Kowtows to the Institutions

Google allowing crypto payments to its cloud services from Coinbase Global (COIN) doesn’t move the needle.

COIN is the crypto exchange platform that has run into a litany of problems recently, from falling trading volumes and regulatory fines to shifting strategic focus.

The news is a footnote to the carnage that is really happening front and center in the crypto market.

Funnily enough, why would a customer choose to pay for Google’s cloud services through Coinbase when fees are still meaningful and alternative rails (cards, bank transfers) dominate?

Crypto isn’t cheap, and it doesn’t pretend to be.

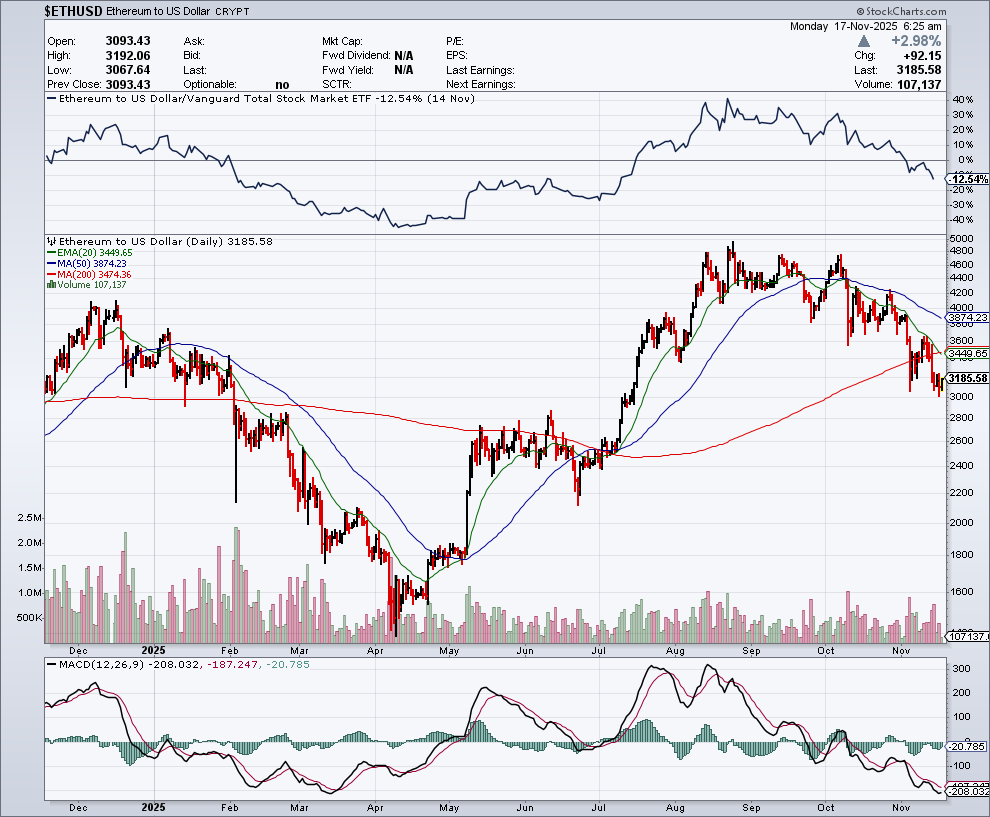

Ether (ETH) remains infamous for its “gas fees.” In 2021, they averaged around $63 for one transaction, which contributed to its lag behind other networks.

In 2025, the network has improved (via upgrades like Dencun and protocol optimizations), but fee-peaks still occur and many users have migrated to layer-2s or alternative chains.

Bank ACH transfers are free or very low cost, and so are most debit/credit card purchases.

Even though El Salvador claims to be a crypto-first economy, most everyday transactions continue to be completed in cash or U.S. dollars.

At least crypto will now be allowed to transact on Google’s platform (or at least participate via some rails), which is a victory in itself, but I don’t believe this will catch on like wildfire.

Crypto is up against a Sisyphean task.

The Google Cloud infrastructure service will initially accept cryptocurrency or crypto-adjacent payments from a limited set of customers; the roll-out is far from universal. Meanwhile, Google has pivoted toward broader payments infrastructure, agentic AI commerce and blockchain layers.

Over time, Google may allow more customers to make payments via crypto or stablecoins but the emphasis is no longer solely “pay with Bitcoin/Ether” but “use stablecoins or tokenized rails.”

Coinbase will (or already does) earn a percentage of transactions that go through whatever rail they enable but the margin of that business remains tiny relative to its overall operations.

It remains high risk to hold crypto on the balance sheet. Coinbase no longer flags a large impairment charge the way it did in 2022, but it continues to grapple with volatility and shrinking core trading revenue. In Q2 2025, Coinbase’s revenue fell to about $1.5 billion, with consumer spot trading volumes down ~45% year-over-year.

Therefore, I expect Google (or Google’s payment rail) to charge a fee or apply a conversion spread to turn crypto in and out of fiat - just as before - or to prefer stablecoin/fiat rails entirely.

From the outside, this really does look like a marketing gimmick.

Blockchain technologies, such as non-fungible tokens (NFTs), have moved out of the “wild hype” phase; for Google’s cloud division the bigger focus now is on tokenized assets, stablecoin infrastructure, AI-agent payments, and building developer tools around these.

Google has announced the Agent Payments Protocol (AP2), an open standard for AI-agent-led payments that supports stablecoins among other rails.

Previously, Google pushed for growth in major industries such as media and retail. This year, it started forming more teams around blockchain, payments infrastructure and “Web3” tooling but the narrative has shifted from “crypto payments” to “tokenized finance + AI commerce.”

However, I thought that crypto was going at its lone-wolf style hoping to create a parallel system to the fiat money system which it despises.

Apparently not.

Tying up with a mega-tech corporate firm sounds like they are giving up to me.

It seems as if the founding investors are ready to cash out and leave the die-hard crypto believers for a more stable income stream.

Annuity-like income stream is something many crypto firms lack and locating one is a hard sell.

Crypto was supposed to be “decentralized” but this appears to be a move that will offer Google the keys to Coinbase’s data while limiting them to lateral moves.

In short, this is a move that allows more centralization in the biggest crypto platform in the United States.

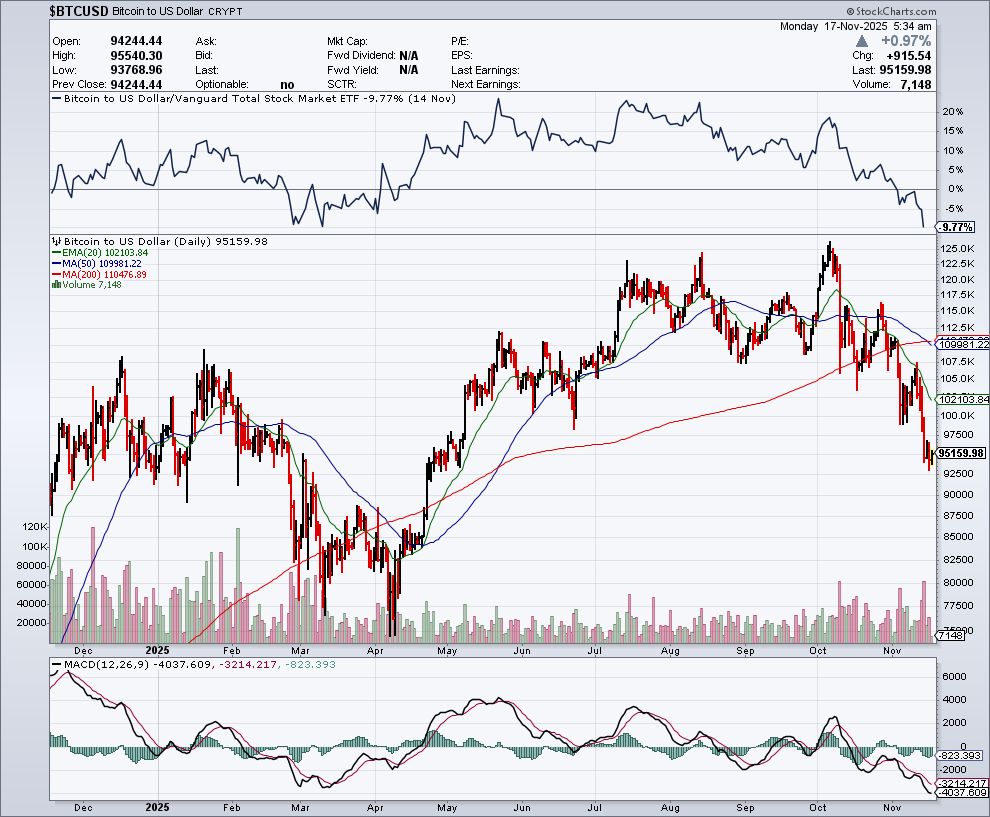

Growth was crypto’s calling card and that means parabolic growth possibilities are over.

Integrating with Google also means Google will have deep insight into how they can use Coinbase to profit from digital currencies - since Coinbase has agreed to onboard their data onto Google’s cloud infrastructure in some capacity.

Honestly, this is a bone-head strategic move for Coinbase, and my inclination would be to buy Google’s stock if one believes in crypto.

Desperation can trigger some unusual moves and we are seeing that in real time. But analyzing the bleak short-term prospects for crypto, this might be a move for survival rather than anything else.