May 13, 2024

(REITS ARE DUE FOR A TURNAROUND SOON)

May 13, 2024

Hello everyone.

Week ahead calendar

Monday, May 13

Switzerland Consumer Confidence

Previous: -38

Time: 3:00am ET

Tuesday, May 14

8:30 a.m. Producer Price Index (April)

UK Unemployment Rate

Previous: 4.2%

Time: 2:00am ET

Earnings: Home Depot, Charles Schwab

Wednesday, May 15

8:30 a.m. Consumer Price Index (April)

Previous: 3.8%

8:30 a.m. Hourly Earnings (April)

8:30 a.m. Average Workweek (April)

8:30 a.m. Empire State Index (May)

8:30 a.m. Retail Sales (April)

10 a.m. Business Inventories (March)

10 a.m. NAHB Housing Market Index (May)

Earnings: Progressive, Cisco.

Thursday, May 16

8:30 a.m. Building Permits preliminary (April)

8:30 a.m. Continuing Jobless Claims (05/04)

8:30 a.m. Export Price Index (April)

8:30 a.m. Housing Starts (April)

8:30 a.m. Import Price Index (April)

8:30 a.m. Initial Claims (05/11)

8:30 a.m. Philadelphia Fed Index (May)

9:15 a.m. Capacity Utilization (April)

9:15 a.m. Industrial Production (April)

9:15 a.m. Manufacturing Production (April)

China Retail Sales

Previous: 3.1%

Time: 10pm ET

Earnings: Take-Two Interactive Software, Applied Materials, Walmart, Deere.

Friday, May 17

10 a.m. Leading Indictors (April)

Euro Area Inflation Rate (final)

Previous: 2.4%

Time: 5am ET

The economic data this week is rather light apart from the US CPI on Wednesday.

The Real Estate Sector is Oversold

Brian Belski, Chief Investment Strategist, and leader of the Investment Strategy Group at BMO sees opportunity for investors in the real estate sector which is currently oversold.

Belski notes that the REITS sector is the only S&P500 sector that is in the red this year, off 6%.

He believes the sector will turnaround in the coming months and is recommending that investors use the current weakness as a dip buying opportunity.

There are only four other periods, Belski argues, that this sector has showed abnormal underperformance. In the year following such troughs, real estate investment trusts outperformed the S&P500 by about 17%, on average.

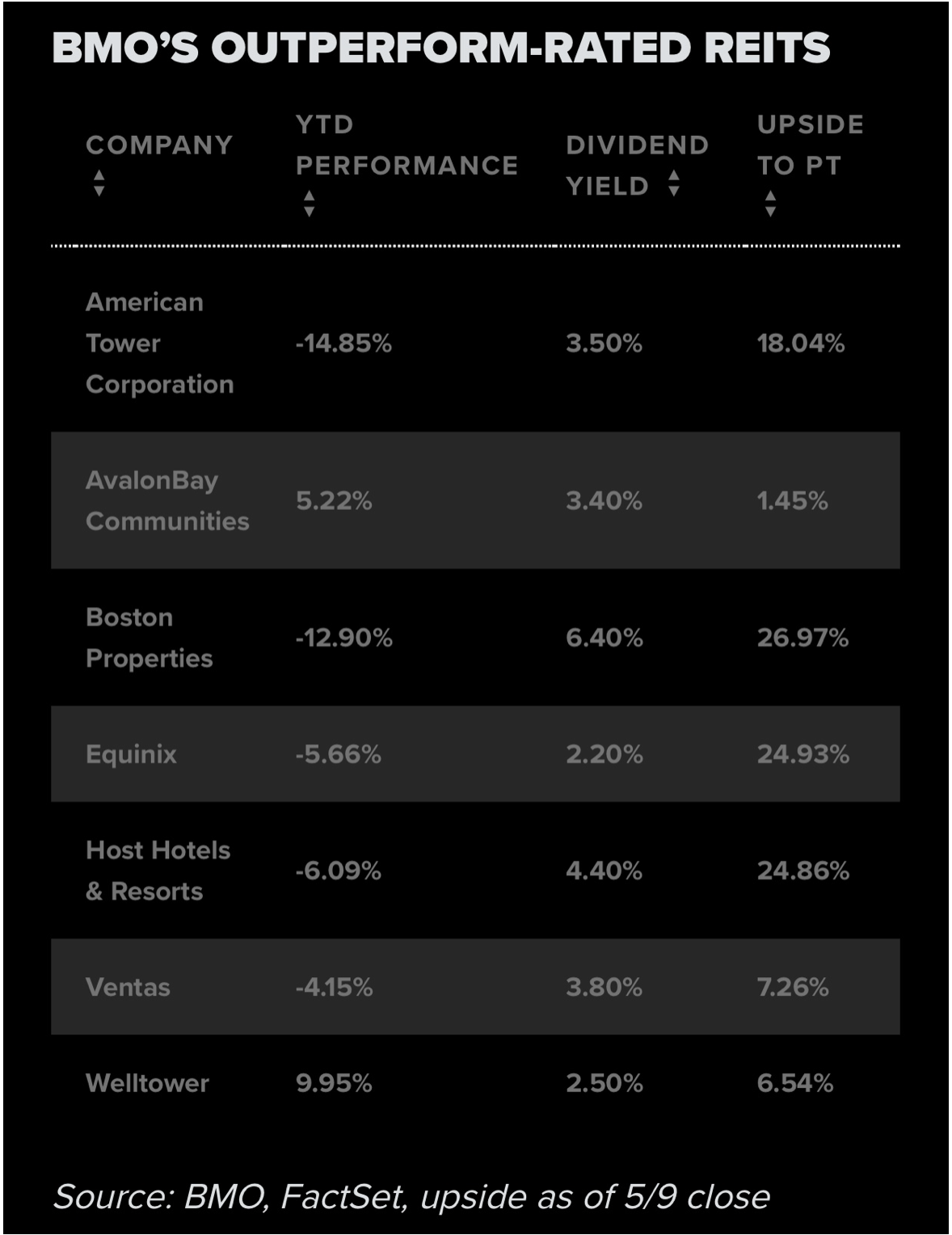

Listed here are BMO’s REITS rated to outperform.

These REITS also pay dividends. For example, Boston Properties pays a dividend yield of 6.4%. The company develops, owns, and manages workspaces across the country, including New York and San Francisco. Belski believes there is a slow return to the office taking place.

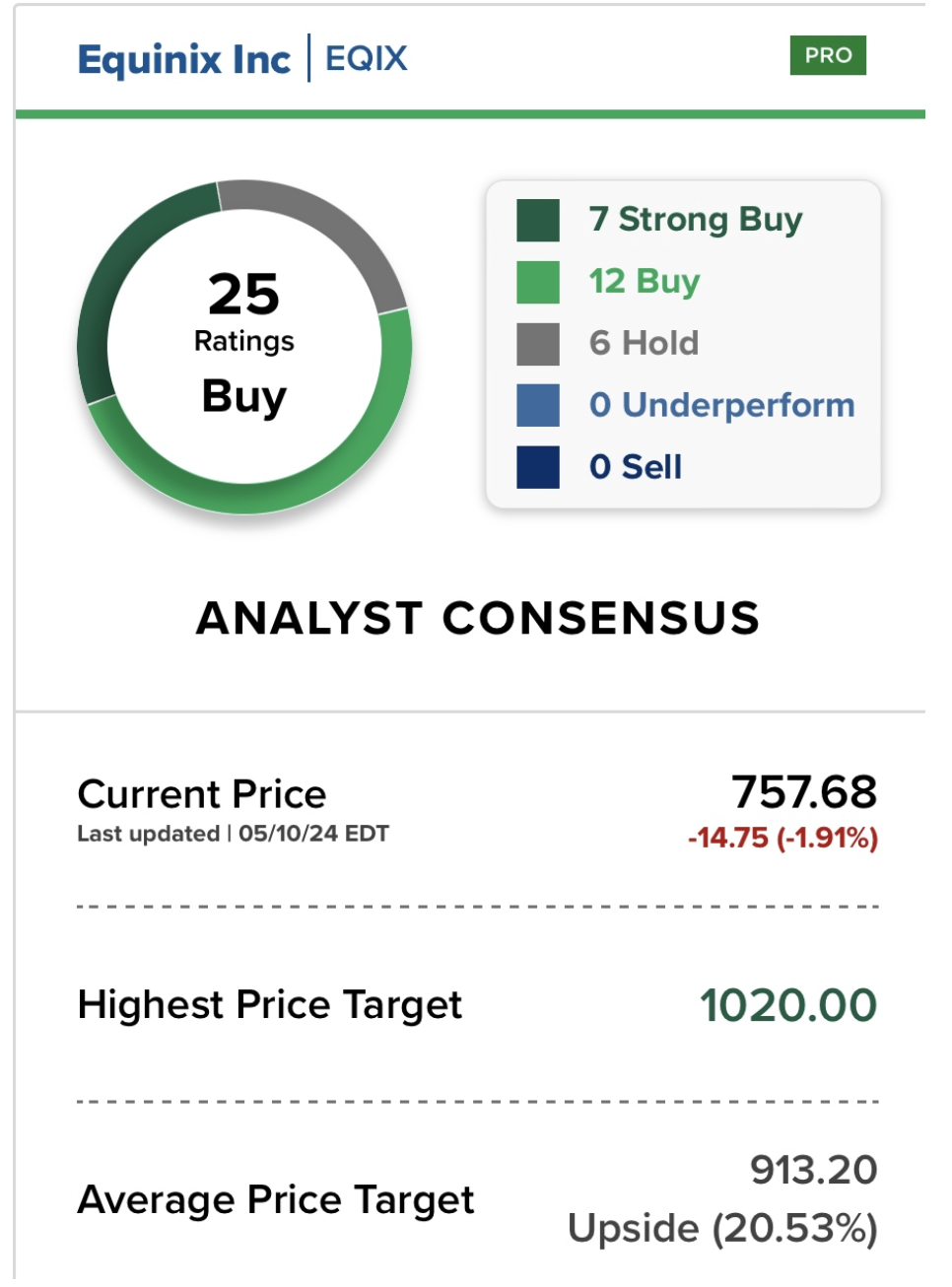

Data Centre REIT, Equinix, will benefit immensely from the rapidly developing landscape of AI. In a statement, CEO Charles Meyers said that “digital initiatives will drive long term revenue growth and operational efficiency.” If BMO’s price target is any guide, Equinix has 25% upside ahead.

Ventas is also down about 4% year to date. The company’s investments include senior housing communities, which stand to benefit from the aging population. The stock which yields 3.8% has roughly 7% upside to BMO’s price target.

Host Hotels & Resorts, which owns luxury and upper-upscale hotels is down nearly 6% this year. Like Equinix, BMO’s price target sees it rallying 25%. This company has a 4.4% dividend yield. Earlier this month, the company posted a revenue beat, and upped its full-year funds-from-operations and revenue guidance.

Market Update:

S&P500 – Bull market in progress. The market is still interpreted to be undergoing a final 5th wave advance onto new highs for the year (around 5,700).

GOLD – New highs are ahead. Looking for a rally to around an initial target of 2400 and then onto 2500-2550.

BITCOIN – Waiting for the next advance. Support lies around $60k/$59k. Looking for an upside target around $80k in the next several weeks to months.

QI Corner

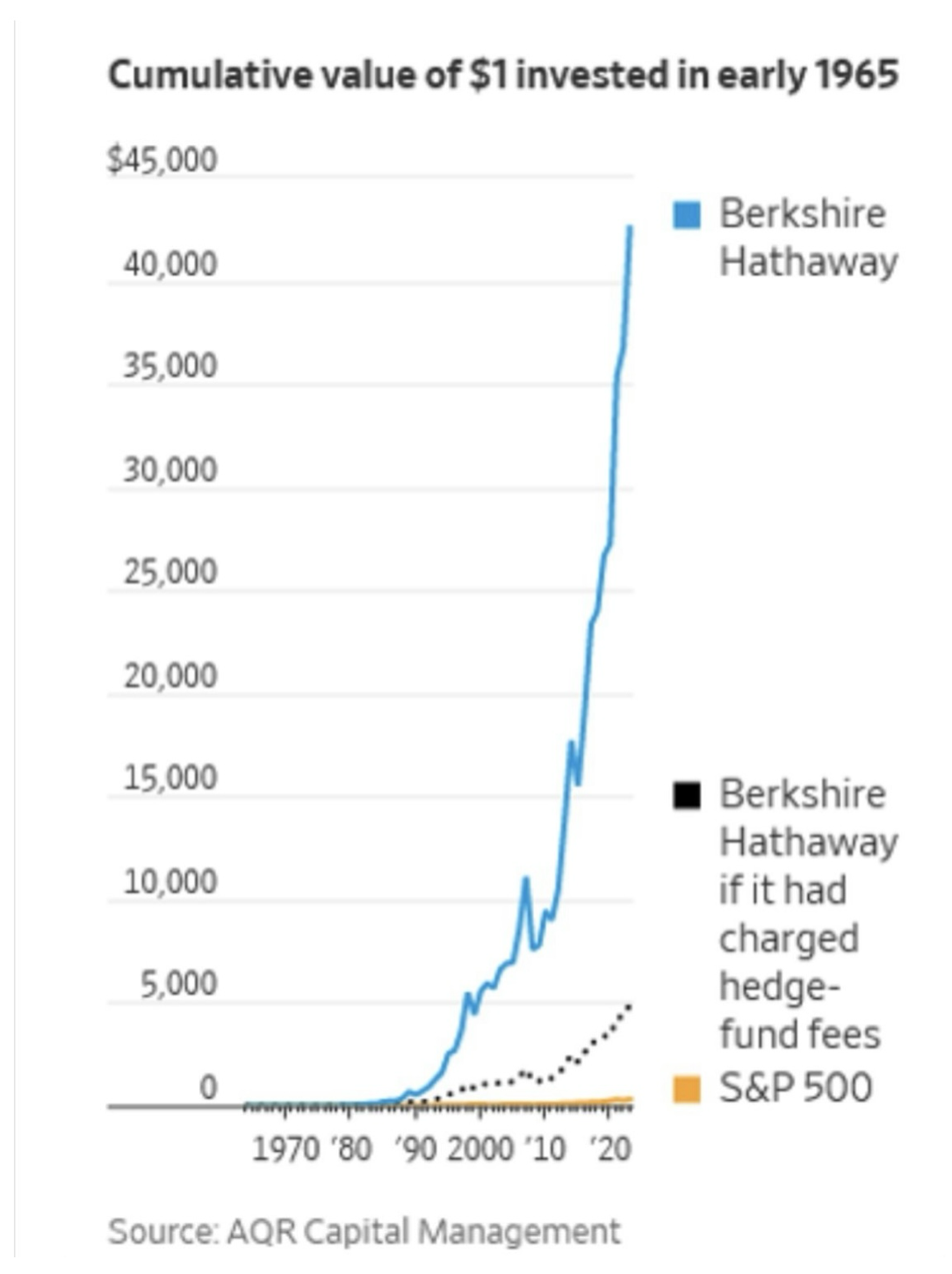

Fees make all the difference.

Northern Lights

Cheers

Jacquie