September 16, 2024

(THE FED RATE CUT SHOW IS HERE – BUT WHAT’S THE NUMBER?)

September 16, 2024

Hello everyone.

Welcome to the biggest show in town this week. It has been hugely hyped, so expectations are high for a spellbinding event that will keep us hanging on every utterance the Fed delivers. Body language interpreters will be busy scribbling notes about Powell’s poker face and hand and arm movements, while other analysts will be dissecting his speech and looking for what was not said, which can also speak volumes.

And the rate cut will be…?

It’s uncertain, but what you can probably bank on is that there will be several cuts within the next year.

If the Fed cuts by 50 bps, markets may interpret that the Fed was behind the curve and made a mistake by not cutting in July and is acting pre-emptively against recession risks – which would be a shift from their typical stance of data dependency. Such a move could see a sell-off in equity markets take place. In other words, a big cut may indicate that the Fed has data that is worse than what we are seeing.

The uncertainty appears to be setting stocks up for an initial sell-off regardless of what the Fed does. We all know that markets hate uncertainty.

The dollar is likely to strengthen on a smaller cut and weaken on a larger one.

Two other major central banks also meet this week. The Bank of England is expected to hold rates at 5%, diverging from the ECB’s recent cut. The Bank of Japan is also likely to hold rates, but the meeting is still worth monitoring given their past surprise moves.

So, sit back and grab a front-row seat. Just make sure you scoop up opportunities’ volatility reveals.

WEEK AHEAD CALENDAR

Monday, Sept. 16

8:30 a.m. Empire State Index (September)

5: 00 a.m. Euro Area Wage Growth

Previous: 5.3%

Forecast: 3.2%

Tuesday, Sept 17

8:30 a.m. US Retail Sales (August)

Previous: 1.0%

Forecast: 0.2%

9:15 a.m. Capacity Utilization (August)

9:15 a.m. Industrial Production (August)

9:15 a.m. Manufacturing Production (August)

10 a.m. Business Inventories (July)

10:00 a.m. NAHB Housing Market Index (September)

Wednesday, Sept 18

8:30 a.m. Building Permits preliminary (August)

2:00 p.m. US Rate Decision

Previous: 5.5%

Forecast: 5.25%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: General Mills

Thursday, Sept 19

8:30 a.m. Current Account (Q2)

8:30 a.m. Continuing Jobless Claims (09/07)

8:30 a.m. Initial Claims (09/14)

8:30 a.m. Philadelphia Fed Index (September)

10:00 a.m. Existing Home Sales (August)

10:00 a.m. Leading Indicators (August)

7:00 a.m. UK Rate Decision

Previous: 5.0%

Forecast: 5.0%

Earnings: Lennar, FedEx, Darden Restaurants.

Friday, Sept. 20

12:00 a.m. Japan Rate Decision

Previous: 0.25%

Forecast: 0.25%

MARKET UPDATE

S&P500

Looking at the market through an Elliott Wave lens, we can interpret that the market has recently completed a corrective Wave ii of 5/ on its September 6 low of 5,403 to enable the resumption of Uptrend onto new highs for the year, with potential for advance toward 6220/6256 over coming weeks. A strong break above 5,652/5,670 will confirm this interpretation.

GOLD

Uptrend in progress. Support = $2,570/$2,530. Next upside target is around $2,640.

BITCOIN

Upside potential. Bitcoin has been undergoing a complex correction since reaching $73,794 in mid-March. The low reached on August 5th at $49,577 may have completed this correction. Through an Elliott Wave lens, it is possible to understand that Bitcoin may now have commenced a Wave 3/ advance toward a target of around $73,826.

Initial target is around $65,000 while holding support at around the mid$58s.

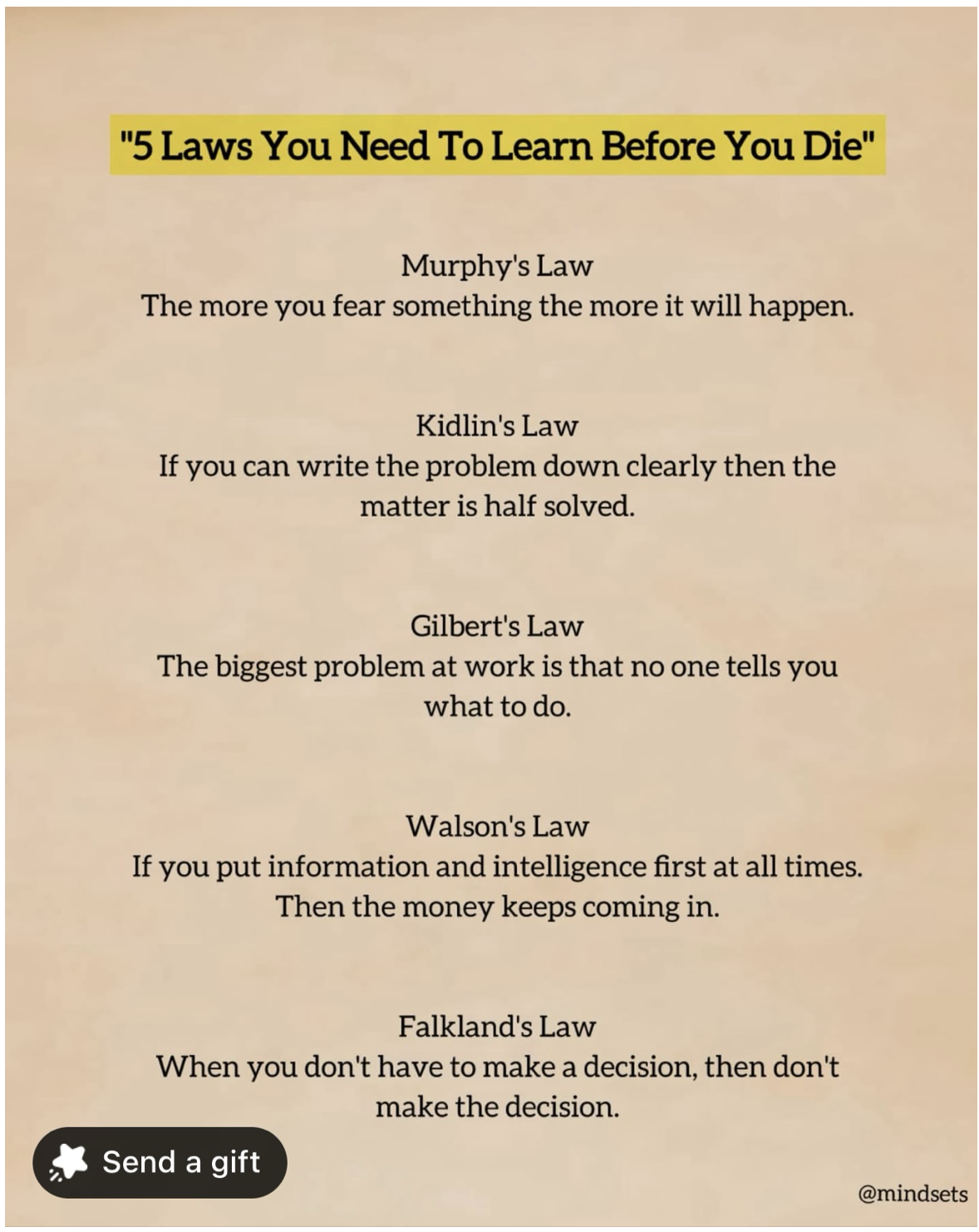

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie