June 14, 2024

(SUMMARY OF JOHN’S JUNE 12, 2024 WEBINAR)

June 14, 2024

Hello everyone,

TITLE

Reversal of Fortune

PERFORMANCE

June +1.94% MTD

Since inception 696.94%

Average annualized return +51.53% for 16 years.

Trailing one year return 36.44%

PORTFOLIO

Risk On

(AMZN) $160-$170 call spread (10%)

Risk Off

(GLD) $200-$205 call spread (10%)

(SLV) $23 - $25 call spread (10%)

Total Aggregate Position 30.00%

METHOD TO MY MADNESS

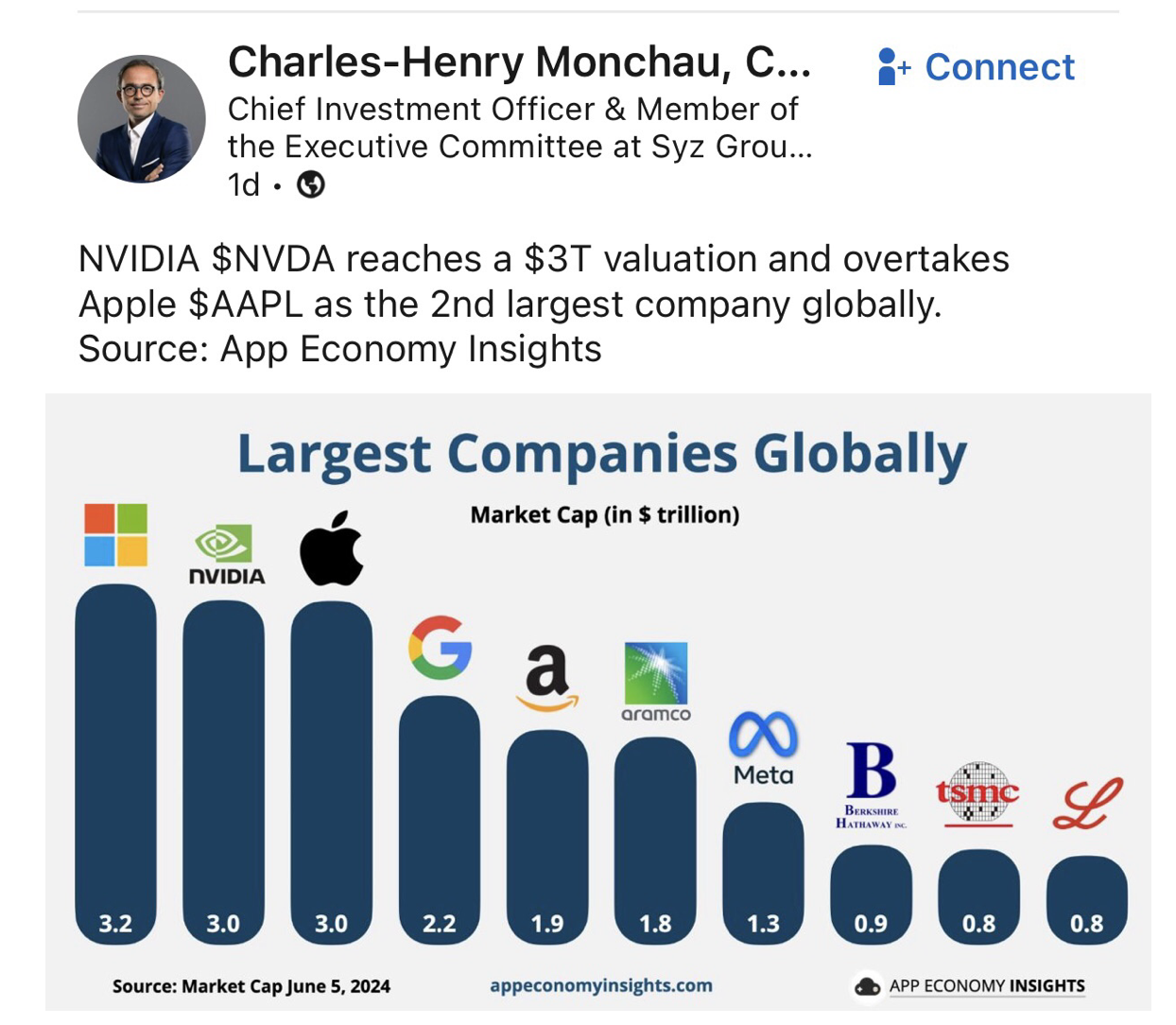

Nvidia has split. Which stock is next?

The next focus is on the first interest rate cut in five years, no matter how long it takes.

The general downside is limited to 5%-8% with $8 trillion in cash on the sidelines and a further $26.8 trillion in short-term US treasury bills.

Technology stocks won’t crash, just have a sideways “time” correction.

All economic data is globally slowing. The May Nonfarm Payroll report was an anomaly.

Interest rates are higher for longer, but September is back on the plate in view of recent date releases.

Interest rates are higher for longer, but September is back on the plate in view of recent date releases.

Buy stocks and bonds on dips.

THE GLOBAL ECONOMY – FLIP-FLOPPING

May Nonfarm Payroll report comes in hot at 272,000, double expectations.

The headline unemployment rate reached 4.0%, a 21/2 year high.

Job gains were concentrated in health care, government, and leisure and hospitality, consistent with recent trends.

The Fed’s favourite inflation gauge cooled by 0.2% in April, with the PCE, or the Personal Consumer Inflation Expectations Price Index.

ADP Private Payrolls drop to only 152,000, a sharp drop from last month’s 188,000

JOLTS Job Openings Report dive in April, down 296,000 to 8.059 million, a three-year low.

Europe cuts Interest Rates, for the first time in five years.

Money supply rises for the first time in more than a year.

STOCKS – THE BULL LIVES

Goldman Sachs sees “Wall of Money” flooding the stock market this summer.

Since 1928, the first 15 days of July have been the best two-week trading period of the year for equities, and they tend to fade after July 17.

Cruise lines are suddenly offering great deals because more vessels are flooding into the popular Caribbean and Alaskan destinations as they reroute ships away from Red Sea destinations due to the ongoing conflict between Israel and Hamas.

AMD launches new AI chips and details its plan to develop AI chips over the next two years in a bid to challenge industry leader Nvidia.

Roaring Kitty is back, after publicizing a $289 million long position in GameStop (GME). Avoid (GME).

American Airlines gets slaughtered, down 15% yesterday, and will slash its capacity growth in the second half of the year.

AMZN Trade Suggestion: Jan 2025, 195/200, LEAPS.

AMD and PANW are other LEAPS candidates.

CAT – go long at 200-day MA

FCX – buy now. Target is $100.

TLT – LEAPS candidate.

BONDS – CUT OFF AT THE KNEES

Hot Nonfarm Payroll reports slam bonds. Earlier rallies were based on weak economic data.

Funds are pouring into corporate bonds at four-year highs.

Global investors hoovered up $3.6 billion into investment-grade corporate bond funds in the week to Wednesday in the 31st straight week of inflows, the longest streak since 2019.

Bonds are becoming respectable again after a long winter. Buy (TLT) on dips.

FOREIGN CURRENCIES – DOLLAR CATCHES A BID

Red hot May Nonfarm Payroll Report gives dollar a new bid.

Right-wing wins in European elections deliver currencies a second punch on economic destabilization fears.

Japanese yen still looking for a bottom at Y160.

Bank of Japan intervened with a $62 billion yen buy, dollar sell. Avoid (FXY)

Chinese Yuan remains weak. International trade is collapsing

Higher for longer rates mean higher for the longer greenback.

Rates falling = a falling dollar for 2024.

ENERGY & COMMODITIES – OUT OF FAVOUR

AI creating a nuclear power demand surge, with its voracious demand for power

OPEC maintains production caps into 2025, with US production hitting a 2024 high at 19.9 million barrels/day.

AT&T’s copper is worth more than the company, and with plans to convert half its copper network to fiber by 2025 could free up billions of tons of the red metal to sell on the market.

Copper prices have doubled over the past two years, and they could double again by next year.

Conoco Phillips buys Marathon Oil for $22.5 billion, in a further consolidation of the oil industry.

Porsche goes for a hybrid, bringing out a new model for $164,900, the last to do so. Look for a 20-year death spiral for oil prices.

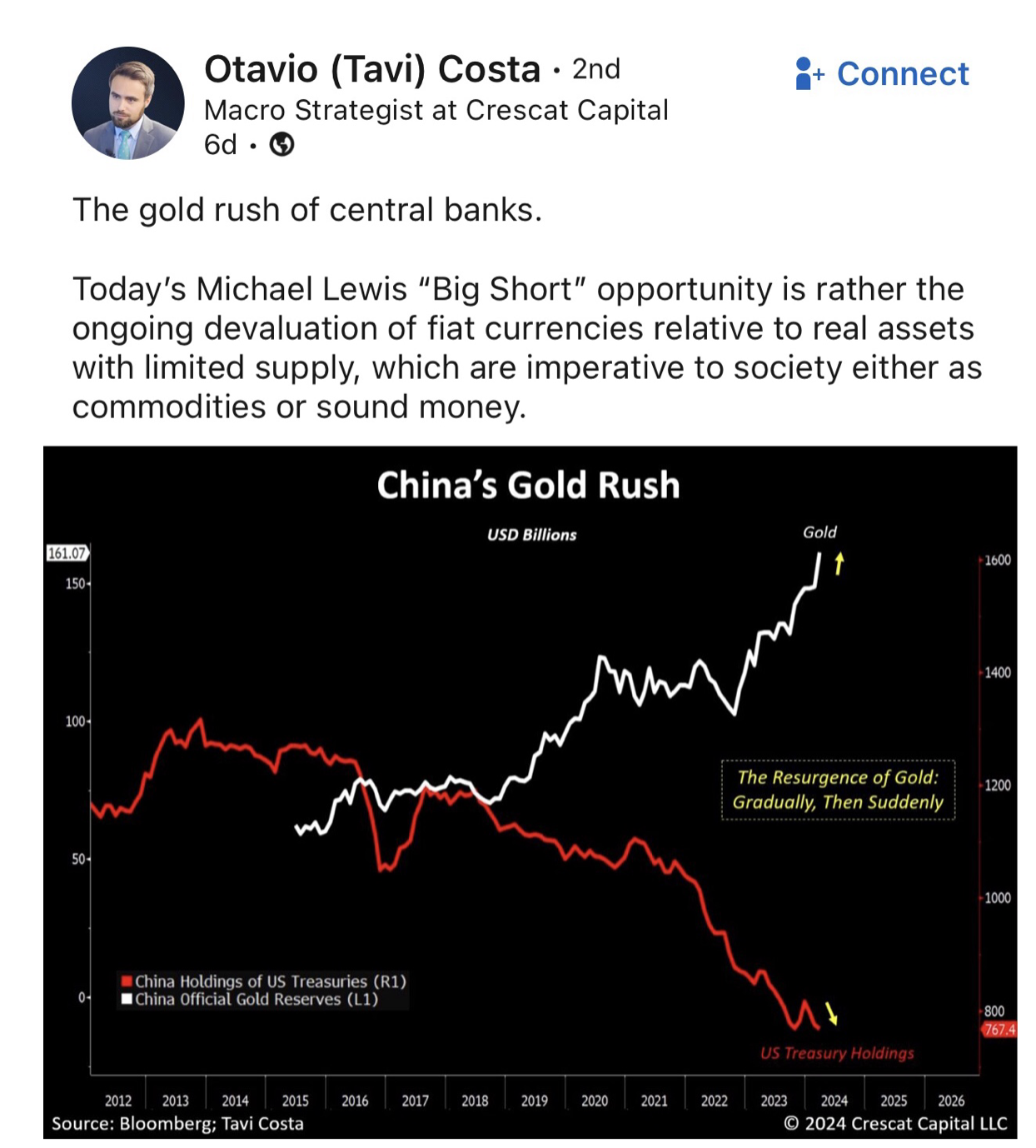

PRECIOUS METALS – REALITY CHECK

Red hot May Nonfarm Payroll Report kills gold trade.

When the Chinese enter a trade, the volatility increases, and this is a perfect example.

Higher for longer interest rates mean lower for longer gold and silver.

Buy precious metals on the dip because rates have to fall eventually.

Miners are expanding their operations and ramping up production as prices for the precious metal climb to decade highs.

Buy (GLD), (SLV), and (WPM) on dips.

REAL ESTATE – TRENDING UP

US Construction spending falls, off 0.1% after slipping 0.2% in March.

Pending Home Sales dive, down 7.7% in April, the worst since the COVID market three years ago.

AI is soaking up San Francisco Office Space faster than you think.

S&P Case Shiller jumps to a new all-time high, with its national Home Price Index.

The index rose by 6.5% YOY, the fastest growth since April 2023. All 20 major metro cities were up.

Home Equity hits an all-time high at $17 trillion according to CoreLogic.

Total home equity for U.S. homeowners with and without a mortgage is $34 trillion. There is a lot of cash that could potentially end up in the stock market.

TRADE SHEET

Stocks – buy any dips.

Bonds – buy dips.

Commodities – buy dips.

Currencies – sell dollar rallies, buy currencies.

Precious metals – buy dips.

Energy – buy dips.

Volatility – buy $12.

Real Estate – buy dips.

QI CORNER

Cheers,

Jacquie