Old Tech?s Big Comeback

Apple blew away the bears today with the issuance of $17 billion in bonds, the largest such corporate debt issue in history. Spread over two, five, ten, and 30 years, the deal was oversubscribed by more than 3:1, with $40 billion in demand left unfilled.

Foreign investors took down a major part of the deal, which explains Deutsche Bank?s senior role in the syndicate. The yield on the ten-year bonds came in at 2.40%, a mere 70 basis points over equivalent US Treasury paper.

The mega deal, dubbed ?iBonds? by traders, underlies the tremendous shortage of high-grade fixed income securities worldwide. Since 2007, the amount of double ?A? or better rated paper has declined by 60%, thanks to widespread downgrades inspired by the newfound religion of the ratings agencies.

As I never tire of pointing out at my strategy luncheons and lectures, the principal sin of governments is not that they are borrowing too much money, but not enough. This has given us a global bond shortage that has taken returns to insanely low levels. Look no further than the ten-year yield of 1.68% in the US, 1.20 % in Germany, and a pitiful 0.60% in Japan.

The issue also highlights the sudden fascination of all things Apple since its better than expected calendar Q1 earnings report last week, with $43 billion in revenues spinning off $9.5 billion in profits. Since then, we learned that the richest man in Russia, Alisher Usmanov, soaked up some $100 million of stock close to the $392 bottom. This is a man who?s proven track record of market timing is uncanny.

It doesn?t require a lot of imagination to figure out what this deal is all about. With $145 billion in cash on the balance sheet, why borrow another $17 billion? The reality is that this is a way of repatriating, through the back door and tax-free, some of the estimated $100 billion in cash the company has parked in offshore bank accounts.

What will it do with the money? How about buying back $17 billion worth of stock? Buy borrowing at 2.4% and retiring 3.2% dividend stock, the yield pick up on the transaction comes to $136 million a year. That goes straight to the bottom line. The deal reminds me of the kind of financial engineering that dominated Japanese finance during the late 1980?s. When I was a director of Morgan Stanley, I signed many of these multi billion dollar deals as a co-manager.

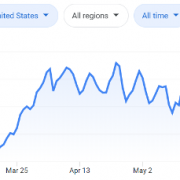

It wasn?t just Apple that has returned from the grave, which saw its stock rise by 14% since last week?s two year low. Look at many of the old tech warhorses, like Microsoft (MSFT), Applied Materials (AMAT), Hewlett Packard (HPQ), and Intel (INTC), which have blasted forth from long moribund levels in recent weeks.

Which raises an interesting possibility. What if the long predicted selloff in May does a no show? What if, instead of the usual 10%-25% swan dive, we only get the 2.5% that has been the pattern for 2013? The possibilities boggle the mind.

In that case where will the money flood into next? Stocks that have been going up like a rocket for the past eight months, or shares that have either fallen like a stone during this time, or barely budged? Stocks that are trading at double the market multiple, or at half the market multiple? Hmmmm. Let me think about this one.

There are two major categories of the latter, commodity related shares and technology ones. China is still slowing, placing a monkey on the back of most commodities related companies. So I vote for technology, which by the way, is the cheapest it has ever been on an earnings multiple basis.

In that case, the strength in old tech will develop into far more than a one-week wonder. It could provide the rocket fuel that will power the major indexes for the rest of the year. That would take the S&P 500 up to 1,700 where it can flaunt a glitzy earnings multiple of 17.

Don?t get too giddy. This is definitely a best-case scenario. But then lately, the best-case scenarios have been happening, thanks to the reflationary efforts of our friend, Ben Bernanke.

That would be fantastic news for Apple?s long-suffering shareholders. Now that its stock has clearly broken through the 50-day moving average on the upside, the eventual target of this leg could be as high as the 200-day moving average at $541. One can only hope.