July 3, 2024

(GENERATIVE AI WILL BE A $100 BILLION DOLLAR + ANNUAL BOOST TO THE AUSTRALIAN ECONOMY BY 2030)

July 3, 2024

Hello everyone,

AI will generate profits in the trillions globally over the coming years. But the sector will need a skilled workforce to see industries transformed.

There are already 33,000 workers in Australia that work directly in AI or use AI as part of their main job, according to CEO Damian Kassabgi, at Tech Council of Australia. Kassabgi believes that number is expected to grow by 200,000 by 2030.

In 2014, there were 800 jobs related to AI.

Overall, Australia needs to train and educate an entire new AI specialist workforce to meet the current and future operational needs of the industry. Schools, universities, technical colleges, and private training providers will all play a role in developing these skills. The training imperative relates to young and old workers at all stages of learning. This will require a mix of strategies catering to the unique needs of individuals.

We are in the early stages of the AI boom. Through innovation, companies will become more productive and more efficient by virtue of AI tools.

The potential growth in the area is so great that analysts and experts believe AI could contribute $115 billion annually to Australia’s economy.

These three areas are where AI investment will be focused in Australia.

The revolutionary AI boom will require lots of power.

Companies that will power this sector are a buy-and-hold.

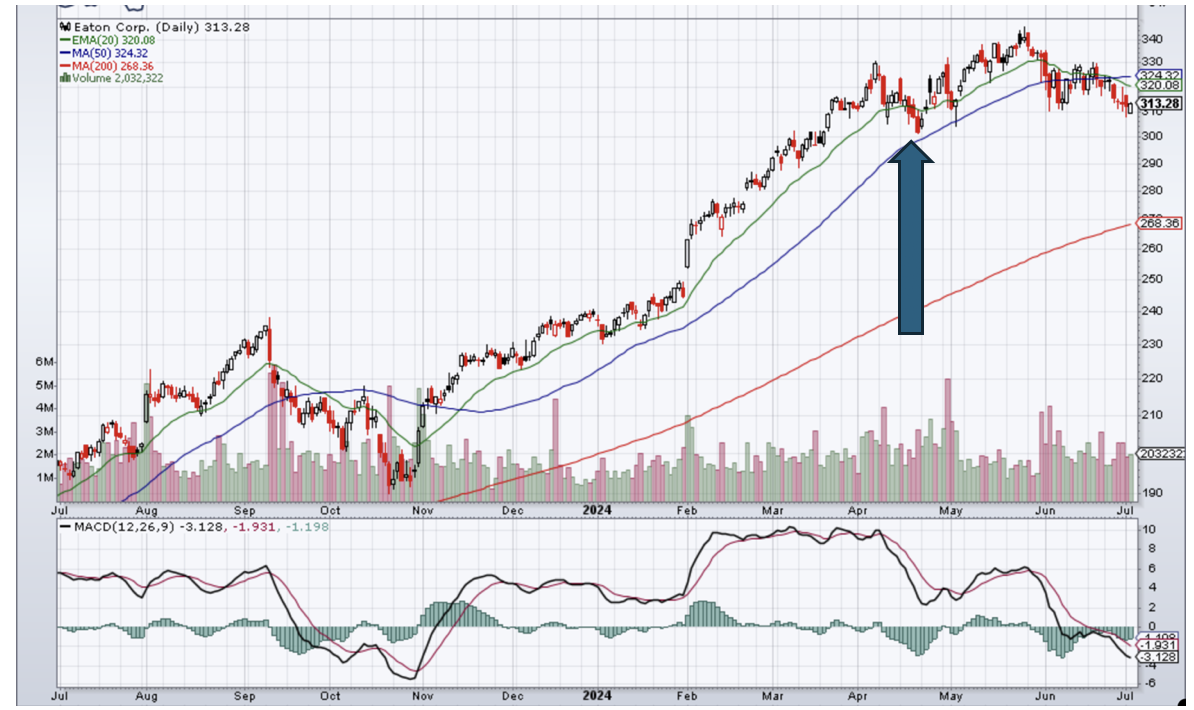

Eaton Corp. (ETN)

I first recommended Eaton Corp. on April 22, 2024. The price then was $303.02.

Artificial Intelligence requires vast amounts of data processing to function – and data processing requires electricity. The power management company Eaton (ETN) is set to benefit from heightened demand for the setup and upgrade of electrical grids as more data centers are required. Eaton is well-positioned thanks to its scale, size, equipment, and inventory. Shares of the U.S. power management company have been a little rocky over recent days but remain up nearly 30% year-to-date and 54.4% in the last 12 months. Of 25 analysts covering the stock, 17 give it a buy or overweight rating, according to FactSet data. They give it an upside potential of around 11%.

QI CORNER

Something to think about

Cheers,

Jacquie