Pox Populi

Hold onto your hazmat suits because the world of infectious diseases just got a lot more interesting. And if you're someone with a stomach for volatility, you might want to pay attention.

Mpox is back, and it's brought a nasty new cousin to the party. The World Health Organization (WHO) just hit the big red button, declaring the mpox outbreak a public health emergency of international concern (PHEIC). That's fancy talk for "this is serious, people."

Let's break it down. We're not dealing with your garden-variety mpox here. This is a new strain, dubbed Clade Ib, and it's tearing through central Africa like a bull in a china shop.

The Democratic Republic of Congo (DRC) has seen over 15,600 cases so far this year, more than all of last year. And it's not staying put.

Kenya, Burundi, Rwanda, and Uganda are all reporting their first-ever mpox cases. It's like watching a virus go on a world tour, minus the t-shirts and overpriced concessions.

Now, before you start panic-buying toilet paper again, the Centers for Disease Control and Prevention (CDC) says the risk to the U.S. is very low.

But they're still telling healthcare providers to keep their eyes peeled for any funky rashes on patients who've been globe-trotting lately.

So, what do we do with this information? Well, let's talk vaccines.

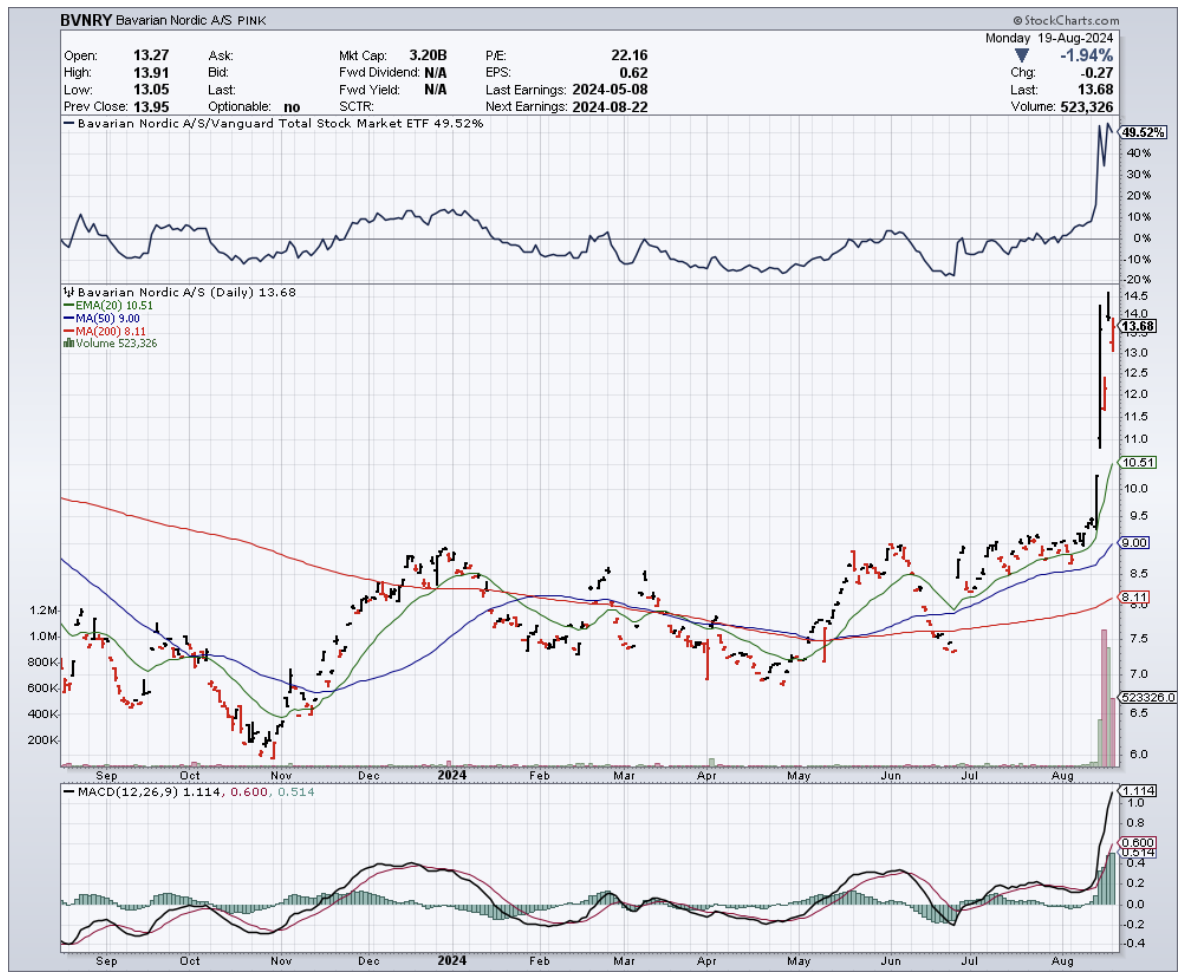

Bavarian Nordic (BVNRY), the company behind the most widely used mpox vaccine, has seen its stock jump more than 30% since the WHO's announcement. It's like they won the pharmaceutical lottery.

And Uncle Sam's not shy about showing them some love – the U.S. Department of Health and Human Services just placed a $156.8 million order for a bulk vaccine product.

But they're not the only player in town.

Emergent Biosolutions (EBS), another vaccine manufacturer, also saw its stock surge when the news broke.

Even GeoVax Labs (GOVX) saw its stock shoot up 40% yesterday morning. Not bad for a company most people had never heard of last week. They're working on an MVA vaccine – that's Modified Vaccinia Ankara for you science nerds out there. It's the go-to choice for folks with weakened immune systems.

But it's not all sunshine and rainbows in vaccine land.

Siga Technologies (SIGA) released some disappointing trial data for their antiviral drug TPOXX. Turns out, it's not much better than a sugar pill for treating mpox.

Other companies are also jockeying for position.

Chimerix (CMRX) is developing brincidofovir, an antiviral that could potentially treat mpox. Tonix Pharmaceuticals (TNXP) is working on TNX-801, a live-virus vaccine candidate.

And let's not forget the diagnostic giants like Thermo Fisher Scientific (TMO) and Abbott Laboratories (ABT). After all, in the world of infectious diseases, being able to spot the bad guy quickly is half the battle.

Even the big guns of the COVID-19 vaccine world, Moderna (MRNA) and Pfizer (PFE), might decide to flex their mRNA muscles in the mpox arena. And with their track record, who's going to bet against them?

But here's the million-dollar question: Is this a golden opportunity for investors, or a potential minefield? The answer, as always in the stock market, is "it depends."

On one hand, companies directly involved in mpox vaccines, treatments, and diagnostics could see their stocks soar if the outbreak worsens.

On the other hand, the biotech sector is about as stable as a jenga tower in an earthquake. Today's miracle drug could be tomorrow's cautionary tale.

The smart money isn't putting all its eggs in the mpox basket. Diversification is still the name of the game. Remember, this outbreak could fizzle out as quickly as it started, leaving one-trick ponies high and dry.

Plus, let's always keep in mind the wild card in all this: government contracts.

In the world of infectious diseases, Uncle Sam often holds the purse strings. Keep your ear to the ground for any whispers of government funding or contracts. That kind of news can send stocks into the stratosphere faster than you can say "public health emergency."

So, what's the bottom line? The mpox outbreak is creating some intriguing opportunities in the biotech sector. But as with any investment, don't let the fear of missing out cloud your judgment.

And remember, in the stock market, as in epidemiology, it's all about managing risk.

In the meantime, maybe skip that bushmeat sandwich on your next African safari. Just a thought.