MOT Follow-Up to Text Alert - (SPX & VXX) - August 2, 2016

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times.

Mad Options Traders ?

Great session this morning! We knocked out our standard strategic and operational brief followed by a review of existing positions in the model portfolio.? I also added 2 new positions to the model portfolio ? a new SPX bull put spread and a portfolio hedge with VXX. The tactic is called a bullish double vertical and will be covered in a couple weeks on Wednesday night at 8 PM in our live training session.

The replay will be posted shortly to the member page, where yesterday?s Weekly Options replay is posted. You can follow this link to get to the page:? http://www.madhedgefundtrader.com/mot-webinars/

Here?s an overall look at the 2 new trades, adjustments to existing portfolio positions, and fills:

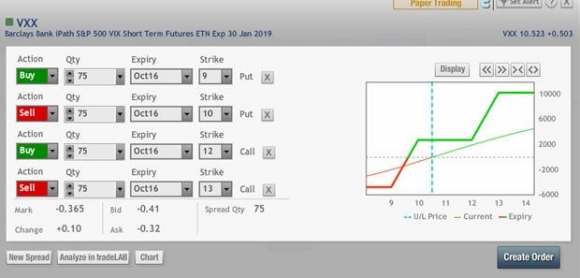

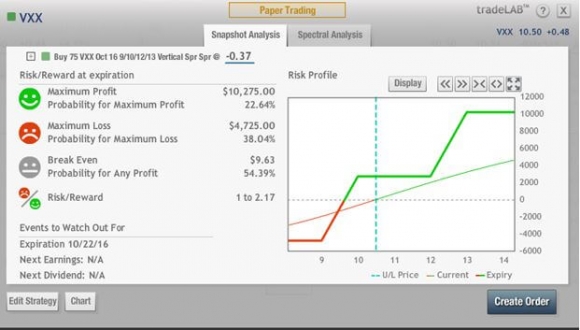

New portfolio hedge with VXX out to Oct, a bullish double vertical:

Trade metrics:

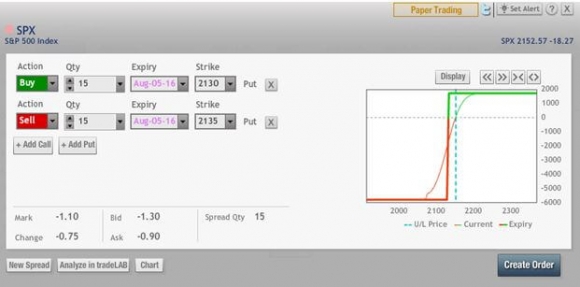

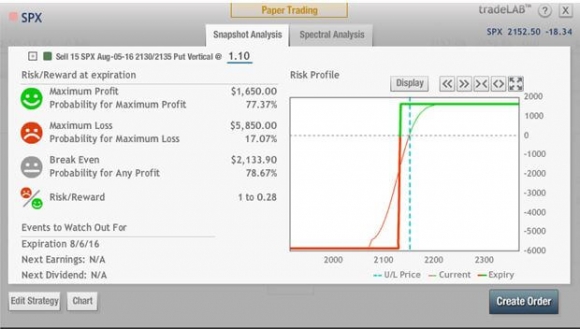

New SPX bull put spread expires Friday:

Trade metrics:

We will have a live training session tomorrow night at 8 PM eastern, keep an eye on your email for the registration link.

One final note to those of you new to weekly options ? RELAX.

I?m not promising that the market will turn around by Friday, but it is EARLY in the life of these trades and a lot of things can happen between now and Friday. As the ?pilot in command? of your portfolio if you want to bailout or roll the FB and SPX trades down and out now, that?s your call.

I don?t see too many major reasons for the sell off today which tells me it may be profit taking. I doubt it?s the strong Yen or some other reasons the talking heads are searching for.

But again, close the trades if they hit your eject point. I am holding these trades; we have a crude oil report tomorrow and job Friday ? which is a long time away in weekly options world.

We have a full month of options trading to go, and today I placed and got filled on a hedge that could profit over $10,000 if the market rolls over.

So we keep our hedges on as the market takes profits and we will keep fighting on.

See you tomorrow night,

Whiz