March 28, 2025

(THE RETAIL INVESTOR IS BUYING THE DIP)

March 28, 2025

Hello everyone

The buy-the-dip mentality is still strong among the retail investing crowd, even though markets have been spooked by the Trump administration trade war and the growing risk of a recession.

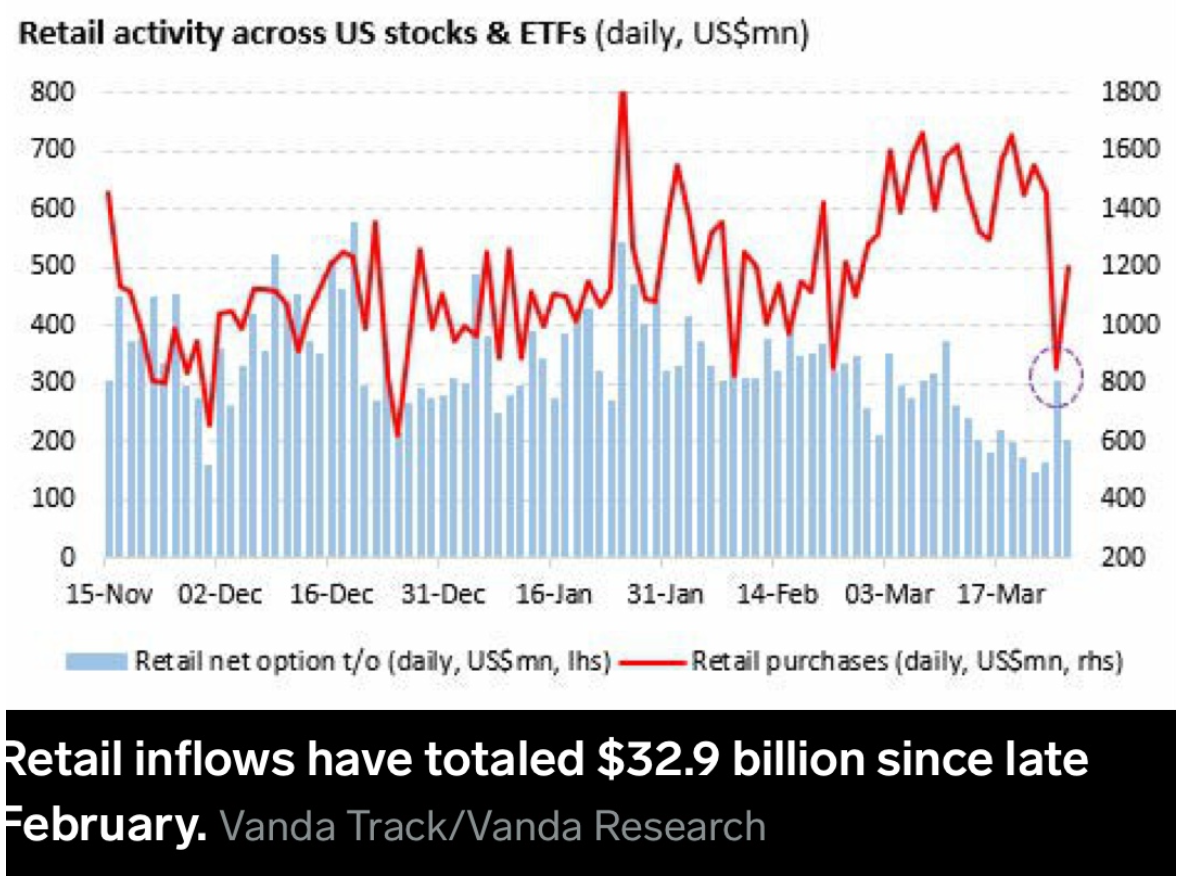

Individual investors have invested $32.9 billion into stocks since late February, according to Vanda Research.

Retail Investors have been buying the dip mostly in mega-cap tech names and among chip stocks.

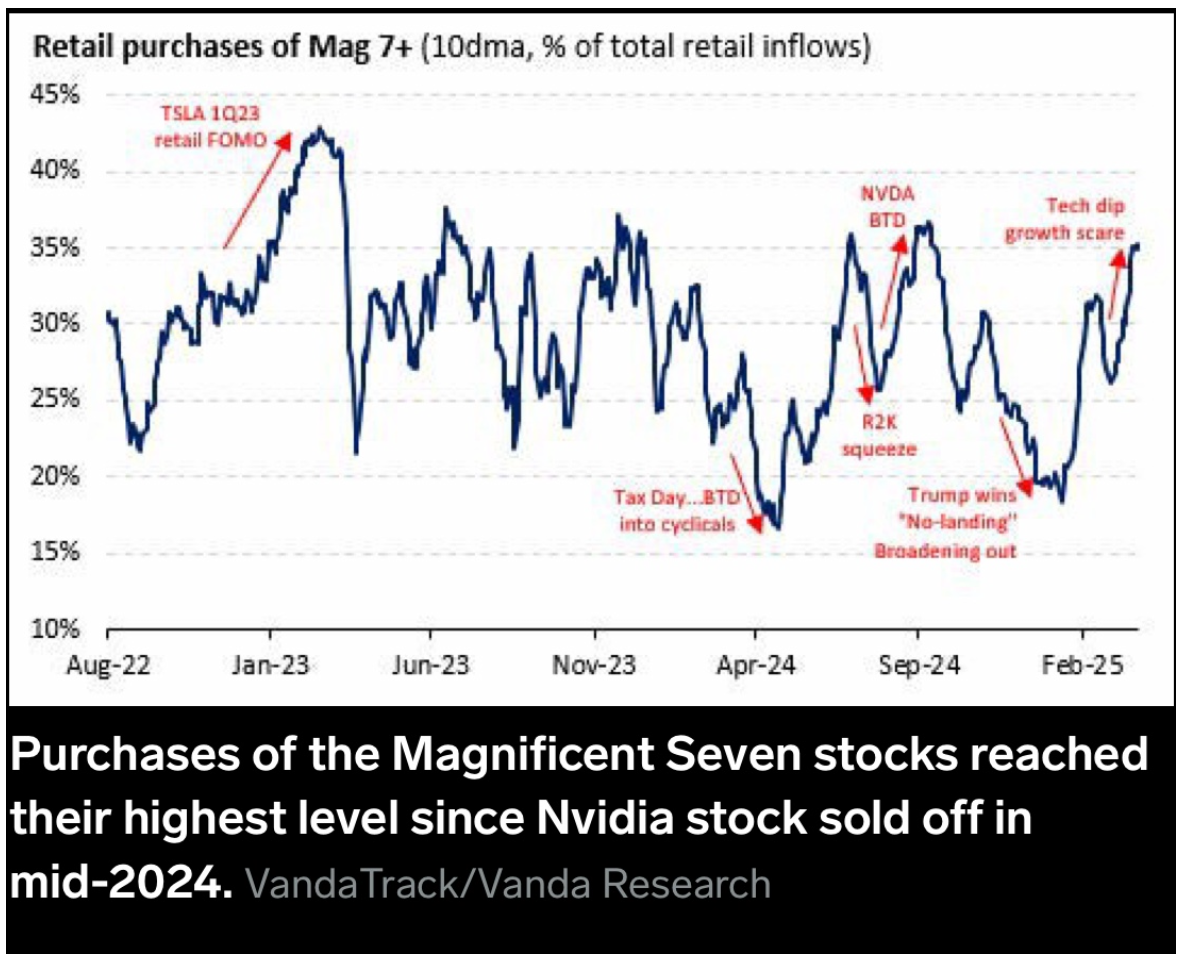

The 10-day moving average of retail flows into the Magnificent Seven stocks climbed to its highest level since mid-2024 when investors bought the dip as Nvidia shares declined 30% from a peak of $135 a share last June.

Nvidia remained the most popular retail stock, with net flows reaching 1.39 billion in the last five trading days. Nvidia shares are down 18% year-to-date.

Tesla was the second-most popular stock among retail investors, who bought a net $811 million worth of shares in the last five trading days. The stock is down 28% year-to-date.

Palantir (PLTR), Amazon (AMZN), and Advanced Micro Devices (AMD) were also among the top five most popular retail stocks in the last week, with investors pouring in a net $417 million in the three companies.

The jitters on Wall Street are not discouraging retail investors from buying the dip. That’s even despite growing concern over the impact Trump’s trade war may have on the economy and the potential for the U.S. to enter a recession later this year. (The U.S. is probably already in recession – but hard data will only confirm that later this year).

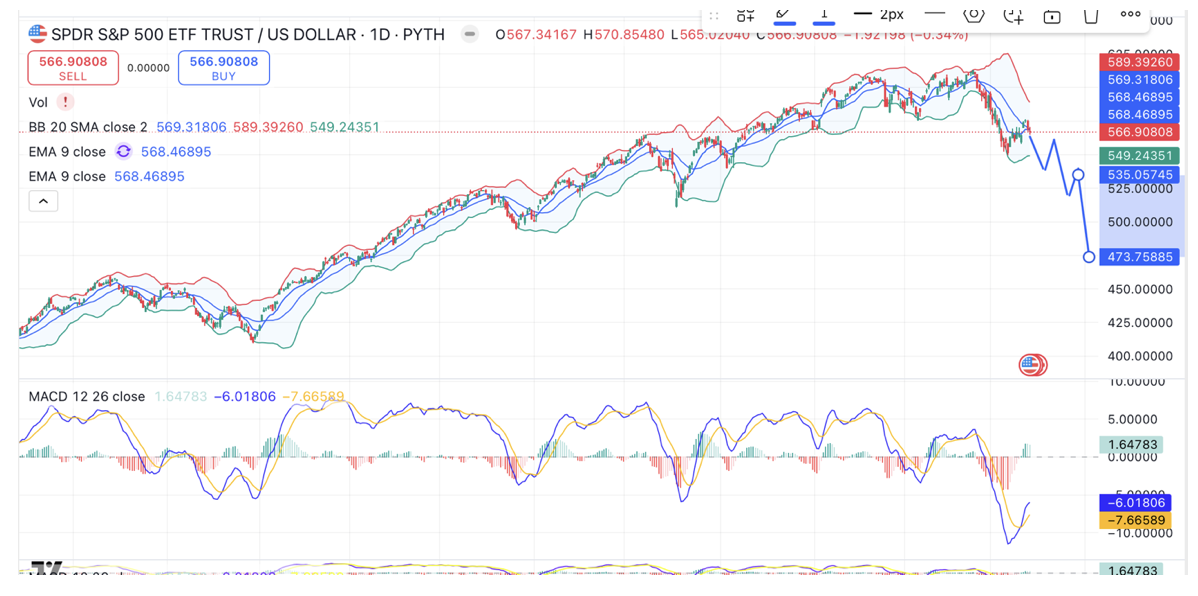

Citi and HSBC downgraded their ratings for the US stock market this month, citing growth concerns in the US. Meanwhile, Goldman Sachs, RBC, and Barclays have also trimmed their price targets for the S&P500.

It seems that the retail investor has grown numb to hard data, or should I say they have grown a rhino hide in response to the hard data being thrown at them.

To be still buying this market when consumer confidence declined for a fourth straight month in March, and expectations for income, business activity, and the job market declined to a 12-year low, reveals a truly blaze attitude.

Retail investors have probably been taught to lean into the fear and buy anyway.

And this is why this bear market will probably end up looking like an expanding triangle. Example provided here.

Retail investors return to the market after the first drop and buy heartily, not concerned at all about any future drops in the market. Then a second fall happens, and the retail investor once again picks up the pieces and buys again, and the market rallies. However, it might be the third big drop that really sets the heart pounding and makes them think twice about buying again. Have they been taken in by a buying the dip mentality, without question?

I think so.

QI CORNER

Take care.

Be well.

Cheers

Jacquie