June 10, 2024

(THE IMPACT OF RECENT ELECTIONS IN INDIA AND MEXICO ON EMERGING MARKETS)

June 10, 2024

Hello everyone,

Last week the Bank of Canada and the European Central Bank cut their rates for the first time in many years. Contrarily, The Fed and the Bank of Japan are expected to maintain current rates at their meetings this week. Perhaps more significant than the rate decision itself is the Fed’s updated projections on interest rates, and the timing of cuts. The dialogue here may well drive the markets for the next few weeks. The release of May’s CPI inflation data on the day of the June FOMC meeting could result in market volatility, particularly if it deviates from expectations.

Week ahead calendar

Monday, June 10

1 p.m. 3-year Treasury note auction.

9:30 p.m. ET Australian Business Confidence

Previous: 1

Tuesday, June 11

6 a.m. NFIB Small Business Index (MAY)

1 p.m. 10-year Treasury note auction

2:00 a.m. ET UK Unemployment Rate

Previous: 4.3%

Earnings: Casey’s General Stores

Wednesday, June 12

7 a.m. Weekly mortgage applications (week ended June 7)

8:30 a.m. Consumer price index (May)

2 p.m. FOMC policy announcement

Previous: 5.5%

2:30 p.m. Fed Chair Jerome Powell holds news conference

Earnings: Broadcom, Dave & Buster’s

Thursday, June 13

8:30 a.m. Weekly jobless claims (week ended June 8)

8:30 a.m. Producer price index (May)

Previous: 0.5%

1 p.m. 30-year Treasury bond auction

Previous: 0.5%

Earnings: Adobe, Signet Jewellers, John Wiley

Friday, June 14

8:30 a.m. Import/export prices (May)

10 a.m. University of Michigan consumer sentiment index (preliminary, June)

12:00 a.m. ET JP Interest Rate Decision

Previous: 0.1%

Recent election results in India and Mexico surprised many emerging market investors. The stock markets in both countries saw big swings in the aftermath of the initial election results.

As the election results are finalized and the changes take place, the countries could have a large impact on emerging markets exchange-traded funds, which have had a solid start to 2024.

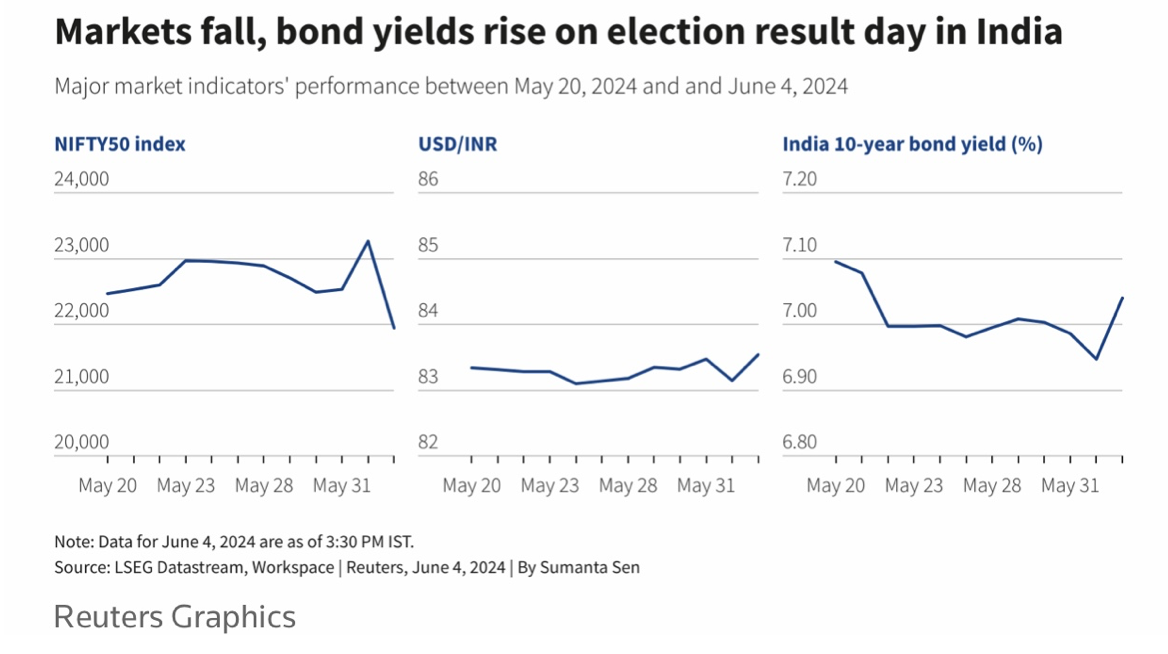

India’s Prime Minister Narendra Modi has declared victory in his re-election campaign. Despite this, his party had a weaker showing at the polls and lost seats in parliament.

Indian stocks have been a global outperformer under Modi; however, the election result disturbed some traders. The iShares MSCI India ETF (INDA) fell 6% on Tuesday as the results became clearer. The rupee dropped 0.5% against the dollar which, although not groundbreaking, was its biggest fall in 16 months.

Analysts do not believe economic growth will be impacted by Modi’s lacklustre party performance at the polls. Coalition governments have been stable in the past, but one main negative may be achieving consensus on major reforms. Indian stocks have rebounded after initially selling off. From a technical standpoint, the rally appears to be largely intact, according to analysts.

At brokerage Emkay Global, analysts said that difficult but potentially beneficial changes to land and labor policies, along with privatization of some of India’s big state-run firms, were now “off the table”.

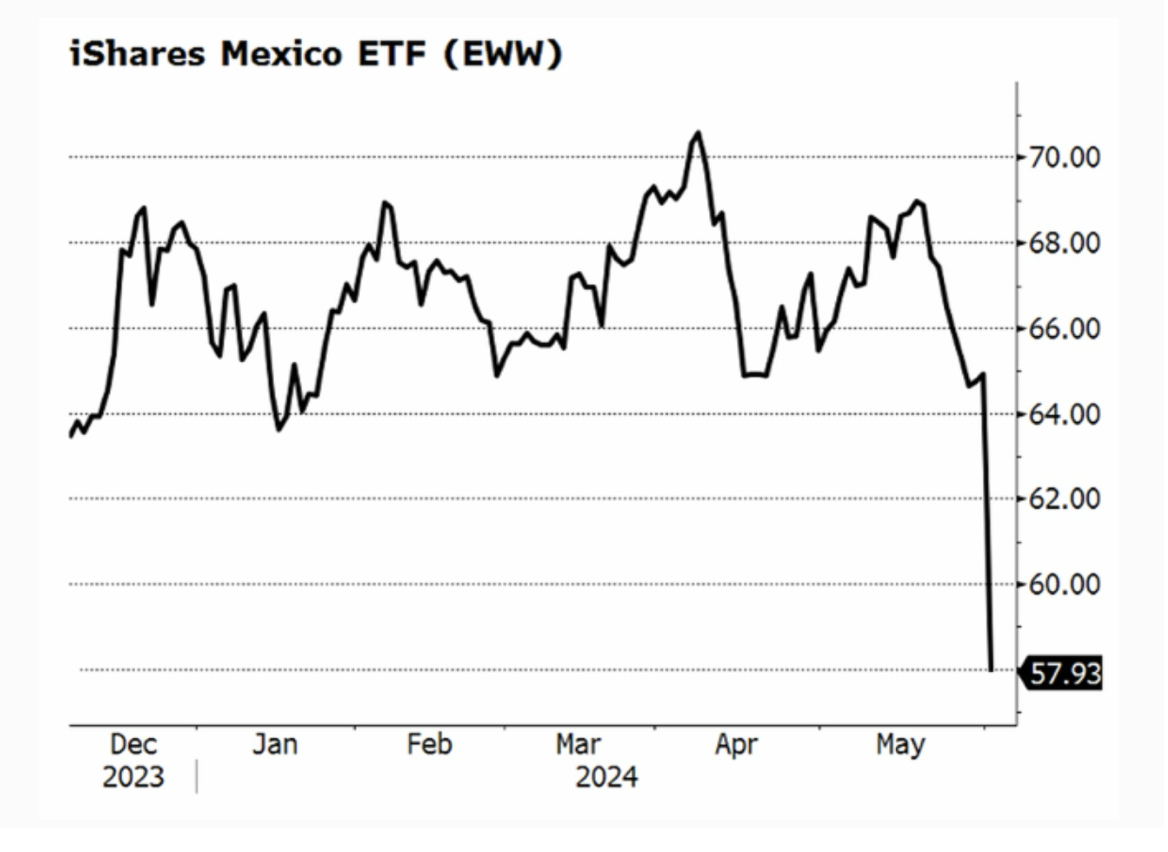

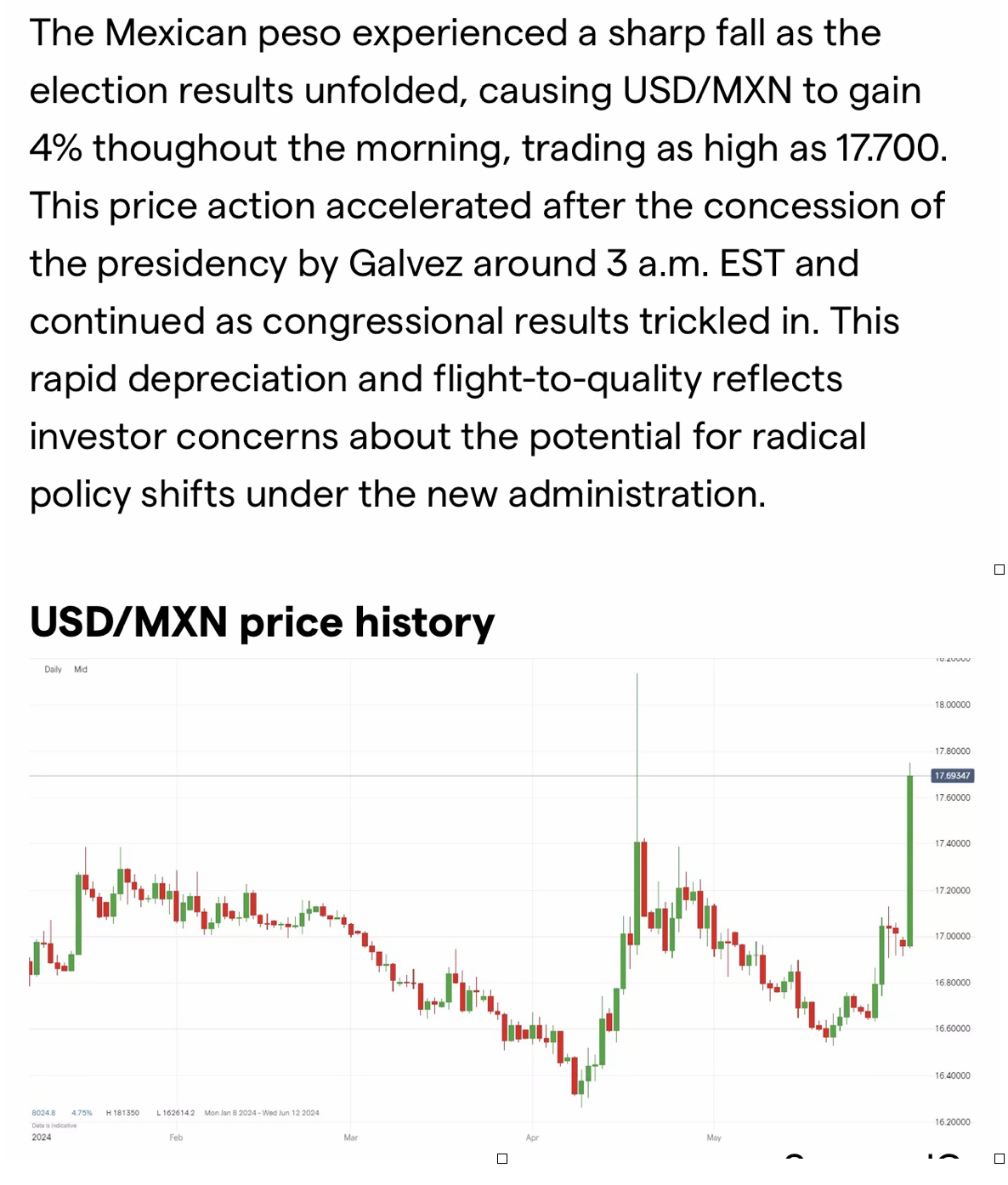

In Mexico, the favored candidate won, but the margin was a surprise. Claudia Sheinbaum won the presidency, and her party’s performance is arguably strong enough to put it close to a large enough majority in the legislature to pass constitutional changes.

The initial market reaction was negative. The iShares MSCI Mexico ETF (EWW) fell 10% last Monday after the initial election results, and the peso dropped sharply against several major currencies. It was the worst day for Mexican stocks since the Covid-19 shock in 2020.

Just how many seats the ruling party ends up controlling may take some time to ascertain. Of some concern is the idea that the Morena party’s strong mandate may lead to market-unfriendly policies, including constitutional reforms that could negatively impact the business environment. The adverse market reaction to the results also represents fears by investors regarding increased state control over critical sectors, and expanded social welfare programs that could strain the budget. (the party is guaranteeing all workers receive 100% of their final salary as a pension, despite lacking a clear financing mechanism, and has included social programs which include universal pensions for seniors and scholarships for students).

Maintaining a stable and predictable business environment is essential if Sheinbaum’s administration wants to forge ties with foreign investors and grow the domestic economy. Mexico has benefited from nearshoring opportunities since the COVID-19 pandemic; the country became an attractive destination for U.S. companies relocating their supply chains closer to home. Any policy change that disrupts the nearshoring trend affects foreign investment in Mexico and will impact the currency and the domestic economy.

The energy sector is also wary. Concerns about protectionist policies that favour state-owned enterprises over private and foreign investments could also deter foreign investment and impact market confidence.

MARKET UPDATE

S&P 500 -we are in a 5th wave advance. Targets include 5432 level and 5752 max. (If you are a short to medium-term trader/investor, you should be looking to take some profit from your positions. For example, you could look at selling 20% or 30% of your Nvidia (NVDA) holdings stock position and the same with your T-Mobile (TMUS) stock holding).

Gold – retracement in progress. Support lies around the $2,252/$2,220 level. Extended corrective weakness could target $2175 support area. If you don’t have any gold stocks or silver stocks, this retracement provides you with a great opportunity to scale in. Look at (GLD), (WPM), and (SLV).

Bitcoin – short-term retracement. Possibly testing low/mid $60k over the coming days. If you are interested in Bitcoin, this corrective pullback is the time to scale in.

QI CORNER

MY CORNER

Hiking in Reno before the summer heat sent temperatures soaring.

Cheers,

Jacquie