June 1, 2023

(BIG WALL STREET BANKS ARE MOVING INTO AI)

Thursday, June 1, 2023

Hello everyone,

I didn’t sleep well last night. Is there an AI out there that can help me sleep when I am restless and have a lot on my mind? I’m not really into pill-popping. CALM Is one app that comes to mind.

Apparently, some banks are now jumping into AI. And JP Morgan is one of them. An AI bot, called Index GPT, was introduced in a U.S. Patent and Trademark filing on May 11 by the investment banking firm.

The product “provides temporary use of online non-downloadable cloud computing software using artificial intelligence for use in computer software selection of financial securities and financial assets,” the patent file noted.

The patent also covers:

Software as a service (SAAS) services featuring software using artificial intelligence for Generative Pre-trained Transformer models in the field of financial services.

Provides consumer product information for the purpose of selecting artificial intelligence (AI) hardware and software to meeting the consumer’s specifications; software as a service (SAAS) services featuring software for analysing and selecting securities tailored to customer needs.

So, is this the beginning of the end of human financial advisors? While the Chatbot version trademarked by JPMorgan Chase doesn’t infer it will displace actual money managers, industry experts argue that it’s only a matter of time. It does appear that JPMorgan wants to use IndexGPT to choose stocks, bonds, and funds for its wealth management clients.

Last month, JPMorgan Chase CEO Jamie Dimon stated that “the importance of implementing new technologies simply cannot be overstated.”

What! No human contact at all? What if you had a question, a complaint, or just wanted to share your success or share your experience with another human being? Trading is a solitary experience right now – will AI push us further into our own worlds and have us communicate less? Would you want a world without a human creating the information in Jacquie’s Post, or a world without John Thomas of Mad Hedge Fund Trader sending out newsletters and trade alerts? Would you want to be cut off from any social connection with us? We must be able to work side by side with this technology. And that’s what we will do, and in fact, all sectors will do this.

Banks shift tech focus to artificial intelligence.

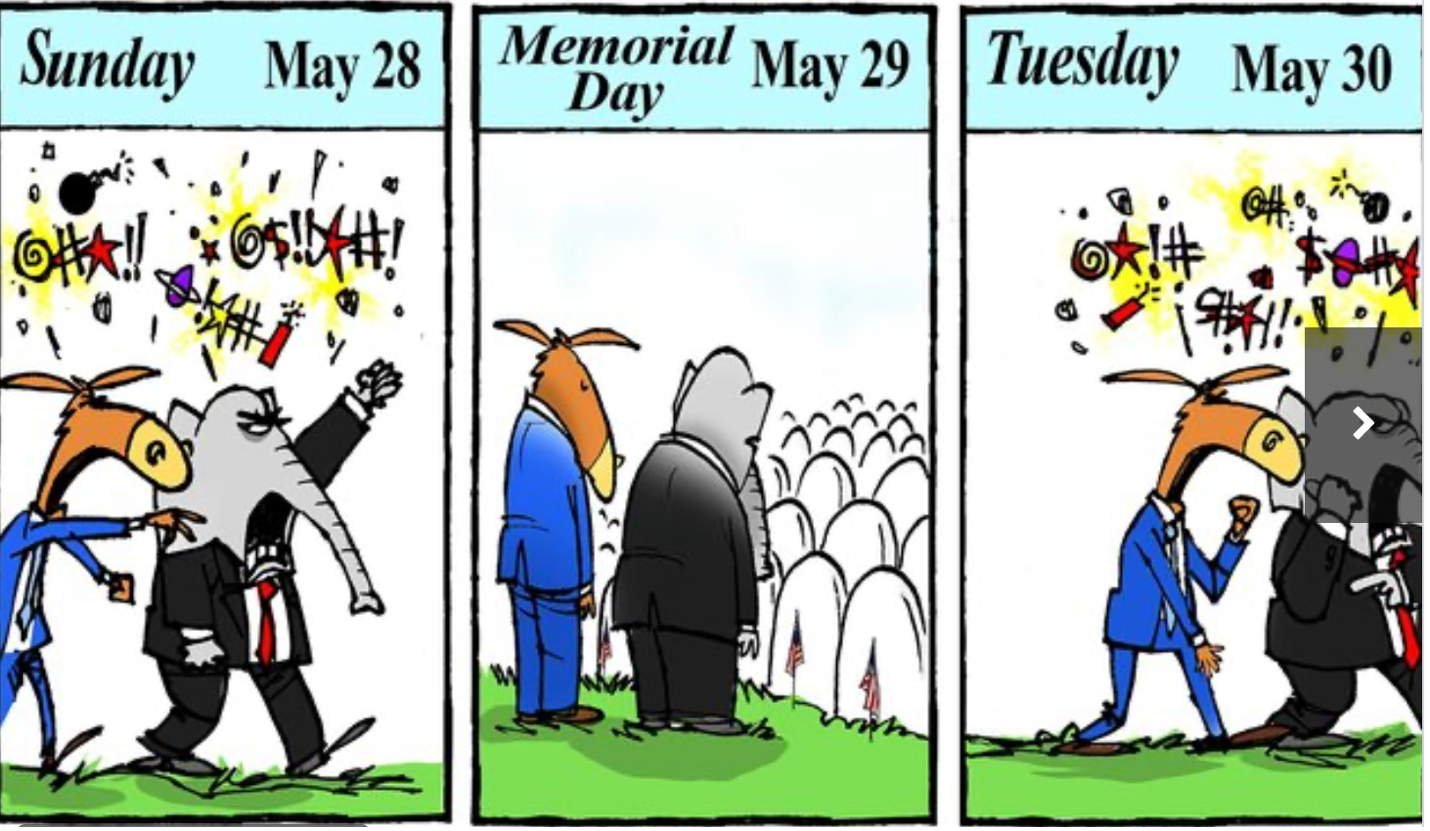

An update on the debt ceiling deal:

So, what’s changed?

The deal between Biden and McCarthy would suspend the $31.4 trillion debt ceiling until January 1, 2025, allowing the U.S. government to pay its bills.

The trade-off? Non-defence discretionary spending would be roughly flat at current levels in 2024. There is an estimation that non-defence discretionary spending excluding benefits for veterans would total $637 billion for the 2024 fiscal year, down marginally from $638 billion the year before. That total would also increase by 1% in 2025.

The debt limit extension lasts past 2024 – until after the November 2024 presidential election. But Congress will still have to knuckle down and make some rational decisions about how to allocate money under the new spending caps this year.

The deal would boost total defence spending to $886 billion, in line with Biden’s 2024 budget spending proposal.

That’s about a 3% increase from the $858 billion allocated in the current budget for the Pentagon and other defence-related programs in other agencies.

Biden and Democrats secured $80 billion for a decade in new funding for the IRS.

Impact: hiring thousands of new agents – the extra tax revenue they generated is expected to offset many of the climate-friendly tax credits.

Clawback unused Covid relief funds which is estimated to be between $50 billion and $70 billion.

No changes to Medicaid in the deal.

But work requirements would be imposed on some low-income people who received food assistance under the program known as SNAP up to age 54, instead of up to age 50.

End the current pause on student loan repayments by late August.

Biden’s plan to forgive $430 billion in student debt, is still under review in the Supreme Court.

Energy projects to find it easier to gain permit approval.

We are waiting for Congress now. Will the deal be passed or will it fail?

Wishing you all a great week.

Cheers,

Jacquie

“If we command our wealth, we shall be rich and free. If our wealth commands us, we are poor indeed.” --Edmund Burke