Looking For A Savior

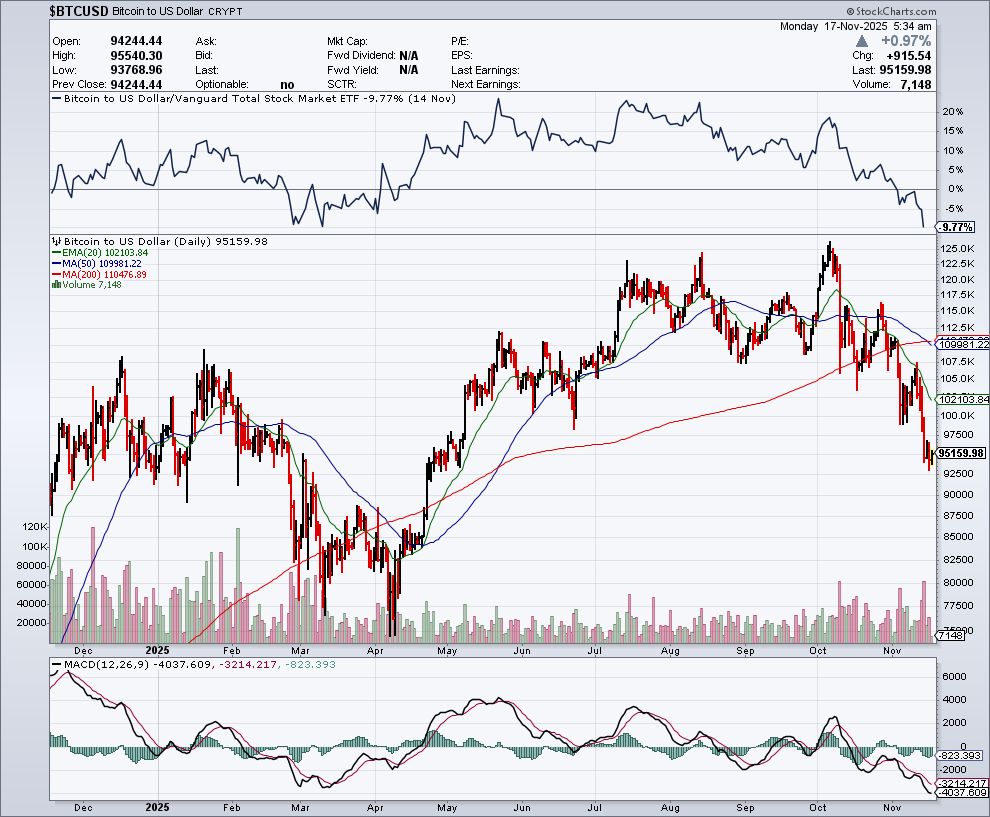

Bitcoin slipped to around $95,000 this week after a delayed U.S. inflation print and hawkish Federal Reserve commentary raised doubts about a near-term rate cut.

The result means that another modest adjustment in interest rates is already priced into the markets; traders are now focused on whether further cuts or hikes will follow.

There was some fleeting hope back in 2022 that the Federal Reserve wouldn’t need to tighten further, but those ideas were dashed as inflation surged.

A similar dynamic persists in 2025: markets still swing whenever inflation surprises, even though today’s debate is about the timing of cuts rather than large hikes.

Let me remind readers that the US Central Bank employs over 10,000 Ivy League-trained economists earning well over $150,000, yet they are navigating a policy landscape still shaped by earlier missteps.

The longer the Fed allows persistent inflation to erode the health of the US economy, it could be argued that we might be living in an America with only rich and poor people in the future. While “hyperinflation” never arrived, multi-year price increases still stoke that concern.

How does this affect cryptocurrency?

In one word – devastating.

Crypto is reliant on low rates to fuel overperformance.

High liquidity is necessary too.

However, we diverged from those two pillars through 2023–2024, and only recently has easing begun to appear on the horizon.

Crypto, like physical gold, needs rates to be low to represent an attractive investment because of its speculative nature.

The uncertainty now centers on whether the Federal Reserve will delay rate cuts into early 2026.

So what did the price of Bitcoin do upon hearing this news?

In 2022, Bitcoin slid toward $18,000 on similar macro fears. Today, it fell toward $95,000 as traders reassessed the timing of future rate cuts rather than hikes.

Cryptocurrencies had been trading mostly sideways at times earlier in 2025, but Bitcoin’s consolidation ranges now span tens of thousands of dollars, not hundreds.

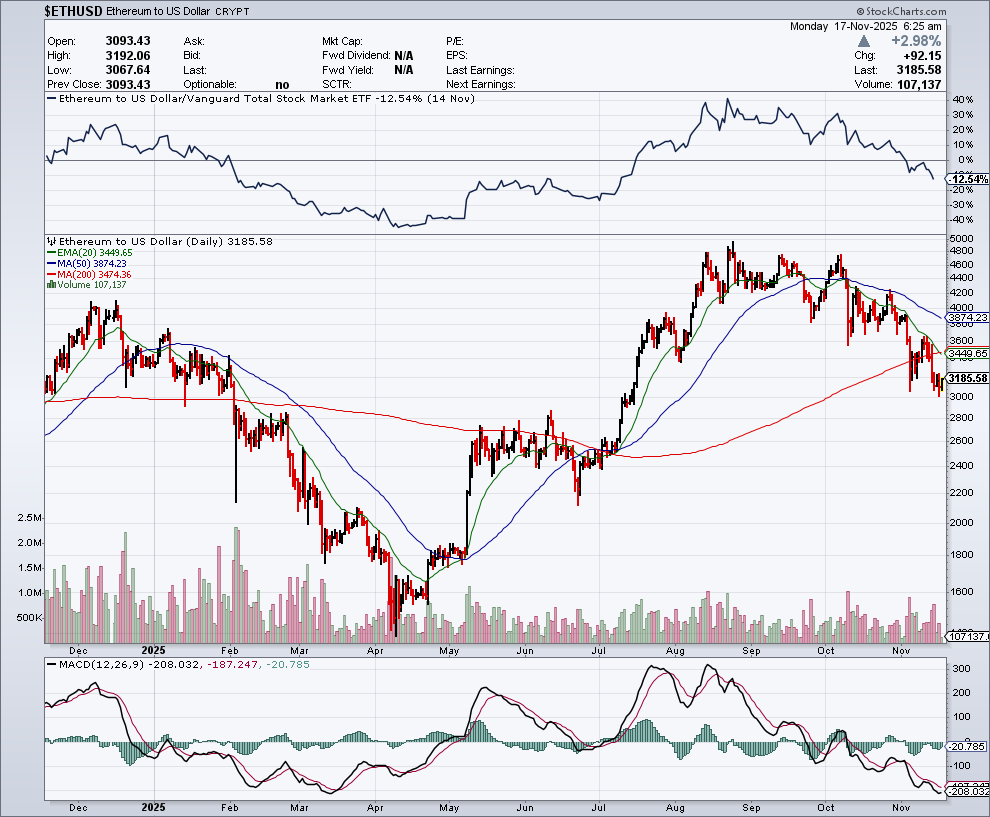

That’s been a key shift, and a clear move lower this year led to correction lows near $74,000 for Bitcoin. Ether’s mid-2025 lows were near $3,500.

Clearly, there is a lot to worry about for readers who are heavy crypto traders.

Moderating but sticky inflation still leaves the economy vulnerable to price spikes heading into winter.

My guess is that upcoming high inflation data will show up in the form of elevated utility bills, particularly in natural gas.

The sabotage and geopolitical tensions that disrupted energy supply in prior years still echo through markets, and OPEC’s decisions continue to have global effects.

The negative events are just piling on top of each other at this point.

I just don’t see how Bitcoin sustains itself above six-figure territory in the short term.

If it does surpass $120,000 because of a bear-market rally, traders will take profits yet again, rinse and repeat.

Although equity markets may rally through the day, this remains another reminder of the strategic fragility of this alternative asset that once offered so much hope.

Crypto has turned into nothing more than an ultra-speculative asset that, in times of tight liquidity, goes on life support.

It remains volatile, and although institutional adoption and ETFs have added legitimacy, its price still fails many traditional store-of-value tests.

Sell any rally over $120,000 because it won’t last there long.