July 15, 2024

(RESHUFFLING THE SECTOR LANDSCAPE IN READINESS FOR A RATE CUT)

July 15, 2024

Hello everyone,

Week ahead calendar

Monday, July 15

8:30 a.m. Empire State Index (July)

12:30 p.m. US Fed Powell Speech

Earnings: Goldman Sachs, BlackRock

Tuesday, July 16

8:30 a.m. Export Price Index (June)

8:30 a.m. Import Price Index (June)

8:30 a.m. Retail Sales (June)

10 a.m. Business Inventories (May)

10 a.m. NAHB Housing Market Index (July)

8:30 a.m. Canada Inflation Rate

Previous: 2.9%

Forecast: 2.9%

Earnings: J.B. June Transport Services, State Street, Morgan Stanley, Bank of America, PNC Financial Services Group, United Health Group.

Wednesday, July 17

8:30 a.m. Building Permits (Preliminary)

8:30 a.m. Housing Starts

9:15 a.m. Industrial Production

9:15 a.m. Manufacturing Production

2:00 p.m. Fed Beige Book

2:00 a.m. UK Inflation Rate

Previous: 2.0%

Forecast: 2.0%

Earnings: United Airlines, Discover Financial Services, U.S. Bancorp, Johnson & Johnson, Citizens Financial Group, ASML

Thursday, July 18

8:30 a.m. Continuing Jobless Claims (07/06)

8:30 a.m. Initial Claims (07/13)

8:30 a.m. Philadelphia Fed Index (July)

10:00 a.m. Leading Indicators (June)

8:15 a.m. Euro Area Rate Decision

Previous: 4.25%

Forecast: 4.25%

Earnings: Netflix, M&T Bank, KeyCorp, Domino’s Pizza, D.R. Horton, Blackstone, Taiwan Semiconductor.

Friday, July 19

2:00 a.m. UK Retail Sales

Previous: 2.9%

Forecast: -0.4%

Earnings: SLB, American Express, Halliburton, Fifth Third Bancorp, Regions Financial, Huntington Bancshares

PREPARING FOR THE INEVITABLE RATE CUT

With interest rates predicted to fall, the bond Universe is looking increasingly attractive.

Falling interest rates tend to be a good thing for the bond market because interest rates and bond prices historically share a strong, inverse correlation.

Three niches of the bond market – government bonds, investment-grade corporate bonds, and high-yield bonds – look more attractive due to the ongoing shift in interest rate expectations for the second half of 2024.

Morningstar recently published its 2024 outlook on interest rates and projected that the federal funds rate could drop as low as 3.75-4.00% by the end of 2024. Morningstar expects that downward trend to persist into the next year, forecasting that interest rates could drop to a range of 2.25-2.50% by the end of 2025. (I have been forecasting this for some time in my Zoom monthly meetings).

Like Morningstar, PIMCO also expects rate cuts this year. It sees 75 basis points of net cuts in 2024, which implies that the federal funds rate will drop to roughly 4.50% by the end of 2024.

So, now we understand that it is almost a done deal that the Fed will cut this year, and maybe more than once, what should we be looking at to capitalize on this landscape?

Bond products to consider in 2024

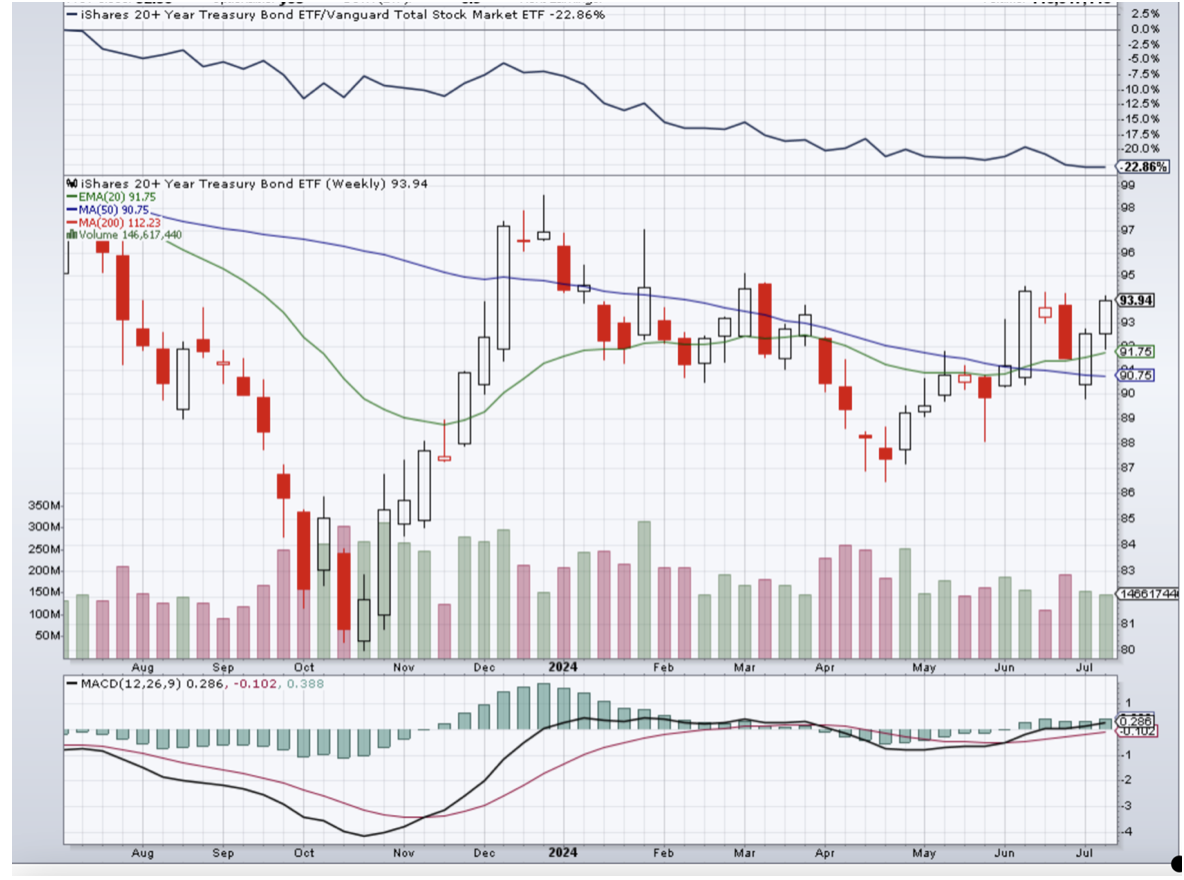

One that immediately comes to mind is the iShares 20 Plus Year Treasury Bond ET (TLT).

You should be buying the TLT and/or buying LEAPS one or two years out. If you want to be conservative, buy in the money LEAPS, if you want to be more aggressive, buy out of the money LEAPS.

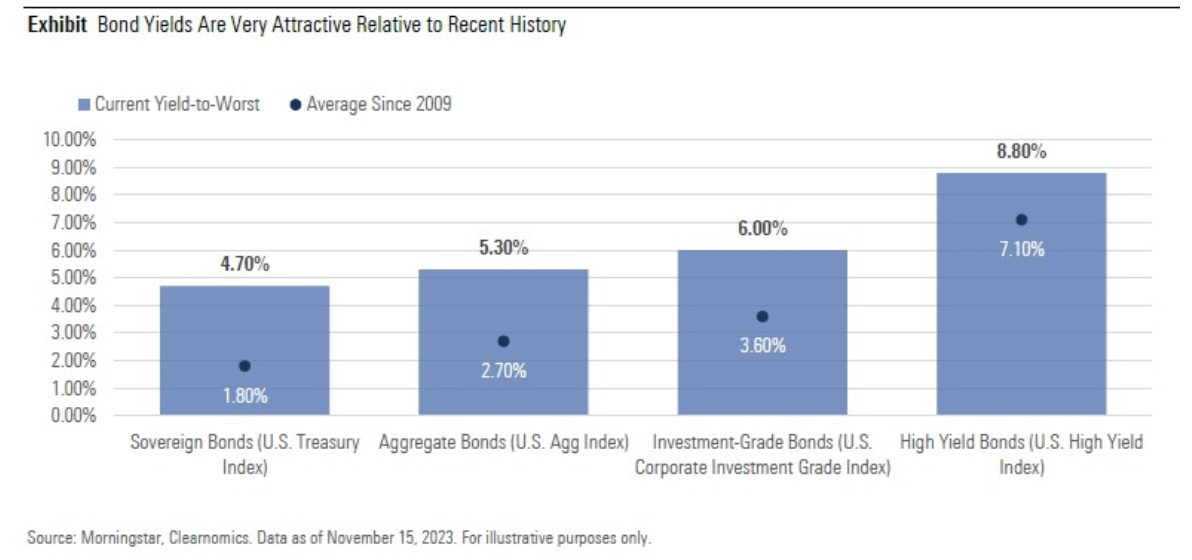

As shown here in this chart, the expected returns for government bonds, aggregate bond funds, corporate bond funds, corporate bonds, and high-yield bonds have trended above their long-term averages.

Source: Morningstar

The current yield-to-worst (YTW) for each of the above-listed bond categories has climbed well above its respective long-term average.

Yield-to-worst is a projection for future returns and represents an estimate of the lowest possible yield for a bond by averaging returns across a wide range of different scenarios. Investors use yield-to-worst as a risk management tool to evaluate the potential downside risk associated with a particular bond investment.

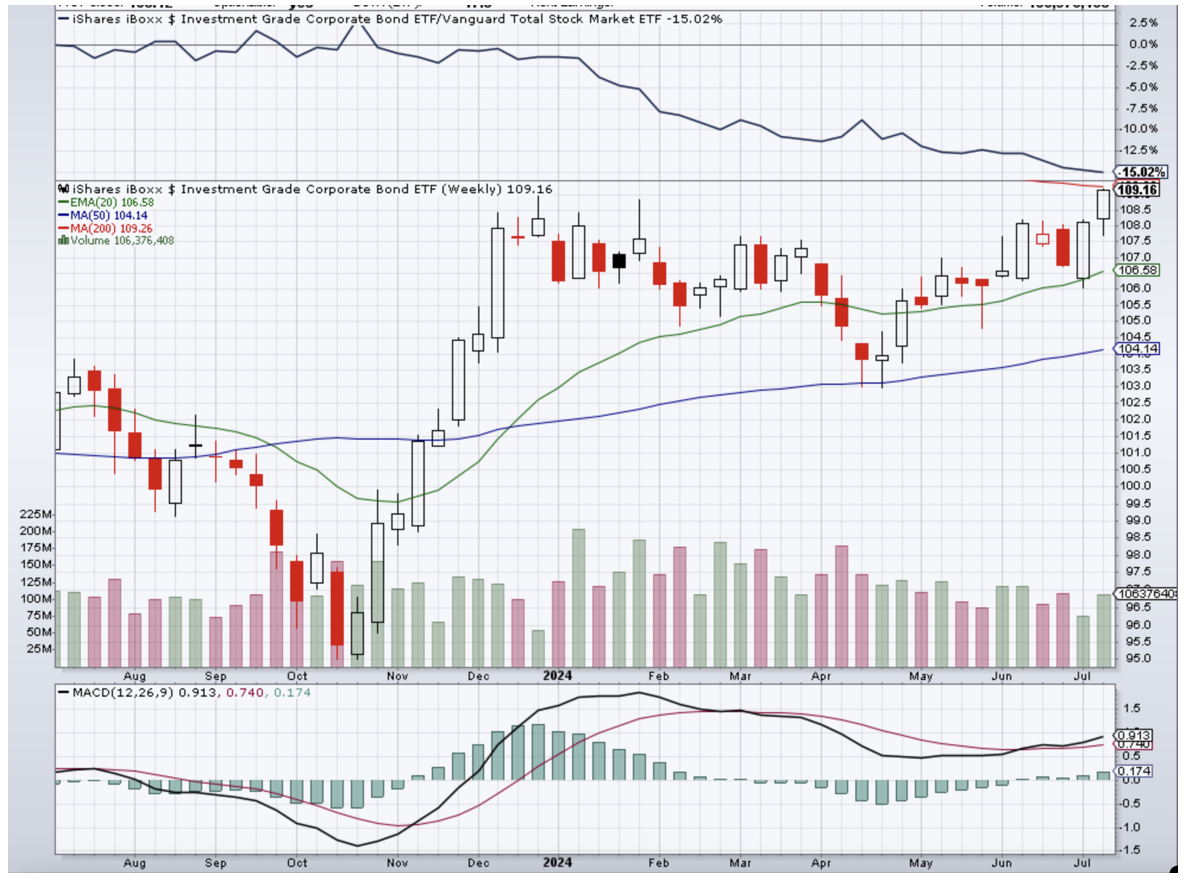

But we always must remember, that no investment is without risk. If you are very risk-averse, look at investment-grade bonds, which are typically issued by financially stable and reputable organizations with access to considerable financial resources.

Two well-known ETFs that focus on high-quality corporate debt include the iShares iBoxx Investment Grade Corporate Bond ETF (LQD), and the iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB). Investors and traders looking for exposure to international corporate bonds can also consider the Invesco International Corporate Bond ETF (PICB).

In addition to high-grade corporate bonds, investors and traders may also consider high-yield bonds. These bonds, often referred to as junk bonds, are a category of corporate bonds that have credit ratings below investment grade. And this means that the companies issuing these bonds have a higher probability of defaulting on their interest rates or failing to repay their principal at maturity.

The potential returns are higher for this category of bonds due to their elevated credit risk. If you are risk-averse, this category might not be your cup of tea.

Two well-known high-yield ETFs include the iShares iBoxx High Yield Corporate Bond ETF (HYG) and the SPDR Bloomberg High Yield Bond ETF (JNK). Investors and traders who are interested in internationally focused high-yield bonds can also consider the iShares International High Yield Bond ETF (HYXU).

Returns for bond ETFs since rate expectations started to shift. (returns from Oct. 19, 2023, through Jan. 3, 2024):

- iShares 20 Plus Year Treasury Bond ETF (TLT), +19%

- iShares iBoxx Investment Grade Corporate Bond ETF (LQD), +12%

- Invesco International Corporate Bond ETF (PICB), +10%

- iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB), +9%

- iShares iBoxx High Yield Corporate Bond ETF (HYG), +7%

- SPDR Bloomberg High Yield Bond ETF (JNK), +7%

- iShares International High Yield Bond ETF (HYXU), +7%

Considering the above returns, TLT’s performance outshines all bond categories. It is theoretically less risky than corporate bonds and high-yield bonds, and arguably the best bet for investors and traders who want exposure to the bond market but also want to minimize risk.

TLT tracks the performance of U.S. Treasury bonds with maturities of 20 years or more. As such, TLT provides investors with exposure to long-term U.S. government debt, which is generally considered one of the safest assets in the fixed-income universe.

Of course, I am not saying that significant rallies in corporate and high-yield niches will not occur. But they carry more risk than TLT. Ultimately, it is up to each investor and trader to choose the product that matches their risk appetite and outlook.

The usual narrative we hear all the time is that you should be weighted 60% in equities and 40% in fixed income. I believe it is a personal choice dependent on many factors, as every person’s situation is unique. Ultimately, as investors, we want capital preservation, but we also have to embrace risk as part of the investing process. Your risk appetite and your goals, as well as many other factors, will determine your weighting of equities and fixed income. Diversification amongst sectors is key.

iShares 20 Plus Year Treasury Bond ETF (TLT) Weekly chart

iShares iBoxx Investment Grade Corporate Bond ETF (LQD) Weekly Chart

iShares iBoxx High-Yield Corporate Bond ETF (HYG) Weekly Chart

MARKET UPDATE

S&P 500

Uptrend closing in on targets. Support lies at 5, 525/5,4440. Only a break of these levels would signal that a correction has started.

GOLD

Uptrend in progress. Support lies around $2,400. Initial target is the mid-400s and then onto upside targets around $2,550.

BITCOIN

It is too soon to say that Bitcoin has completed an irregular corrective structure. At the present time, support lies around $58,000/$57,000. If Bitcoin can hold this level, we should see it continue its upside rally.

US DOLLAR

The dollar may be on the verge of starting its journey south. You want to be scaling into Pound Sterling (FXB), Euro (FXE), and Aussie Dollar (FXA). If you trade FOREX and are experienced, look for a good entry point to go long the Euro and Pound Sterling, either by reading the candlesticks or bar chart price action. The charts tell the story.

RECORDING OF JUNE 2024 JACQUIE’S POST ZOOM MEETING

https://www.madhedgefundtrader.com/jacquie-munro-meeting-replay-june-2024/

PSYCHOLOGY CORNER

ACCEPT THE RISK

How many times have you sold your position before the stock hit your stop loss level? If so, why did you place your stop-loss order to begin with?

I could also ask the question; how many times have you sold a position before your TP (Take Profit level)?

Did you think the stock was not acting as you anticipated? Your wise decision to cut the trade often happens right before the market takes off. If this has happened to you, it is one of the most frustrating events that can occur in the market.

Your analysis was correct. In the end, the market gave you what you expected. Why did you second guess it? It seems likely that you were not willing to accept the randomness of the market and the fact you could lose money.

Until you truly learn to accept the risk, you will interpret the noise of the market as a potential threat and will find some way of rationalizing to yourself that you must exit the trade now.

QI CORNER

Tesla originally purchased $1.5 billion worth of #BTC in January 20221, just weeks after this exchange below, and after a few rounds of selling it now holds roughly 10,000 of the original 43,000 bitcoin purchased.

This single formula in the image represents the entire monetary policy of Bitcoin, now and forever. You don’t need to fully understand it to use it. You can easily create a private wallet and buy Bitcoin and receive Bitcoin in exchange for your goods and services. Bitcoin is a vehicle which highlights the flaws in our financial system. What does it mean to you?

MY CORNER

Alex and I played pool quite recently. He beat me 4 games to 0. My only consolation was the games were close. (I will have to keep practicing).

SOMETHING TO THINK ABOUT

GOOD VIBES CORNER

Have a great week.

Cheers,

Jacquie