Looking to Make a Difference

A non-fungible token (NFT) is a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity and ownership.

Like cryptocurrencies, they are also digital tokens.

But compared to cryptocurrencies, which are fungible, or interchangeable, NFTs are singular and unique. Like cryptocurrencies, they exist on the blockchain as cryptographic assets.

The price direction of NFTs is a good way to take a barometer of a speculative technology market underpinning crypto.

I can tell you that the NFT marketplace is dead as a doornail, and like how the price of Bitcoin had been engulfed in a crypto winter during 2022–2023, it’s even worse in the NFT world. Bitcoin has recovered since then, but NFTs haven’t.

How bad?

Multimillion-dollar NFT purchases marked down to $100 kind of bad.

In times when the crypto industry is bullish, NFT prices benefit from being a second-derivative industry.

One might say that it’s just a 3X ETF of Bitcoin and for speculators, this can be either good or bad.

If you don’t believe me about the state of NFTs, let's roll through some of the data points.

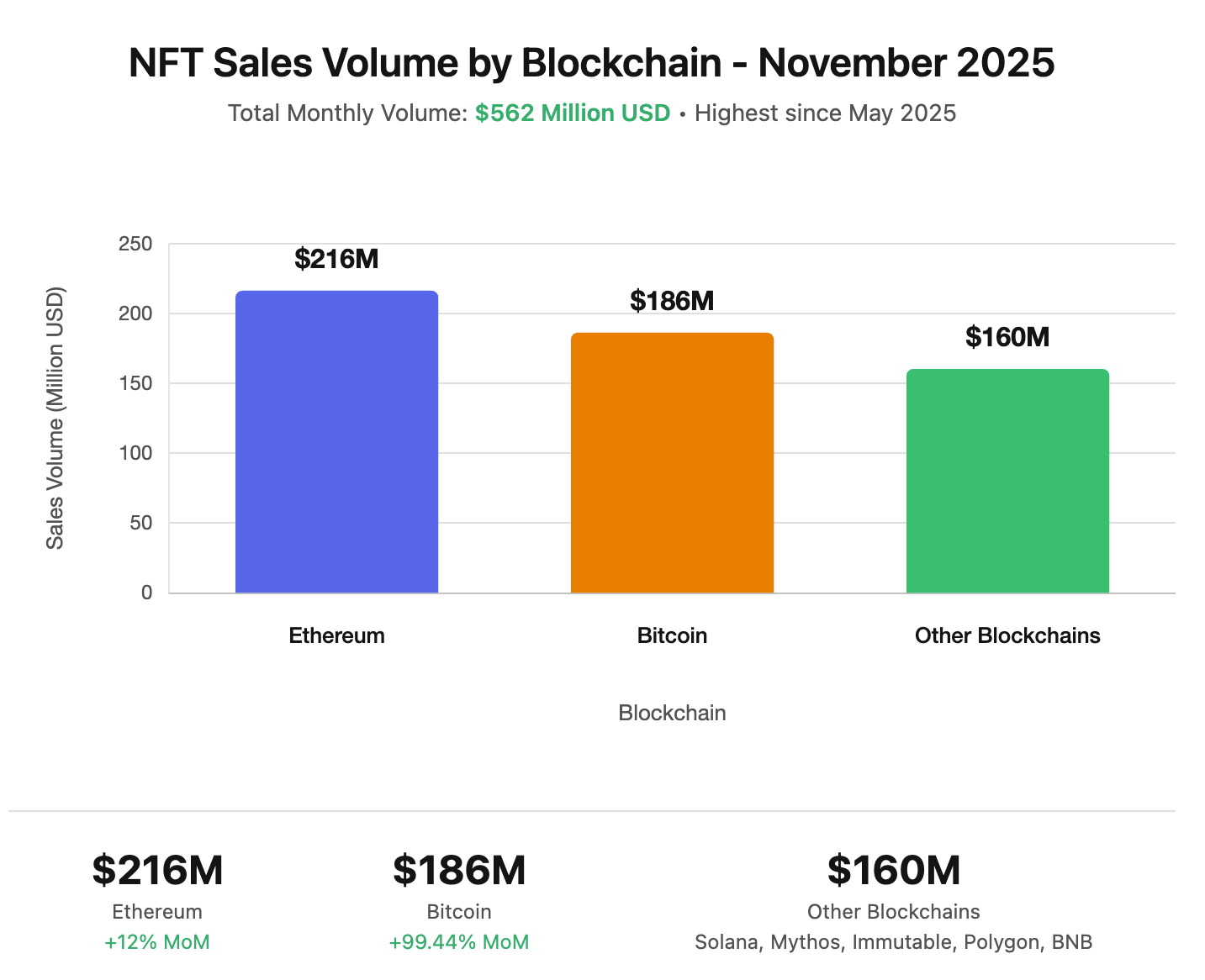

In sectors from art to gaming, trading volume and prices collapsed more than 90% from their early-2022 peaks, and by 2024–2025 an estimated 96–98% of NFT collections saw virtually no trading activity at all.

By 2025, global NFT sales sit in the low single-digit billions per quarter, compared with tens of billions at the height of the 2021–2022 mania. Daily volume across major collections now totals only a few million dollars.

The NFT capitulation is solid proof that NFTs are not stores of wealth and definitely aren’t inflation hedges.

I can also say that Bitcoin pretty much failed every test of legitimacy during the 2022–2023 crypto winter.

NFTs and Bitcoin are speculative assets that only do well during a time of increasing liquidity. The reverse holds true as liquidity tightens.

Many of those art NFTs are being bought and sold on OpenSea, the most prominent peer-to-peer marketplace.

Daily trading volume on OpenSea peaked around $2.7 billion on May 1, 2022 and then fell by about 99% to under $10 million a day by late August 2022. By 2025, OpenSea’s annualized marketplace revenue is in the low tens of millions of dollars, a fraction of its peak activity.

Personally, I don’t believe in NFTs long term, I don’t get how a digital certificate will hold weight.

I rather have a real physical certificate that shows I own something like a real estate deed.

For those who might think NFTs could hold more utility in the future, then I am another hater you must convince.

Preaching to me about how long-term prospects are positive and investors should buy the dip is laughable.

Any serious asset doesn’t go down 95% in one year without a crisis and in the short-term survival of NFTs isn’t guaranteed. For most collections, prices remain more than 90% below their 2021–2022 highs even in 2025.

This was a fad that caught on and rode the hysteria of Bitcoin to relevance and now is being dumped faster than one can imagine.

Back in 2022, as markets braced for a Fed-induced recession that ultimately turned into a slowdown rather than a deep, official downturn, it was hard to believe Americans would be interested in buying an NFT when they worried about keeping their jobs - and even in 2025, high rates and lingering inflation shocks have left little appetite for ultra-speculative JPEGs.

Surveys show that roughly half of U.S. adults have heard at least a little about NFTs, while globally about 47% of consumers have never heard of them at all, only 7% say they know exactly what they are, and roughly 1% actually own one.

But most understand that securing shelter and food during unemployment is more important than throwing money down the toilet.

Avoid the NFT asset class, period.