One of America's Dirty Little Secrets

Crypto is still controversial - still this bizarre, unruly, too-big-to-explain thing that half the population dismisses as nonsense and the other half swears will hit six figures “any day now.”

You’d think after all these years the debate would cool off, but if anything it’s turned into a running commentary on the world young people walked into.

Remember when Millennials and Gen Z were mocked for complaining?

“Well of course the economy is screwed. Nobody wants to pay a decent salary, and nobody wants to work.”

Funny how that line hits differently when inflation actually shows up, interest rates rocket higher, and the cost of living goes from “annoying” to “how is this even allowed?”

But here we are. And if you believed the economy was compromised, then naturally something else had to fill the ideological gap.

Crypto stepped in, not just as a speculative lottery ticket, but as a middle finger to a system that politely thanked young people for their degrees and then handed them a lifetime of rent payments.

The roots of this frustration aren’t mysterious. The US spent decades outsourcing manufacturing, suppressing wages, and printing money like a kid discovering the family label maker.

That era of zero-percent interest rates and endless quantitative easing felt like a cheat code until 2022–2023 ripped it away. Suddenly money wasn’t free. Inflation wasn’t theoretical. The bill had arrived.

And then remote work blew the doors off the old labor map. Wage arbitrage used to be something corporations did. Now individuals do it, too.

People work from Bali, Buenos Aires, or Boise while competing with candidates from everywhere. Geography melted. Job markets stretched. And wages…stayed stubbornly unimpressive.

Meanwhile, the cost of living decided to cosplay as a space rocket. Housing affordability didn’t just get worse - it went full dystopian. Real wages moved an inch while prices sprinted a mile.

Even well-paid professionals found themselves barely clearing the month. The “just get a good job” advice aged about as well as a bowl of shrimp in the sun.

Put all that together and it’s no wonder younger adults turned to crypto. Was it partly hope? Yes. Was it partly desperation? Also yes. Was it also a little bit of “screw it, the system isn’t giving me anything anyway”? Absolutely.

Crypto became the alternative ideology because the old one - work hard, buy a home, retire someday - stopped functioning as advertised.

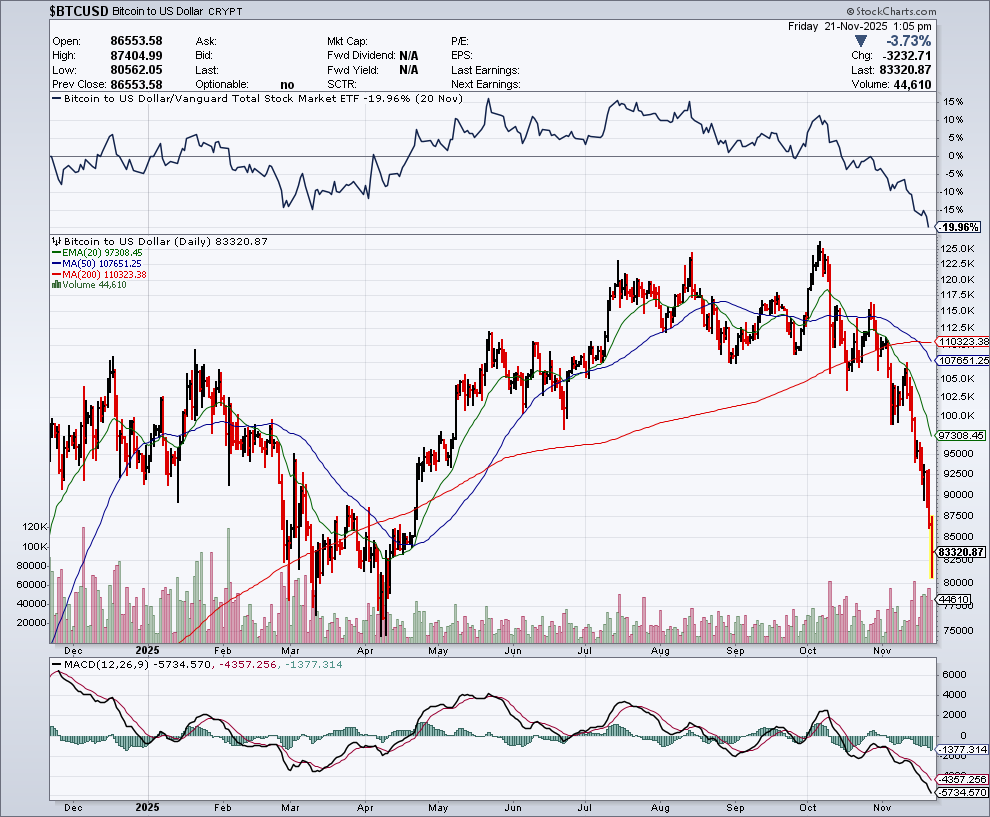

But here’s the twist: by 2025 that original crypto narrative has mutated into something completely different.

After the spectacular blowups of 2022 (we all remember them), crypto didn’t die. It matured.

Bitcoin ETFs launched in 2024. The IRS finally drew up rulebooks instead of threats. Global regulators settled on actual frameworks. Big banks stopped pretending crypto didn’t exist and quietly rolled out services like it was no big deal.

We went from “crypto is too wild to regulate” to “crypto is now part of my retirement account.”

In other words, the industry that was supposedly “too big to fail” is now simply part of the same financial system it once tried to disrupt. Not exactly the revolution the early evangelists dreamed of, but certainly more stable than the critics predicted.

And yet, underneath all the regulation, all the institutional adoption, all the shiny ETF commercials on cable news, something deeper remains. Young people still want ownership. Of something. Anything. A stake in a world that constantly feels like it’s slipping further out of reach.

Crypto didn’t fix that existential ache. It just became one of the few places where the door didn’t slam shut on them.

But reality check: if crypto does end up creating massive new wealth (again), it will still go mostly to the people who had disposable income to invest.

The vast majority living paycheck to paycheck aren’t buying Bitcoin; they’re buying dinner. Volatility is not a luxury they can afford.

And now they’ve got a new anxiety: AI. Automation. Entire job categories looking shakier than a meme coin on a Sunday night. Younger workers aren’t throwing rocks at the system; they’re just trying to stay afloat while the rules change every five minutes.

This is why crypto still feels like a real option in 2025. Not because it’s a secret to getting rich (that’s over) but because it’s one of the few places where younger generations can participate without asking permission from gatekeepers.

But let’s be clear: crypto is not a golden ticket. It’s not a lottery. It’s not the road to Lambo-land. It’s simply an asset that survived hype cycles, regulatory crackdowns, spectacular failures, and global uncertainty - and came out the other side as part of the mainstream.

We don’t need to overhype it. We don’t need to bury it. We just need to acknowledge what it actually is now: a tool. A legitimate piece of the financial puzzle. A place where the rules are finally written down. A sector driven not by chaos but by clarity.

Crypto isn’t a passport to extravagant dreams anymore. It’s a viable strategy in a world where traditional routes to stability have eroded.

And maybe that’s the point. Maybe what younger generations wanted all along wasn’t a revolution but a chance to belong to the economy they were promised.

Crypto didn’t give them that. But it did tell the truth about the world that made them look for it.