May 6, 2024

(“WOODSTOCK FOR CAPITALISTS” SHOWED BUFFETT IS STILL IN GOOD FORM)

May 6, 2024

Hello everyone.

Week ahead calendar

Monday, May 6

No economic data of note.

Earnings: Loews, Spirit Airlines, Tyson Foods, BioNTech, Hims & Hers, Vertex Pharmaceuticals, Lucid Group, Palantir Technologies, Simon Property Group, Aecom, Microchip Technology, Rocket lab, Goodyear Tire, Flavours & Fragrances, Marriott Vacations, Noble Corp., Vornado Realty, Coty, Bell Ring Brands, Cabot

Tuesday, May 7

3:00 pm Consumer Credit (March)

Earnings: UBS, BP, Nintendo, Squarespace, Kenvue, Aramark, Gogo, Energizer, Tempur Sealy, Bloomin’ Brands, Crocs, Datadog, Duke Energy, Rockwell Automation, Spirit AeroSystems, TransDigm, Expeditors, Nikola, Walt Disney, Ferrari, Global Foundries, NRG Energy, Perrigo, Electronic Arts, Cirrus Logic, iRobot, Redfin, Lyft, TripAdvisor, Adaptive Biotech, Arista Networks, Dutch Bros., Kyndryl, Marqeta, Oddity Tech, Olo, Sonos, Toast, Upstart Holdings, Virgin Galactic, Twilio, IAC/InterActive, Match Group, McKesson, Rivian Automative, Brighthouse, Occidental Petroleum, Assurant, Angi, Kinross Gold, Astera Labs, Diamond Offshore, Reddit.

Wednesday, May 8

10:00 a.m. Wholesale inventories (March)

Earnings: Anheuser-Busch InBev, Edgewell Personal Care, Embraer, Elanco Animal Health, United Parks & Resorts, ODP, Emerson Electric, Brookfield, New York Times, Performance Food Group, Reynolds Consumer Products, Shopify, Teva Pharma, Uber Technologies, Brink’s Tegna, Hain Celestial, Choice Hotels, Dine Brands, Liberty Broadband, Affirm Holdings, Fox Corp., Cushman & Wakefield, Liberty Media, Valvoline, Arm Holdings, Airbnb, Robinhood, Beyond Meat, Bumble, Kodiak Gas Services, NuSkin, SolarEdge Technologies, TKO Group, Vizio, AMC Entertainment, Cheesecake Factory, News Corp., Toyota Motors, Celanese, Instacart, Klaviyo.

Thursday, May 9

8:30 a.m.

Continuing jobless claims

8:30 a.m. Initial claims

Earnings: Nissan, Cedar Fair, Six Flags, Yeti, Hanesbrands, Planet Fitness, Sally Beauty, Tapestry, US Foods, Warby Parker, Krispy Kreme, Hyatt Hotels, Warner Bros, Discovery, Roblox, Viatris, Papa John’s, Hilton Grand Vacations, Warner Music Group, Solventum, DropBox, Akamai, Figs, Sweetgreen, Unity Software, Yelp, Synaptics, H&R Block, Iamgold, Fidelis Insurance, GenDigital, Savers Value Village.

Friday, May 10

10:00 a.m. Michigan sentiment (May)

2:00 p.m. Treasury budget (April)

Earnings: Honda Motor, AMC Networks.

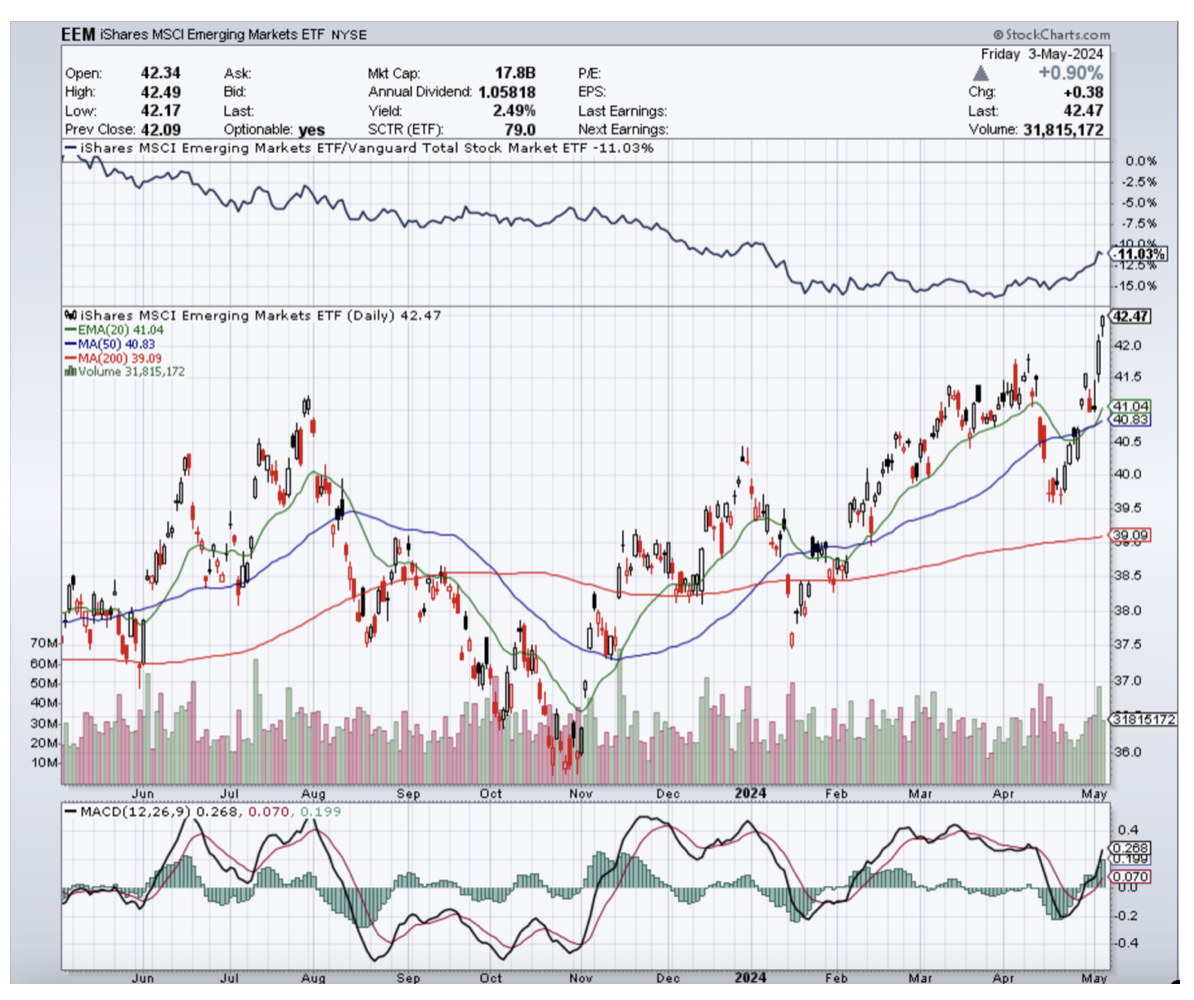

Maybe time to start looking at Emerging Markets.

The weaker than expected employment numbers last Friday marked the first sign this year that we may just see some interest rate movement in the form of cuts toward the latter part of this year.

And if we do see a lower rate environment on the horizon, one area that will be boosted is emerging markets.

Emerging market equities are at attractive valuations presently; earnings growth too has started to accelerate.

Start looking at this ETF:

(EEM)iShares MSCI Emerging Markets ETF

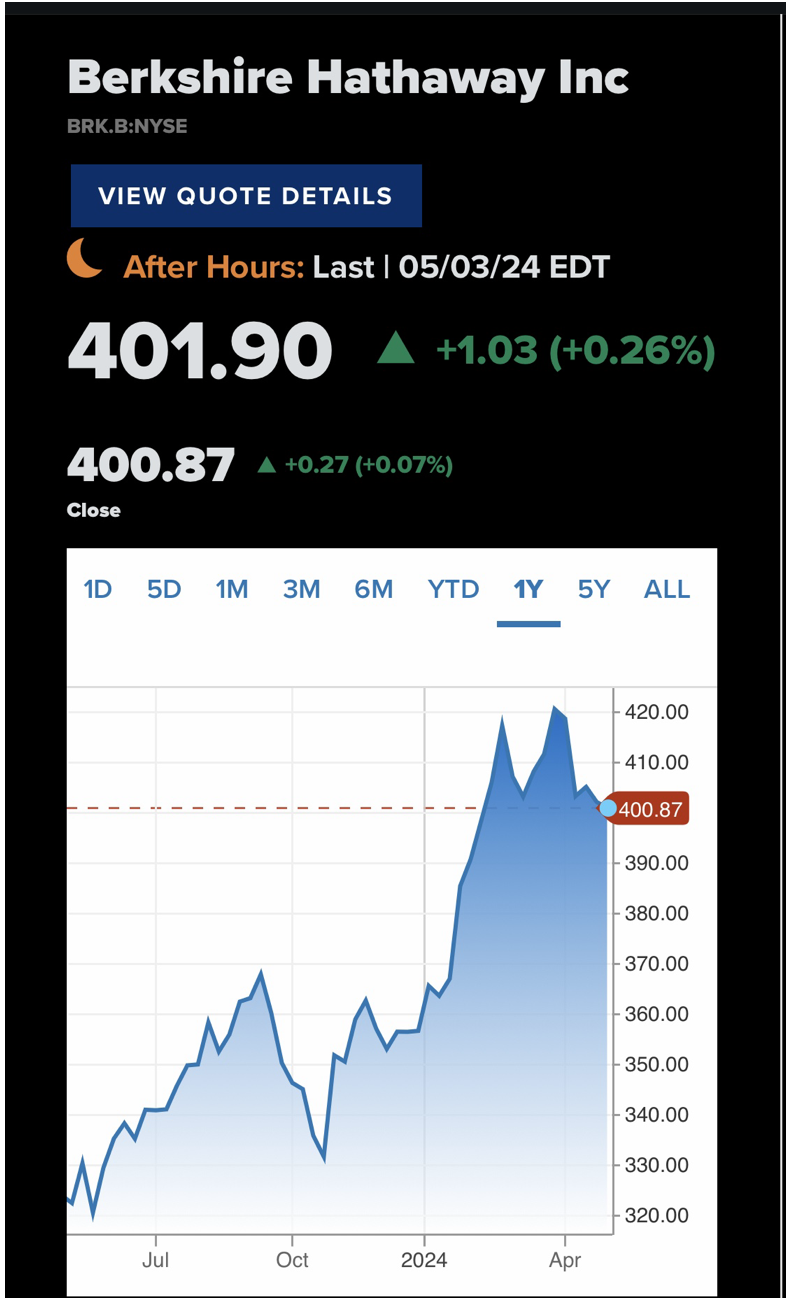

Continue scooping up some Berkshire Hathaway stock.

Berkshire Hathaway’s annual general meeting on Saturday, May 4, has been dubbed “Woodstock for Capitalists.”

Analysts have a $472 price target on class B shares, and this suggest nearly 18% upside from last Thursday’s close.

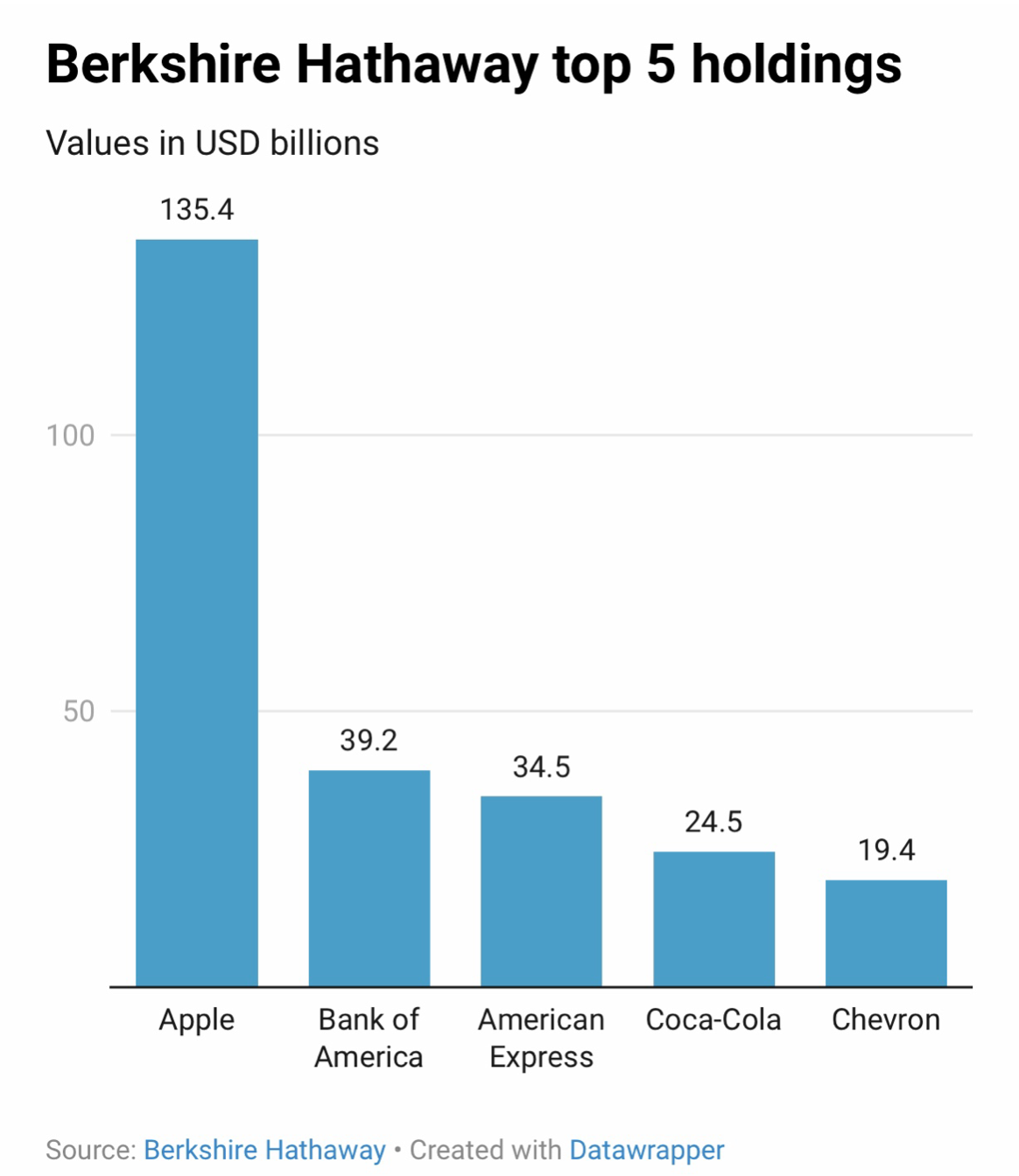

I listened to several hours of the meeting and the topics covered included climate change, succession planning, artificial intelligence, the sale of a chunk of Apple shares (around 13%) - 115 million shares.

The company has approximately $200billion in cash. Greg Abel will make investing decisions for Berkshire Hathaway when Buffett passes.

Buffett spoke of “scamming” as a growth industry, which will be enabled by AI. While he didn’t see AI as all bad, he did note that the potential for AI to manipulate videos and images - to extract money from people - poses enormous harm to those who are unsophisticated in critically evaluating these types of media.

One of the best lessons from Charlie Munger.

Patience.

Munger was well known for waiting – not only when it came to building wealth, but for finding attractive investing opportunities.

In his words: “We wait for no-brainers. We’re not trying to do the difficult things. And we have the patience to wait.”

When it came to investing in what he viewed as great companies, Munger shared Buffett’s view that your best move as an investor is holding for the long term.

In Buffett’s words: “When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever.”

Warren Buffett’s insights about life.

“If you are lucky in life, make sure others in life are lucky too.”

“Be kind and the world will be better off.”

Market Update:

S&P500

It’s possible that this correction is completed to enable the resumption of uptrend in a Wave 5 advance towards the next upside target at around 5,450. If the 5th wave has begun, then support at 5,060/5,011 should now hold.

We must be aware, though that there is still risk of a final sell-off toward the low/mid 4,800’s, before the uptrend is ready to resume.

The Bigger Picture outlook remains bullish. The 5,735 mark is the potential target over the coming months.

Gold

Gold has been undergoing a 4th wave correction. A sustained break above $2,350 resistance will represent the resumption of uptrend for rally back toward the area of $2,430.

The Bigger Picture outlook remains bullish, with the next upside target at around $2,530.

Bitcoin

Bitcoin has been undergoing a 4th wave correction, and this might be completed now.

Support lies around the $59,500 level. If this area holds, we should now see rallies on to the next resistance areas at $67,240 and $73,794 levels.

Bitcoin’s bullish structure remains in place.

QI Corner

Cheers

Jacquie