I am convinced that Congress will fail to act swiftly to head off the debt ceiling crisis that every trader should circle on their calendar.

December 15 is the day and that gives us only half a month for Congress to raise the federal debt limit, and Senate Majority Leader Charles Schumer and Minority Leader Mitch McConnell are miles apart.

Much of the trading these days is fueled by algorithms that decide on buying and selling based on the market data and this software is about to get bombarded with the U.S. possibly defaulting on their debt obligations.

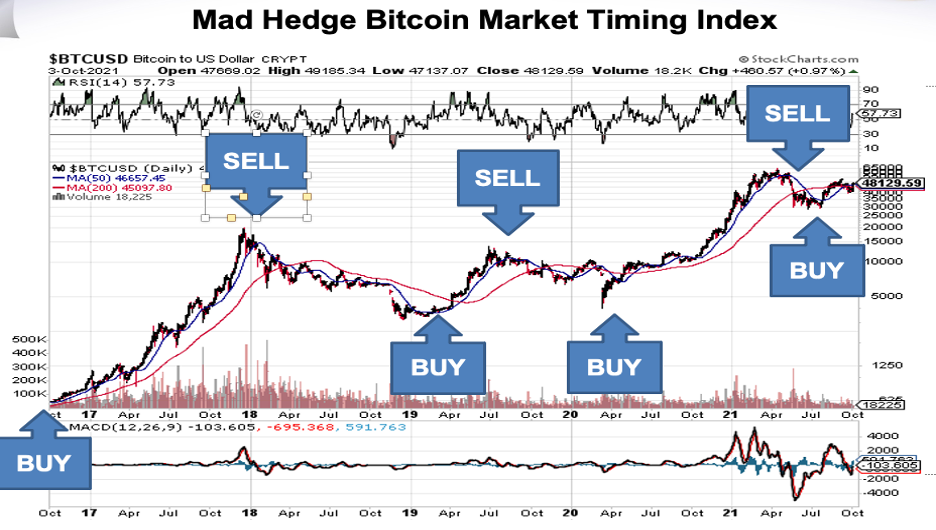

The scare of a default or the perceived threat of a default, even if nobody thinks it will happen, will lend credibility for alternative assets namely Bitcoin and crypto-assets.

It’s hard for me to see Bitcoin not going up in the next 2 weeks and I believe traders should play from the $58,000 level which is the line of technical support.

Another flashing green indicator is the exploits of CEO of MicroStrategy (MSTR) Michael Saylor who has piled into the digital gold as his predominant strategy.

MSTR spent $414 million in buying 7,002 bitcoins yesterday.

MicroStrategy bought the coins at an average of $59,187 per Bitcoin. He added that following this latest acquisition, MicroStrategy now holds 121,044 bitcoins, and it used $3.57 billion to acquire them.

MicroStrategy is already profitable regarding its cryptocurrency investment. Its 121,044 bitcoins are worth $6.81 billion, a profit level of nearly 100%. There is not a bigger bull out there than Saylor who has staked his existence on the digital gold going higher.

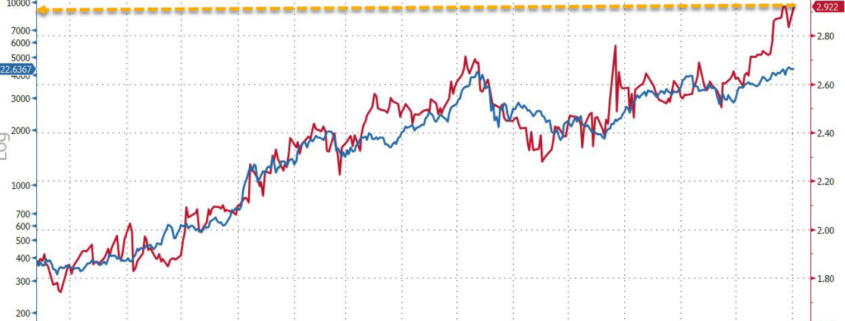

Another positive indicator is the growing margin leverage ratio which shows more borrowed funds that will be bet on the price of bitcoin going up.

Less leverage in the system means less capital flowing to buy crypto.

What’s marinating in Washington?

Democrats insist that Schumer will not waste a week of Senate floor time to use the budget reconciliation process to raise the debt limit with only Democratic votes.

Both leaders hope to circumvent another brutal fight, but McConnell and Republicans are poised to really play hardball for this one.

McConnell was criticized for laying an egg during the last debt ceiling crisis and giving up negotiating leverage.

If McConnell doesn’t extract something on spending out of Democrats, especially when we’re looking at the Build Back Better bill possibly passing the Senate in some form, it’s an abject failure.

The conundrum is fueling predictions within the Senate that Treasury Secretary Janet Yellen will push the deadline for increasing the nation’s borrowing authority until January or February which is a positive event for the price of Bitcoin.

Yellen could find a couple of extra quarters in the cushions and push it to January or February, but it’s not a 2-foot putt.

Also, Democrats are nixing the Republican argument that Yellen has the flexibility to extend the deadline into January or February.

Yellen also warned leaders this month that the passage of the $1 Trillion Infrastructure Investment and Jobs Act gave her less room to maneuver because it requires a $118 billion transfer to the Highway Trust Fund by Dec. 15.

Bitcoin’s function as a rock-solid market hedge has never been more applicable as Congress is behaving almost as if money is unlimited and as if there are no consequences to that assumption.

What we are going to slowly see is that in terms of attractiveness, crypto will be that shiny wrapper compared to stocks and gold.

Even if the odds of a real default are almost zero, there could be some sort of technical default, Bitcoin will be that safe haven if the unthinkable comes to pass.

More and more people are coming to a realization they need a Plan B.

Back on the battlefield, it’s almost impossible in any plausible way that the inflationary genie with be bottled up any time soon unless it’s a nominal Fed speak victory.

The U.S. government is just too far past the point of possible return and whether it is labeled as the omicron variant, supply chain constraints, energy shortages, tight labor market, or however you want to fill in the blank, these events are almost all entered through the narrow prism of politics intersected with politics and the output is inflation.

Inflationary in the sense they add costs to either the national debt or the cost of existing as a human in the modern world and sooner than later, everyone will conclude the only way to counteract these forces are alternative assets or cryptocurrencies