(AUSTRALIA CHALLENGES BIG TECH BY IMPOSING SOCIAL MEDIA BANS FOR UNDER 16’s)

November 27, 2024

Hello everyone

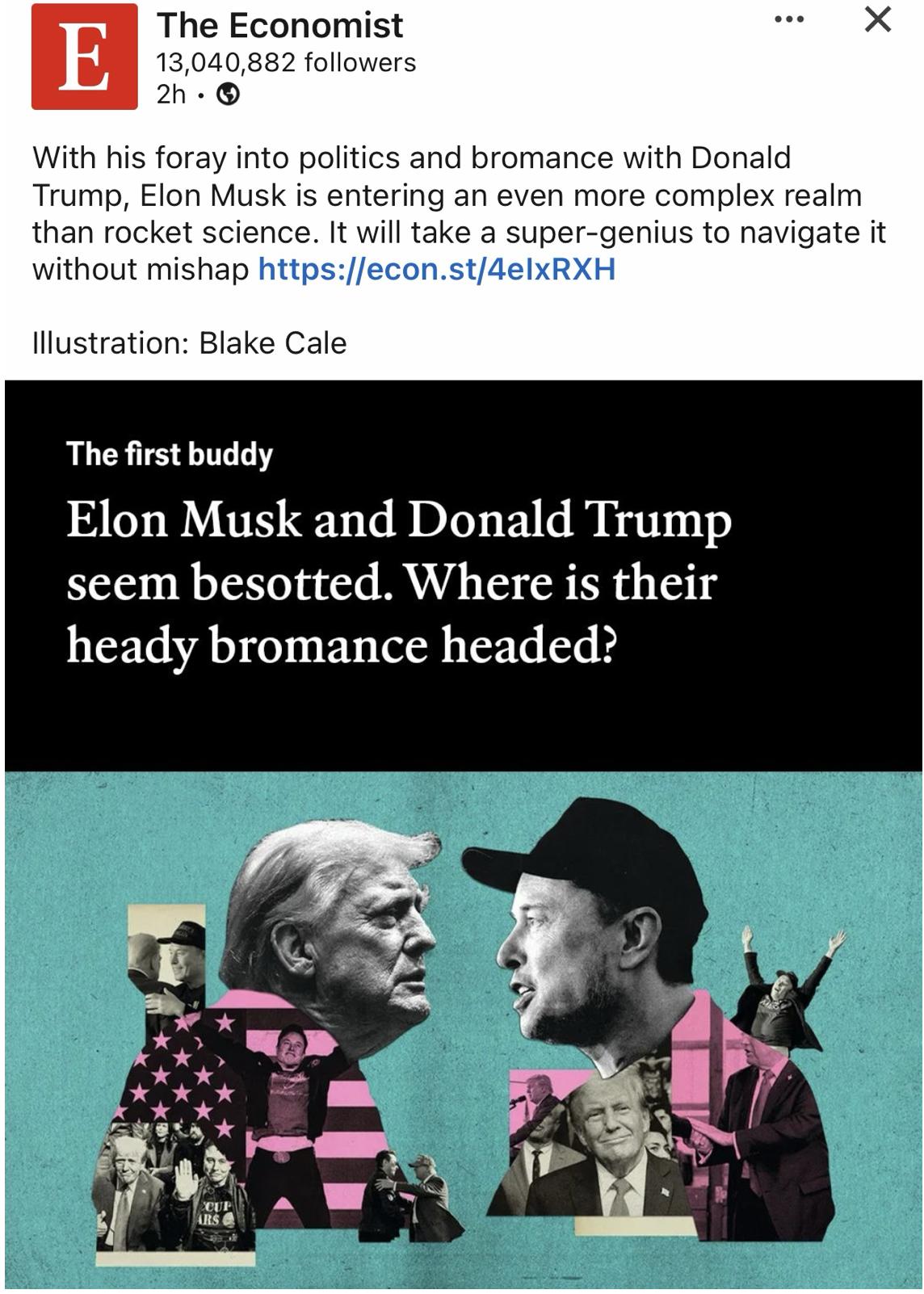

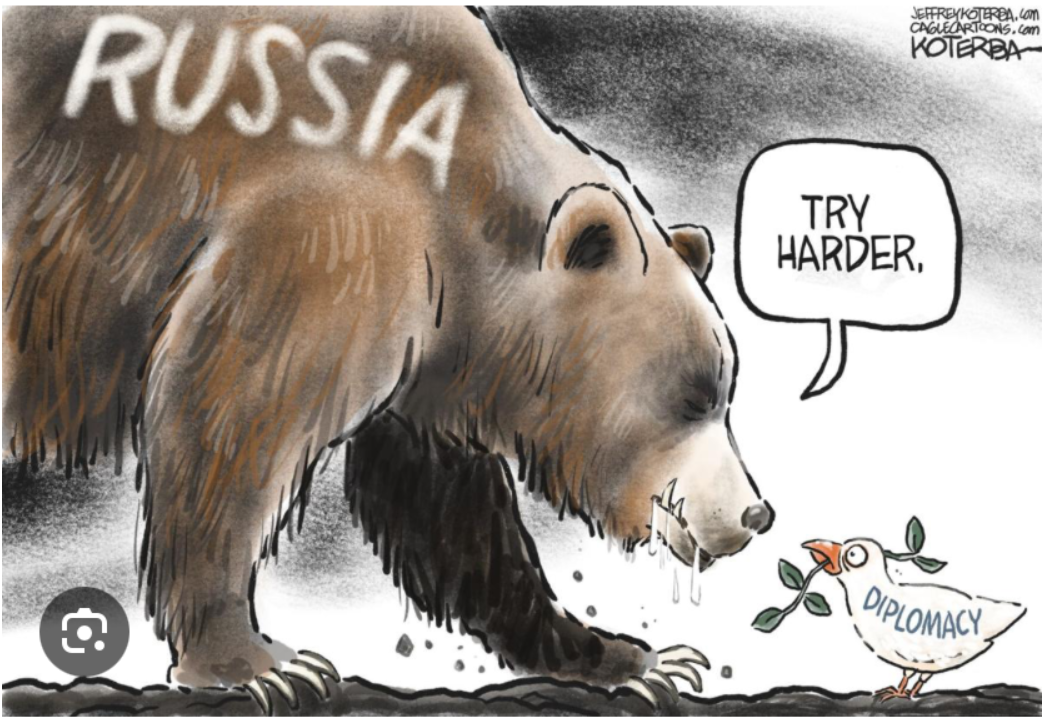

AUSTRALIA COULD BE IN THE DOGHOUSE UNDER TRUMP’S WATCH

It seems that Donald Trump’s team finds Albanese’s move to introduce social media bans for those under 16’s a little bit “on the nose,” to say the least. So much so that Australia could find itself hit with hefty US tariffs.

Elon, who is not a stranger to sharing his views bluntly, has already slammed the move within hours of the bill being tabled. “Seems like a backdoor way to control access to the internet by all Australians.”

If the bill is passed, social media companies could be hit with fines of up to $50 million if they fail to do enough to verify a user’s age on their platforms.

The changes will impact social platforms like TikTok, Facebook, Instagram, Reddit, and X, but YouTube will be exempt.

Snapchat is also expected to come under the same Australian law.

A ban on social media won’t be a cure all. Stopping someone looking at social media will not address mental health issues by itself. It’s more complex than that.

Of course, the ban won’t stop teenagers under 16 from using social media. They will find a way to get around it.

Here’s a way to look at the ban.

There are age restrictions on alcohol. Having those restrictions in place at a certain age sets a standard.

The laws would come into force 12 months after passing, and the eSafety commissioner would be responsible for enforcing the legislation.

How they are going to enforce the legislation is not yet clear.

Ultimately, more education programs about social media need to be put in place – in schools, universities, and in workplaces – to highlight the pros and cons and understand its place and function in the world at large.

Such programs would enable parents and children to develop knowledge and awareness of how to navigate these spaces safely.

We all know that the character of people who use this channel of communication can be either destructive or helpful.

Unfortunately, those who want to inflict harm find social media facilitates their malicious intent. They hide behind their anonymity. Fake posts scammers parading around under the guise of “looking for romance” when they are really looking for the contents of your wallet. And let’s not forget your actual friend’s Facebook page being hacked by some loser who has nothing better to do. Or scammers who use Facebook to sell something or offer their trade services and then disappear after they receive the funds.

No doubt, with the advancement of AI, social media could morph into a smarter communication form, which may be able to better police and eradicate the “wolves in sheep’s clothing,” or at least “red flag” the post.

My 19-year-old son only uses Instagram occasionally; he doesn’t use any other social media platforms. Discord is his platform of choice to communicate with friends.

Social media platforms should be held accountable for making sure their platform is a safe space to use.

Equally important is educating users about how to safely traverse these platforms so mental health issues do not dominate their lives.

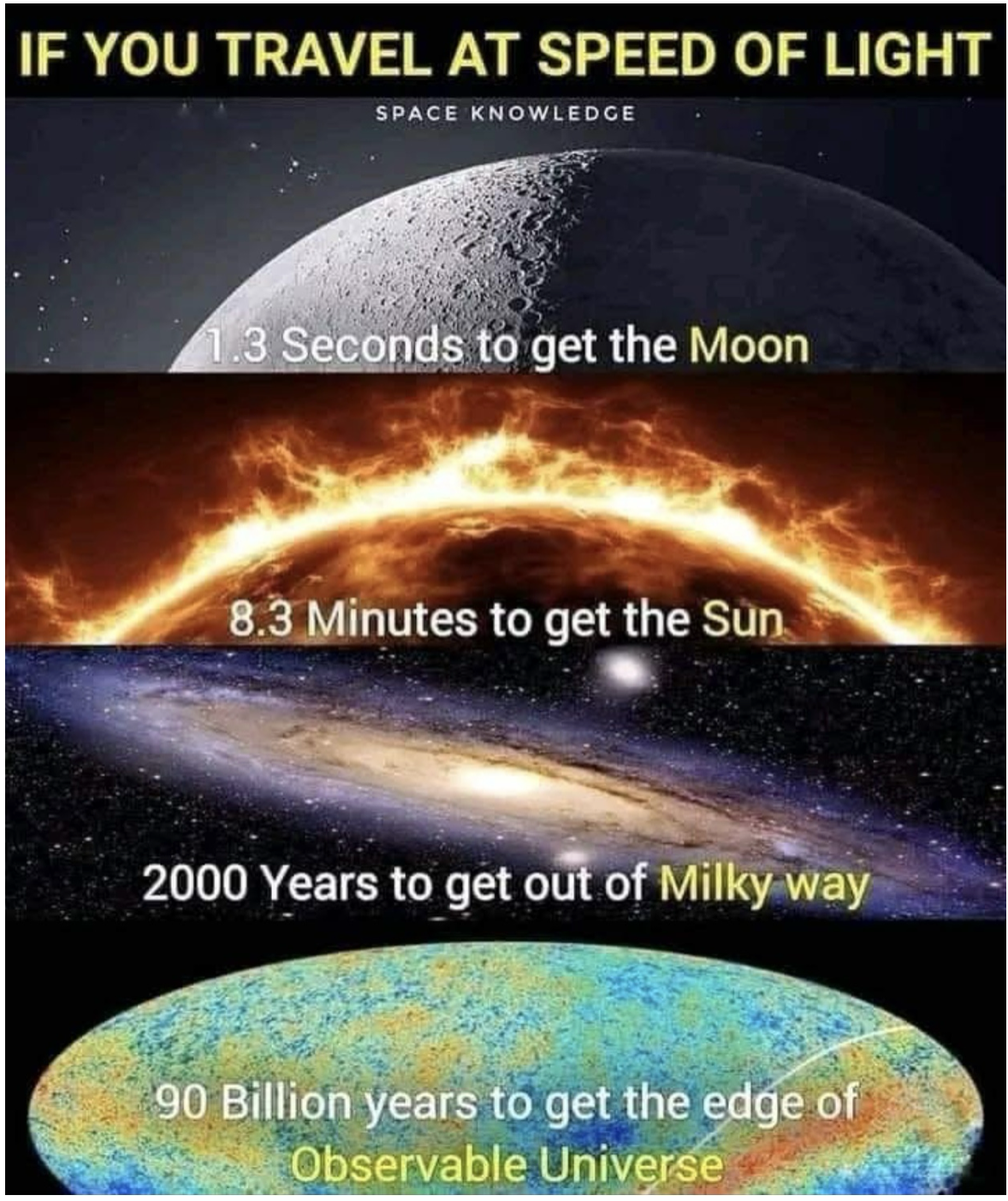

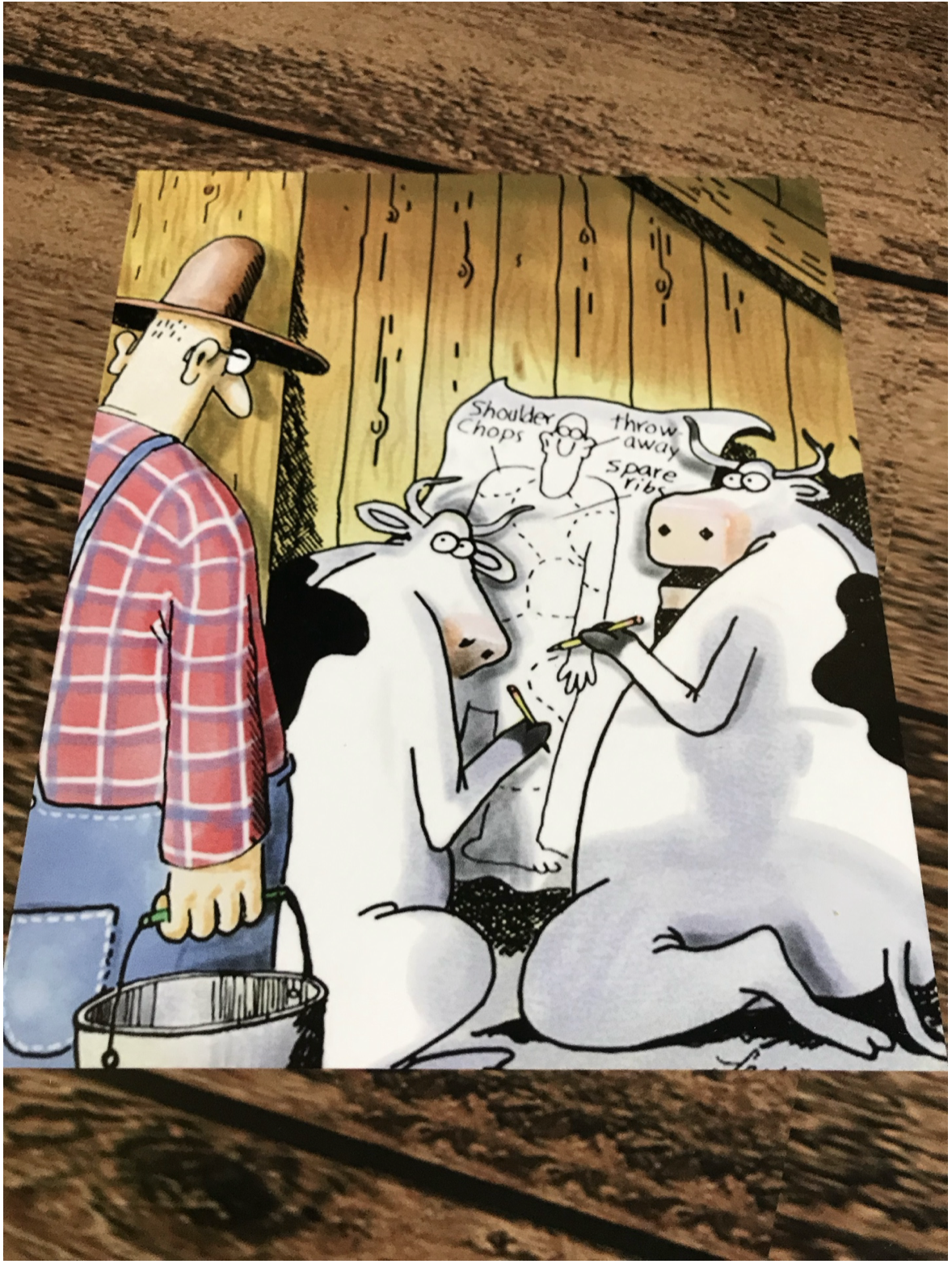

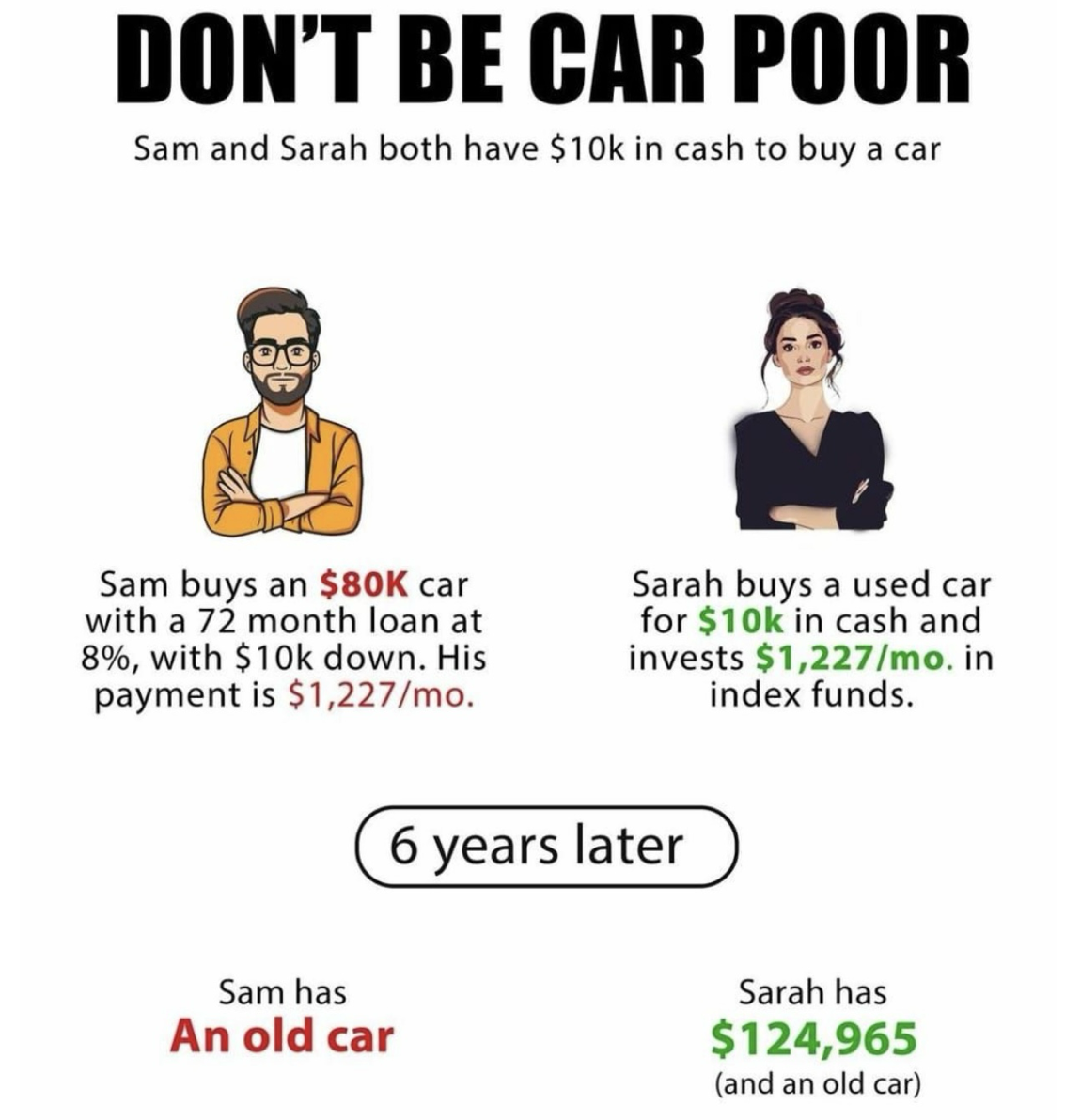

QI CORNER

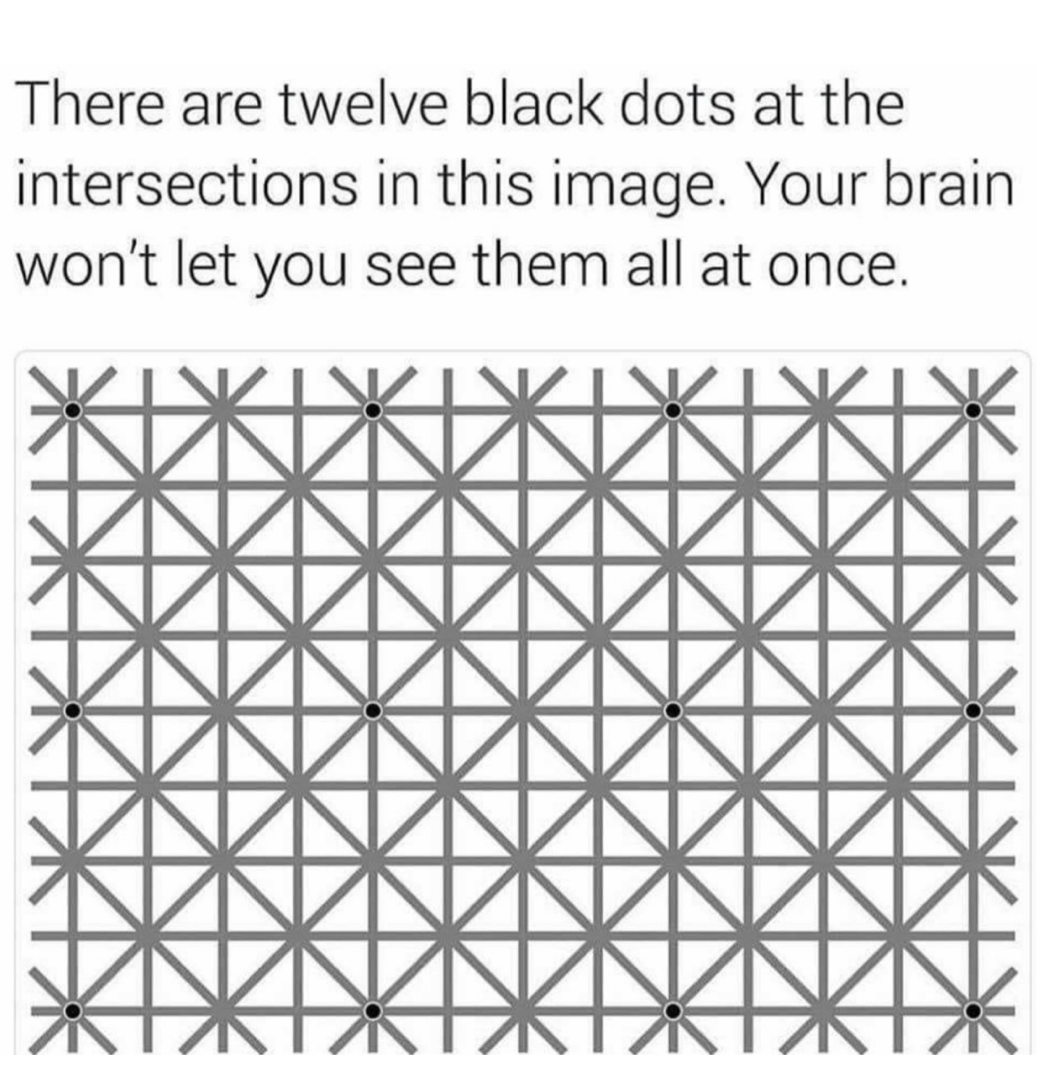

SOMETHING TO THINK ABOUT

HOUSEKEEPING

Apologies for the late arrival of the October Zoom meeting recording. It is still being edited. The November Zoom monthly meeting will be held early next week. Zoom links will be sent out in the next couple of days.

And

Cheers

Jacquie