March 17, 2025

(INVESTORS ARE LOOKING FOR CLARITY AMID THE CHAOS)

March 17, 2025

Hello everyone

WEEK AHEAD CALENDAR

Monday, March 17

8:30 a.m. Empire State Index (March)

8:30 a.m. Retail Sales (February)

10:00 a.m. Business Inventories (January)

10:00 a.m. NAHB Housing Market Index (March)

Tuesday, March 18

8:30 a.m. Building Permits preliminary (February)

8:30 a.m. Housing Starts (February)

8:30 a.m. Import Price Index (February)

9:15 a.m. Capacity Utilization (February)

9:15 a.m. Industrial Production (February)

9:15 a.m. Manufacturing Production (February)

11:00 p.m. Japan Rate Decision

Previous: 0.5%

Forecast: 0.5%

Nvidia GTC on March 17-21, with keynote address March 18.

Wednesday, March 19

2:00 p.m. FOMC Meeting

Previous: 4.5%

Forecast: 4.5%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: General Mills

Thursday, March 20

8:00 a.m. UK Rate Decision

Previous: 4.5%

Forecast: 4.5%

8:30 a.m. Current Account (Q4)

8:30 a.m. Continuing Jobless Claims (03/08)

8:30 a.m. Initial Claims (03/15)

8:30 a.m. Philadelphia Fed Index (March)

8:30 a.m. Existing Home Sales (February)

8:30 a.m. Leading Indicators (February)

Earnings: Nike, Micron Technology, Lennar, FedEx, Darden Restaurants

Friday, March 21

8:30 a.m. Canada Retail Sales

Previous: 2.5%

Forecast: -0.4%

This week investors will have one eye on the geopolitical landscape, and Trump’s relationships with Europe and other countries around the world, and the other on domestic data as it relates to the health of the U.S. economy.

The Retail sales report will reveal the temperature of the consumer – always a good indicator of the strength of the U.S. economy.

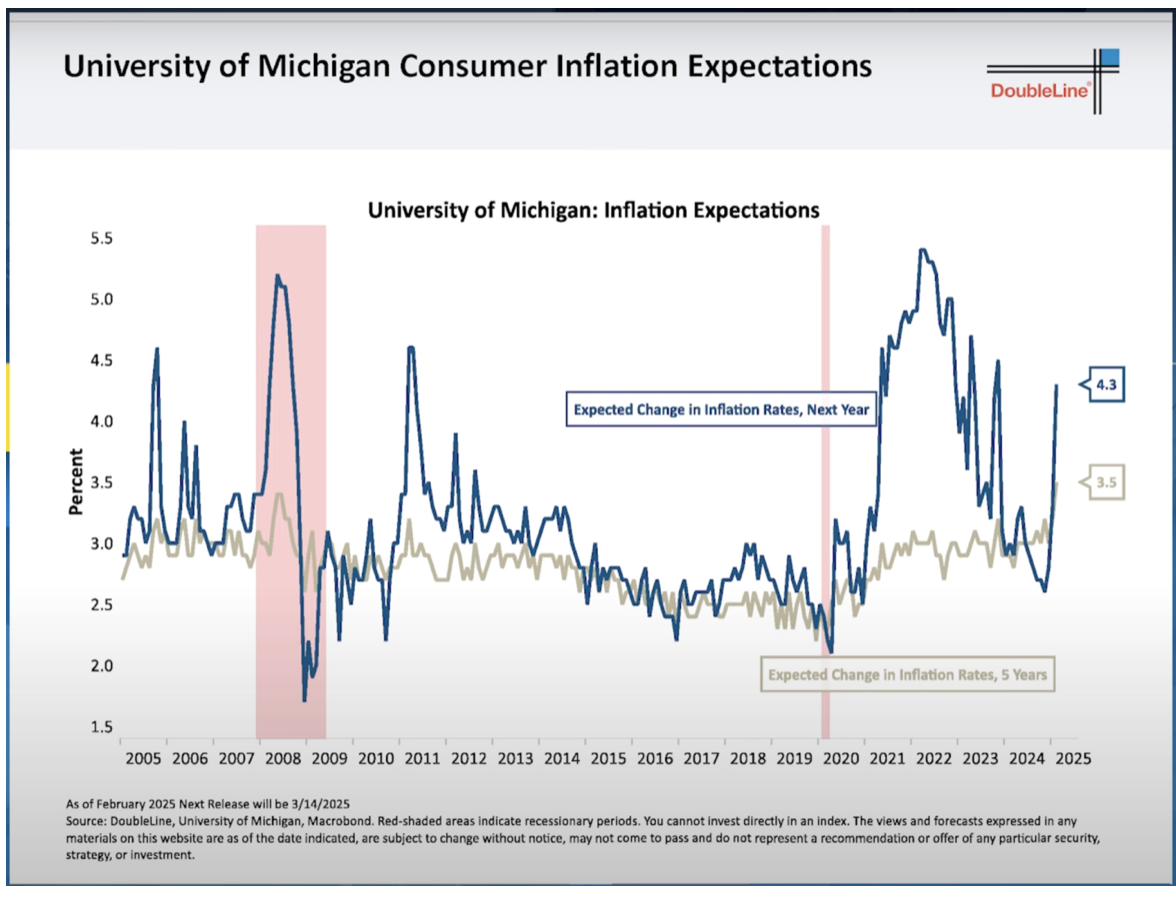

The Fed is widely expected to hold rates steady at its meeting this week. But it’s the post-meeting that will be interesting. Investors will be listening for any shifts in monetary policy because of the ongoing uncertainty stemming from the Trump administration, and the recent sluggishness in the economy.

Also, this week, Nvidia (NVDA) could get a kick along from the GPU Technology Conference (GTC). Investors are looking for Nvidia’s ability to keep delivering new chips at a faster pace than in the past. It’s a tall order! Investors will also be looking for details on Nvidia’s next chips called “Rubin”, named after Vera Rubin, the astronomer who discovered dark matter.

MARKET UPDATE

S&P500

After a tumultuous couple of weeks, the S&P500 has finally found some support around 5495/10. The market is very oversold, so there is potential for a bottom to form here for a few weeks.

Support = $5500/10 and $5435

Resistance = $5635/$5780

GOLD

Gold hit another new high, recently reaching $3005. If we look at the big picture, through an Elliott Wave lens, the rally from the Nov. low at $2537 is in its final upleg, which suggests a rising risk of an approaching multi-month top. So, even though we could get some more short-term upside in gold, investors need to be aware that a top is near. After a correction, gold will resume its bull market rally. Targets include $3,500, and $4000.

Support = $$2676/$2930/$2892

Resistance = $3005/$3030

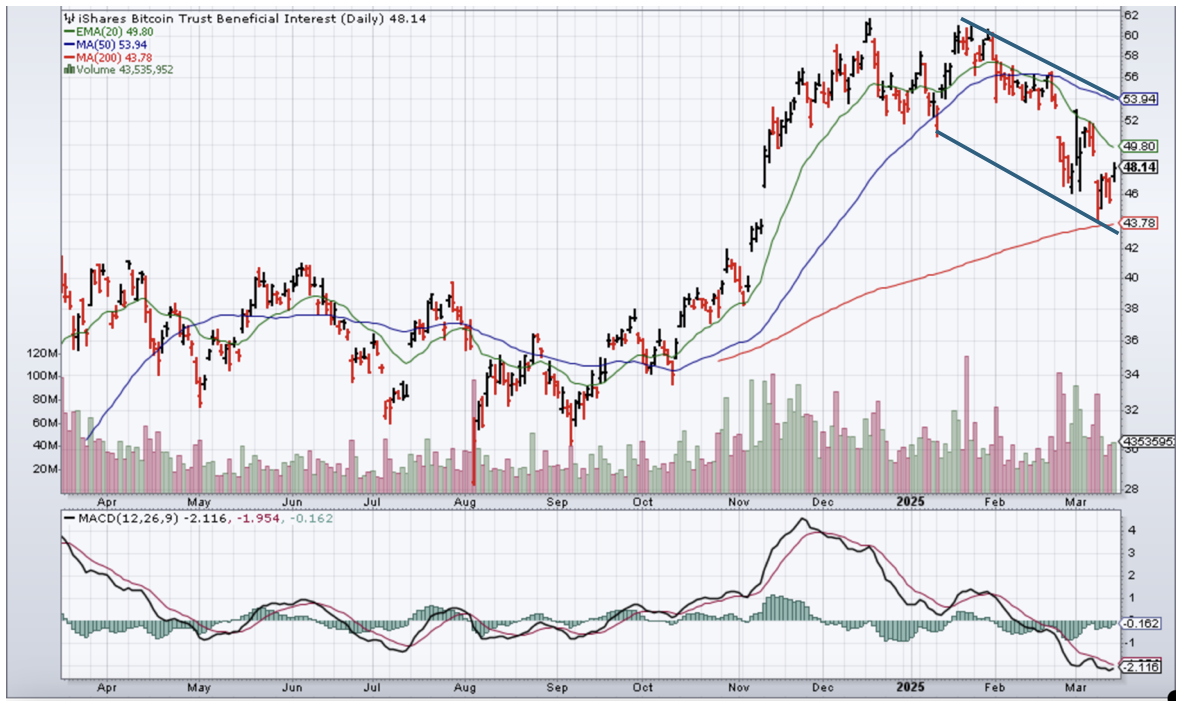

BITCOIN

Bitcoin has been continuing its messy bottoming behaviour, reaching a recent low at 76.6k. In the big picture, Bitcoin’s movement is seen as a large correction with an eventual upside rally targeting new highs. Bitcoin could continue this ranging/basing for another week or two, and even touch lows below 76, though the extent and pace of the move will likely be limited. Bitcoin should not breach 60k, but if it does, it will most probably be a spike movement to test the Bitcoin bulls.

Support = $79.7 and $75.6 area

Resistance = $$87.6k/$88k

TRADES CORNER

AS I eventually expect bitcoin to rally in the short to medium term, I have been researching some options to play this rally. Many of you don’t own bitcoin, so the next best thing is to either own or do options on (IBIT) and (MSTR).

Below I have displayed a few alternatives option plays for (IBIT) and (MSTR). It’s up to you how many you do – you can place all of the trades, just one, or none of them, should you just want to observe the action. Also, the number of contracts is up to you – just choose a weighting that is comfortable for you, so you can sleep at night. Of course, by the time you enter any of these option trades, prices will probably have moved, so please trade accordingly.

(IBIT) Price = $48.14

1/ Sell 1 May 16, 2025, (IBIT) $55 call

Buy 1 May 16, 2025, (IBIT) $50 call

Max Profit = $337

Max Loss = $163

Cost = $1.63

2/ Sell 1 June 20, 2025(IBIT) $65 call

Buy 1 June 20, 2025 (IBIT) $55 call

Max Profit = $815

Max Loss = $185

Cost = $1.85

3/ Sell 1 August 15, 2025 (IBIT) $70 call

Buy 1 August 15, 2025 (IBIT) $60 call

Max Profit = $837

Max Loss - $163

Cost = $1.63

MicroStrategy (MSTR) Price = $297.49

Sell 1 May 16, 2025 (MSTR) $320 call

Buy 1 May 16, 2025 (MSTR) $310 call

Max Profit = $630

Max Loss = $370

Cost = $3.70

Sell 1 July 18, 2025 ((MSTR) $325 call

Buy 1 July 18, 2025 (MSTR) $315 call

Max Profit = $647

Max Loss = $353

Cost = $3.53

MicroStrategy Daily Chart

(IBIT) Daily Chart

QI CORNER

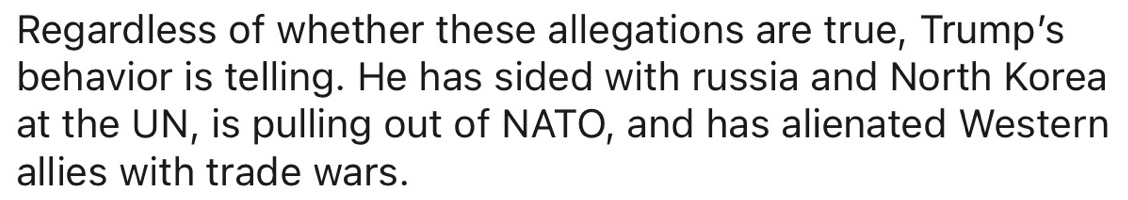

HISTORY CORNER

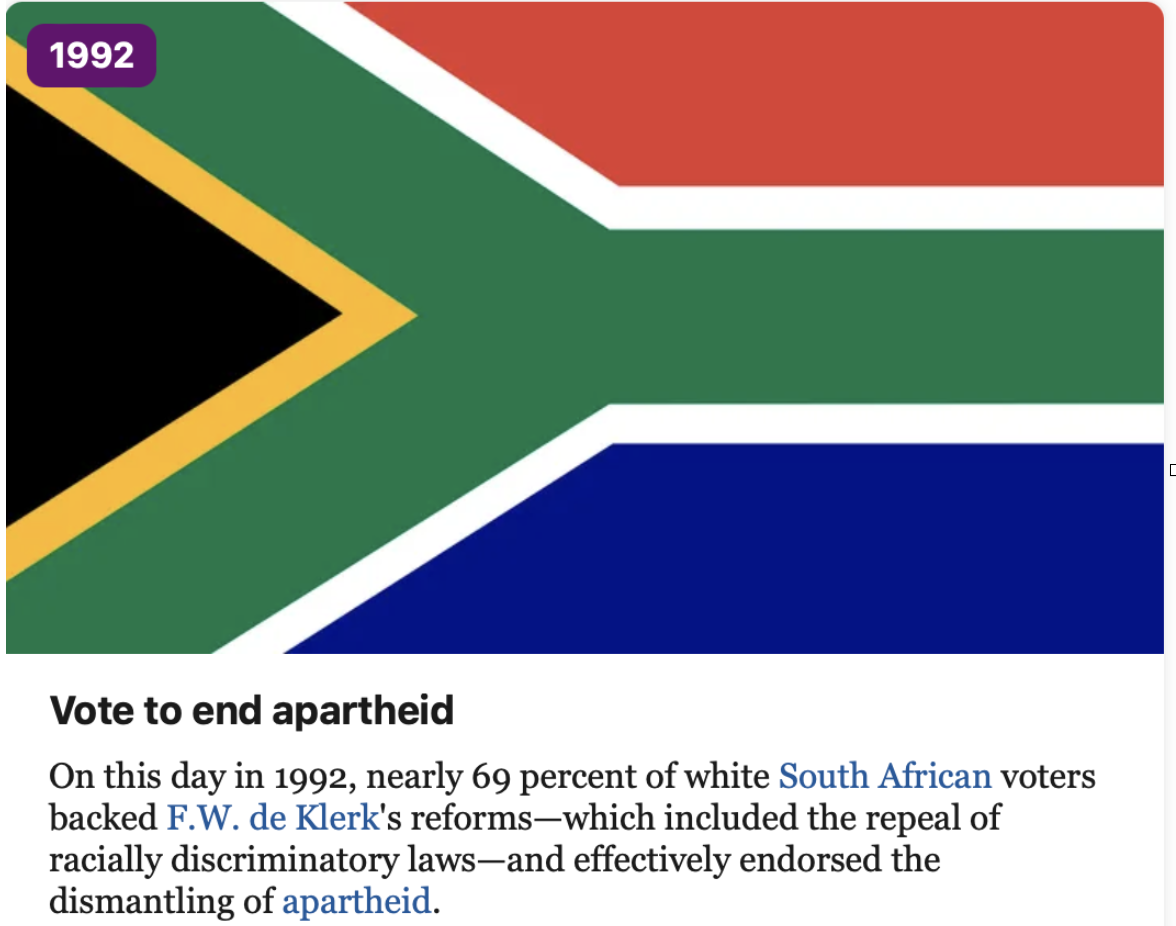

On March 17

SOMETHING TO THINK ABOUT

Cheers

Jacquie