March 28, 2023

Another Look at Rivian

27 March 2023

Hello everyone,

Welcome to a new week.

Hopefully, the drama surrounding regional banks dies down this week and it’s back to looking at the overall market and digesting some facts.

We hear a lot about EVs now and it’s usually all about Tesla. But let’s consider Rivian for a moment.

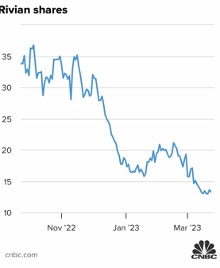

This year Rivian’s shares have been hitting all-time lows, dipping below $13 per share at some point during March. Its shares are down around 25% year to date. By way of contrast, rival EV maker, Tesla has soared 56% in the same period. So, what gives?

Rivian’s underperformance versus its peers comes after a series of developments this year. Most recently, it said it was in talks with Amazon to adjust an exclusivity clause to produce 100,000 electric trucks for the e-commerce giant. That came as Amazon was underwhelmed with its order numbers.

Rivian shares also plunged after it said it planned to raise $1.3 billion in cash via a sale of convertible bonds.

To ignite its upward trajectory, Morgan Stanley estimates Rivian could spend nearly $6 billion on both operational and capital expenditure this year – which is 1.5 times its full-year 2023 revenues, the bank forecast. Morgan Stanley also highlights Rivian’s aggressive growth rate. Rivian’s spending levels are higher as the company is targeting a much steeper growth rate compared to Tesla’s trajectory in 2015.

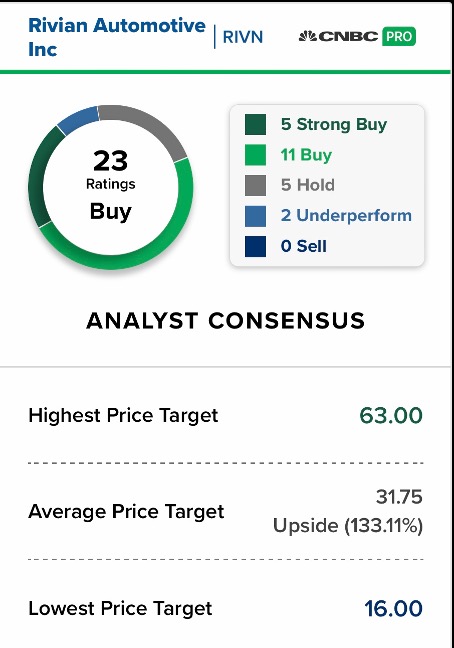

Morgan Stanley is giving the stock an overweight rating, and a price target of $26.00 – or nearly 90% upside.

Morgan Stanley’s analysts said Rivian was the only EV start-up name it recommends, apart from Tesla which is also rated overweight.

Chief analyst, Adam Jonas, at Morgan Stanley, says that while the stock offers a rather wide risk/reward skew ($5 bear case to $55 bull case) the firm remains compelled by the company’s differentiated product, scalable end markets, cost-cutting potential, cash balance, and valuation.

Looks like Rivian is a good buy, although the shares may take time to rally. Be patient.

“Trust is the coin of the realm. When trust was in the room, whatever room that was – the family room, the schoolroom, the locker room, the office room, the government room or the military room – good things happened,” said my late friend, US Treasury Secretary George Schultz.

John Thomas and George Schultz