November 11, 2024

(THE TRUMP TRADE 2.0)

November 11, 2024

Hello everyone

WEEK AHEAD CALENDAR

Monday Nov. 11

6:30 a.m. Australia Consumer Confidence

Previous: 89.8

Forecast: 89.5

Tuesday Nov. 12

2:00 a.m. UK Unemployment Rate

Previous: 4%

Forecast: 4.1%

6:00 a.m. NFIB Small Business Index (October)

5:00 p.m. Philadelphia Reserve Bank President Harker speaks at Carnegie Mellon University

Earnings: Occidental Petroleum, Live Nation Entertainment, Tyson Foods, Home Depot, Mosaic.

Wednesday Nov. 13

8:30 a.m. US Inflation Rate

Previous: 2.4%

Forecast: 2.6%

8:30 a.m. Consumer Price Index (October)

8:30 a.m. Hourly Earnings final (October)

8:30 a.m. Average Workweek final (October)

2:00 p.m. Treasury Budget NSA (October)

Earnings: Cisco Systems

Thursday Nov. 14

8:30 a.m. Continuing Jobless Claims (11/02)

8:30 a.m. Initial Claims (11/09)

8:30 a.m. Producer Price Index (October)

6:50 p.m. Japan GDP Growth

Previous: 0.8%

Forecast: 0.2%

Earnings: Applied Materials, Walt Disney

Friday Nov. 15

8:30 a.m. US Retail Sales

Previous: 0.4%

Forecast: 0.3%

8:30 a.m. Export Price Index (October)

8:30 a.m. Import Price Index (October)

8:30 a.m. Empire State Index (November)

9:15 a.m. Capacity Utilization (October)

9:15 a.m. Industrial Production (October)

9:15 a.m. Manufacturing Production (October)

10:00 a.m. Business Inventories (September)

Earnings: Progressive

THE WORLD ACCORDING TO TRUMP

Tax Cuts, Tariffs, Deregulation & Deportation

U.S. Equities

Sector Rotation: Financials, industrials, and energy stocks may benefit from tax cuts & deregulation & small caps could outperform due to Trump’s pro-domestic agenda.

Value Over Growth: Value & cyclical stocks likely to lead over growth sectors as focus on traditional industries & manufacturing.

Tech & Telecom: Tax cuts may support capital spending.

Antitrust scrutiny could weigh on large tech firms.

With Deregulation Innovation Likely to Thrive

Autonomous Mobility

Healthcare

Digital Assets

Fixed Income

Rising Yields: Treasury yields have climbed, led by real rates & nominal yields.

Short-Duration Preference: Long rates up, investors favor shorter maturities, particularly in high-yield debt, as risk sentiment rebounds.

U.S. Dollar

Strengthening Trend: A strong dollar driven by yield differentials & trade policies may challenge emerging markets reliant on dollar-denominated debt.

Commodities

Energy: Oil & Gas poised for gains from deregulation & U.S. production expansion. More industrial expansion = the need for more lithium, copper & silver.

Gold & Metals: Gold prices softened on risk appetite but may stabilize amid potential geopolitical risks. U.S. metals production benefits from fewer regulatory restrictions.

Factors stronger than Trump will keep driving the gold rally.

Central bank buying, the Brics, De-dollarization.

Real Estate

REIT Headwinds: Rising rates could pressure rate-sensitive sectors like REITS, but strong growth could mitigate some effects.

Emerging Markets & Global Equities

Emerging Markets at Risk: Higher U.S. rates & a strong dollar pose challenges to emerging market debt & currencies, particularly in Asia & Latin America.

Global Trade Impacts: Non-U.S. companies face trade headwinds, with auto & manufacturing hubs in Europe & Asia at risk from tariffs. Deals could counter-tariffs

Policy & Fiscal Implications

Corporate Tax Cuts: Anticipated tax cuts would

Benefit U.S. competitiveness but increase deficits.

Tariffs: Intensification of tariffs on China & possibly Europe. Mexico & other EM currencies pressure from U.S. manufacturing policies.

Regulatory Rollbacks: Energy & financial sectors may see deregulation. Includes potential rollbacks on emissions standards & banking regulations.

Deficit Expansion: Fiscal stimulus combined with tax cuts could expand deficits – growth could offset some debt pressures.

Rates & Inflation Dynamics

Higher Rates Likely: Nominal rates on the 10-year Treasury may range from 4.2% to 4.75%, driven by fiscal expansion. Inflation fears remain subdued, but the Fed may adjust rate cut trajectory due to pro-growth policies.

Geopolitical Risks

China Trade Relations: Tariffs impact China, affecting global supply chains. Europe’s manufacturing sector could similarly face pressure.

Energy Shift: U.S. energy independence initiatives may shift global energy dynamics, affecting OPEC & other oil producers.

Defense & national security – secure the borders & protect the homeland and the U.S. way of life. Help those countries who are prepared to help themselves.

MARKET UPDATE

S&P500 – Uptrend extension.

We are still in a Wave 5, and it is extending, so instead of a Wave 4 decline and then a resumption of uptrend, we appear to be rallying straight up without a retracement.

Targets: 6400+

Near term target: ~6200

GOLD - Correction

Gold is correcting ahead of its next rally onto new all-time highs.

Support = $2,670/$2,640 & $2,600

Targets: $2,850, $3,000

BITCOIN - Rallying

Strong uptrend in progress. New highs for the year.

Support =$75,300, $73,600

Targets = $90,000, $97, 780

QI CORNER

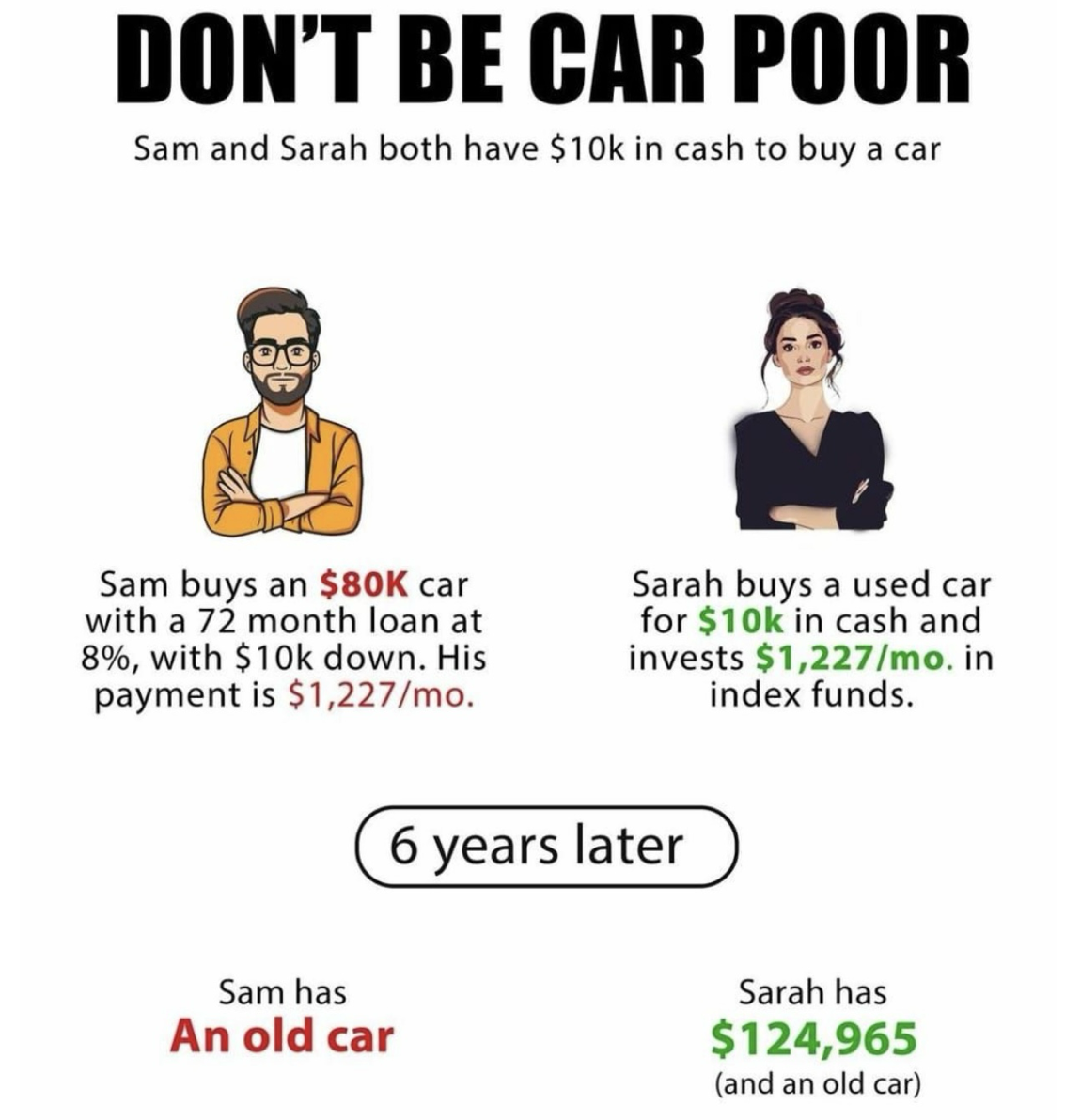

SOMETHING TO THINK ABOUT

Cheers

Jacquie