November 13, 2024

(CRYPTO MINERS CATCH-UP AS BITCOIN RALLIES)

November 13, 2024

Hello everyone

Crypto Miners will power ahead as Bitcoin rallies

Bitcoin has been rallying strongly since Trump secured the Presidency.

Bitcoin recently broke out of the flag pattern that has been forming for the past year and has rocketed to the upside.

I have been recommending a small portfolio allocation into Bitcoin and related crypto stocks for over a year now.

With Bitcoin consistently reaching new records since Election Day – a trend that is likely to continue through next year – crypto miners could start to play catch-up.

The buying opportunity is here for Bitcoin miners.

Bitcoin miners are among the best investment vehicles for investors to express their bullish outlook on Bitcoin.

CleanSpark is up nearly 50% year to date.

Among the diversified miners, TeraWulf has soared 246% in the same period, and Core Scientific (CORZ) has rallied 407%. (I recommended (CORZ) on August 7 this year at the price of $9.71). It is now just over $17.00.

Core Scientific Weekly Chart (CORZ)

The promises made by Trump in his campaign included keeping all bitcoin mined in the U.S.

The previous administration thwarted the crypto industry as it attempted to mandate energy surveys on miners and proposed a 30% excise tax on them.

Private Prison Operators See a Big Move

We can understand Tesla and Bitcoin moving up strongly. Tesla can almost be seen as a sector on its own. But let’s dive into Prison Operators and see what their move is all about.

Shares in the leading publicly traded prison firms GEO Group and CoreCivic have jumped roughly 70% since November 4.

The gains point to the big opportunity investors see for private prison operators as Trump vows to round up and deport millions of migrants.

Trump’s first actions as president have been focused on assembling the team in charge of immigration policy, a signal it is likely to be a priority.

While Trump’s immigration policy may be sound for private prisons, it may not be good for the economy. The housing, agriculture, and hospitality industries rely on migrants to fill laboring jobs. Without that labour pool, the U.S. could see labour shortages, and higher wages, an environment that would not be conducive to helping remedy the housing shortage.

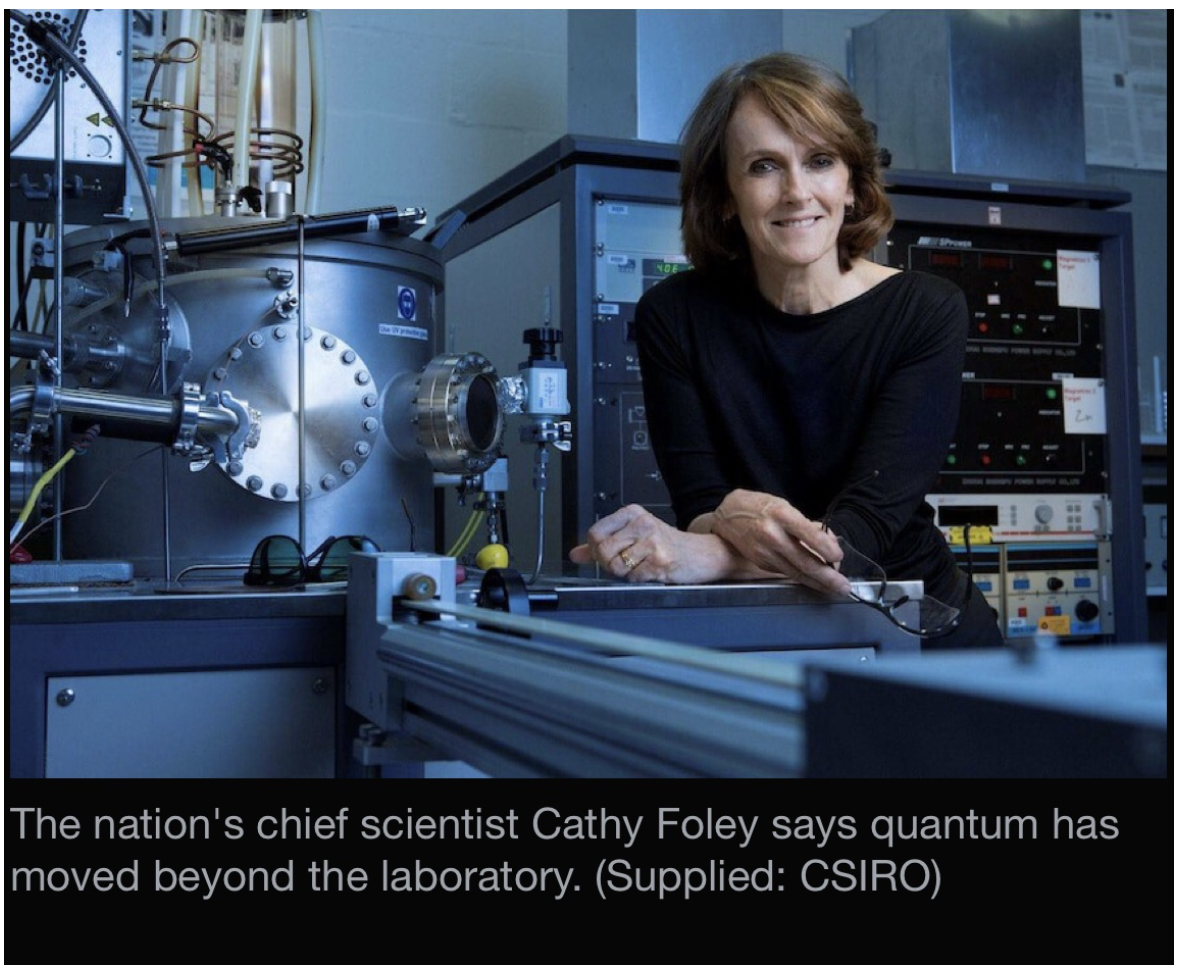

AUSTRALIAN CORNER

The Australian Government has become a big spender on quantum computing, outcompeting private capital in hopes to make Australia a world leader.

In the past 18 months, there has been a $470 million investment into PsiQuantum, matched by Queensland, a company that promises to deliver the world’s first “utility-scale” quantum computer from its Brisbane headquarters.

Global consultancy McKinsey has estimated the sector could be worth trillions within the next decade, with particular applications for problem-solving in the sciences and powering navigation and communication tools.

The first “State of Australian Quantum” report says Australia’s own quantum industry will be worth a projected $6 billion and employ 19,400 Australians by 2045.

Earlier this year, QuintessenceLabs, announced a US partnership to provide “quantum-safe cybersecurity” to government agencies.

As of August this year, there were at least 53 facilities and laboratories researching quantum technology in Australia and 38 quantum businesses headquartered in Australia.

QUIRKY CORNER

Cheers

Jacquie