May 5, 2023

(TREMORS IN THE FINANCIAL SYSTEM)

May 5, 2023

Hello everyone,

Tremors are being felt in the financial system and the feeling is that they will become a lot stronger.

What will be the consequence of those tremors??

We’re not sure yet, but things could get “interesting” in the markets in the next few months.

Let’s look at what Cathie Wood is saying.

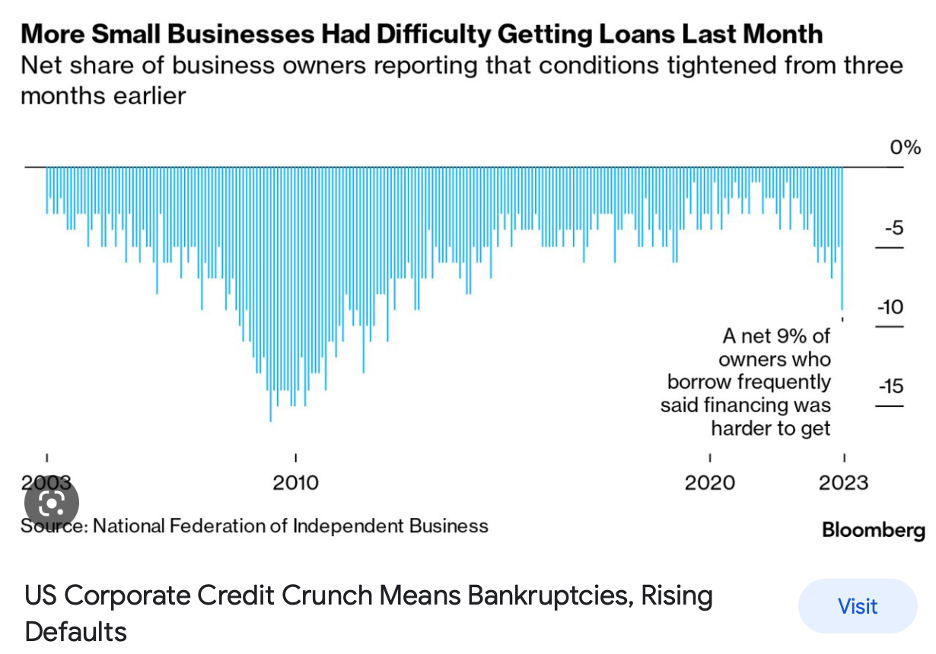

She thinks a credit crunch is underway, and it’s going to get a whole lot worse. Wood has said that customer deposits are still leaving regional banks and are going into Treasury funds, limiting the ability for banks to potentially produce loans in the future.

Treasury funds can’t be loaned out, and therefore can’t encourage business activity. So, her idea is that we are in the early stages of a credit crunch that is going to be much more serious than most are expecting.

Wood has cited the downward trajectory of the SPDR S&P Regional Banking ETF (KRE) as a basis to forecast a continued deposit outflows from regional banks. The ETF has declined roughly 14% in the past five days alone. It’s also down about 17% over the past month.

Most of us are aware that regional banks have most definitely been hammered since the collapse of the Silicon Valley Bank and Signature Bank, which has stoked worries over the health of the U.S. banking system. Last weekend, First Republic was taken over by JPMorgan Chase.

Wood argues that the Federal Reserve will be forced to cut benchmark interest rates to stop the bleeding from these losses.

Wood points out that the (KRE) has broken down, which tells us deposits will continue to outflow until the Fed reverses its position – until it pivots. The Fed hiked rates by 25 basis points Wednesday, even as tighter monetary policy appears to have exacerbated the banking issues.

DoubleLine Capital CEO Jeffrey Gundlach agrees with Wood’s sentiment. He says that the Fed will need to pivot to end the regional banking crisis. On Thursday, European Central Bank chief, Christine Lagarde said tighter credit conditions would similarly weaken further bank lending.

Wishing you all a wonderful weekend.

Cheers

Jacque

The wealth which enslaves the owner isn’t wealth.