July 24, 2024

(CONSUMERS ARE BEING SWINDLED IN THE BANKING WORLD)

July 24, 2024

Hello everyone,

Savings account traps: why billions are disappearing

Research shows that Australian adults are losing an average of $1500 per person every year through using the wrong savings accounts.

The research paper by financial services technology company Upworth says consumers collectively miss out on about $30 billion in interest annually, often because of confusing accounts, information overload, or overconfidence.

It says cash deposits currently pay between 0% and 5.75%, and almost three-quarters of bonus interest savings accounts do not pay the bonus rate because savers don’t meet the conditions required.

Upworth illustrates the fact that complex product design often makes it hard to compare products. The headline interest rate is a very different concept from the effective interest rate an individual earns. Base rates, bonus rates, and introductory rates all come in the mix.

Upworth co-founder Maxime Chaury said people with deposits were lending money to their banks, and banks were trying to minimize their borrowing costs.

Chaury points out one of the easiest ways to do this is to make their product offering confusing and have as many low-interest-rate savings accounts as possible and as few high-interest-rate savings accounts. And what that does is increase the chances you will end up with a low-interest rate account.

Chaury says that people had psychological biases that resulted in them earning less interest.

This included overconfidence, loss aversion, and preferring the status quo. Information overload also played a role. We all know that when we are faced with too many options and an overload of information, we are typically overwhelmed. And rather than engage with any complexity, we are likely to default to inaction. And the banks are counting on that behaviour.

Chaury said conditions attached to many accounts – such as minimum monthly deposits or limited withdrawals – could drastically reduce interest, while introductory interest rates were only temporary, typically three to six months.

Banks understand many people will never change their savings account, despite the rate dropping significantly after the introductory period.

Savings rates are littered with fine print (that many people never read), designed to limit the amount of interest a bank has to pay its customers, from balance-based rate tiers, age minimums and maximums, and monthly bonus rate conditions.

There are millions of big bank online saver customers who signed up for an introductory rate five or ten years ago, which gave them a higher interest rate for the first few months or so and have now been earning next to nothing for years because they haven’t been bothered to switch to a more competitive account.

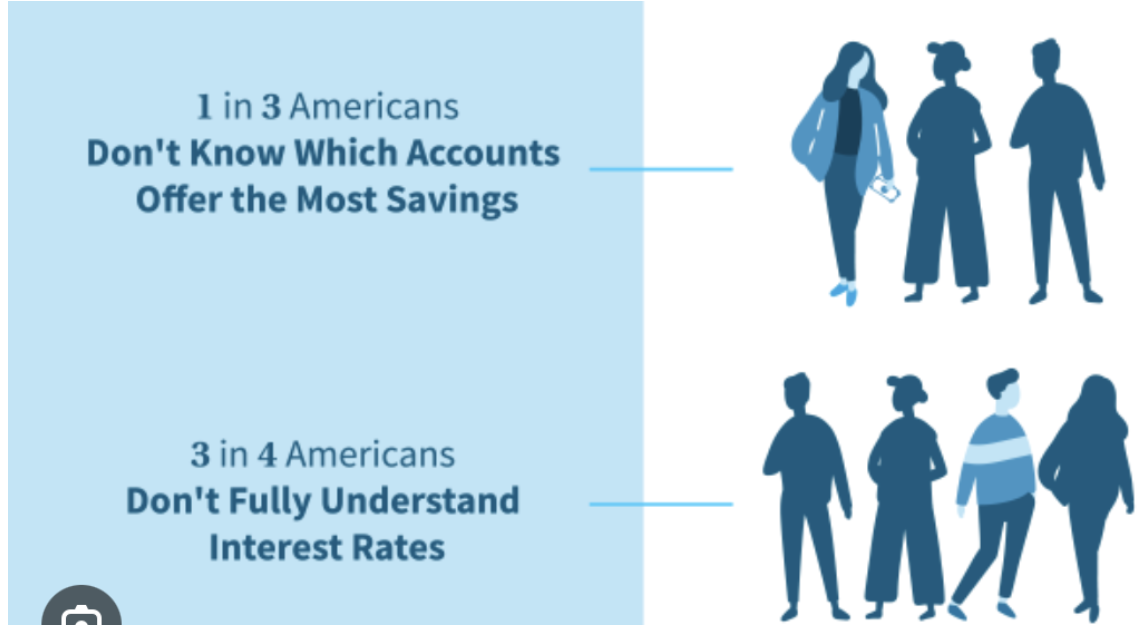

Australians aren’t the only ones confused about their Savings Accounts.

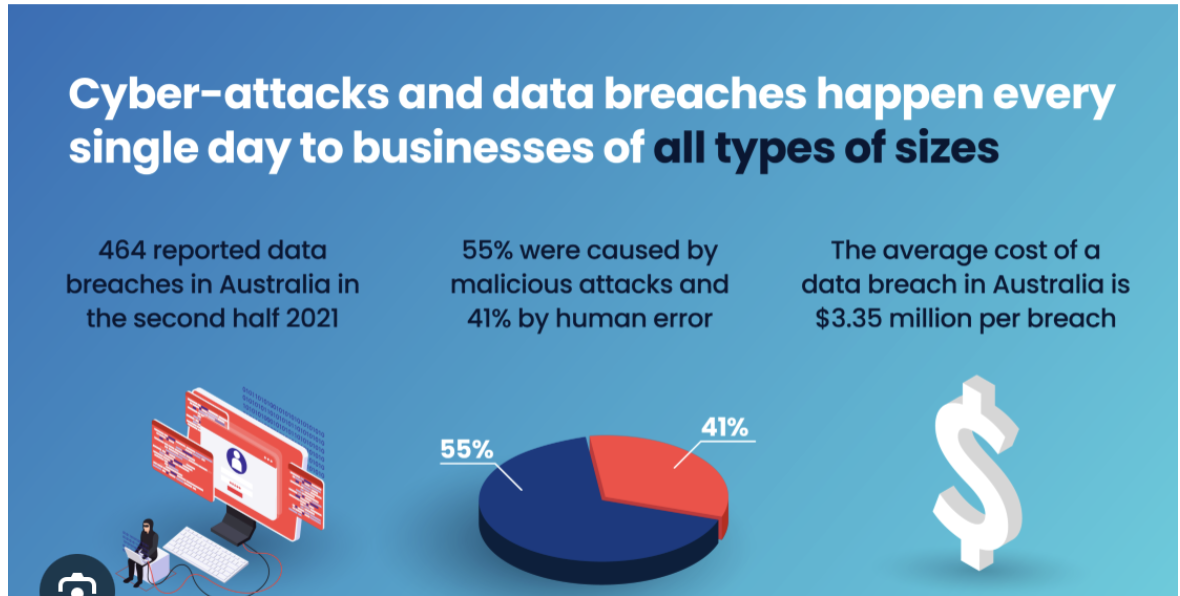

The largest cybersecurity breach in Australian history

Cybersecurity experts say the highly sensitive data of 12.9 million Australians, stolen from eScripts provider Medi Secure, has already been sold on the dark web and is up for sale again.

MediSecure confirmed in May it was the victim of a ransomware attack in 2023 and last week revealed the scale of the breach, which puts it among the largest in Australian history.

Data stolen includes names, phone numbers, addresses, and Medicare numbers, as well as sensitive medical information such as which drugs people had been prescribed and why they were taking them. It was previously unclear if the data had been sold, but cyber threat intelligence analysts say there’s a strong indication that at least one sale has taken place.

Cheers,

Jacquie