AbbVie Inc (ABBV) has transformed into one of the industry leaders in the biotech world, showing off a notable top-line growth and providing competitive dividends ever since its launch as an Abbott Laboratories (ABT) spinoff in 2013.

Despite its growth, AbbVie’s shares fell by a crushing 20% in the past year. This caused the company’s net value to trade at less than eight times forward earnings making it a blue-chip biopharma stock that could be bought for next to nothing!

What could be causing investors to sidestep this leading biotech?

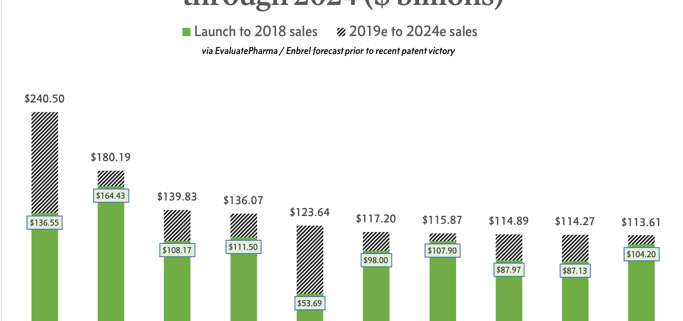

The primary reason is the dwindling sales of AbbVie’s longstanding blockbuster drug, Humira. Despite its dominance in the market today, this arthritis medication is nearing its twilight years and is anticipated to eventually succumb to competition.

The threat to Humira’s dominance in the market is a huge deal for AbbVie particularly because of its heavy dependence on the drug’s revenue. In 2018 alone, the arthritis medication contributed approximately $20 billion to the $32.7 billion annual sales of the entire company.

Humira’s status in the United States is secure until its patent expires in 2023. Unfortunately, the drug doesn’t enjoy similar protection in international markets as biosimilar competition has already challenged its presence in the European Union. This has actually hit AbbVie’s performance as global sales showed a 28% decline in the past year.

Meanwhile, AbbVie’s blood cancer treatment Imbruvica is fighting off aggressive competitors in the market. At the moment though, investors remain optimistic about Imbruvica. The drug has been reported to achieve strong growth rates, generating roughly $4 billion in yearly revenue.

With this performance, Imbruvica is projected to hit a peak of $7 billion in sales. Although the medication is projected to perform well in the hematology space, the growing number of programs geared towards creating a similar treatment remains an ongoing threat to the company.

On a positive note, AbbVie has been active in beefing up its product portfolio. So far, three promising mega blockbusters are anticipated to boost the declining sales of the company, namely, psoriasis drug Skyrizi, uterine fibroids medication Orilissa, and rheumatoid arthritis treatment Rinvoq. All three have been recently approved and are expected to be the new growth products that could keep AbbVie on top of its game.

So far, Skyrizi has only contributed $48 million in sales. However, the psoriasis treatment is expected to reach $5 billion in profits in the coming years. Pitching in to boost AbbVie’s immunology assets is Upadacitinib, a drug that the company hopes to market as the next Humira and has been submitted for priority review. If all goes well, Upadacitinib is projected to rake in as much as $6 billion in peak sales.

While these treatments are pegged as promising additions to AbbVie drug portfolio, the biotech firm took another major step towards the expansion of its product line through its acquisition of Allergan (AGN) earlier this year. Although this move ensures that more products are queued to its pipeline, the deal with the Botox-maker could pose concerns for AbbVie’s balance sheet as the terms include the absorption of Allergan’s long-term debt worth $19.6 billion.

Nonetheless, AbbVie is still an interesting stock for a lot of investors. Perhaps one of the reasons for the lingering interest in the biotech company is its current dividend yield of 6.51% -- an impressive number especially if you consider the fact that AbbVie is still in its growth phase. Since 2017, its dividend showed an increase from $0.64 quarterly to reach $1.07 quarterly in 2019.

Another reason could be its valuation. As of this writing, the stock is trading at $75.83. Taking into account its adjusted earnings per share in 2018 of $7.91 and a P/E ratio of 8.2, this is already a pretty low price for any company that’s not experiencing a decline in revenue but extremely cheap for a company that has the potential to hit a 15% profit growth and 41% increase in adjusted earnings per share.

Overall, AbbVie is really a tempting stock for investors particularly dividend investors due to its high dividend yield and growth rates. However, the decline of Humira sales remains worrisome especially if you consider how dependent the company is on the drug.

Either way, AbbVie stock is really cheap at the moment and from a valuation perspective, there’s no substantial growth estimate priced in the stock to date. Basically, it all boils down to how much trust you want to put on a company with a proven track record but with high debt levels.