June 16, 2023

(NVDA), (INTC), (MSFT), (AMZN)

Imagine a world where computers possess the incredible ability to see and understand the visual wonders that surround us.

This seemingly futuristic concept is now a reality, thanks to the groundbreaking work of computer vision companies worldwide.

These visionary organizations are revolutionizing the field of artificial intelligence by unlocking the potential for machines to perceive and interpret visual information – just like we humans do.

At the heart of this transformative technology lies deep learning and machine learning, the driving forces behind AI-powered vision. Computer vision companies harness the power of these cutting-edge techniques to train sophisticated models that "teach" computers to make sense of images and videos.

By delving into the depths of deep learning, these companies can construct intricate neural networks with multiple layers.

These networks possess an extraordinary ability to learn and extract intricate features from visual data. They can effortlessly recognize objects, comprehend scenes, and perform a myriad of awe-inspiring tasks such as image classification, object detection, image segmentation, and even facial recognition.

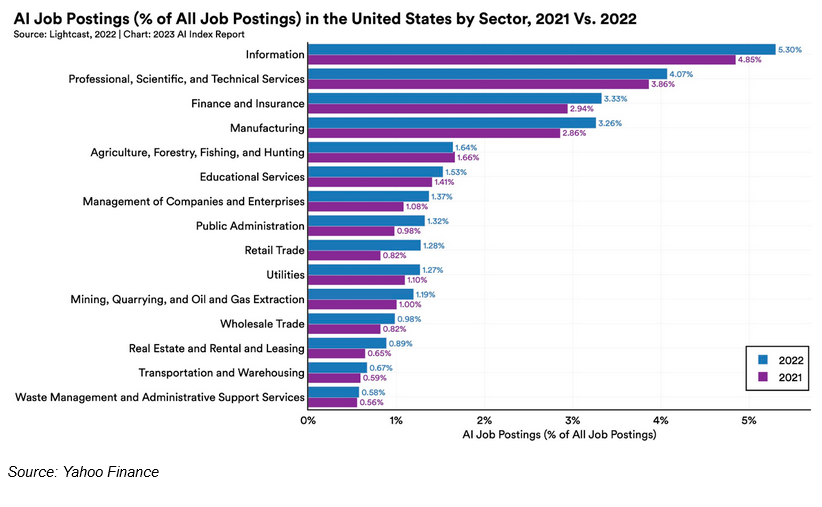

Computer vision companies play a pivotal role in advancing this groundbreaking technology. To date, several publicly traded and start-up organizations are actively involved in AI, specifically in the field of computer vision.

NVIDIA Corporation (NVDA) is the first in line for all things tech-related, creating GPUs (graphics processing units) that are the go-to for AI tasks, specifically computer vision.

Their hardware and software development expertise has produced NVIDIA CUDA, a platform tailored for working with their GPUs.

To top it off, they have also created the NVIDIA TensorRT deep learning inference optimizer that allows for streamlined processing of computer vision tasks.

Basically, NVIDIA TensorRT helps accelerate the performance of AI applications, making them faster and more efficient. Think of it as a speed booster for AI algorithms.

For example, in autonomous driving, TensorRT can process complex data from sensors in real time, allowing cars to quickly recognize objects and make split-second decisions for safe navigation.

In healthcare, it can enhance medical image analysis, enabling faster diagnoses. TensorRT's optimizations save time and resources, making AI applications more practical and accessible in various real-world scenarios.

Another is Intel Corporation (INTC), which offers various AI solutions, such as the Intel Movidius Neural Compute Stick. This USB device enables devices like cameras and drones to analyze images and videos quickly, without relying on an internet connection.

In terms of practical uses, the stick can be utilized in a security camera to identify faces or objects in real time, helping to enhance safety. It can also be used in agricultural drones to assess crop health by analyzing aerial images.

Meanwhile, it’s no secret that Microsoft Corporation (MSFT) has invested significantly in AI and computer vision.

They offer the Azure Cognitive Services platform, which provides ready-to-use artificial intelligence (AI) capabilities for developers to integrate into their applications. This platform allows applications to understand and interpret data from the real world.

For instance, the Azure Cognitive Services platform can analyze images to identify objects or people, transcribe speech into text, understand natural language, and even detect emotions from facial expressions.

These services can then enable developers to build intelligent applications that recognize, understand, and respond to human input, making them useful in scenarios like automated customer support, smart assistants, or sentiment analysis in social media.

Unsurprisingly, Microsoft's computer vision technology is used in various applications, including autonomous vehicles, surveillance systems, and augmented reality.

And, of course, there’s Amazon.com, Inc. (AMZN), which has the Amazon Rekognition service provided by Amazon Web Services (AWS). This platform uses advanced artificial intelligence to analyze images and videos. It can recognize objects, faces, and text, as well as detect emotions and activities in visual content.

In simple terms, Amazon Rekognition is like a smart assistant for images.

For example, imagine you have a security camera system in your home. Amazon Rekognition can automatically detect and alert you if a stranger enters your property. Or, if you have an e-commerce platform, Rekognition can help identify products in images, making it easier to organize and search through your inventory.

Needless to say, the work of computer vision companies is shaping a future where computers can truly "see" and understand the world around us. Fueling their progress are vast datasets brimming with meticulously annotated images and videos.

These datasets serve as the training ground for the intelligent models they create. Through countless iterations, these models grasp the intricacies of visual patterns and relationships, making them formidable "sight-givers" for computers.

Moreover, the impact of AI-powered vision spans numerous industries and domains.

Imagine machines that can analyze medical images with unparalleled precision, unlocking new frontiers in healthcare.

Picture autonomous vehicles that navigate our roads, powered by the ability to perceive and comprehend their surroundings.

Envision retail stores where computers seamlessly identify products and enable cashier-less transactions. The possibilities are endless.

With computer vision at the helm, the future is teeming with opportunities. From manufacturing to agriculture, surveillance to augmented reality, the visual realm is ripe for transformation. These computer vision companies drive this revolution, propelling us into an era where machines possess the extraordinary power of sight.