September 9, 2024

(AUGUST INFLATION DATA WILL STEAL THE LIMELIGHT THIS WEEK)

September 9, 2024

Hello everyone.

WEEK AHEAD CALENDAR

Monday, Sept. 9

10:00 a.m. Wholesale Inventories final (July)

3:00 p.m. Consumer Credit (July)

11:00 p.m. China Trade Balance

Previous: $84.7b

Forecast: $83.9b

Earnings: Oracle

Apple’s “It’s Glow Time” event

Tuesday, Sept 10

6:00 a.m. NFIB Small Business Index (August)

2:00 a.m. UK Unemployment Rate

Previous: 4.2%

Forecast: 4.2%

Goldman Sachs’ Communacopia and Tech Conference

U.S. presidential debate

Wednesday, Sept 11

8:30 a.m. Consumer Price Index (August)

8:30 a.m. Hourly Earnings final (August)

8:30 a.m. Average Workweek final (August)

Thursday, Sept 12

8:30 a.m. Continuing Jobless Claims (08/31)

8:30 a.m. Initial Claims (09/07)

8:30 a.m. Producer Price Index (August)

2:00 p.m. Treasury Budget (August)

8:15 a.m. Euro Area Rate Decision

Precious: 4.25%

Forecast: 4.0%

Earnings: Adobe, Kroger

Friday, Sept 13

8:30 a.m. Export Price Index (August)

8:30 a.m. Import Price Index (August)

10:00 a.m. Michigan Sentiment preliminary (September)

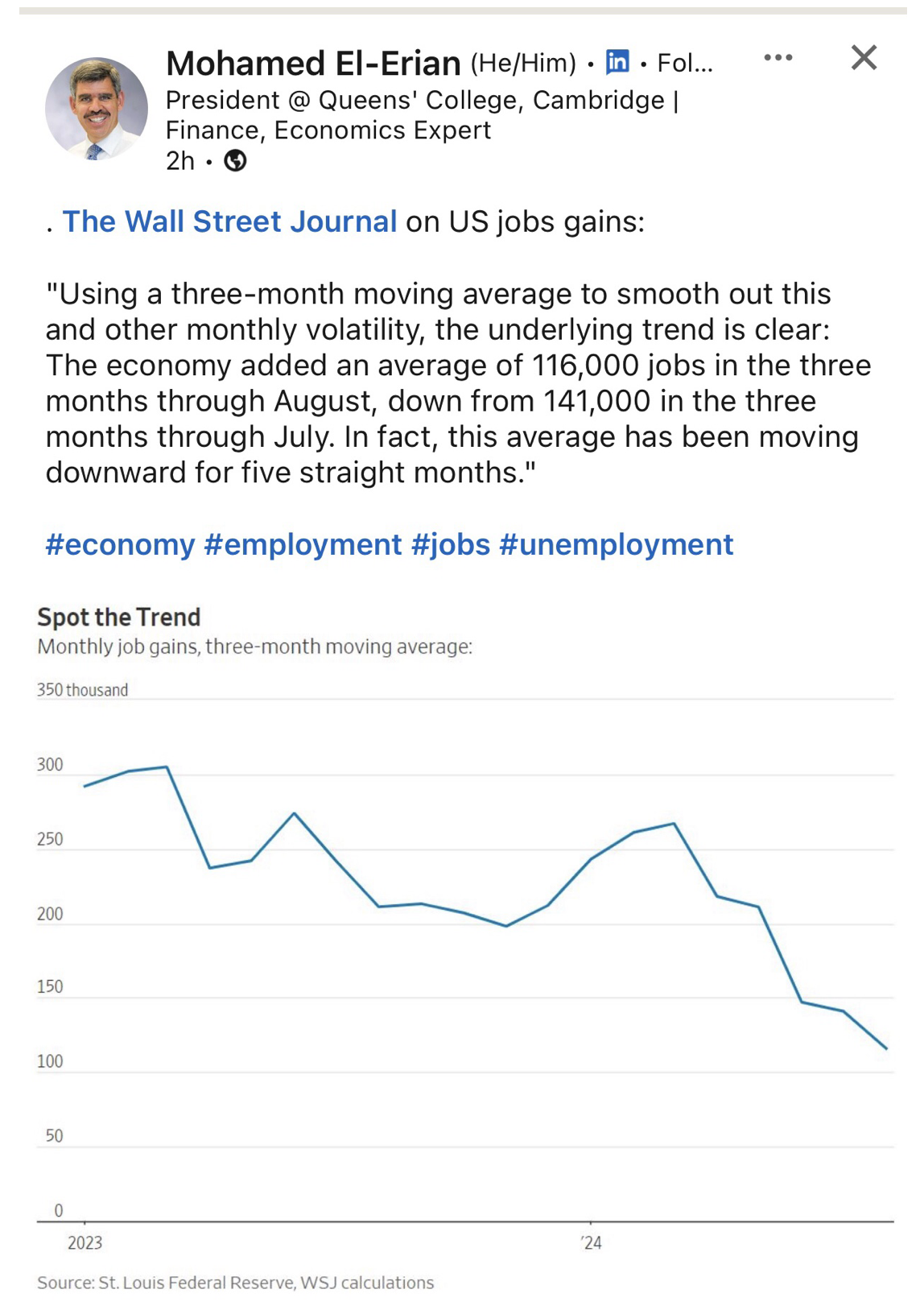

Last Friday, the highly anticipated US jobs data came in slightly lower than expected, with only 142,000 jobs added in August. The US$ shrugged its shoulders at the number but was still weaker on the week.

This week brings the euro into focus with an interest rate decision from the ECB on Thursday. Rates are expected to be lowered by 25bps. US CPI data arrives on Wednesday, with inflation expected to tick lower towards the Fed’s 2% target.

This week will also bring the first presidential debate between Vice President Kamala Harris and former President Donald Trump, an event traders will closely watch as the candidates outline their economic policies.

MARKET UPDATE

S&P500

Corrective sell-off in progress. The question on everybody’s lips: Is this a new bear market or a corrective move? At the moment I view the action in the market as a correction, and support around 5,100 should hold. A sustained break below the aforementioned level would question my thesis and risk a move toward the mid 4,000’s.

GOLD

Gold uptrend persists. Resistance = $2,530. Once this level is cleared the uptrend can extend onto the late $2,500s.

As a caution, any sustained break below $2,470, risks a move to around $$2,400.

BITCOIN

Complex Correction in progress. Resistance = $56,250/$58,500. With downside pressure dominant at the moment, we could see the $50,000 level tested and even test the mid $44k.

WHAT IS…?

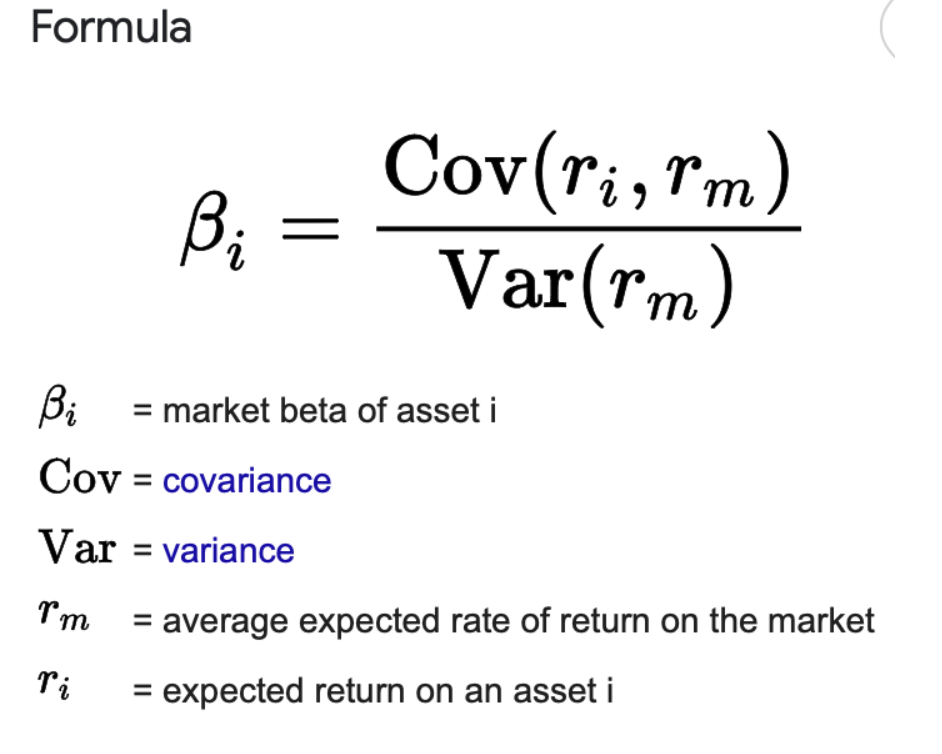

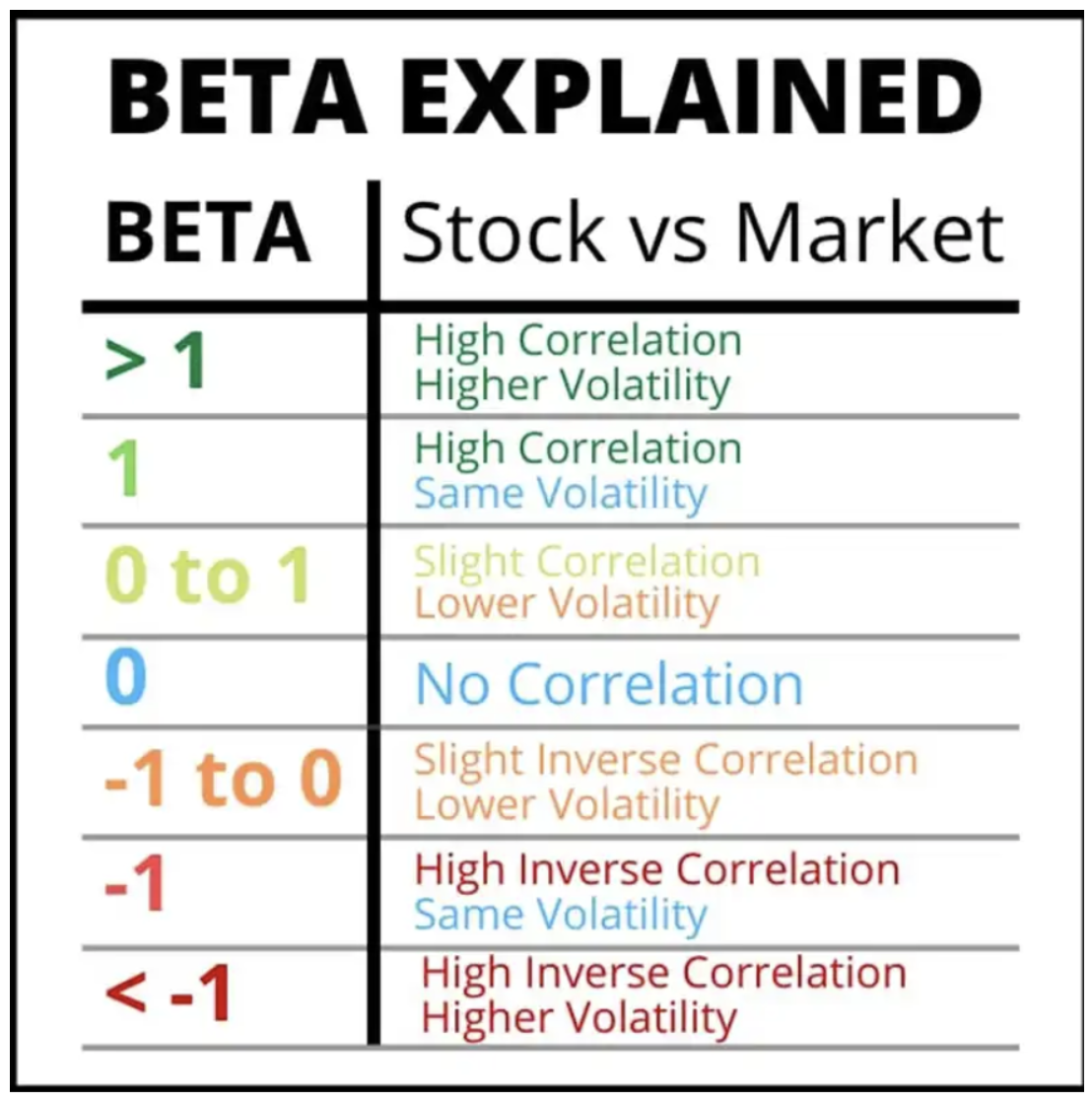

Beta is a statistical measure of a security’s risk or volatility as compared with the market as a whole.

The market has a Beta of 1.0, and individual stocks are ranked according to how much they deviate from the macro market. If stock (XXX) has a beta of 1.5, then we would expect stock (XXX) to move 50% more than the market. So, if the S&P500 moves up/down 1.0%, we would expect (XXX) to move up/down 1.5%.

A higher beta implies greater risk with the potential for higher returns, whereas a lower beta implies lower risk, but also the potential for lower returns.

How do we calculate Beta?

AUSTRALIAN CORNER

Morningstar says the following companies are stocks that investors could hold for life.

Note: this list does not cater to those who want stocks for dividend income and doesn’t consider valuation. In other words, investors need to look at different stocks for income and should wait for a retracement before scaling into any of the stocks listed here.

The filter that was used included:

- Part of the ASX 300 (well established firms with some history of success, which excludes most small caps).

- Long runway of growth opportunities (leaning toward companies that have global operations, and/or large markets to operate in).

- Economic moats (sustainable competitive advantage: network effects, intangible assets, cost advantages, switching costs, or efficient scale).

- Goods return on capital

- Sound balance sheet (Not a big reliance on too much debt to generate returns).

- Don’t rely on exceptional managers to succeed. (The business needs to stand on its merits).

- Unlikely to be disrupted (you are betting on things that won’t change).

James Hardie (ASX: JHX)

Since it pioneered the development of fiber-cement technology in the 1980s, it has dominated the fiber-cement siding category for houses in the US and Australia. It has a long runway of growth and an economic moat based on brand and scale that should keep competitors at bay, resulting in above-average returns for decades to come.

REA Group (ASX: REA)

Owns realestate.com.au – the premier online listing platform for Australian residential real estate. Even during the downturn in listings in 2022, it was able to substantially lift pricing – which demonstrated its immense pricing power and moat.

QI CORNER

Last week…

SOMETHING TO THINK ABOUT

Cheers

Jacquie