March 6, 2024

(WHY GOLD WILL SHINE IN 2024)

March 6, 2024

Hello everyone,

The price of gold has surged to a record high, driven by expectations of US interest rate cuts, investors hunting for haven assets and months of prodigious buying by central banks and Chinese investors.

On Tuesday, gold hit $2,141, beating the previous record of $2,135 set in December.

Tuesday’s move represents a continuation of a rally triggered on Friday by growing hopes of a Federal Reserve rate cut in June following weaker economic data. Gold, an asset with no yield, benefits from lower borrowing costs as investors feel they have not missed out so much by not putting their cash into bonds.

Gold’s 16-month rally from just above $1,600 in late 2022 has been primarily supported by record buying by central bank emerging markets after the US weaponised the dollar in its sanctions against Russia for its full invasion of Ukraine.

Chinese consumers have also participated in sending the metal higher as they are seeking a safe place to park their cash after local property and stock markets have tumbled.

Ross Norman, chief executive of Metals Daily, confirms that “Gold continues to flow to the east.”

Gold’s recent surge is still remarkable when you consider that the Fed’s benchmark rate is still at a 22-year high of between 5.25% and 5.5%, a level you would think would take the lustre out of gold’s allure. Seemingly, gold has broken its correlation with real rates and is instead being driven by central banks and Chinese household asset allocation. Furthermore, the expectation for slightly higher inflation trends in the future – higher than the pre-pandemic period - could explain this strong performance by gold. It is possible to interpret that this is a new era for gold which suggests that downside risks may be limited.

However, gold is still some way off its inflation-adjusted all-time high of $3,355.00 reached in 1980 when oil-driven inflation and turmoil in the Middle East capped a nine-year bull run.

Last week, the ISM Manufacturing Purchasing Managers’ Index indicated a far larger than expected contraction in the US manufacturing activity in January.

That propelled gold beyond what the market saw as its ‘triple top’ $2,070 mark, when Covid smashed the US in 2020. Russia invaded Ukraine in 2022 and the US banking crisis erupted last year.

Signs of pain in the US economy were reflected in government bond yields moving lower in the past week. This slowing also raised expectations that the Fed could cut rates in June.

Two-year Treasury yields have fallen by 0.23% points since the start of last week to 4.56%. Traders now place an 85% probability on the Fed delivering its first 0.25% point cut by June, up from 70% early last week.

New entrants in the sector have also contributed to the volatility and gold’s rise. Speculative trading, that is, option traders, have been positioning for bullion prices to rise. With the latter in mind, gold could also fall when trades reach expiration, or are liquidated.

Newmont Mining

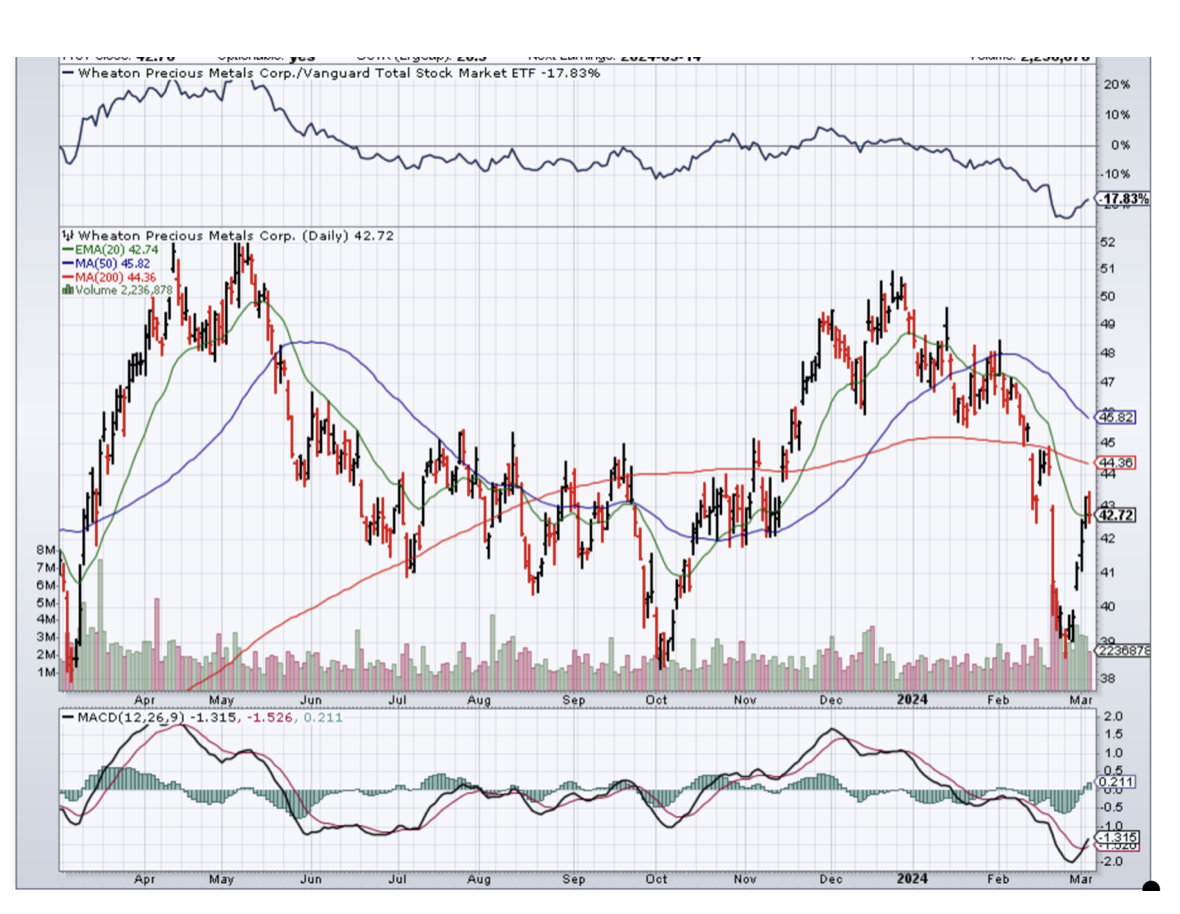

Wheaton Precious Metals

Barrick Gold

Cheers,

Jacquie