Mad Hedge Bitcoin Letter

January 6, 2022

Fiat Lux

Featured Trade:

(THE US FED MOVES FRONT AND CENTER)

(BTC), (ETH)

Mad Hedge Bitcoin Letter

January 6, 2022

Fiat Lux

Featured Trade:

(THE US FED MOVES FRONT AND CENTER)

(BTC), (ETH)

The US Central Bank has confirmed our biggest fears — they plan to move faster than expected to head off hyperinflation that is crushing the cost of living in the United States.

Bitcoin has never been through this type of scenario before and the bad news for us is that Bitcoin is negatively correlated with the yield of US 10-year interest rate.

The price of crypto isn’t looking past the secular drivers of inflation, mass adoption, and store of wealth at this point because the Fed has usurped the narrative and is front and center.

The Fed is the driving force now of every asset class in the world from fiat currency to housing prices to tech stocks, yes, they are that influential.

I don’t want to sound like a broken record but until there is some sort of solution or handoff creating an easing in the accelerating interest rate expectation, Bitcoin and other cryptocurrencies are capped to the upside and exposed to the capriciousness of rate fluctuations.

The price movement tells the story of the digital gold dropping to the lowest level since its December flash crash as the first month of trading appears to have generated the conditions for unimpressive performance.

I say that because in the world of cryptocurrencies, conditions can turn on a dime, but in the short term, cryptocurrencies of all flavors will have a hard time re-accelerating.

If you had to choose one crypto to hang out in, I would choose Ethereum (ETH) because it will outperform relative to bitcoin in the long run.

This weakness won’t be the case forever. We simply need an event to greenlight the movement into crypto and that will happen sooner than later.

Bitcoin has surged by about 500% since the end of 2019 in the wake of stimulus measures put in place during the Covid-19 pandemic.

Tokens of popular DeFi applications including Uniswap and Aave are also down.

Certainly, this won’t be a buy-and-hold type of year where the price goes in one direction.

The knee-jerk reaction came out of nowhere and buyers of crypto must reload their bullets for when the time comes.

The weakness has really been in all subsectors such as bitcoin mining stocks which took a beating as analysts reconsider their outlooks after a record-breaking year.

Bitcoin had climbed to a record of almost $69,000 in early November after U.S. regulators allowed Bitcoin futures-based exchange-traded funds.

A secondary reason for today’s weakness is the geopolitical flare-ups in Kazakhstan.

The internet shutdown all over the country due to protests against inflationary pricing meaning mining computers are down.

Why does this matter?

Kazakhstan is the second-largest country for Bitcoin mining, with 18% of Bitcoin’s computing power, so the internet shutdown caused a 12% drop in Bitcoin’s hash rate within a few hours.

The hash rate is not directly correlated to the price of Bitcoin, but it gives an indication of the network’s security, a drop might scare investors in the short term.

Kazakh miners are still offline and it’s yet to see how the situation shakes out in the small Central Asian country.

The reason for these protests were inflationary prices which is a common theme all over the world and particularly higher energy prices will hurt the Kazakh bitcoin mining sector in the long run and could shift them to other jurisdictions.

Mad Hedge Bitcoin Letter

January 4, 2022

Fiat Lux

Featured Trade:

(BITCOIN HOLDS STEADY)

(BTC), (MSTR)

After Bitcoin’s asymmetric rise to $65,000, the pullback to $45,000 has been hard on all of us.

The momentum sucked out of the asset shows how fortunes can turn on a dime, but that doesn’t mean the price of Bitcoin is dead, it’s just resting.

Without pussyfooting around, the truth is that Bitcoin is highly volatile which is why I do not encourage readers to bet the ranch on it at any moment in time or on any sort of cryptocurrency.

Even the use case of it is constantly attacked almost similar to when Tesla wasn’t Tesla yet and many emerging asset classes but go through teething pains before they mature.

The bottom line is that as volatility increases, the potential to make more money quickly also increases.

Conversely, the bad news is that higher volatility also means higher risk.

When elevated volatility consumes asset prices, the possibility for above-average profit is squarely on the table, but you also run the risk of losing a larger amount of capital in a relatively shorter period of time.

That being said, it’s salient to take measure of what’s going on beneath the surface in order to take a barometer of the health of the industry development.

We aren’t in the business of buying apartment buildings with tofu-like foundations.

This disciplined approach will help you successfully navigate higher volatility asset classes and manage volatility for your benefit—while minimizing risks.

Beneath the surface, the quantity of Bitcoin (BTC) held by private corporations increased significantly during 2021, improving on the 2020 signaling a maturing of the asset class.

Many fortune 500 companies and a smattering of other public companies have scooped up significant Bitcoin purchases and are highly exposed to Bitcoin on public equity markets.

They mainly do this by buying newly minted crypto ETF’s which there are an ever-growing number of choices even though some have chosen to buy directly from crypto brokers.

This isn’t the Bitcoin of 2 years ago, things have moved on quite drastically.

And I am not just talking about MicroStrategy (MSTR) who have been outspoken about their commitment to the digital gold.

MSTR has also been a huge supporter of online seminars aimed to explain the legal considerations for firms seeking to integrate Bitcoin into their businesses and reserves.

As you see, not all companies use Bitcoin the same way, and public corporations are increasingly viewing crypto as contained to only one part of their balance sheet.

For some, they have made it their entire balance sheet on the backs of corporate bond issuances.

This is of course never happened 2 years ago.

CEO of MSTR Michael Saylor’s is a leading business intelligence firm and is known for being particularly bullish on Bitcoin, owning almost $6 billion in crypto assets.

MSTR just bought another 1,914 Bitcoin worth $94 million. The company has gained more than $2.1 billion in profit since its initial Bitcoin purchase in August 2020.

The data shows that digital currency asset management company Grayscale, a de facto bitcoin ETF and proxy of Bitcoin, had gained the highest market share by a landslide at 645,199 Bitcoin by the end of 2021. This took up 71% of the wider market as holdings of all spot ETFs and corporations together totaled 903,988 Bitcoin according to the chart.

MicroStrategy is the largest corporate investor, holding 124,391 Bitcoin valued at around $5.8 billion, according to Bitcoin Treasuries. Second-placed Tesla holds around 43,200 Bitcoin worth roughly $2 billion at current prices.

In 2020, the amount of Bitcoin held by public companies surged 400% in 12 months to $3.6 billion and 2021 showed more inroads while 2022 is poised again to shatter records.

Internally, Bitcoin and cryptocurrencies as a whole are making the right moves to consolidate this asset class as a legitimate industry whether it be DeFi apps or the growing adoption rate.

I see more public companies participating in Bitcoin as a resounding vote of confidence for the currency and this will put the asset in good stead for the long term.

For the short term, the signaling of higher interest rates has really put the kibosh on the price of Bitcoin, but that should be priced into the equation at this point.

The Fed then moving not as fast to raise could offer crypto that narrow path to higher prices.

At the very minimum, the Fed has stolen crypto’s thunder and all attention has gravitated towards what they will do next, and we can see that in how Bitcoin prices have fluctuated because of that.

I expect a slow grind up from the mid-$40,000 if the Fed signals to investors that they will raise rates slower than first imagined.

Mad Hedge Bitcoin Letter

December 30, 2021

Fiat Lux

Featured Trade:

(CRYPTO PASSIVE INCOME THE RIGHT WAY)

(CELSIUS NETWORK), (BTC), (ETH), (SNX), (CEL), (LINK), (UNI), (AAVE)

So global yields are in the toilet today?

Savings accounts don’t do what they used to do, do they?

How about we try out a certificate of deposit (CD) to harvest some cash?

Are there simply no other interest-bearing vehicles one can park capital in and gain a healthy return?

I would say you are right, but then I would be the fool here and I am certainly not in that line of work.

I will tell you — there is an elixir to the anathema!

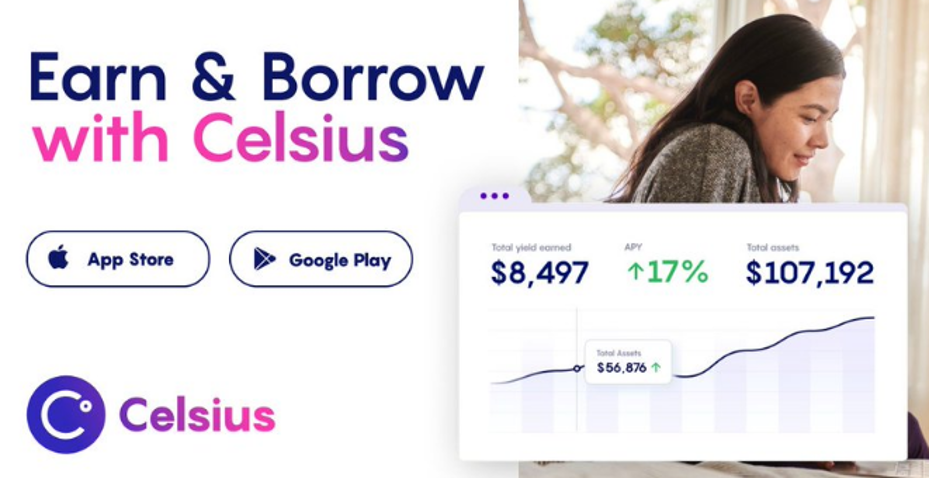

Enter Celsius.

Celsius is a crypto-based financial service hoping to disrupt traditional financial services.

They offer cryptocurrency savings accounts that yield high annual interest rates up to 17% annually. They do this by lending cryptocurrency out to institutional and retail traders who seek to leverage their positions.

Since these platforms require collateral to receive a loan, investors can be sure that the loan will be paid back one way or another.

While these rates are floating interest rates, meaning they can change with the market, they’re relatively stable month-over-month.

These loans are over-collateralized, which means the risk of default is lower than it would be for a standard loan. To this day there has never been a default for any coin on this specific cryptocurrency lending platform.

How Do Celsius Make Money?

Celsius primarily generates revenue through its crypto lending service. The company lends assets to users at a higher interest rate than it pays them for storing their assets on the platform.

Celsius has more cryptocurrencies available for interest-bearing accounts, including BTC, ETH, SNX, CEL, LINK, UNI, and AAVE to name a few.

Payouts and Withdrawals

Celsius users can withdraw their funds at any time without incurring additional fees. Those who wish to withdraw over $50,000 with a single transaction need to wait 24 to 48 hours for it to process. The company makes its weekly interest payments on Mondays.

Let the compound interest payments pile up all while exposed to minimal market risk.

Celsius confirms its holdings of $20,366,621,718 in cryptocurrency assets as of August 13, 2021.

In less than one year, Celsius has grown its total asset holdings from $1 billion to over $20 billion.

Do you want to be part of this 20X growth story?

As part of its Proof of Community (POC) and rewards explorer, Celsius provides real-time data about its assets, loans, users, and rewards paid.

This asset growth trajectory is parabolic with Celsius confirming it is adding close to $1B a month in new assets, as the company trends towards the number one position in total asset holdings in the crypto industry.

For years the traditional banking business has conditioned us naïve folk to accept steep fees and no yield earnings on holdings as the status quo.

I will tell you right now that it’s a load of garbage and nobody should accept these pitiful offers from dinosaur banks.

There is so much more out there that we can access now because of crypto.

With that failing model ripe for disruption, Celsius was built to give consumers what banks never could — a community-oriented platform that provides income and financial independence and it delivers it with a bang.

At the start, Celsius had set a goal to bring the next 100 million people into crypto. Today, they have over 950,000 users worldwide.

Celsius has even just launched its crypto-backed lending service in California following regulatory approval.

The California expansion enables the firm to enlarge its footprint in one of the fintech capitals of the world — California.

The firm claims that it now is "one of the most accessible and affordable lenders in California."

The loans can be issued in both United States dollars and stable coins, the minimum loan value is $500, the process is instant, does not need proof of income or credit check.

You are not dreaming — this is the real deal.

Wake up to fresh crypto interest payment receivables on Monday morning easily convertible into fiat currency.

Participate in one of the most unique crypto deals in the world.

To check out this deal of a lifetime, click here to visit their website.

Mad Hedge Bitcoin Letter

December 28, 2021

Fiat Lux

Featured Trade:

(THE ART OF BITCOIN MINING)

(BTC), (ASIC), (GPU)

What Is Bitcoin Mining?

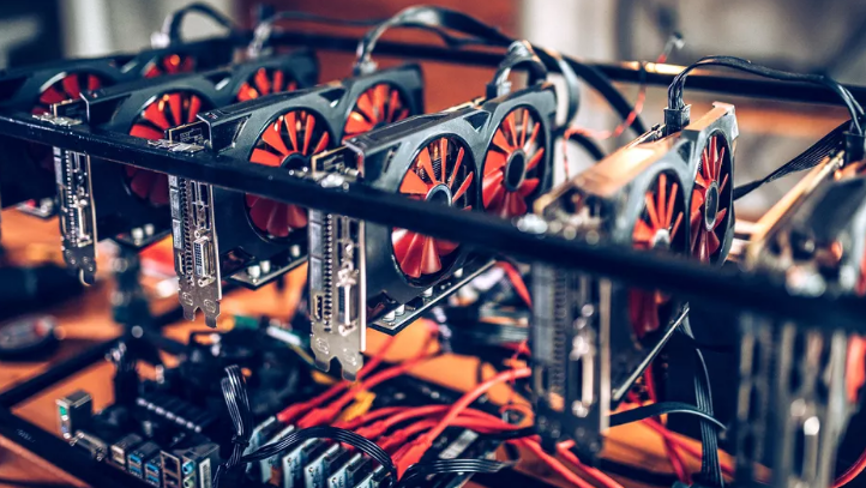

Bitcoin mining is the way in which new coins are added to the existing supply of the cryptocurrency known as Bitcoin (BTC).

These transactions are confirmed by the network and represent a critical component of the maintenance and development of the blockchain ledger.

Cryptocurrency mining is attractive to many investors interested in cryptocurrency and the most profitable are able to do it on a large scale incorporating an industrial mindset.

How Do I Mine Bitcoin?

Mining Bitcoin is not for the faint of heart.

Your computer must solve complicated math problems that verify transactions in the currency.

When a bitcoin is successfully mined — the miner receives a bitcoin.

One can use a normal computer that has a CPU, motherboard, RAM, and storage to mine bitcoin.

The only difference and the most important requirement here is the graphics processing unit (GPU) or the video card.

A high-performance GPU is a must if a person wants to mine Bitcoin.

Bitcoin mining is done using hardware called ASICs that is short for Application-Specific Integrated Circuits.

Another obligatory requirement is electricity for mining machines.

The largest bitcoin miners are usually found in countries with low-cost electricity.

Miners need robust infrastructure to mine mainly energy and equipment.

How do I do it at home?

A company called Compass Mining is betting that individuals will want to partake in bitcoin mining.

There’s a lucrative payout — if you’re lucky enough to mine a coin.

But the hassle of operating a mining rig can certainly cut into profits.

Compass’ new retail program will allow the purchase of a single application-specific integrated circuit (ASIC) mining rig that they can set up at home.

Mining corporations usually buy in bulk — this finally gives the little guy a chance.

Brands include top-of-the-line ASICs WhatsMiner series from MicroBT and the Antminer series from Bitmain, offering 78 to 95 Tera hashes per second and ranging in price from $8,100 to $10,400.

Profitability calculators can help you estimate your potential ROI.

Rigs are noisy and hot so it’s not for everyone.

Potential miners really need to do their due diligence if they want that sort of environment in their house.

About the size of a desktop computer tower, they can emit between 50 and 75 decibels of noise, which is roughly the same level as a vacuum cleaner or a hairdryer.

Just like the work-from-home paradigm was borne out of the pandemic, many who want to mine bitcoin, wish to do it from the confines of their couch and man cave.

The demand for mining hosting sites in North America has been outstripping supply. Encouraging bitcoin enthusiasts to set up their own operations at home is one way to relieve the pressure on existing hosting infrastructures.

China has now initiated a blanket ban on cryptocurrencies opening up opportunities for alternative miners before these Chinese mining operations relocate abroad.

The crackdown nearly halved the mining difficulty for the entire Bitcoin network. Miners outside China have been able to mine more bitcoin given the record low mining difficulty, raking in high revenue.

Corporate self-mining companies, such as Marathon and Riot, as well as third-party hosting sites, are facing a shortage in infrastructure to support more mining operations.

Higher bitcoin prices also mean more incentives for potential miners to flood this industry.

If Compass doesn’t seem right for you, then buying mining machines either from Chinese miners or from mining machine manufacturers through e-commerce platforms such as Alibaba and eBay could be a great option.

Individual mining rigs from Compass are expected to deliver within two to three weeks.

Mad Hedge Bitcoin Letter

December 23, 2021

Fiat Lux

Featured Trade:

(HOW TO SET UP A CRYPTO TRADING ACCOUNT)

(BTC), (COIN)

Mad Hedge Bitcoin Letter

December 16, 2021

Fiat Lux

Featured Trade:

(ANOTHER WAVE OF CRYPTO ADOPTION IS COMING)

(BTC)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.