September 8, 2023

(MARKET MOVEMENTS CAN BE UNDERSTOOD WITH THIS METHOD)

September 8, 2023

Hello everyone,

We have all heard of technical analysis and how it can fine-tune our entries into and exits out of trades.

I’m sure many of you have heard of moving averages, (RSI) Relative Strength Index, (MACD) Moving Average Convergence Divergence, Fibonacci, Elliott Wave theory, and Stochastics.

But have you ever heard of the Wyckoff Method?

What is the Wyckoff Method?

The Wyckoff Method is a technical analysis approach to the markets that investors can use to decide when to buy and sell. The Wyckoff market cycle reflects Wyckoff’s theory of what drives a stock’s price movement. The method is based on the premise that stocks and markets move in predictable cycles. Wyckoff identified nine primary cycles, each of which has a characteristic pattern of price movement. The approach is relatively simple: when well-informed traders want to buy or sell, they carry out processes that leave their traces on the chart through price and volume.

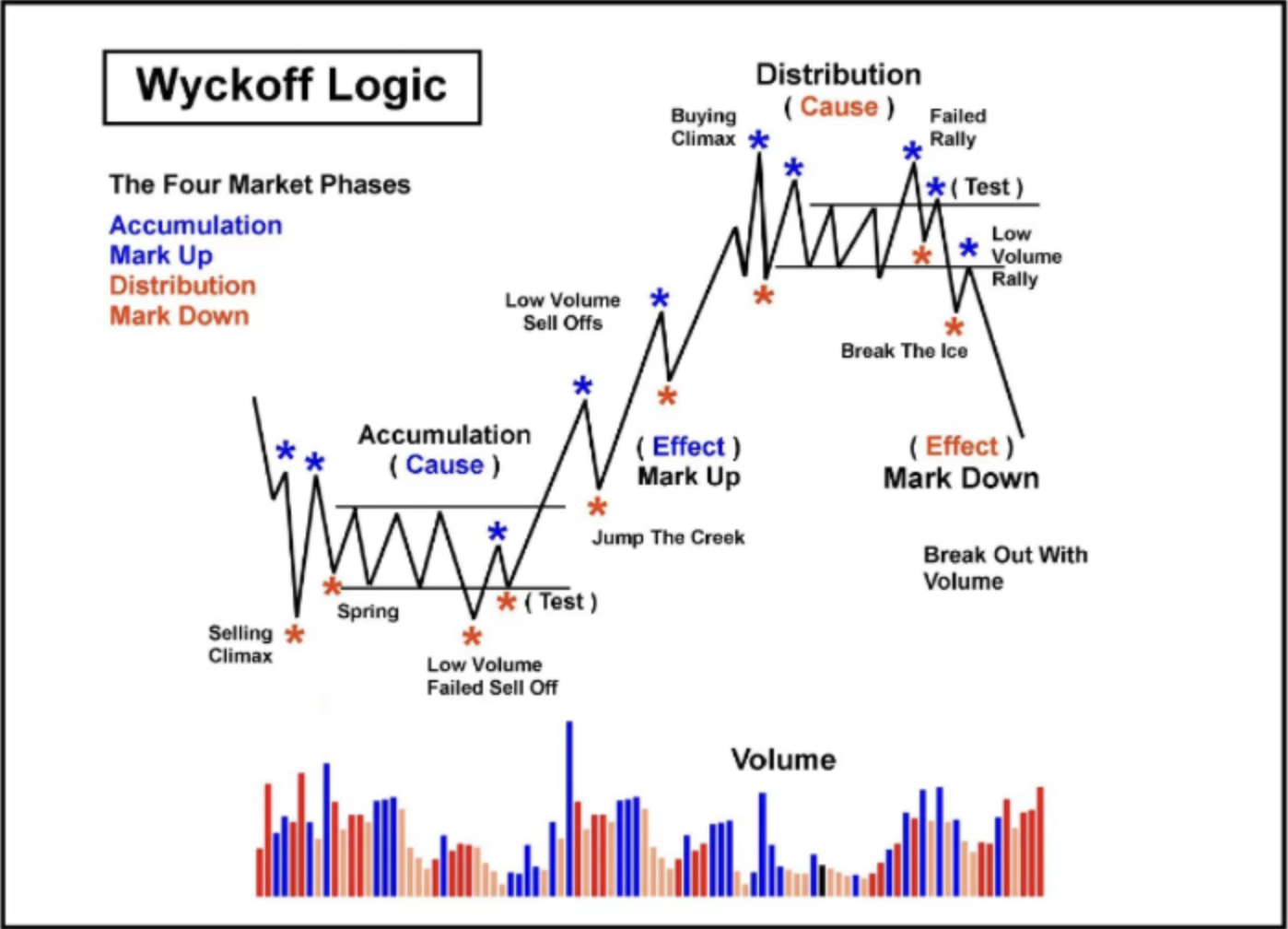

There are four phases of a Wyckoff market cycle: accumulation, markup, distribution, and markdown.

At the top of the markup phase, another event is expected to happen – the Wyckoff distribution phase where the buying pressure ends, and smart traders take their profits and close their positions.

The Wyckoff Method is based on three laws: the law of Supply and Demand, the law of Cause and Effect, and the law of Effort vs. Result.

The Law of Supply and Demand states that the price of a stock is determined by the balance between the supply of shares available for purchase and the demand for those shares. When demand for a stock is high, the price will rise, and when supply is high and demand is low, the price will fall.

The Law of Cause-and-Effect states that every price move has a cause, whether it is a fundamental development or market speculation. By identifying the cause of a price move, traders can better understand the likely direction of future price movements.

The Law of Effort vs Result states that the market moves in trends and that these trends are characterised by periods of accumulation, markup, distribution, and markdown. The effort, or the amount of buying or selling pressure, and the result, or the price movement, can be used to identify the stage of the trend and make informed trading decisions.

The Wyckoff Method was developed by Richard Wyckoff (1873-1934). It consists of a series of principles and strategies initially designed for traders and investors and can be applied to all financial markets.

Wyckoff started as a stockbroker at the age of 15 and by the age of 25 he already owned his own brokerage firm.

Through his observation, while working as a broker Wyckoff noticed the manipulations the big operators carried out and with which they obtained high profits.

He stated that “it was possible to judge the future course of the market by its own actions since the price action reflects the plans and purposes of those who dominated it.”

Enjoy your weekend.

Cheers,

Jacquie