March 13, 2023

The Silicon Valley Bank debacle

March 13th, 2023

Oh no! This is a financial shock the economy just does not need. It only took 48 hours for Silicon Valley to blow up. Financial regulators are discussing two different facilities to manage the fallout from the closure of Silicon Valley Bank if no buyer materializes.

One way that the regulators may step in would be to create a backstop for uninsured deposits at Silicon Valley Bank, using an authority from the Federal Deposit Insurance Act. The move would also touch the systemic risk exception that allows the Fed to take extraordinary action to stem contagion fears.

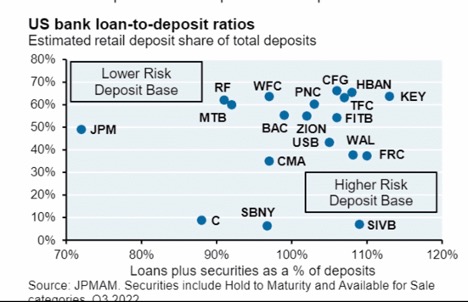

Silicon Valley Bank sowed the seeds of its own downfall. It was a key player for venture capital-capital backed companies in technology and related industries and this appears to have played a major role in its demise, according to J.P. Morgan Asset Management. Michael Cembalest, chairman of the firm, said in a note to clients over the weekend that SVB’s heavy reliance on corporate deposits, (rather than retail) and a high percentage of assets held in loans and securities made it unusually risky compared with other banks. In other words, SVB carved out a distinct status for itself in riskier assets and this set itself up for large potential capital shortfalls in case of rising interest rates, deposit outflows and forced asset sales.

The chart below shows how unique Silicon Valley really was… it sits in the lower right far away from the other regional banks:

The concentrated mix of deposits appears to have contributed to a massive bank run. There were $42 billion in withdraws initiated last Thursday, according to a regulatory filing. SVB’s demise was also accelerated since it had to sell longer-dated fixed-income securities at a loss – from where they were held on the balance sheet in order to meet withdrawals.

While SVB was unique, there is some concern about these fears spreading to other regional banks. So, it should be an interesting day on Monday.

Economic Calendar this week

Monday UK Employment Data Time: 3.00am ET (Tues) Market: GBP/USD

Tuesday US Inflation Rate Time: 08:30am ET Market: USD pairs

Wednesday US Retail Sales Time: 08:30am ET Market: USD pairs

Thursday Euro Area Interest Rate

Decision Time: 09:15am ET Market: EUR/USD

Friday Euro Area Inflation Rate Time: 06:00am ET Market: EUR/USD

The Money Supply

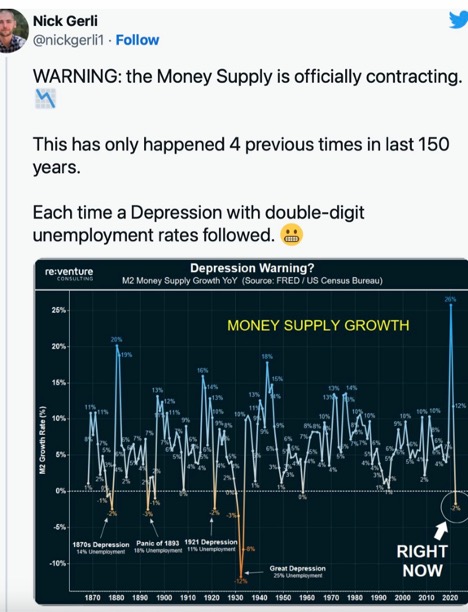

Nick Geril, Founder and CEO of Reventure Consulting has presented a chart that looks a little disturbing. He has used M2 accounts (all money in your pocket at your immediate disposal and savings accounts, certificates of deposit, and money market funds) and U.S. inflation rate data from the Federal Reserve Bank of St. Louis and the U.S. Census Bureau and has plotted out how the money supply and inflationary/deflationary pressures can sometimes correlate.

The U.S. Money Supply is a leading economic indicator with an extensive track record of success within certain parameters.

On that cheery note, I will wish you all an excellent week and much joy.

Take care.

Cheers,

Jacque

"There is nothing impossible to him who will try." - Alexander the Great