No Sherpa Required

Perched high above the timberline on Colorado's Mt. Elbert last weekend, I found myself short on oxygen and long on questions—namely, which pharmaceutical heavyweight deserves a spot in my portfolio: Merck (MRK) or Bristol-Myers Squibb (BMY)?

At 14,438 feet, the air thins out fast, but the thinking gets clearer. Clarity tends to arrive when your brain’s running at 60% capacity.

I’d stuffed my pack with company reports, earnings transcripts, and a few too many granola bars—one of which was being stalked by a very persistent marmot as I paused to catch my breath. I must’ve looked like an underprepared Everest hopeful, hunched over charts and trying to find altitude-adjusted alpha.

On paper, both firms dominate the oncology space and have made a career out of telling cancer where to shove it. But markets don’t care about reputations—they care about margins, pipelines, and who's going to make it through the next patent cliff without blowing out their kneecaps.

Let’s start with the money.

Merck posted Q4 2024 revenue of $17.76 billion, up 6.77% year-on-year. Its price-to-sales ratio sits at 3.74x—above the sector median, but still 14.7% cheaper than its own five-year average. It’s also beaten revenue expectations for 12 straight quarters. That’s not a hot streak. That’s clinical precision.

Bristol-Myers pulled in $12.34 billion last quarter with 7.5% YoY growth, but it trades at a much lower 2.51x P/S. That’s a discount—16.5% under the sector median. Ten out of twelve quarters beating the Street is nothing to sneeze at either. You get the sense both firms have their accounting departments on creatine.

Debt? Merck sits on $24.6 billion in net debt, but with a net debt/EBITDA ratio of 0.84x, it's practically sipping debt through a paper straw. Bristol-Myers, on the other hand, carries $40.1 billion with a 2.07x ratio. Still manageable, but not the kind of leverage that makes you sleep like a baby—unless you're the baby in question.

Dividends? Bristol-Myers pays more—4.14% vs. Merck’s 3.42%. That might earn it a second glance from income hawks, but when you zoom out, Merck still wears the financial crown.

Now here’s where things get messier.

Merck has a bit of a single-product addiction problem. Keytruda brought in $7.83 billion last quarter, making up a jaw-dropping 50.2% of total revenue. It's a blockbuster, yes, but when one drug makes up half your business, you start looking like a biotech version of Jenga. Merck’s top five products represent 75.7% of sales.

Bristol-Myers shows better balance. Eliquis is its biggest hitter, pulling in 25.9%, while its top five products account for 71.6% overall. Not exactly ironclad diversification, but a more even spread than Merck’s lineup.

Still, Keytruda is a monster. It outsold Bristol’s Opdivo by a whopping $5.4 billion in Q4 alone. That’s not a competition—that’s a beatdown. But both companies are running out the clock on their oncology flagships. Keytruda loses U.S. patent protection in 2028. Merck’s answer is a subcutaneous version—MK-3475A—patent-protected until 2039. Bristol’s already fired back with Opdivo Qvantig, a smart preemptive strike that could buy them time and market share.

Pipelines? Merck leads here too. BMY has 74 active R&D projects, 11 in Phase 3. Merck? Over 90 clinical-stage assets, 31 of them in Phase 3, and five are already under regulatory review. They’re not just defending Keytruda—they’re building the next dynasty.

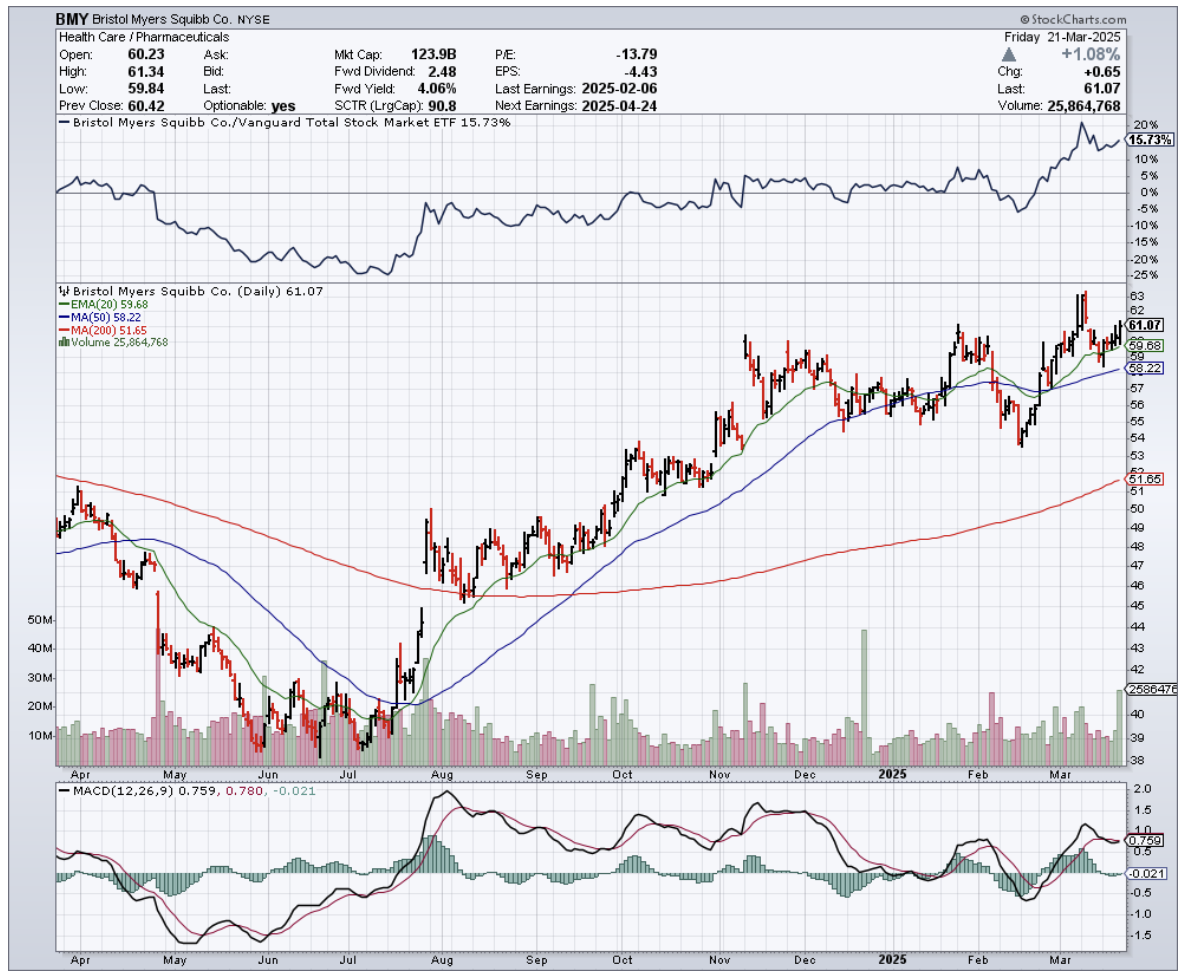

Meanwhile, Bristol-Myers’ stock is flashing overbought signals like a Christmas tree. Merck, by contrast, trades below its VWAP, and Wall Street sees an 18.3% upside from here. Bristol-Myers? A yawn-worthy 1.36%. That's a rounding error, not an investment thesis.

Fast forward to 2029. I expect Merck to print a non-GAAP EPS of $11, led by Keytruda, Welireg, and a few wild cards currently in late-stage trials. Bristol-Myers might reach $6.80 EPS on $44 billion in revenue. Not bad, just... not Merck.

After sorting through this on the summit—between water breaks, altitude headaches, and one increasingly assertive marmot—the picture came into focus. Merck is the better long-term pick. They’ve got the product, the pipeline, the margin, and the momentum.

As I packed up and started the long descent, I dropped my guard for half a second and the marmot made his move—snatched my energy bar right off my pack. Bold little bastard. But honestly, he earned it.

Sometimes, the one who climbs higher sees further and waits patiently gets the prize. Merck just did all three.

After all, in investing—as in mountain climbing—peaks and profits favour those who don’t lose their breath or their nerve.