July 21, 2023

(HOW TO INVEST IN RENEWABLE ENERGY)

July 21, 2023

Hello everyone,

Thank goodness the European heatwave did not also hit London. Temperatures were a balmy 23-24 degrees Celsius while I was there.

Many electric taxis now grace the roads in London. You must make a mental effort to watch for cars instead of listening for them, as with electric cars, you cannot hear them approaching.

And how will a lot of electricity (Including these electric cars) be fuelled in the future?

Renewable energies.

Solar and wind power generation is set to triple by 2030, according to a report from the Rocky Mountain Institute leading to a disruption in the global electricity sector. And with this disruption comes a promising renewable energy trade for investors.

According to Rocky Mountain Institute (RMI), solar and wind power will fuel 33% of electricity generation in 2030, up from 12% in 2022. Furthermore, the Institute predicts that solar energy, which is already the cheapest energy source in history, will halve in price by 2030, continuing the dramatic downward trajectory of solar and wind energy costs. The levelized cost of energy (LCOE) for solar and wind was around $40 per megawatt hour in the first half of 2023, as noted by (RMI), which is approximately half the cost of coal and gas.

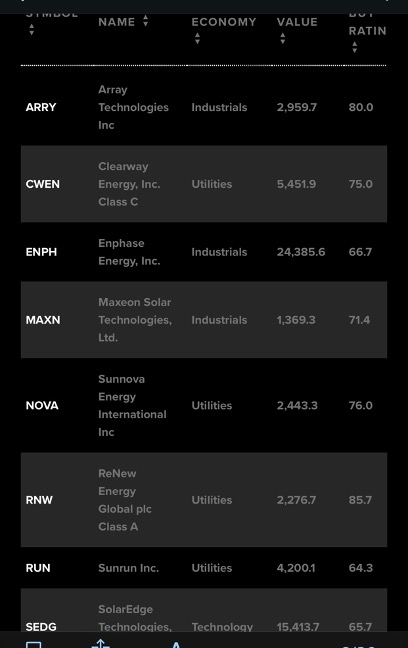

Companies that are well-positioned to outperform from the rise of solar and wind energy production are shown below. Each of these companies secured a buy rating from 60% of analysts, and each has at least 30% upside to the average price target. In addition, they have been covered by at least seven analysts, and are listed on the NYSE or the NASDAQ.

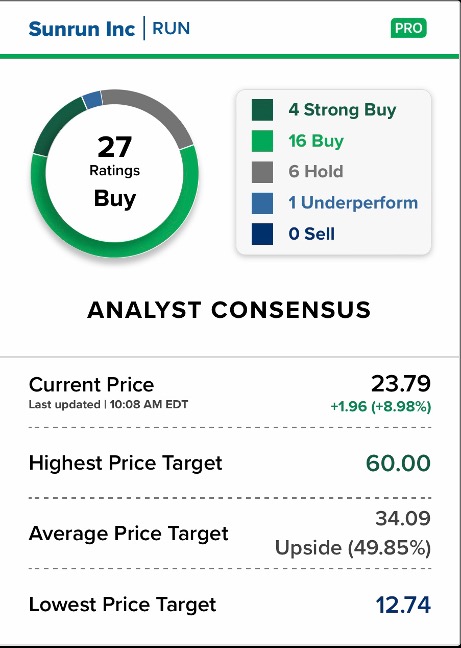

Shares of Sunrun could surge more than 77%, according to the average price target on shares. Andrew Percoco, a Morgan Stanley analyst revealed that 64% of analysts covering the stock have issued a buy rating.

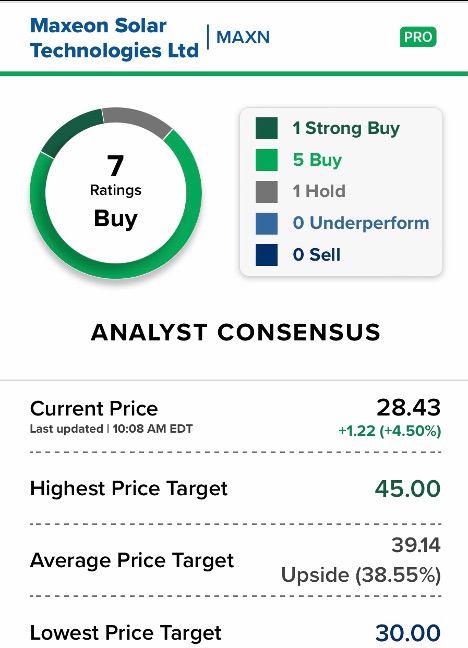

Maxeon shares have risen 68% in 2023 and could jump another 50%, per the average price target on shares. Percoco noted that the decline in solar panel market prices due to oversupply could pressure the company’s margins in 2024. However, it is worth noting that MAXN has largely locked in pricing for the remainder of 2023 and carved a niche with its premium DG (Distributed Generation) storage & energy. According to FactSet data, 71.4% of analysts covering the stock have issued it a buy rating.

Enjoy your weekend.

Cheers,

Jacquie