October 4, 2023

(RESUMPTION OF STUDENT LOAN BILLS AND THE IMPACT ON THE ECONOMY)

October 4, 2023

Hello everyone,

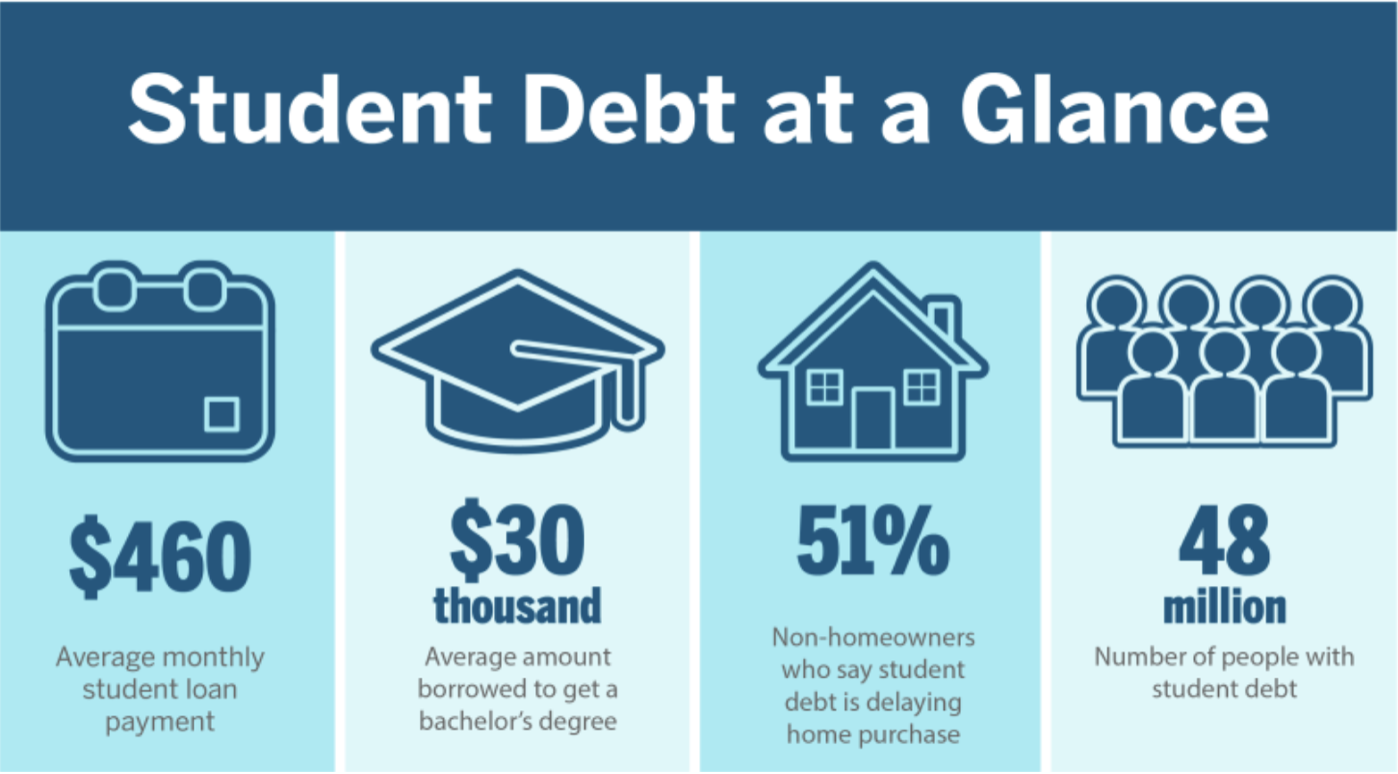

40 million may be the approximate number of Americans who will be looking at a new monthly bill as of Sunday.

That’s when the pandemic-era pause on federal student loan payments ended.

No one is certain, including economists, how this will impact the economy and households, but retailers and lenders are bracing for a hit.

There is a convergence of events happening now. The first bills will be distributed at a time when households are already dealing with the highest interest rates in decades, when workers are striking across the country, and a government shutdown is a possibility when the 45-day payment agreement expires in November.

Financial services firm, Jefferies is warning that “there could be a significant risk to consumer spending ahead,” due to the resumption of student loan payments.

A Jeffries survey which polled around 600 consumers with student debt, showed that about 70% of borrowers plan to postpone big-ticket purchases from October onwards. Additionally, it was shown that many students plan to cut back on their spending on clothing, travel, and food.

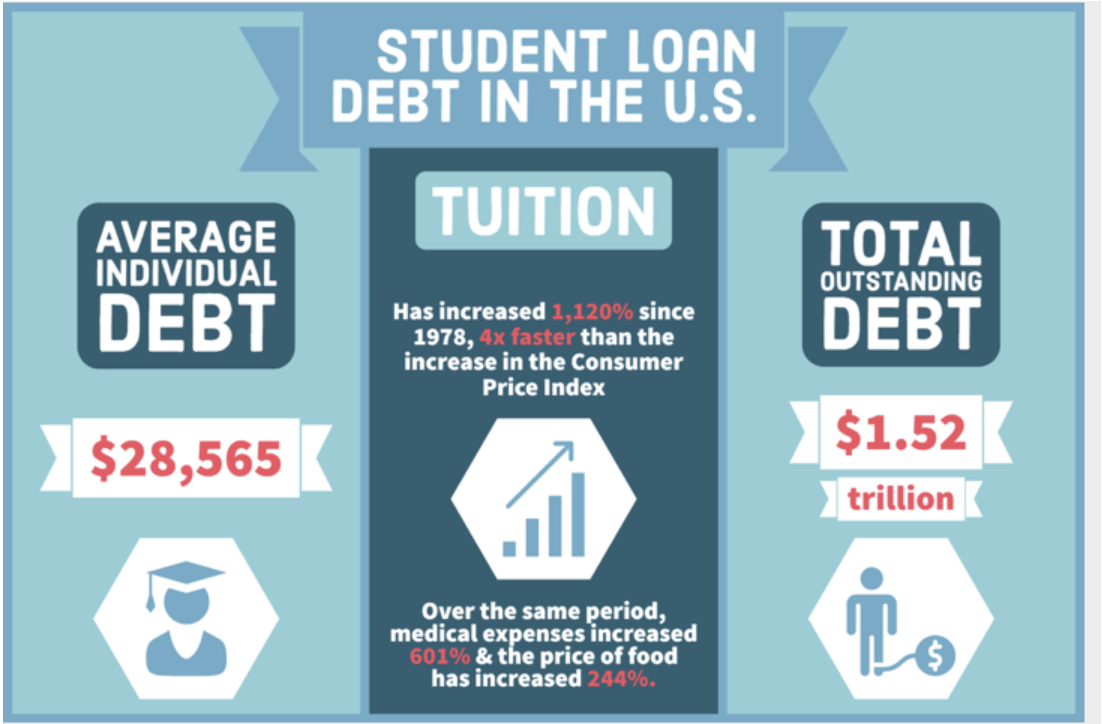

We are moving towards holiday season now, so these extra payments that households must make could drag on consumer spending. Pandemic relief payments and forbearances on mortgages and student loans were just some of the factors that led to households having more to spend during the pandemic. Rather than paying off student loan debt, (that had been paused) much of the relief money went towards clothing, house repairs/renovations, travel/entertainment after pandemic restrictions were lifted. The strong consumer demand has played a role in the higher inflation rates over the past few years. Commencement of student loan debt obligations means that households may have to rein in spending once again, so there is a likelihood that consumer demand will fall.

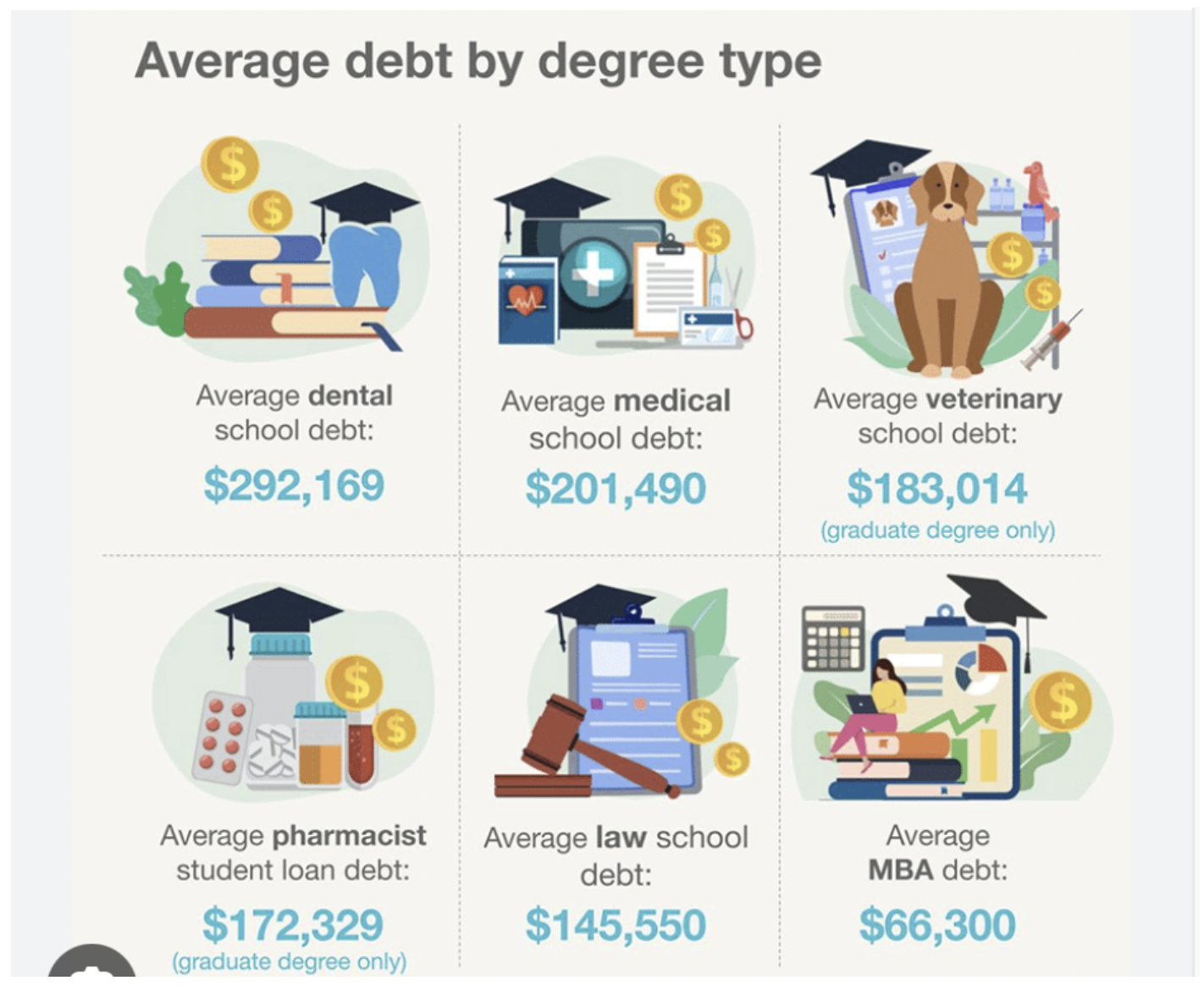

The typical student loan bill is around $350 a month, but at least 10% of borrowers have a payment of over $700.

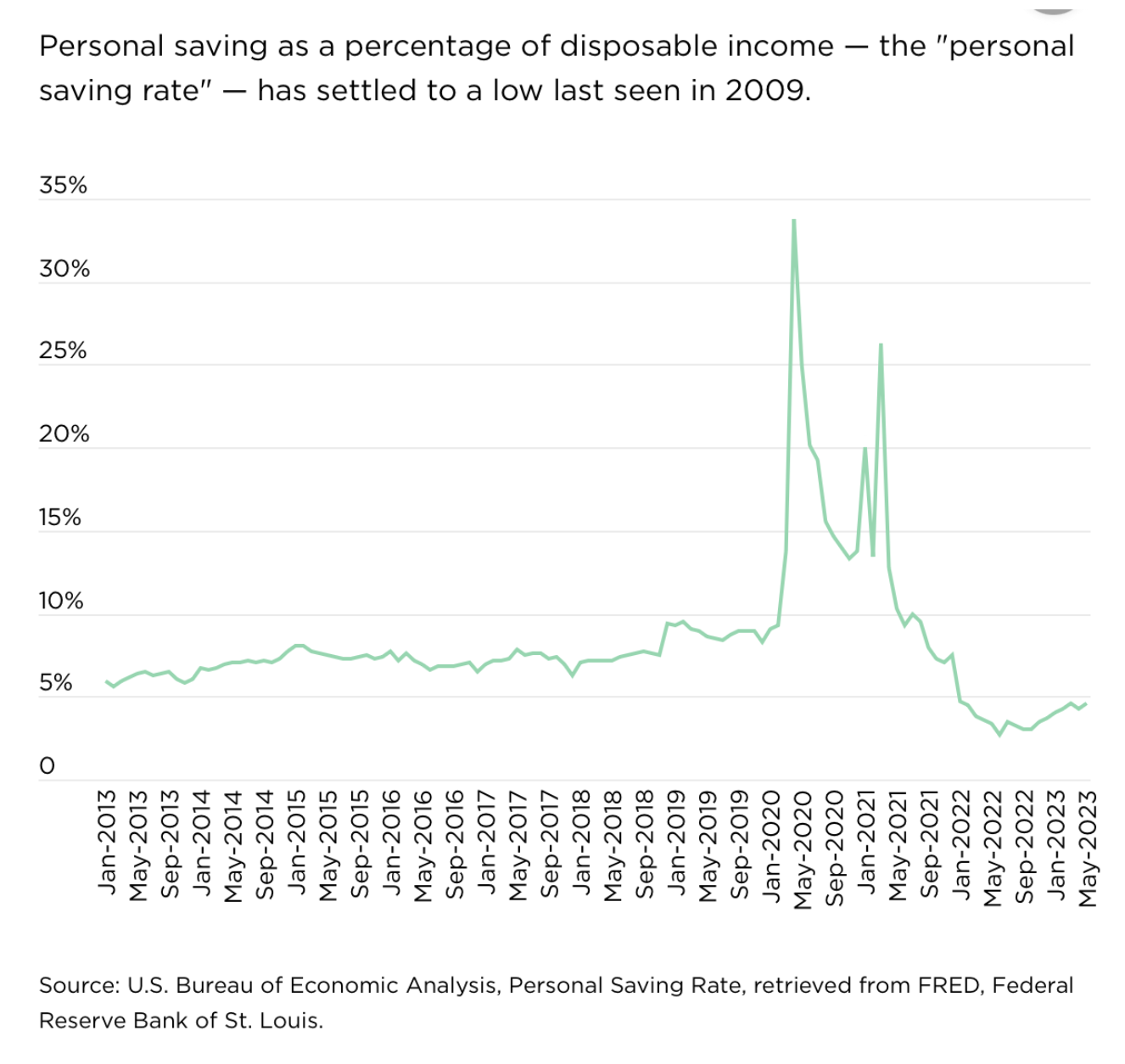

Student debt obligations may also eat into a household’s ability to maintain savings. The personal savings rate rose early in the pandemic, hitting 34%. However, now it is at the lowest level since the Great Recession, at 4.6%, according to the Federal Reserve Bank of St. Louis.

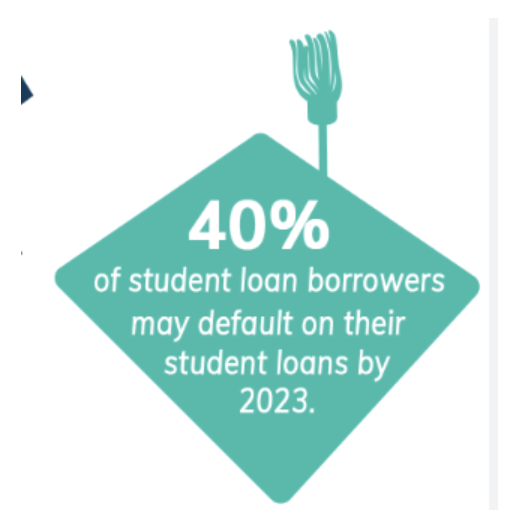

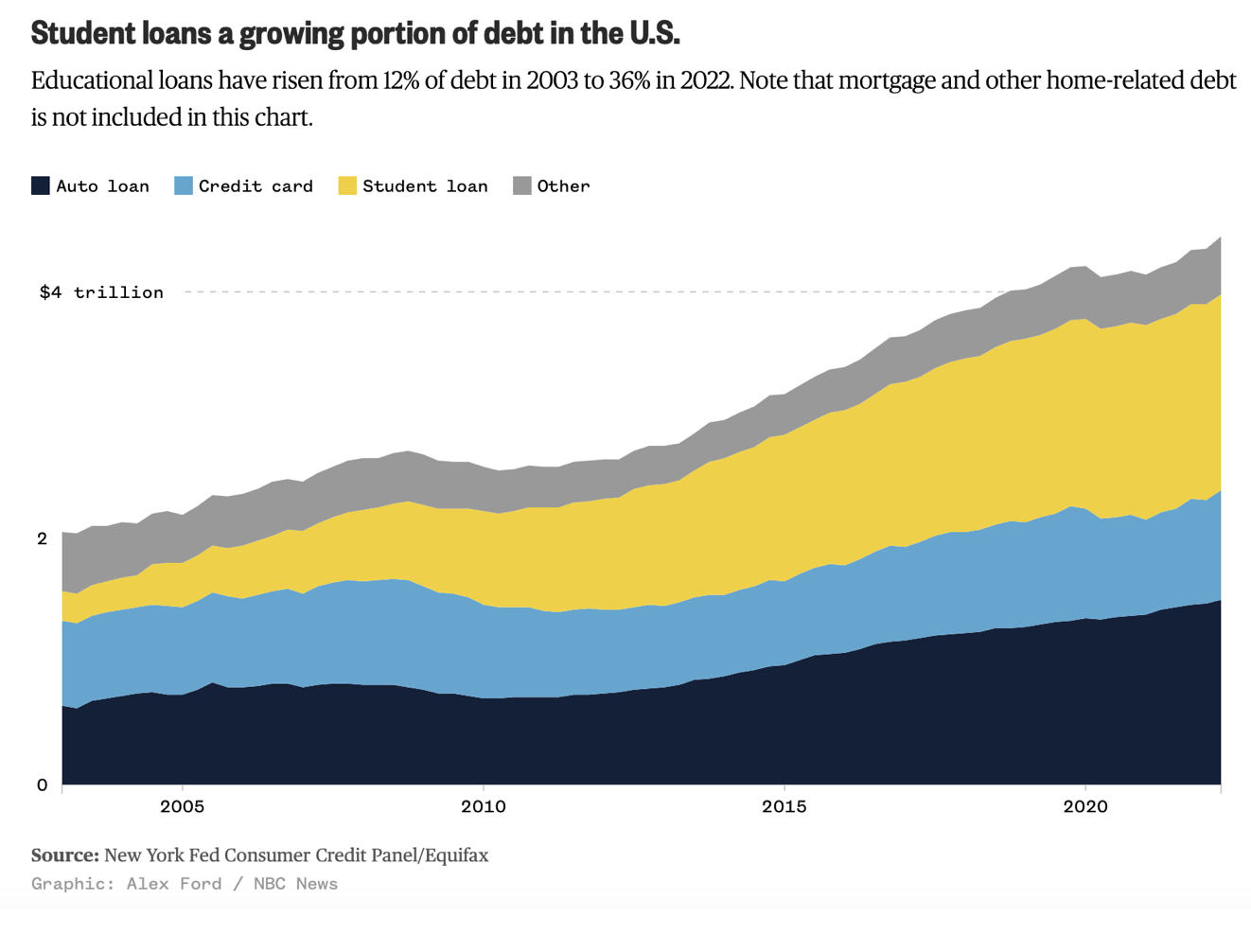

The Consumer Financial Protection Bureau has also found that student loan borrowers have fallen deeper into debt during the pandemic, with more than half of borrowers holding higher monthly debt-related expenses than they did before the pause on bills began in March 2020. According to the CFPB, more than 1 in 13 borrowers are currently behind on their other payment obligations. Adding student loan bills to credit card bills and auto loans will undoubtedly squeeze households going forward and may contribute to a slowing economy.

My son, Alex, has just started college this year. I am paying for his college fees upfront. So, no student loan debt in our family.

Happy Wednesday.

Cheers,

Jacquie