October 6, 2023

(SUMMARY OF JOHN’S OCTOBER 4, 2023, WEBINAR – CHAOS REIGNS)

October 6, 2023

Hello everyone.

LUNCHES

October 6, 2023 – Frankfurt, Germany

October 13, 2023- Kiev, Ukraine

October 20, 2023- London, England

October 30, 2023- Sarasota, Florida

October 31, 2023- Miami, Florida

PERFORMANCE

61% on the year.

83.85% trailing one year return.

657.99% since inception.

48.15% average annualised return.

POSITIONS

Risk On

TSLA 10 $200-$210 call spread

NVDA 10 $370-$380 call spread

Risk Off

TLT 10 $89-$92 put spread.

THE METHOD TO MY MADNESS

The market is discounting a worst-case scenario – no budget deal until we get a new congress in January 2025.

Technically, we are without a government now.

The markets will refocus on the possibility of a shutdown as November 17 draws near.

The tech sell-off will be brief. Too many people are trying to get into accelerating long term earnings.

Bonds breakdown to new 2023 lows.

Fall will present the best buying opportunities of the year.

Precious metals take a hit. But they should certainly be at the top of any “BUY” list to cash in on an economic recovery.

Patience. Let the market come to you.

A year-end rally may be compressed into a short-term time frame. If we get a shut-down, we can write off any rally.

THE GLOBAL ECONOMY – UNCHANGED RATE

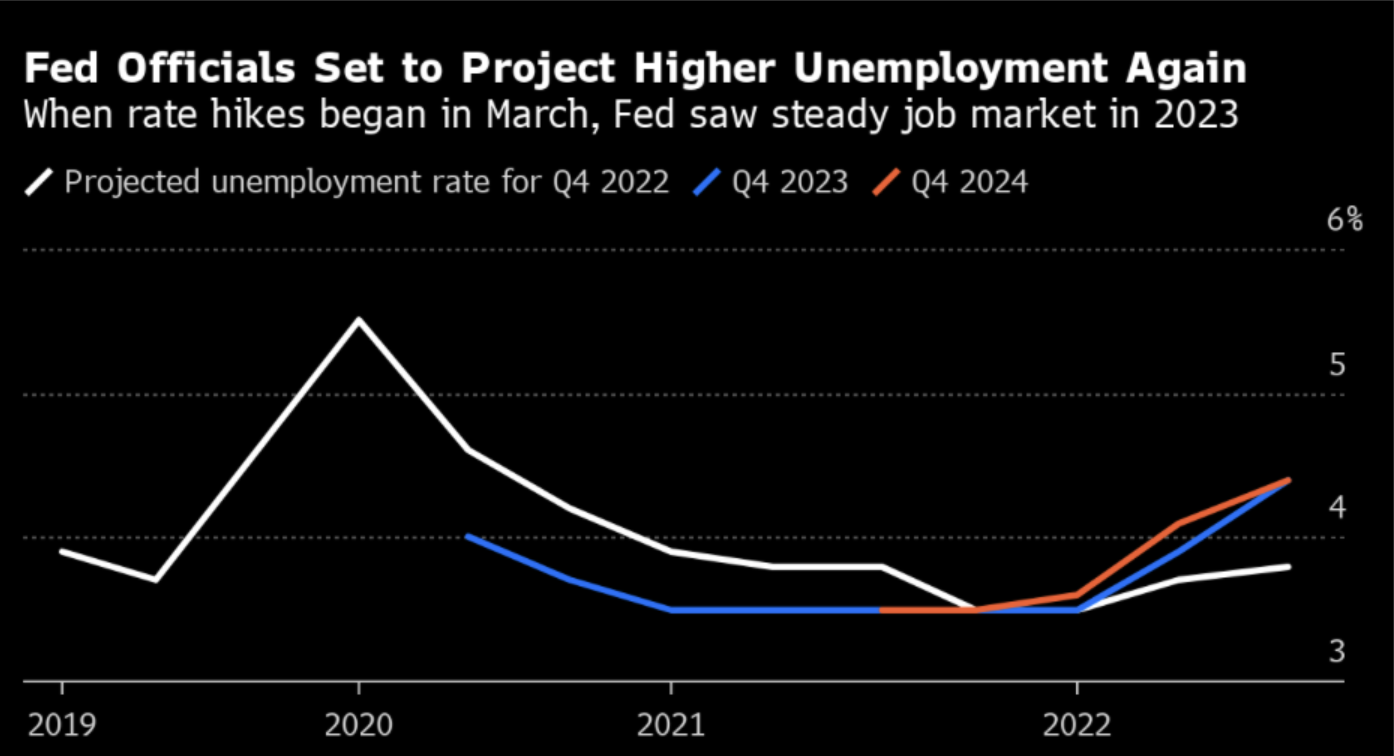

Fed leaves interest rates unchanged.

John says that the most important things that Powell didn’t say in the Fed press conference is that quantitative tightening or QT continues. And that drains $1 trillion a year from the financial system through bond sales until 2031 to get the Fed balance sheet down to zero.

Soft Commodity prices are soaring, from orange juice to live cattle, which are complicating the inflation picture.

Personal Consumption rose 3.9% YOY and only 0.1% in August alone.

Personal Spending was up only 0.4% versus 0.9% in July, a three-year low.

Are we going to be hit with another rate rise in November?

If inflation goes up to 4%, we may be able to have a soft landing, but if inflation goes above 4% the Fed is looking at tightening more, raising interest rates, which could be enough to tip us over into recession, which according to John, will be short in timeframe.

After 150 days, the Hollywood Screenwriters Guild strike is over. The strike probably cost the U.S. economy around $5 billion.

STOCKS – LOOKING FOR LOWS

Stocks probing a 10% correction. We can thank the Oil price rise, inflation rate rise, Fed rate rise, Bond market collapse.

Government shutdown is adding extra fuel to the fire.

Hedge Funds have been cutting risk at their fastest pace since 2020.

Biggest week-on-week decline in portfolio leverage since the depths of the pandemic bear market.

A Nobel Prize in chemistry is presented to Moderna (MRNA).

Rite-Aid will file for bankruptcy – it plans to close 500 of its 2,100 stores.

If we have more bad news, we could get down to 4000 on the S&P.

PANW – holding up well. If we get close to the 200MA enter a trade.

CAT and FCX – buy on the dip. FCX is a great LEAP opportunity going out two years.

BRKB – has fallen along with everything else. If the stock moves toward the 200MA, it is a great buy.

BONDS – SEARCHING FOR A NEW NORMAL

The Treasury Bond Freefall continues as long-term yields probe new highs. New issue of $134 billion this week didn’t help. Nothing can move – risk is heightened – until rates top out. May have to wait until 2024.

Ten Year Treasury yields hit new 16 year high, at 4.70%.

Government shutdown is a new negative, even when it’s delayed by 45 days.

Moody’s warns of further U.S. government downgrades.

The U.S. budget deficit is climbing once again increasing bond sales.

Falling interest rate/rising bond price trade has been delayed for six months. There has been hotter than expected economic growth at 2.40% for Q2 and more Fed rate rises are possible.

Keep buying 90-day T-bills, now pushing a 5.48% risk free yield.

Junk bond ETF’s (JNK) and (HYG) are holding up extremely well with a 6.5% yield.

Stand aside from (TLT) until we find the new floor.

FOREIGN CURRENCIES - NEW DOLLAR HIGHS

The Fed message “higher for longer” has rocketed the U.S.$ to new 2023 highs.

The possibility of a government shutdown is also adding fuel to the dollar’s rally as it has become a flight to safety bid.

Collapse of the dollar is now a 2024 story.

The Aussie dollar collapse has been prompted by a slowing Chinese economy – no demand for Aussie energy or commodities.

Put the following on your shopping list before the U.S.$ turns down from its rally. (FXE), (FXB), (FXA), (FXY).

ENERGY AND COMMODITIES – NEW 2023 HIGHS

Saudi Arabia continues Oil supply squeeze into Q4.

A cold winter will see demand for oil rise.

Russia bans all diesel exports, partly to meet its own military needs but also to squeeze the price up.

Strike ends at Australian export facilities.

Electrification will be the big theme of this century.

The power grid must increase fivefold in size to accommodate the electrifications projects already underway.

(My input here) The OPEC Secretary General, Haitham Al Ghais, argues that oil underinvestment is endangering the energy sector. He points out that the world will require at least 12 trillion of new investment globally for the oil industry until 2045. Of significance is the fact that by 2030 over ½ billion people will move into cities globally. Ghais argues that there is no way we can meet this future demand by relying on renewables alone. Thirty years ago, fossil fuel consumption was 80% globally. And thirty years on today, it is still at 80% or over 80%. So, if we project into the future – say 2030 – how far do you think we will be with our transition to a renewable energy world? Five or six years is not a long time. If we consider the challenges that are facing the introduction of electric vehicles, penetration of EV’s globally, availability of critical minerals globally, the supply chain and logistical issues, then we start to comprehend that the sheer size and volume of electrification required globally to be able to move to an electric world is a monumental challenge.

PRECIOUS METALS

The Fed’s stance on interest rates pushes precious metals to new 2023 lows.

Costco has started selling gold bars, and they are selling out within hours.

Gold Target = $3000 by 2025.

Silver is the better play with a higher beta.

Russia and China are also stockpiling gold to sidestep international sanctions.

REAL ESTATE

New U.S. Home mortgage rates hit 17- year high and have virtually ground to a halt.

Homebuilder sentiment turns down for the first time in seven months in August to 45.

S&P Case Shiller rises to new all-time high for sixth consecutive month as inventory shortages drove up competition housing.

In July the index increased 0.6% month over month and 1% over the last 12 months, on a seasonally adjusted basis.

July’s movement reached a new high for the nationwide home index, surpassing the record set in June 2022.

The median home price for existing homes rose to 1.9% to $406,700 according to the National Association of Realtors (NAR).

The robust housing market suggests that while some buyers pulled back due to high borrowing costs, demand continues to outweigh supply.

Wishing you all a great weekend.

Cheers

Jacquie