July 22, 2024

(A GLOBAL PORTFOLIO + REAL ASSETS MAY BE THE BEST INVESTMENT FOR THE FUTURE)

July 22, 2024

Hello everyone,

The week ahead calendar

Monday, July 22

8:30 a.m. Chicago Fed National Activity Index (June)

Earnings: Verizon

Tuesday, July 23

10 a.m. Existing Home Sales (June)

10 a.m. Richmond Fed Index (July)

Earnings: Visa, Enphase Energy, Capital One Financial, Texas Instruments, Tesla, Alphabet, Freeport McMoRan, Lockheed Martin, Sherwin-Williams, Comcast, Coco-Cola, Kimberly-Clark, General Motors, United Parcel Service, Philip Morris International, GE Aerospace

Wednesday, July 24

9:45 a.m. PMI Composite preliminary (July)

9:45 a.m. Markit PMI Manufacturing preliminary (July)

9:45 a.m. Markit PMI Services preliminary (July)

Earnings: O’Reilly Automotive, Chipotle Mexican Grill, International Business Machines, Las Vegas Sands, Ford Motor, Align Technology, Lamb Weston, Next Era Energy, AT&T, GE Vernov.

Thursday, July 25

8:30 a.m. Continuing Jobless Claims (07/13)

8:30 a.m. Durable Orders preliminary (June)

8:30 a.m. GDP first preliminary (Q2)

8:30 a.m. Initial Claims (07/20)

8:30 a.m. Wholesale Inventories preliminary (June)

11:00 a.m. Kansas City Fed Manufacturing Index (July)

Earnings: American Airlines, CBRE, Valero Energy, Hasbro, Tractor Supply, RTX, Northrop Grumman, Southwest Airlines, Honeywell International, AbbVie, PG&E, Norfolk Southern

Friday, July 26

8:30 a.m. Personal Consumption Expenditures price index (June)

8:30 a.m. Personal Income (June)

10:00 a.m. Michigan Sentiment final (July)

Earnings: T.Rowe Price Group, Bristol-Myers Squibb, Colgate-Palmolive, 3M

This week we will get insight into the economy from more than half the broad market index. Results from earnings this week should give investors valuable information about the economy, and the consumer.

We have had data showing a slowing economy, and inflation easing, but corporate results and commentary could give investors a very transparent lens into how the consumer is really traveling in this economy.

On the investor side of the fence, that could determine what happens to markets in the short to medium term.

Last week, the S&P 500 and the Nasdaq dropped as we saw investors pivot away from the mega-cap tech leaders into the market laggards, such as small caps, healthcare, and energy. This rotation out of the mega-cap tech stocks has been a long time coming, so expect some volatility as the dust settles from this stampede out of one sector and into several others.

To say that the market is due for a rest would be an understatement. Expect some corrective movement as we digest near-term market antics and political turmoil.

Macroeconomic data is also reported this week, which will give the investors some clarity on how the Fed may act in the near term. Let’s be mindful that there is potential for the economy to deteriorate much faster than most people are expecting right now. If this comes to pass, and the Fed is too slow to act, the market may give an abrupt response.

There have been significant events in the world over the last week or so. The attempted assassination of Mr Trump, an IT outage caused by CrowdStrike, and today, July 21, Mr Biden withdrawing from the Presidential race. Even though it is mostly economic data, company earnings, and Fed policy that moves markets, we must also consider the policies of political parties and their potential effects on equities/sectors and the dollar moving forward.

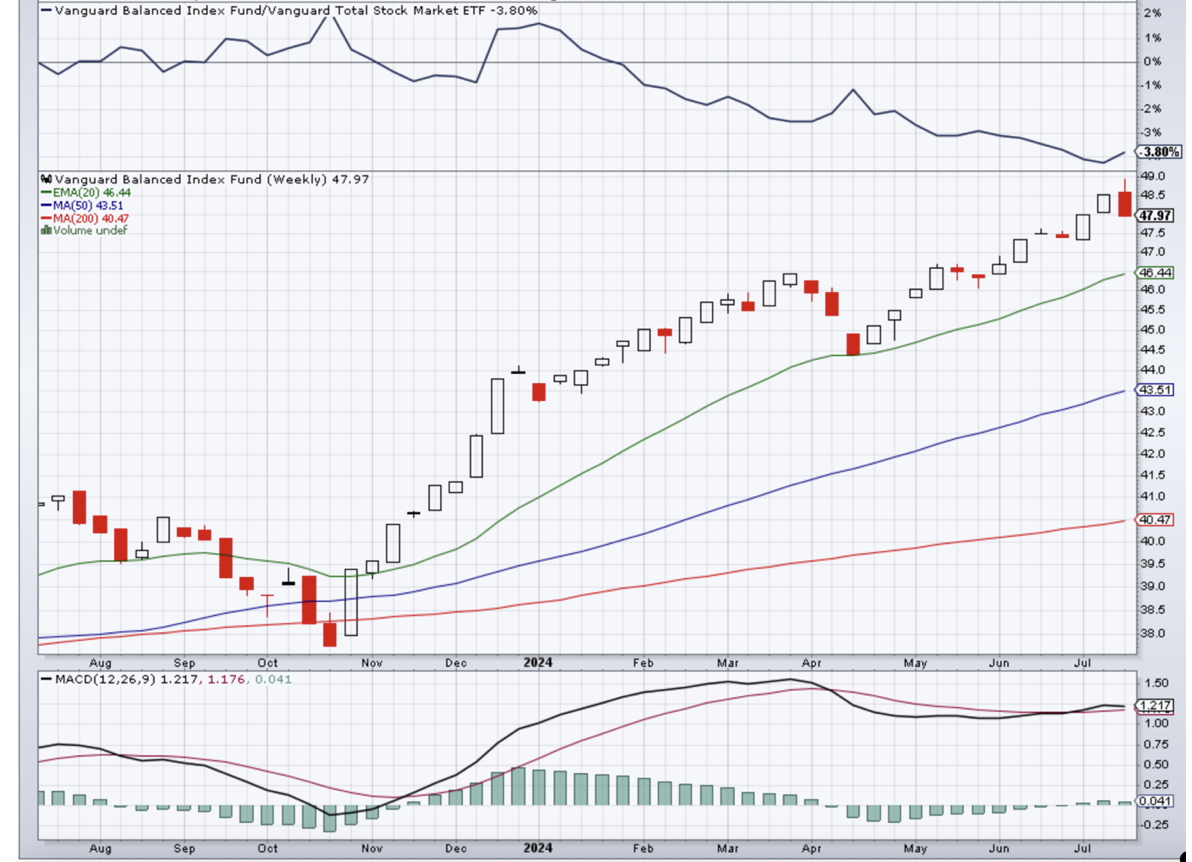

Let’s look at the classic 60/40 portfolio split.

According to Bank of America (BofA) analysts, over the past decade, the Vanguard Balanced Index Fund (VBINX), which basically follows the classic 60/40 formula, has returned 8.24%.

The 60/40 portfolio provided its classic diversification benefit only when inflation was running at less than 2%. That encompasses much of the two decades of the current century, a limited span on which much of the historical data supporting the 60/40 is based.

International diversification makes sense given the strong preference for a weak dollar by both Republican and Democratic parties. Republican policies show that they see a strong dollar as a hindrance to U.S. manufacturers and a subsidy for cheap imported goods for U.S. consumers. The Democrats continue to back tariffs. Neither side has shown support for free trade or a stable dollar.

This landscape means that we are likely to see less stability and diminished purchasing power. And with such a backdrop, it will be important to look at global equities, not just U.S. stocks, and real assets, most notably gold (which we have seen hitting new highs recently) and cryptocurrencies (which are likely to face fewer regulatory constraints), rather than bonds with fixed claims on dollars losing value in real terms.

In other words, regardless of investors’ political preferences, they must accept that the future is unlikely to resemble the past. Inflationary trade and budget policies are favoured by both Democrats and Republicans, differing only in degrees. BofA analysts contend that’s bad for long-term bonds, but favourable for inflation hedges such as commodities.

History draws a telling picture. BofA analysts point to the entire post-World War II period which showed that a 60/40 portfolio hedged with the latter portion in commodities did better than with long-term Treasury bonds. And going back even further to the 1919 era, it was found that bonds were a drag on returns, with a 60/40 portfolio returning 8.8% per annum versus 10.3% for U.S. equities.

However, four decades of falling interest rates and inflation after 1980 resulted in bonds providing a substantial contribution to balanced portfolio returns. Traditional conservative policies promoted by former President Ronald Reagan were part of this era. These have been replaced by progressive or populist policies of the current left and right.

Global diversification should be the catchcry. Let’s not forget to point out that Vanguard’s 60/40 portfolio is globally diversified. The 60% equity portion is 36% in broad U.S. market stocks and 24% in non-U.S. stocks. The 40% bond portion is 28% in broad U.S. fixed income and 12% non-US., nondollar bonds. This mix provides a significant hedge against the decline in the dollar’s value.

Vanguard Balanced Index Fund (VBINX) weekly chart

PSYCHOLOGY CORNER

Balance Trading Risks

It is a common psychology of trading to take positions in the stock market even when there is no meaningful opportunity. Such traders can’t resist the temptation to play in the market and end up losing money.

A successful trader, however, understands that capital protection is a more important objective of trading than profit maximization. Profit maximization can be achieved only after the capital is protected. A successful trader knows when and what to trade as well as he knows when not to trade.

A trader trades mindfully using safety measures like stop loss to protect capital and follows a disciplined trading plan to balance risks while minimizing losses.

WHAT IS…Capital Gains Tax?

Tax on gains(profits) you make from the sale of capital assets, like stocks and other investments. Under U.S. tax laws, if you hold an investment for more than a year before you sell it for a gain, you may qualify for a long-term capital gains tax rate. Gains from investments held for less than a year are usually considered short-term capital gains and are taxed as ordinary income (which is usually a higher tax rate than long-term capital gains).

MARKET UPDATE

S&P500 – The stock market has reached an interesting stage. The S&P500 made a Bearish “Outside Reversal” week which cautions us to prepare for a possible trend change. However, it is too early to call an end to this bull market. From an Elliott Wave perspective, the S&P500 can be interpreted to have completed a Wave 3 advance (from the 3,809 low of February 2023), to signal the start of a Wave 4 correction. Sustained break below 5,440 would confirm this correction is underway.

Wave 4 correction would likely find support between 5,265 -4,954.

There remains a final Wave 5 advance ahead before this bull market is complete. Only a sustained break below 4,954 would frustrate this outlook.

GOLD – Gold’s selloff last week from the $2,484.00 high can be viewed as corrective. In the short term, resistance now lies at $2,420/$2450. There is a risk of a test of the $2350/$2325 support area over the coming days.

BITCOIN- Bitcoin looks to have completed an irregular corrective structure on its July 5 low of $53,500. An advance appears in progress which should target the low $70k area. Support lies around the low $60s.

AUSTRALIAN CORNER

An alarming number of Australian homeowners may be forced to sell their homes, if interest rates stay elevated into next year. According to the Bureau of Statistics, about 3.3 million Australian households have a mortgage. Should rates stay at current levels (4.35%) into 2025, 165,000 households “would have to sell”, a survey found. The unemployment rate nudged up 0.1% to 4.1% in June. Many economists believe unemployment needs to be half a percentage point higher for inflation to cool.

GOOD VIBES CORNER

SOMETHING TO THINK ABOUT…

Cheers

Jacquie