May 19, 2023

(THESE STOCKS MAY BENEFIT OR LOSE FROM CHINA)

May 19, 2023

Hello everyone,

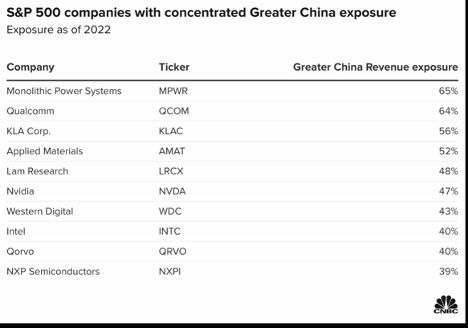

The U.S. companies listed below have a high revenue exposure to China. If the Chinese economic recovery post pandemic loses momentum, a negative trend may ensue.

Goldman Sachs has analysed company 10K filings to determine the geographic revenue exposure of each stock in the S&P 500. What they found was that several of the stocks had revenue exposure to Greater China of over 40%.

If the recovery from strict covid measures remains muted, these stocks could be hurt. Early in the year, consumer and business activity was largely robust, but this has since faded.

On the other hand, if China turns on the taps and lets loose with policy stimulus to boost growth, these companies tied to the nation could see a near-term tailwind.

Companies that generate a significant number of sales from Greater China were exclusively in the chip industry, according to Goldman.

Semiconductors have been caught up in the U.S.-China battle for tech dominance. Washington has tried to cut China and Chinese firms off through sanctions and export restrictions in the past few years, including blacklisting Huawei.

The U.S. also introduced broader chip restrictions last year, aiming to deprive Chinese firms of critical semiconductors that could serve artificial intelligence and more advanced applications.

Monolithic Power Systems is on the top of the list with 65% of its 2022 revenue derived from Greater China, according to Goldman. The stock has gained about 18% this year.

Qualcomm also generated more than 60% of its revenue from the region. Qualcomm recently saw a big decline in sales from handset chips, a core business for the company. CEO Cristiano Amon has pointed out that there has been no evidence that smartphone sales are recovering in China.

===========================================================================

I’ll leave you today with this possibility. Traders in the fed funds futures are assigning a roughly 1 in 4 probability that the FOMC increases its benchmark rate by another 25 basis points following the June 13-14 meeting, according to the CME Group’s FedWatch tracker.

Have a great weekend.

Cheers,

Jacque