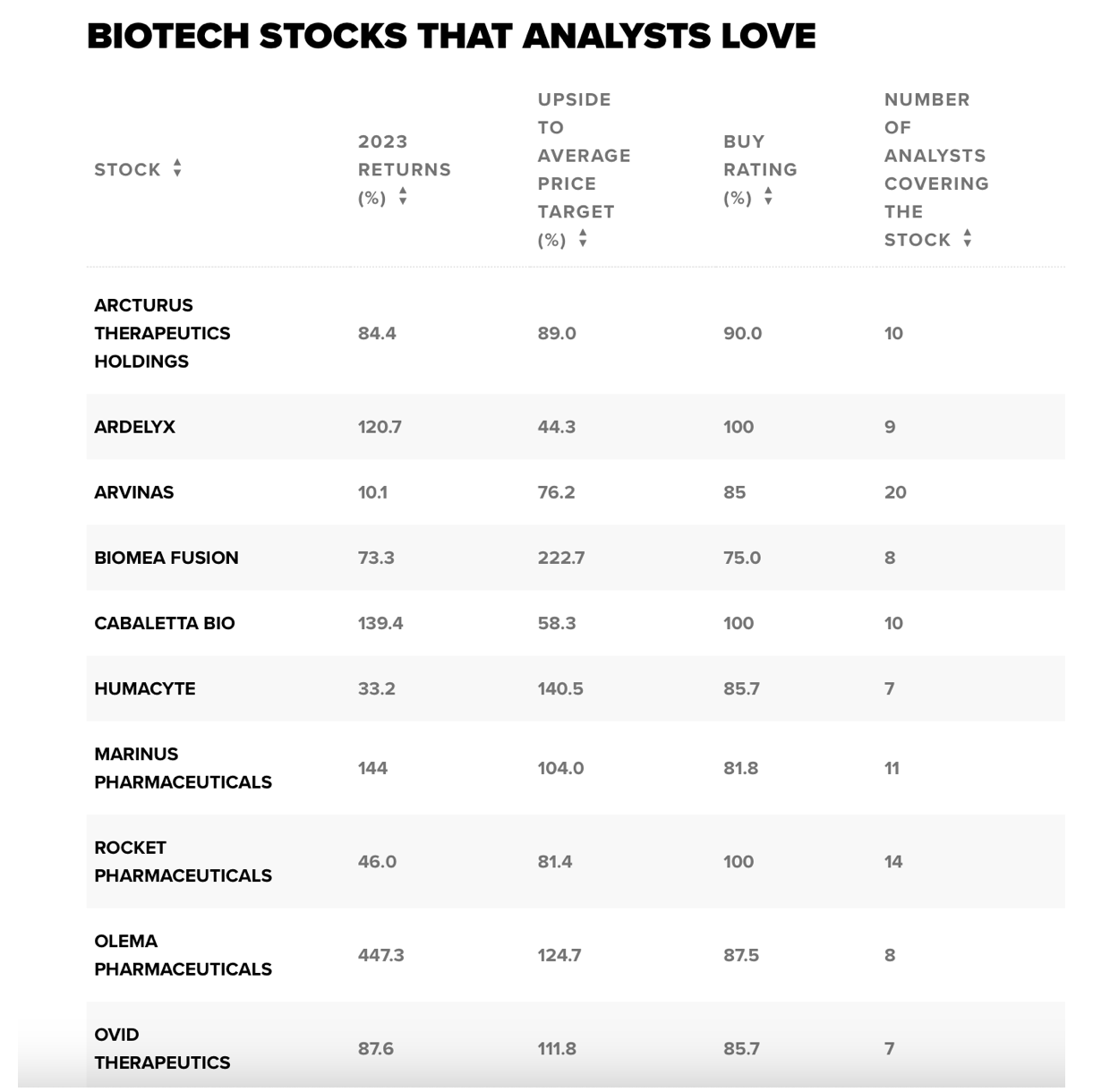

I have been looking for biotech stocks that did well last year and that analysts are still positive about.

These stocks were up more than 20% in 2023.

They have a potential upside to the average price target of more than 40%.

They have a buy rating of more than 70%.

And seven or more analysts have covered the stocks.

Humacyte (HUMA)

Marinus Pharmaceuticals (MRNS)

Olema Pharmaceuticals (OLMA) is involved in developing therapies for women’s cancers, particularly in breast cancer. The company is looking to partner for its Phase 3 studies and it’s anticipated that shares could react once such a relationship is announced in the near to mid-term.

Ovid Pharmaceuticals (OVID)

These stocks have all been given more than 100% upside.

Biomea Fusion (BMEA) has been given more than a 200% upside to the average price target and a 75% rating from analysts. (Citi gave it more than 800% upside last November, as the bank remarked that its treatment therapies had “potential advantages” over others.

Another three stocks here drew 100% buy ratings from analysts: Ardelyx (ARDX), Cabaletta Bio (CABA), and Rocket Pharmaceuticals (RCKT). Of these, RCKT got the highest potential upside of 81.4%

Here is a brief description of just a few of these stocks that I like:

Biomea Fusion (BMEA) (Stock price: $17.74)

A biopharmaceutical company focused on the discovery and creation of novel covalent small molecules to treat patients with genetically defined cancers. Their mission is to create therapies that cure patients of their diseases. Thomas Butler co-founded Biomea Fusion in August 2017. He is CEO and a member of the Board of Directors. Analysts’ ratings put the company near the top of the Biotech industry. The name biomea derives from the Greek word bios meaning “life” and the Latin word mea meaning “my”.

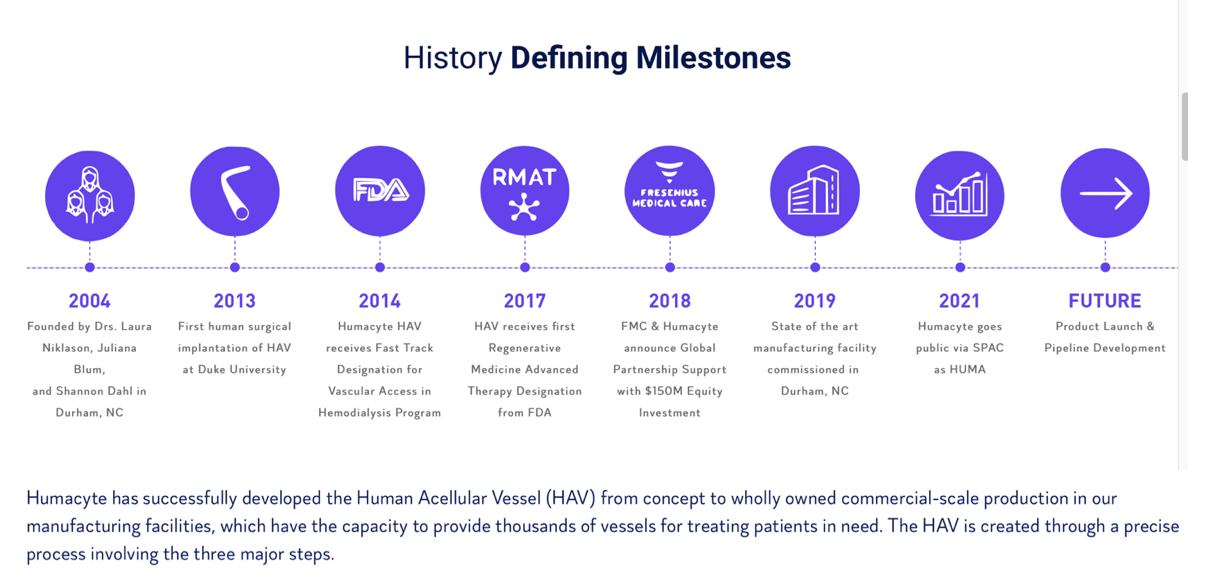

Humacyte (HUMA)(Stock Price: $3.19)

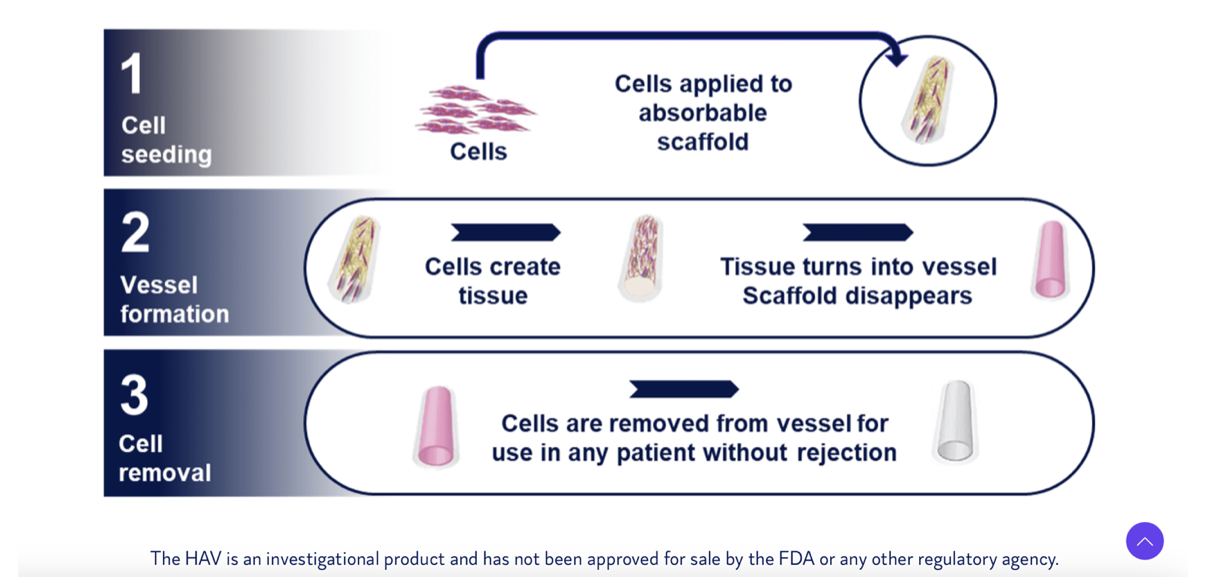

This company is involved in the manufacture of human acellular matrix products for vascular and non-vascular applications. It offers its products to the cardiovascular, cosmetic, soft tissue reconstruction, neurosurgical, and orthopedic markets. The company was founded by Laura E. Niklason and Juliana L. Blum on October 13, 2004, and is headquartered in Durham, NC.

On average, Wall Street analysts predict that HUMA’s share price could potentially reach $7.75 by Dec 27, 2024. The average HUMA stock price prediction forecasts a potential upside of 170.98% from the current share price of $2.91.

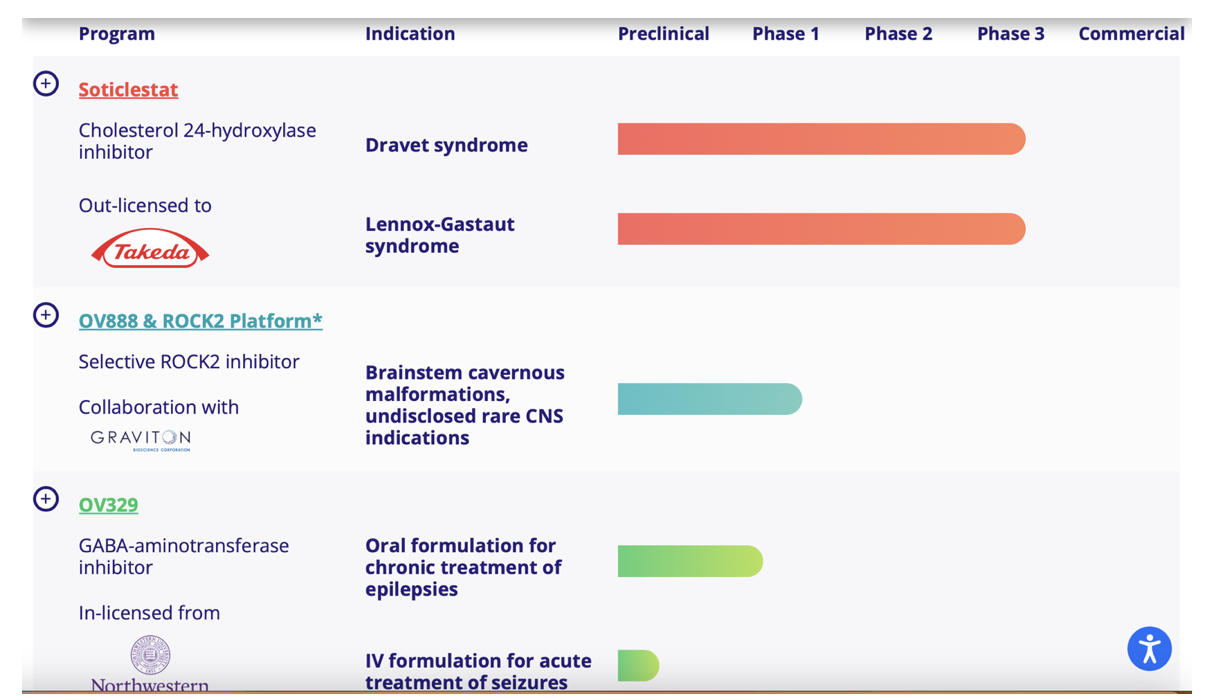

Ovid Therapeutics (OVID) (Stock Price: $3.93) is a New York-based biopharmaceutical company working towards providing treatments for rare neurological disorders. In other words, the company is looking to end epilepsy and seizures through the scope of science. The company is in the process of developing potentially small-molecule medicines that seek to drastically improve the lives of those affected by rare disorders with seizure symptoms. Jeremy Levin, D. Phil, MB BChir, is the chairman and chief executive officer of Ovid Therapeutics Inc.

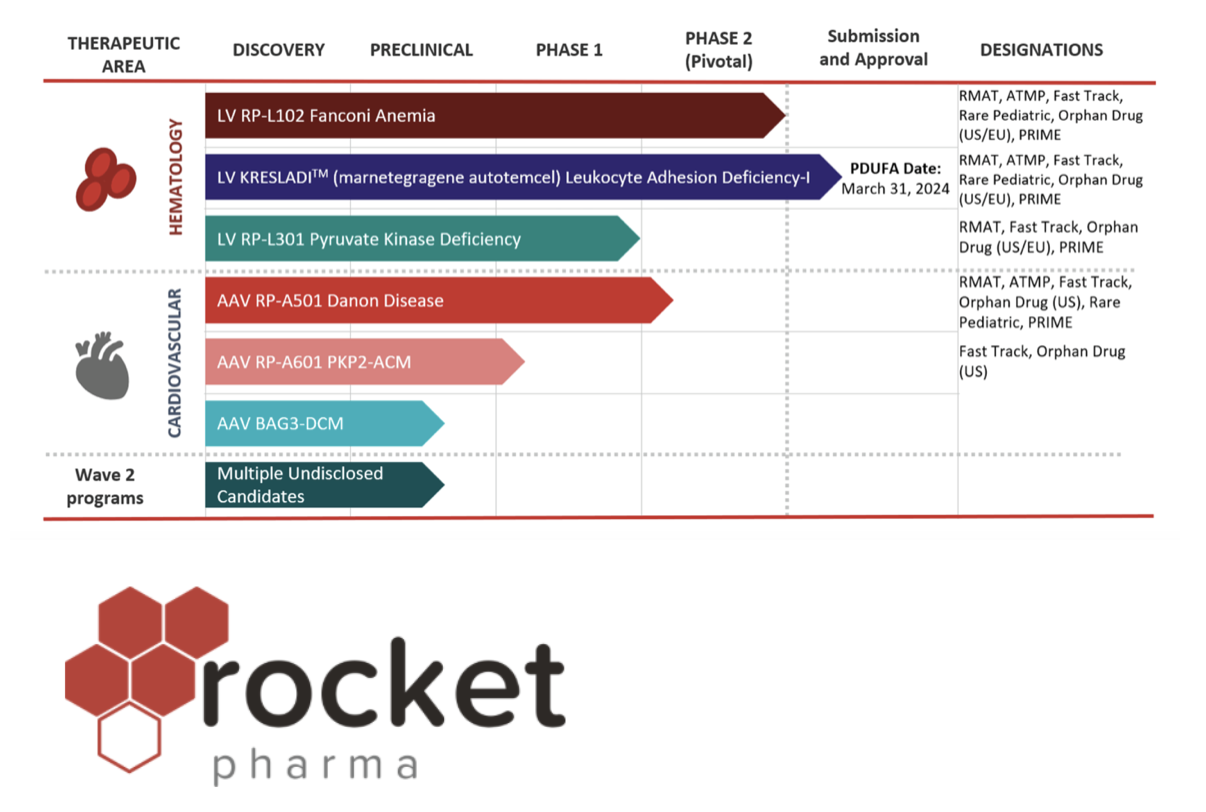

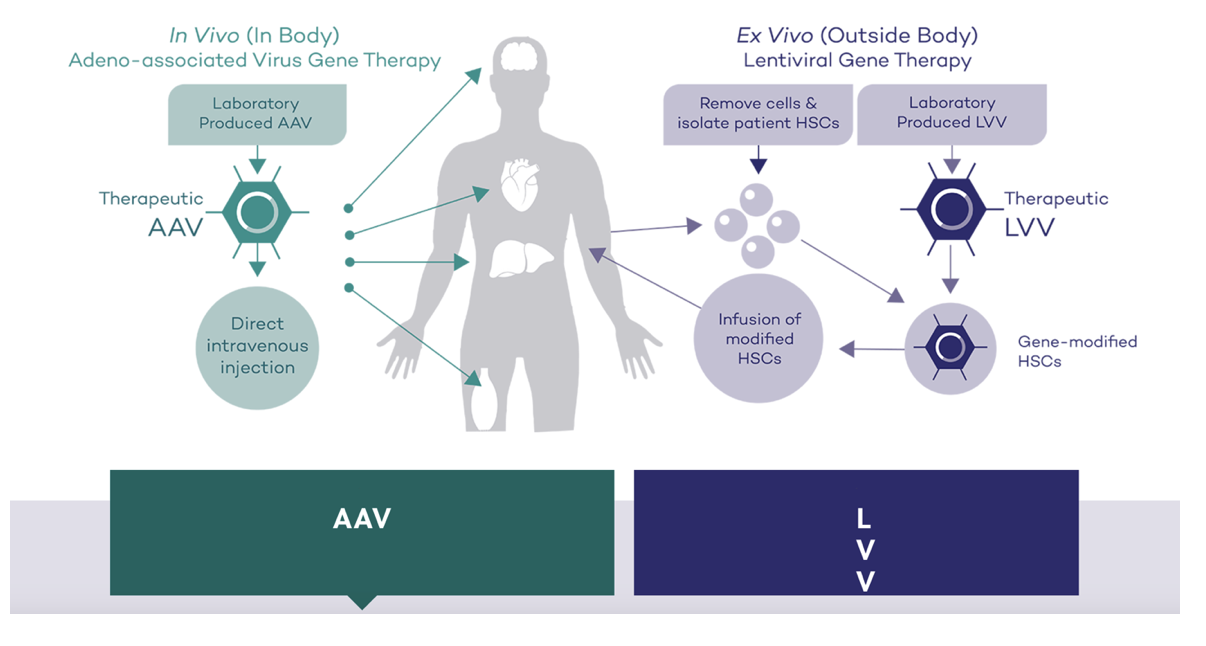

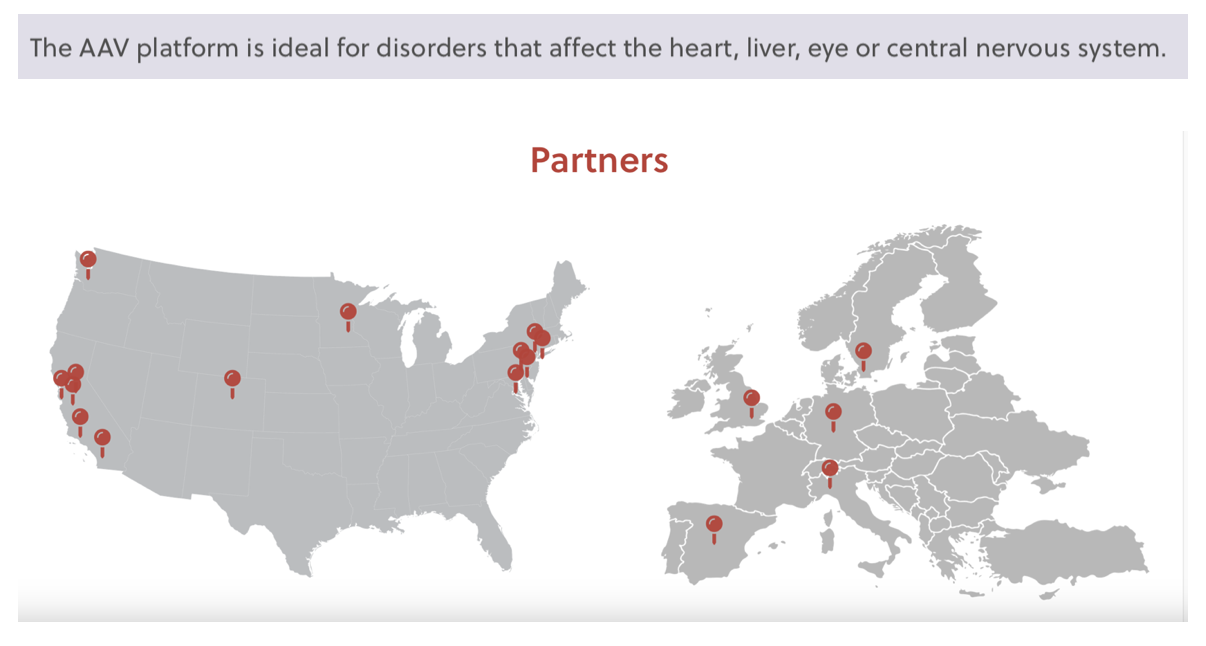

Rocket Therapeutics (RCKT) (Stock Price: $28.96) life mission is to develop gene therapies to cure patients with life-threatening diseases. The company has launched a multi-platform pipeline of treatments that directly target the genetic mutation in the affected cells for rare life-threatening disorders.

Biotech ETFs:

iShares Biotechnology ETF (IBB) or the SPDR S&P 500 Biotech ETF (XBI)

These ETFs hold a basket of shares, including those I have briefly described above. If you would like to invest in the biotechnology area, you can average in with small parcels in single stocks or purchase shares in an ETF for the long term. Biotechnology is an area that will lead to discoveries, development, and the manufacture of new therapies that can cure our modern-day diseases.

Daily chart IBB

Weekly chart IBB

Daily chart XBI

Weekly chart XBI

Cheers,

Jacquie