July 19, 2024

(AIRSPACE DEVELOPMENT IS GROWING IN AUSTRALIA)

July 19, 2024

Hello everyone,

Adding rooftop units is like making money from air

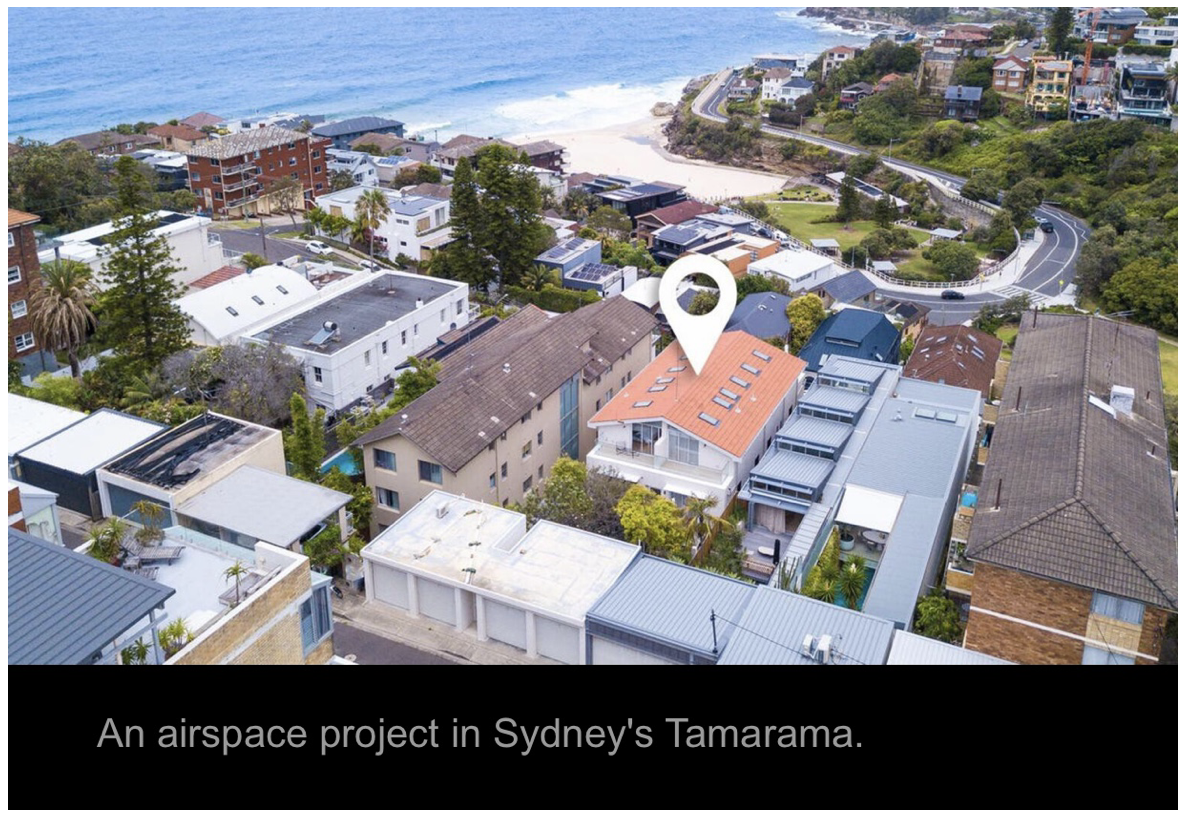

According to Warren Livesey, Airspace development is growing in Australia. Livesey finds old buildings around Sydney that have the capacity to hold a home or two on top and checks their zoning requirements.

In Sydney alone, the industry is valued at $150bn, with the potential to build homes on top of 90,000 strata buildings. Livesey says that the average strata rooftop is about 300 square metres.

Livesey points out that in Sydney there are about 30 million square metres of unused roof space in urban areas that could be used for housing. He goes on to say that there are about 100 million square metres in Australia above our stratum retail buildings that can be used for new rooftop homes.

Rooftop space is about $2500 per square metre, but in some areas, including Sydney’s eastern suburbs, it could go as high as $10,000.

Livesey explains that if you live in an area where you can build up to 12.5 metres and the building only goes to nine, you have that 3.5 metres of airspace that can actually be sold off and be rebuilt by somebody else.

It’s an industry that is still relatively secretive in Australia. Building owners request buyers’ agents, like Livesey, as well as developers and the new property owner to sign non-disclosure agreements on the deals.

Basically, owners don’t want anyone to know. The fear is that if the neighbours found out they would complain and object to the deal before a development application could be approved by a council.

Livesey has been selling between three and four spaces a month. He runs buyairspace.com.au. He set up the business after he had spent 10 years selling airspace in New York, London, and Paris.

He sees a big opportunity to build thousands of homes on top of existing buildings across Australia and says the fact that the homes are more sustainable is proving popular.

Most projects were for modular homes – homes that are built off-site and often take little to put together once on site – with cranes lifting them on top of properties room by room.

This is what makes them more sustainable – modular homes are built in controlled environments where manufacturers have more control over what products are used and how they are built.

If you want to find investments that are cheap, look abroad.

Europe’s Stoxx 600 index and the Japanese Nikkei 225 hit record highs earlier this year, along with the S&P500. But the Stoxx and Nikkei are trading at much more attractive valuations. FactSet data shows the Stoxx is trading at 15 times trailing 12-month earnings, while the latter has a multiple of 23. The S&P500, meanwhile, has 27 times earnings multiple.

This creates an opportunity for investors to find attractive investments at a cheaper valuation.

Europe has shown resilience in the face of recessionary concerns over mounting Russia-Ukraine tensions and a potential energy crisis.

The Stoxx 600 has gained nearly 8% in 2024, while the UK’s FTSE 100 is up 6%.

Here are exchange-traded funds to look at:

iShares MSCI Japan ETF (EWJ): The fund is up 11% year to date and charges 0.5% in fees.

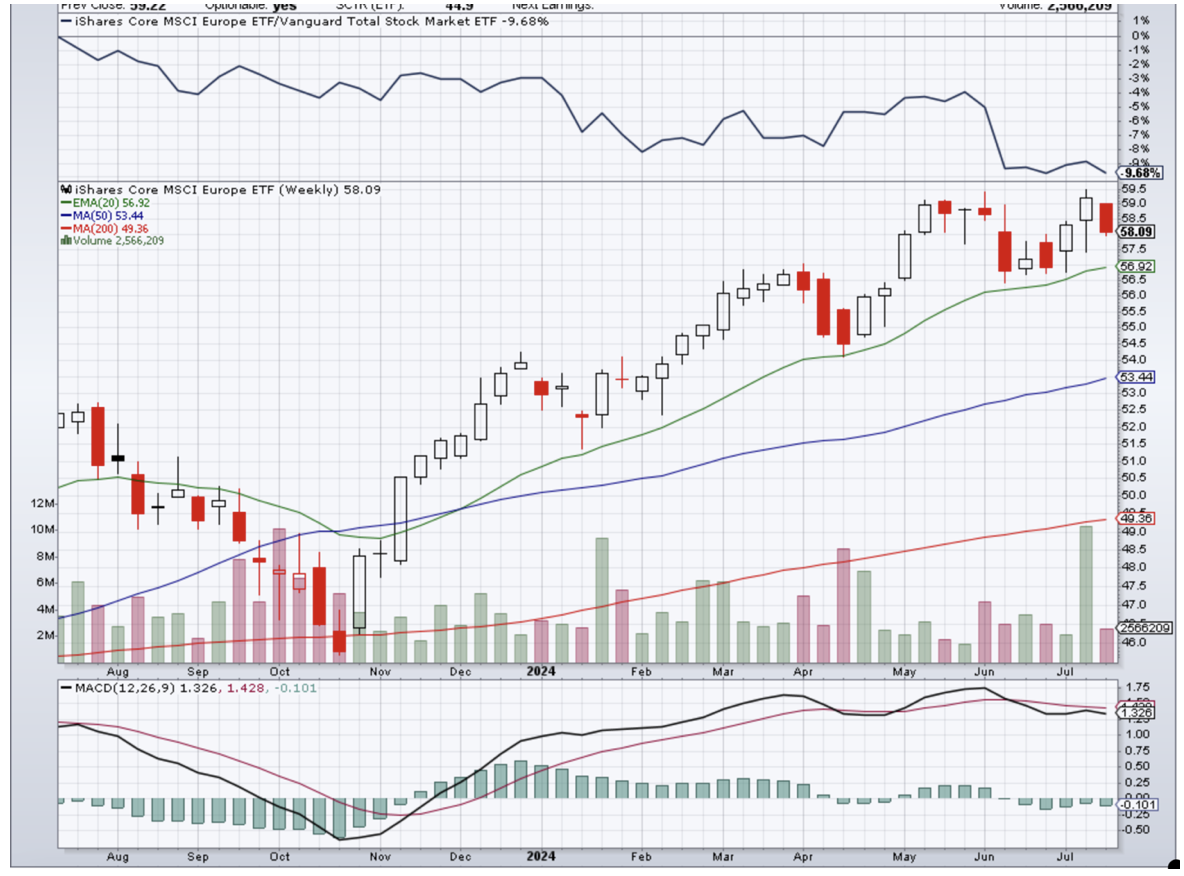

iShares Core MSCI Europe ETF (IEUR): The ETF has climbed 6% in 2024. It has an expense ratio of 0.11%.

Franklin FTSE United Kingdom ETF (FLGB): The fund has gained 8% this year and has an expense ratio of 0.09%.

iShares Core MSCI Europe ETF (IEUR) Weekly chart

Franklin FTSE United Kingdom ETF (FLGB) Weekly chart

Portfolio Update

Options:

On the 7th of February, I recommended options and stock buys on Microsoft, Exxon Mobile, and Barrick Gold.

(XOM) 105/110 and 110/115 out of the money LEAPS expiring on January 17, 2025. These are well in the money, so if you would like to take profits on these, do so. I know there is still time left in these positions, but when the market is giving you a gift, why not take it? The profit is only realized when the money is taken off the table.

I recommended 15/17 January 17, 2025, out of the money LEAPS in (GOLD). These are also in the money. It is up to you when you choose to take profits from this position. I do see gold continuing to rally.

LEAPS were also recommended on Microsoft (MSFT), but strikes were not specified. Again, it is up to you, when you take profits here, but just be mindful that the position was created when Microsoft was $403.66, so any position would be well in the money.

Cheers,

Jacquie