October 9, 2023

(THE MACRO DATA AND PEOPLE’S REALITY)

October 9, 2023

Hello everyone,

Welcome to a new week in October. I believe October and November will be interesting months in the markets.

So, what do we have coming up this week?

Monday: Australia Consumer Confidence Chg.

Previous – 1.5%

Time: 7:30pm ET

Tuesday: US Consumer Inflation Exp.

Previous: 3.6%

Time: 11:00am ET

Wednesday: US PPI MoM.

Previous: 0.7%

Time: 8:30am ET

Thursday: US Core Inflation.

Previous: 4.3%

Time: 8:30am ET

Friday: US Consumer Sentiment

Previous: 68.1

Time: 10:00am ET

THE MARKETS

S&P 500

In the past few weeks, sentiment has turned from bullish to bearish, and the market is entering a “seasonably favourable” period ahead. Friday’s strong employment number gave the market every chance to resume its decline but instead it strengthened. Therefore, there is opportunity for the bulls to regain control. Whilst holding last week’s 4,216 low, it may be possible to interpret the S&P as having commenced its 5th Elliott Wave advance onto new highs for the year (before a significant reversal occurs). The market has much to prove.

Important resistance levels include: 4335, 4400/4430 & key 4510/4540.

GOLD

Gold recorded a bullish “outside reversal day” on Friday, to enable a recovery to now occur. Such a recovery can test the $1860-$1880 resistance area over coming days. However, unless gold can clear resistances at $1884 and then $1905, there is risk this potential bounce gives way to a deeper sell-off below $1804 support – toward the $1700 level in the weeks ahead.

CONFLICT IN THE MIDDLE EAST

Palestinian militants Hamas attacked Israel on the weekend. Oil prices jumped 4% following the surprise attack which is now in its third day. At dawn on Saturday during a major Jewish holiday, Palestinian militant group Hamas launched a multi-pronged infiltration into Israel – by land, sea and air using paragliders. The attack came hours after thousands of rockets were sent form Gaza into Israel. At least 700 Israelis have reportedly been killed according to NBC news. The Palestinian Health Ministry has recorded 313 deaths so far. The conflict sits at the doorstep of a key oil producing and export region for global consumers. Oil rich Iran looms large as the market’s immediate concern. Should the conflict escalate regionally, there could be quite a dramatic effect on the oil market with prices jumping back into the 90’s.

RECORDING OF JACQUIE’S POST MONTHLY ZOOM MEETING 09/27/23

https://www.madhedgefundtrader.com/jp-meet-sep2023/

DATA AND REALITY

Friday’s jobs report showed a strong resilient economy.

But people’s perception of their economic outlook is still gloomy.

Why?

Inflation, although slowly heading lower, is still far more than most people can tolerate.

Statistics and numbers in a book do not reflect what is being experienced in the real world. In other words, people’s experience doesn’t transition into less hardship because the numbers move down.

Numbers and reality are two different beasts.

A healthy jobs picture does not equate to a positive consumer sentiment.

All the extras we have become used to are being removed. It might appear subtle at first, but as you tally all findings together, it really becomes very clear.

Let’s see. Do you still get free drinks with children’s meals anymore? At some places, no.

The size of the product you buy at the grocer is smaller but has the same tagged price. That packet of laundry soap I buy is smaller as is the dishwashing liquid, but the price is the same. In Australia, a pound of butter went up a dollar a few weeks ago. Not 25 cents, not 50 cents, but a whole dollar.

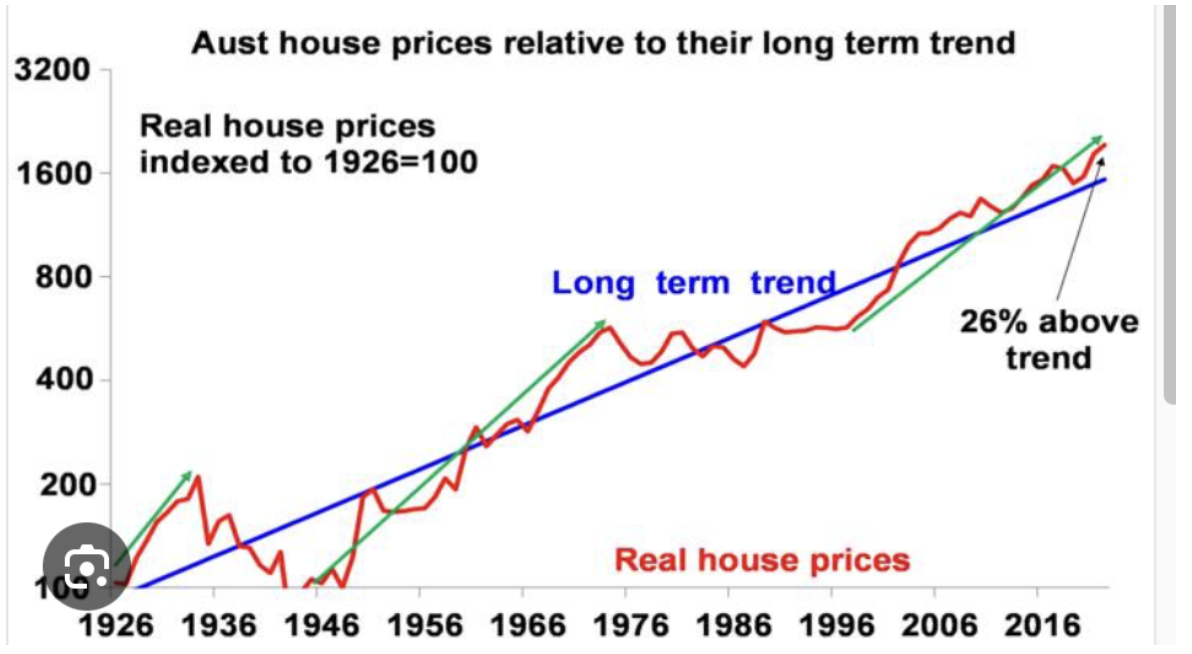

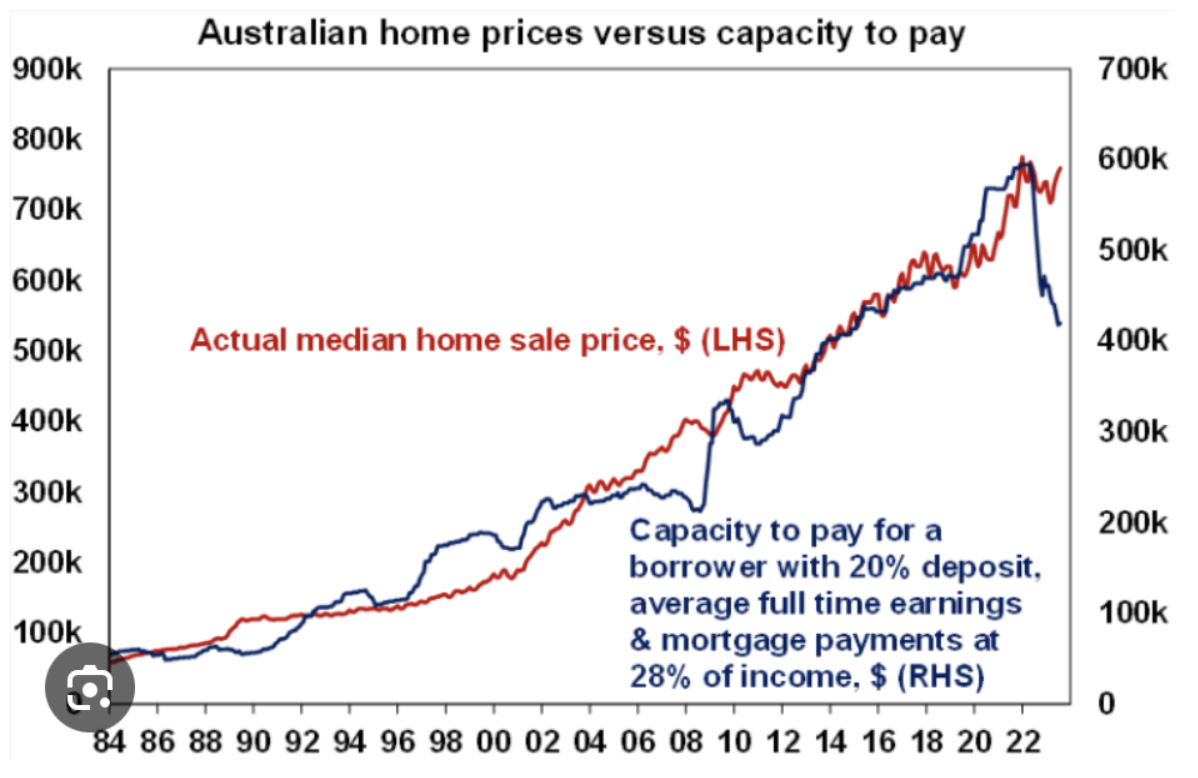

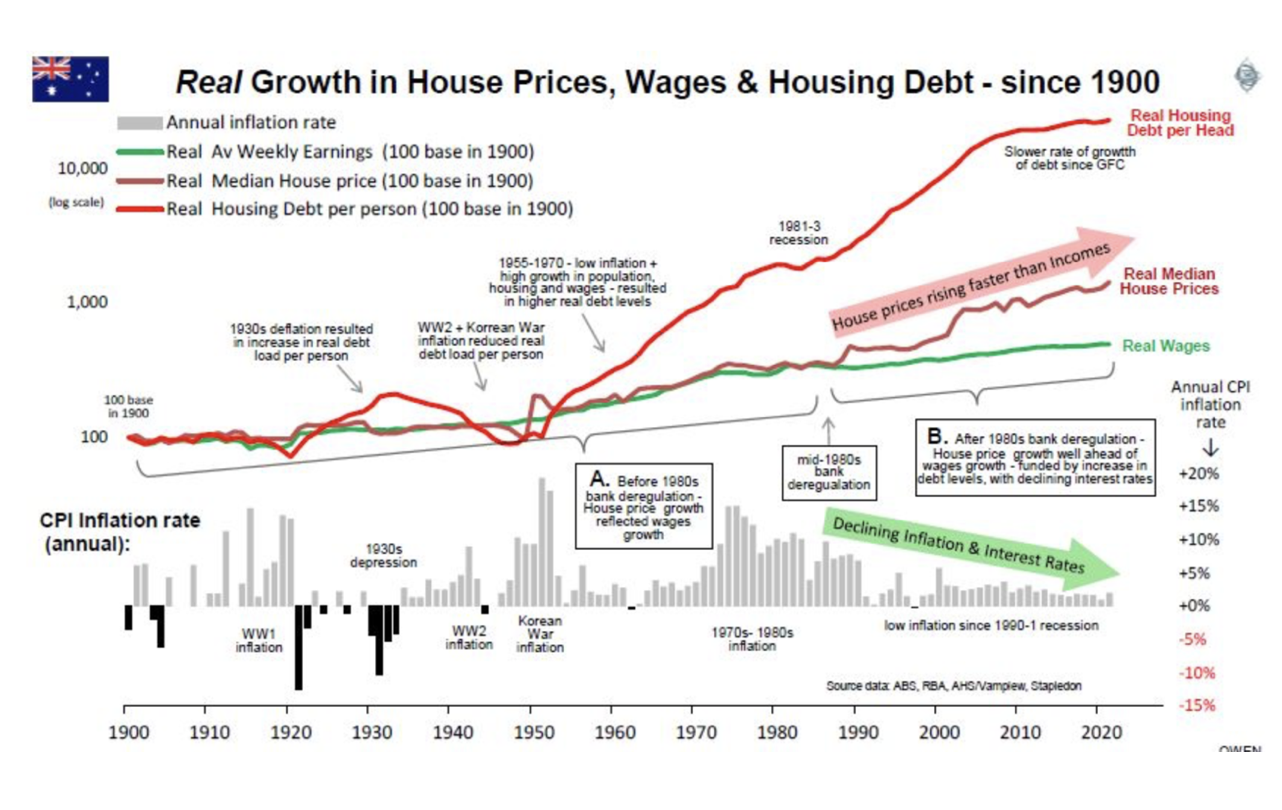

The cost of housing has gone through the roof. In the aftermath of Covid, house prices surged, which pushed people out of the big cities into regional areas. The median home sales price has risen 27% since the end of 2019, and this makes home ownership particularly difficult for younger buyers such as millennials. And it’s not just house prices.

Higher interest rates are a problem too. 30-year fixed mortgages are running at an average 7.83% loan rate. Financial markets are a bit jumpy because of the possibility that the Fed could take rates even higher if inflation doesn’t pull back.

While the consumer price index may show inflation running at a 3.7% annual rate now, it’s about 20% higher than it was since early in the pandemic.

The CPI number for September will be released Wednesday.

Wishing you all a wonderful week.

Cheers

Jacquie

It doesn’t look like interest rates will be moving down in the short to medium term. We have had low rates for a very long time. In Australia, 2025 may be the earliest we could see a shift in rates.