March 27, 2024

(CEOs ARE SELLING INTO THIS MARKET RALLY – IS SOMETHING BREWING…?)

March 27, 2024

Hello everyone,

Insiders are selling the market rally.

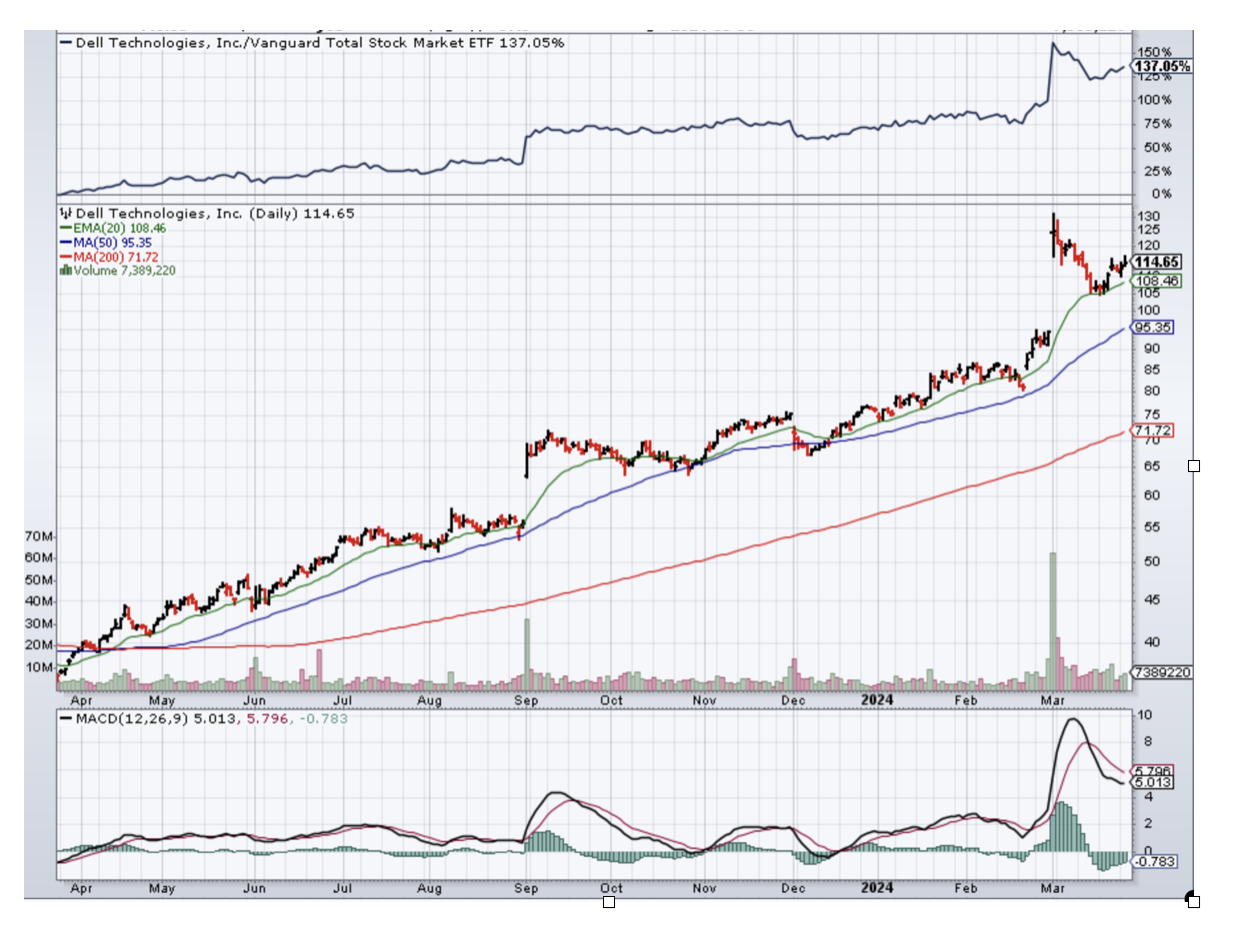

CEOs of technology companies and other firms have been cashing in on this market rally, including a massive sale last week from Michael Dell, founder and CEO of Dell Technologies.

Dell, who took his namesake company public for a second time in 2018, racked up $468 million in stock sales over the past week, according to securities filings and Verity Data. Those moves bring Dell’s total sales this month to nearly $800 million.

If you look at Dell’s stock chart it appears to have topped out, at least in the short term. Shares of Dell are up 200% over the past year, but the stock has fallen over the past three weeks.

Mark Zuckerberg has also been selling off stock. Securities filings and Verity Data show that roughly $114 million has been sold of late.

It seems that Zuckerberg’s moves were done as part of a 105b-1 plan, which is a document filed with the Securities and Exchange Commission to schedule stock sales for executives. His sales also came from several entities, including the Chan Zuckerberg Initiative, a charitable foundation Zuckerberg runs with his wife, Priscilla Chan.

Like Dell, Zuckerberg’s sales come after a massive run-up for his stock. Shares of the company formerly known as Facebook are up more than 40% year to date.

CEOs in the following companies have sold off significant parcels of stocks.

Cadre Holdings - $50.3 million

Arista Networks - $40.9 million

Ares Management - $32.7 million

Gitlab - $16.5 million

Cadence Design Systems - $14.7 million

AppLovin - $9.5 million

Cleanspark - $9 million

As I have been saying, it’s always good to have insurance on your portfolio, and taking some profits is always a good idea.

Is a Boeing turnaround expected soon?

The shake-up at Boeing this week with the CEO set to step down by year-end may have sparked optimism among investors. Boeing has faced significant challenges over the years with the latest incident involving a door plug on an Alaska Airlines 737 Max 9 in January. Numerous groundings and substantial financial losses have come as a result. The stock is down by more than 27% since the start of the year.

The chart of Boeing above shows basically a double bottom. Instead of buying the stock outright, we could purchase a bull call spread to lessen the risk. For a short-term spread trade, you could buy a $190 call and sell a $195 call with an expiration on April 19. If BA trades at or above 195 by the expiration date, this trade could yield a good return.

To get creative with your trades, either change the strikes or change the expiration. If you place your strikes toward $200 you are being more aggressive. If you place your strikes underneath the stock price, (in the money), you are being more conservative.

Tesla is out of favour.

Bernstein has cut its Tesla’s price target from $150 to $120, citing growing demand constraints. The new forecast implies a downside of 30% over the next 12 months.

This quarter to date, Tesla has experienced soft China/Europe demand and constrained US Model 3 production. Bernstein expects lukewarm growth in 2024, as well as 2025, bringing into question the company’s growth narrative. Tesla has lost 30.5% in 2024, making it the worst-performing S&P 500 stock.

Have a great week.

Cheers,

Jacquie