May 5, 2025

(THE RETAIL INVESTOR & WARREN BUFFETT ARE POLES APART)

May 5, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY, MAY 5

9:45 a.m. PMI Composite final (April)

9:45 a.m. S&P PMI Services final (April)

10:00 a.m. ISM Services PMI (April)

Previous: 50.8

Forecast: 50.6

Earnings: Clorox, Palantir Technologies, Ford Motor, Vertex Pharmaceuticals, Diamondback Energy, Coterra Energy, Zimmer Biomet Loews, Tyson Foods, ON Semiconductor

TUESDAY, MAY 6

8:30 a.m. Trade Balance (March)

10:00 a.m. Canada Ivey PMI

Previous: 51.3

Forecast: 51.2

Earnings: Arista Networks, Wynn Resorts, Electronic Arts, Devon Energy, Advanced Micro Devices, TransDigm Group, Marriott International, IQVIA Holdings, Fastenal, Duke Energy, American Electric Power, Gartner, Marathon Petroleum, Global Payments, Fidelity National Information Services, Constellation Energy, Archer-Daniels-Midland

WEDNESDAY, MAY 7

2:00 p.m. FOMC Meeting

Previous: 4.5%

Forecast: 4.5%

2:00 p.m. Fed Funds Target Upper Bound

3:00 p.m. Consumer Credit SA

Earnings: Paycom Software, Fortinet, Skyworks Solutions, Axon Enterprise, Occidental Petroleum, DoorDash, Corteva, EF Industries Holdings, Rockwell Automation, Uber Technologies, Emerson Electric, Walt Disney.

THURSDAY, MAY 8

7:00 a.m. UK Rate Decision

Previous: 4.5%

Forecast: 4.25%

8:30 a.m. Continuing Jobless Claims (04/26)

8:30 a.m. Initial Claims (05/03)

8:30 a.m. Unit Labour Costs preliminary (Q1)

8:30 a.m. Productivity preliminary (Q1)

10:00 Wholesale Inventories final (March)

Earnings: Expedia Group, Insulet, TKO Group Holdings, Paramount Global, Microchip Technology, Akamai Technologies, Warner Bros. Discovery, ConocoPhillips, Tapestry, Molson Coors Beverage, Match Group.

FRIDAY, MAY 9

8:30 a.m. Canada Unemployment Rate

Previous: 6.7%

Forecast: 6.7%

8:30 a.m. New York Federal Reserve Bank President and CEO John Williams speaks on Taylor Rules in Policy, Stanford University.

10:00 a.m. New York Federal Reserve Bank Director of Research and Head of the Statistics Group Kartik Athreya speaks on NY State Large Credit Unions CEO Roundtable.

10:15 a.m. New York Federal Reserve Bank President and CEO John Williams speaks on Reykjavik Economic Conference, Iceland.

All Eyes on The Fed This Week

The Federal Reserve Meeting will be a key focus this week – traders will be awaiting crucial updates on interest rate projections and the Fed’s assessment of the US economy. The Fed is likely to keep interest rates unchanged, but they will likely stress that the economic outlook is uncertain, thanks to tariffs, federal layoffs, & stricter immigration. It will be interesting to see if the US dollar can continue its bounce.

The Average Investor and Warren Buffett – like chalk and cheese

It could be argued that Warren Buffett’s results came from reputation, privilege, access and hard-fought strategic advantage, and not simply buying and holding undervalued stocks.

For most of the last 60 years, Buffett has operated from a position of scale, influence and privilege, that’s completely inaccessible to retail investors. Many of his most lucrative deals weren’t found in the bargain bin of the stock exchange – they were created in private conversations with CEOs, Treasury Secretaries, and Presidents. His returns weren’t solely fuelled by patience, discipline and astute stock selection – they were turbocharged by exclusive deals, regulatory favour and reputation-fuelled access.

So, let’s check out Buffett’s advantages –

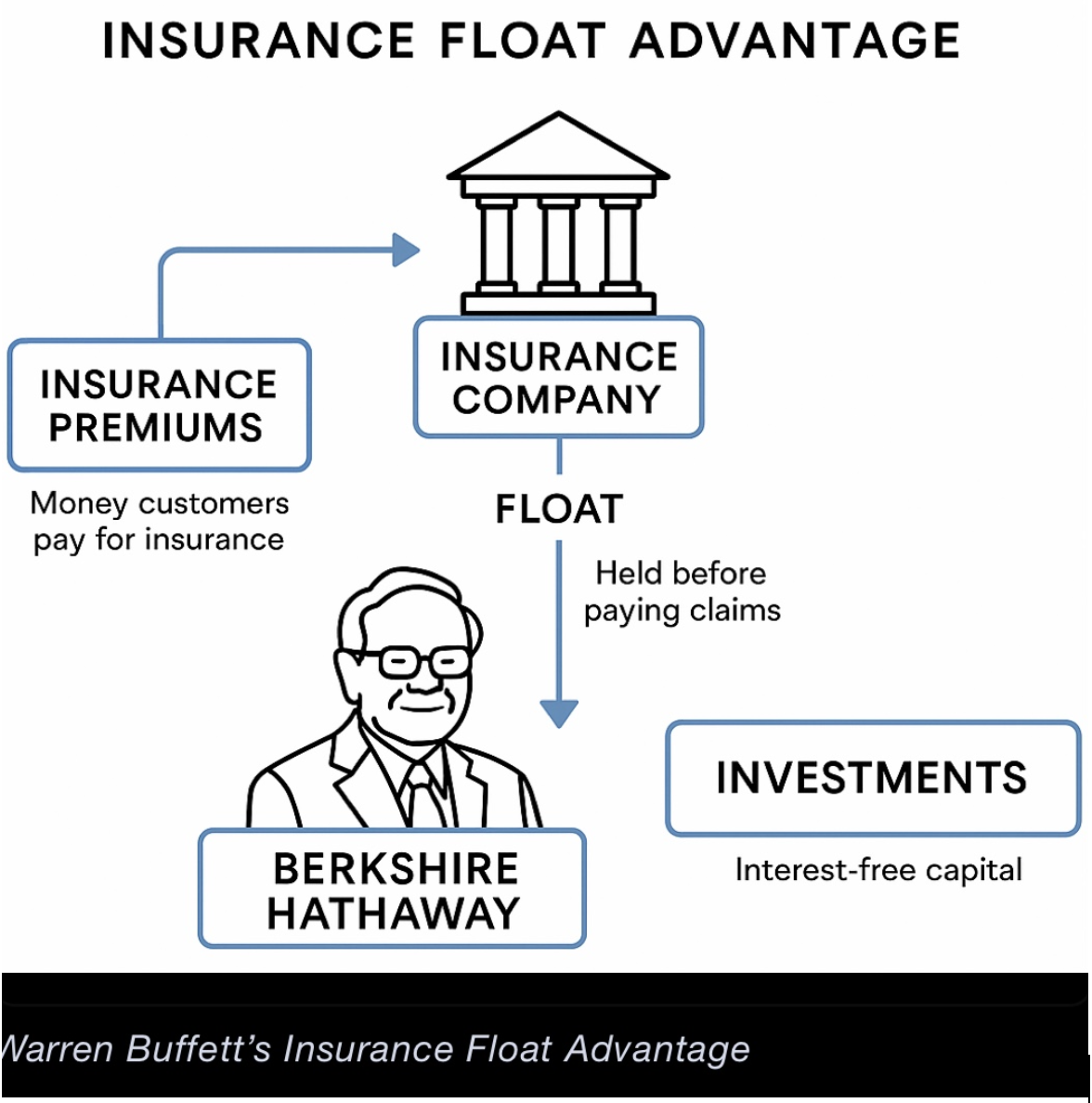

Firstly, you and I invest our own money which we need to earn first and then pay taxes on.

Buffett invests other people’s money, for free, pre-tax, and pockets his share of the gains.

That’s thanks to the “Insurance Float Advantage” – this has helped him grow wealth faster than any average investor ever could hope to aspire.

Secondly, Buffett prefers not to pay dividends, allowing Berkshire Hathaway to retain earnings and compound wealth tax-efficiently.

The average investor mostly cannot afford to compound their returns over a 60-year investment career without having to take any out to live on.

Thirdly, many of Buffett’s deals included warrants and preferred shares with terms that provided Berkshire Hathaway with significant upside but very limited risk – structures not available to retail investors who instead must invest in riskier common stock. Billions of Buffett’s profits were accumulated in this fashion.

Next, we can understand Buffett’s additional advantage in having direct access to policymakers and financial government agency officials that the average investor couldn’t even hope to have. Since the 1980’s, Buffett’s companies, such as BNSF and his utilities, have benefited from policies shaped in part by industry lobbying. Berkshire has influence in Washington and Wall Street circles far beyond the average investor’s reach.

Of particular significance is Buffett’s access to private placements and preferential treatment since 1967. For example, Buffett was involved in the rescue of GE Capital in 2008, when he invested $3 billion in preferred GE stock yielding 10% annually, with added warrants. Ordinary investors got none of these protective features.

It is arguable that Buffett’s greatest returns were made decades ago, and that his post-1990s returns were heavily reliant on reputation, access, and scale – not just investment skill.

The average investor has no chance to be like Warren Buffett. Yes, we can be patient, and buy cheap stocks, and hold them, but we certainly don’t have proximity to policymakers and government officials, nor do we get special deals or preferential treatment.

My advice: do not compare yourself to Warren Buffett. Instead, keep educating yourself, and keep buying stocks through turbulent times and when the market is rallying.

MARKET UPDATE

S&P 500

The index has broken above key resistance at 5475/85. The price action could be part of a period of limited ranging, with an upside bias – though don’t expect large moves to the upside. This could last for the next few months.

Resistance: 5700/5780/5885

Support: 5570/5475 area

GOLD

Gold has moved lower from the April 22nd high at $3500. Bearish technical argue that we may have seen the top for at least a month, and potentially much more.

But when topping occurs, we must remember that it is common to see periods of ranging, rather than a one- way decline.

Resistance: $3265/70 and $3367

Support: $3200/$3160/$3049

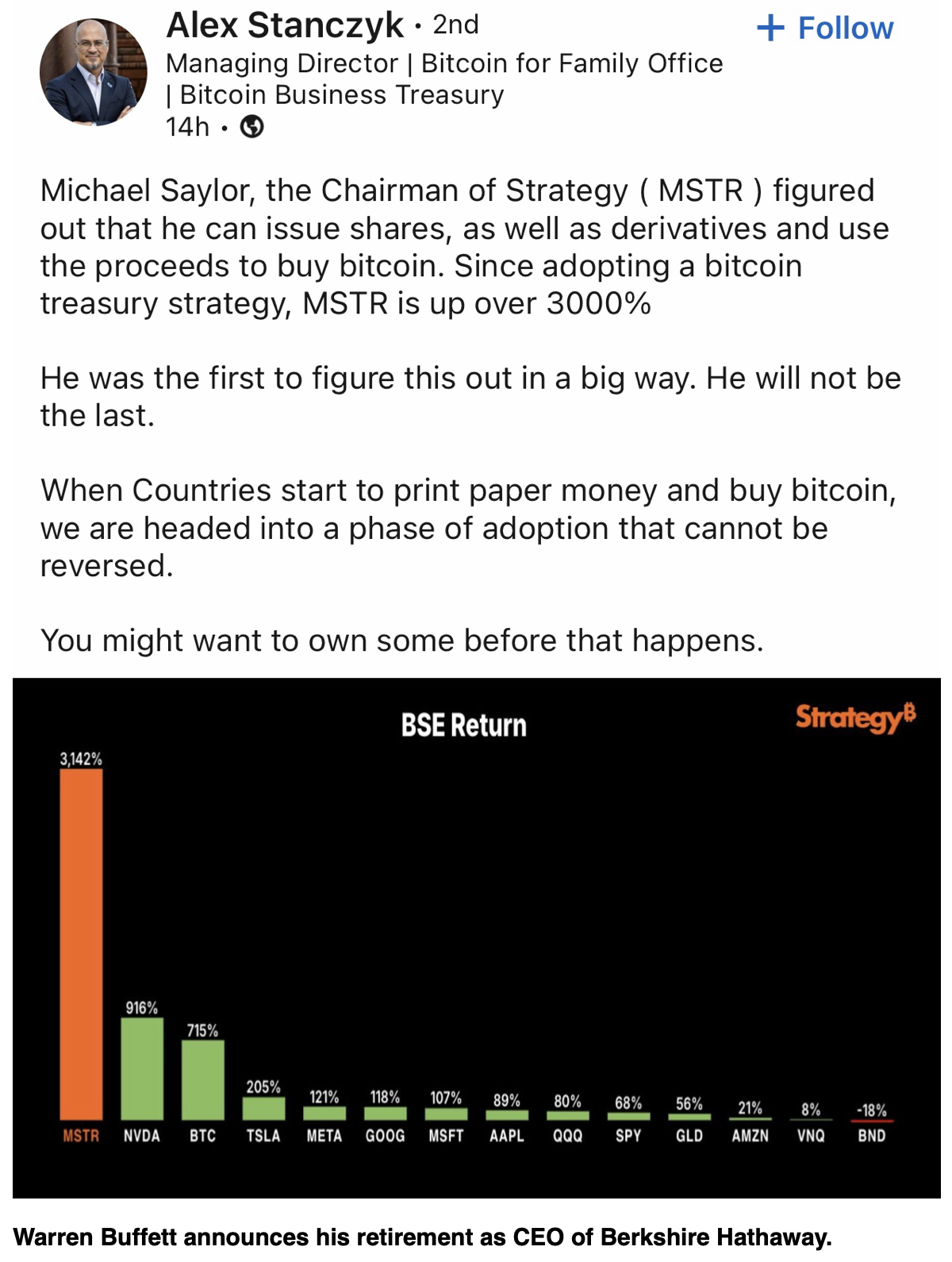

BITCOIN

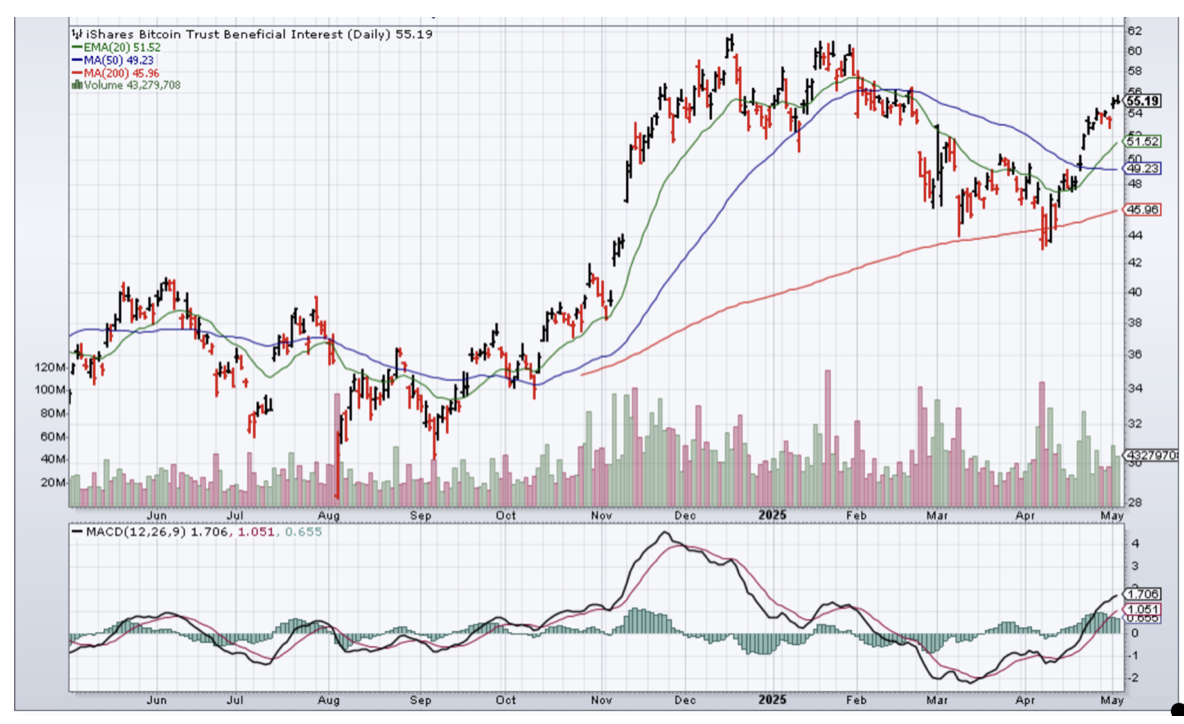

Bitcoin has hit 97.9k – that 109.4k peak remains in view. However, some consolidation may be seen for the next few weeks before we see more strong moves to the upside.

Resistance: 97.9/100.5/101k

Support: 95.3/95.8k and 92.7/88.5k

CURRENT TRADES

Take profits in the (IBIT) and (MSTR) options spreads expiring in May. Monitor (MSTR) option spread expiring in July and your (IBIT) expiring in June. It was up to each individual how many contracts they entered for each trade.

(IBIT)

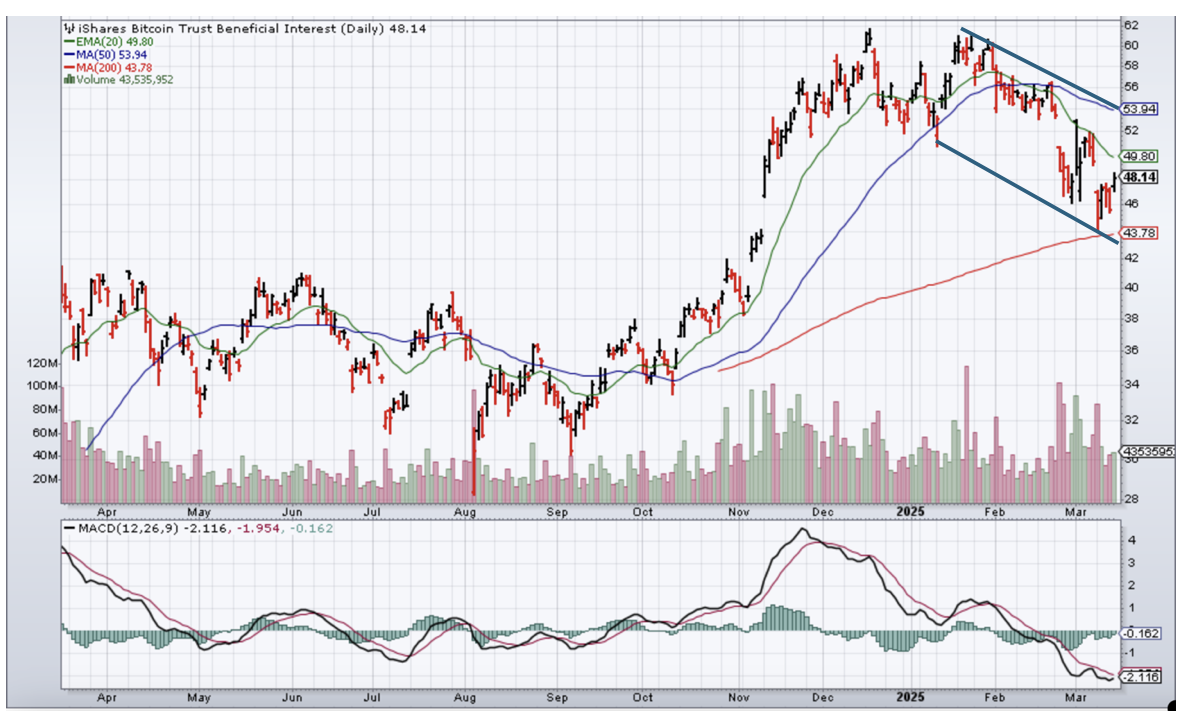

(IBIT) Price = $48.14 on March 17, 2025

1/ Sell 1 May 16, 2025, (IBIT) $55 call

Buy 1 May 16, 2025, (IBIT) $50 call

Max Profit = $337

Max Loss = $163

Cost = $1.63

Sell 1 June 20, 2025(IBIT) $65 call

Buy 1 June 20, 2025 (IBIT) $55 call

Max Profit = $815

Max Loss = $185

Cost = $1.85

(MSTR)

MicroStrategy (MSTR) Price = $297.49 on March 17,

Sell 1 May 16, 2025 (MSTR) $320 call

Buy 1 May 16, 2025 (MSTR) $310 call

Max Profit = $630

Max Loss = $370

Cost = $3.70

Sell 1 July 18, 2025 ((MSTR) $325 call

Buy 1 July 18, 2025 (MSTR) $315 call

Max Profit = $647

Max Loss = $353

Cost = $3.5

MicroStrategy Daily Chart (March 17, 2025)

(MSTR) May 2, 2025

(IBIT) Daily Chart (March 17, 2025

(IBIT) May 2, 2025

HISTORY CORNER

On May 5

QI CORNER

SOMETHING TO THINK ABOUT

Nicole Lapin

NYT bestselling author

Money News Network founder

Cheers

Jacquie