May 1, 2023

(IS IT SELL IN MAY AND GO AWAY?)

Monday, May 1, 2023

Hello everyone,

Welcome to May.

Is it going to be a sell in May and go away time now?

This post will be a summary of John’s latest webinar, which was done last Wednesday.

Webinar Title: Man the Lifeboats.

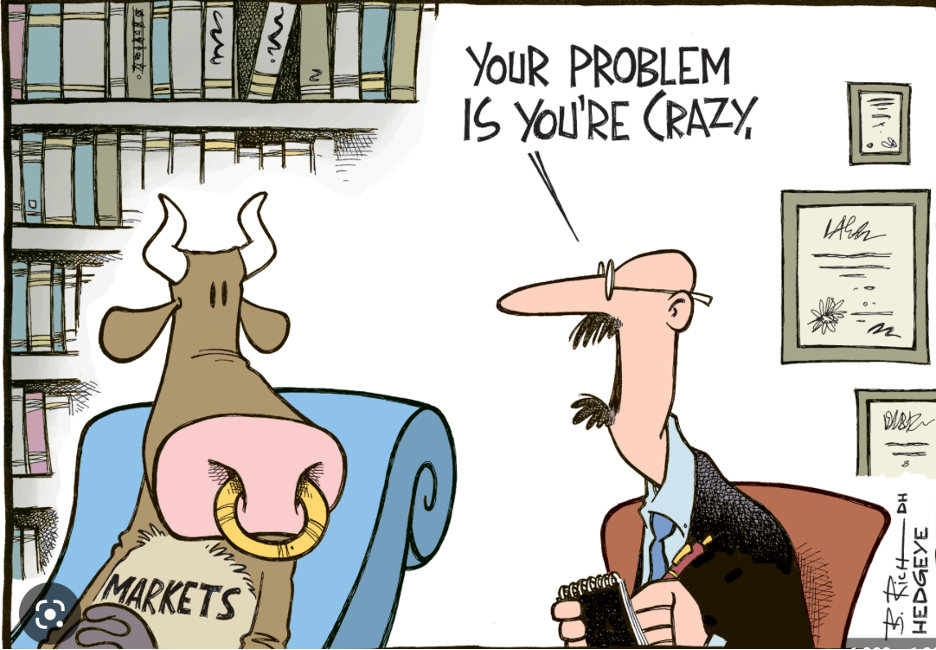

Markets have gone from very low risk to very high risk. We are now at the top end of a high-risk range, with asset classes diverging sharply in outlook.

Bonds, foreign currencies, and precious metals now discounting a recession, while stocks at these prices are discounting a soft landing.

Gold and Silver – be patient -the upside breakout will happen soon.

US$ is fading away on recession prospects.

Look for S&P 500 to correct 10%.

Target is 4,800 for S&P 500 In the medium term.

Vix plunges to $15 – nothing to do here.

FCX target is $100 a couple of years from now.

Recession and debt default are crushing economically sensitive stocks now. Will go lower.

What to do: go to cash.

GLOBAL ECONOMY – FADING

The Fed is looking for “One and Done” with the next 25 basis point rate hike on May 3.

If you’re looking for yield and a safe place to put your funds go to 90-day T-bills. Offering 5% and they may be higher after May 3.

Short sellers take billion dollar hit, betting that European bank shares would collapse in the aftermath of the U.S. regional banking crisis.

Inflation takes a dive, dropping to a 5.6% YOY rate – the 9th consecutive month of decline.

Cash is pouring into money market funds as fears of a market correction mount.

Invest in 90-day T-bills.

PPI gives another deflation hint dropping 0.5% in March for only a 2.7% YOY rate.

Earnings Season sees best start in a decade with 90% beating estimates, albeit low ones.

Only 20% (SPY) companies have reported so far with (JPM) our biggest long, leading the charge.

Consensus (SPY) earnings are currently $220 a share giving moderate price/earnings multiple of 18.77x

All technical indicators are now flashing RED.

Seasonals are now turning strongly against stocks.

Volatility plunges to $15 putting the market to sleep.

Looking for flat first half and strong second half to take us to S&P500 4,800 by year-end.

S&P500 screaming caution.

Everything is rolling over.

UPS -big earnings disappointment – recession warning lights flashing here.

CAT – is a BUY – but wait for the main market to recover.

FCX – selling off – if gets down to 200MA we may go into a buy or even a LEAP.

Buy T-bills direct from U.S. government. Now pushing a 5.2% risk-free yield.

BONDS

10-year U.S. Treasury yields back up. Still looking like a 2.5% yield by the end of 2023.

Keep buying TLT calls, call spreads, and LEAPs but only on dips.

Junk bonds are a great high-yield play. Buy JNK and HYG.

FOREIGN CURRENCIES

Weak U.S.$. Buy Aussie, Pound, Euro, and Yen.

Wishing you all a great week.

Cheers,

Jacque