I get many inquiries asking me how to set up an account to buy Bitcoin (BTC) and so it’s gotten to the point where I will walk new readers through the process of setting up a cryptocurrency account at Coinbase (COIN).

The signup process is actually highly straightforward and only takes minutes.

Why sign up for Coinbase?

This is an exchange that is highly popular and already has a large customer base.

Investors who can’t stomach the higher risk of exposing capital to an unregulated exchange should just dabble in bitcoin-connected ETFs which is completely reasonable.

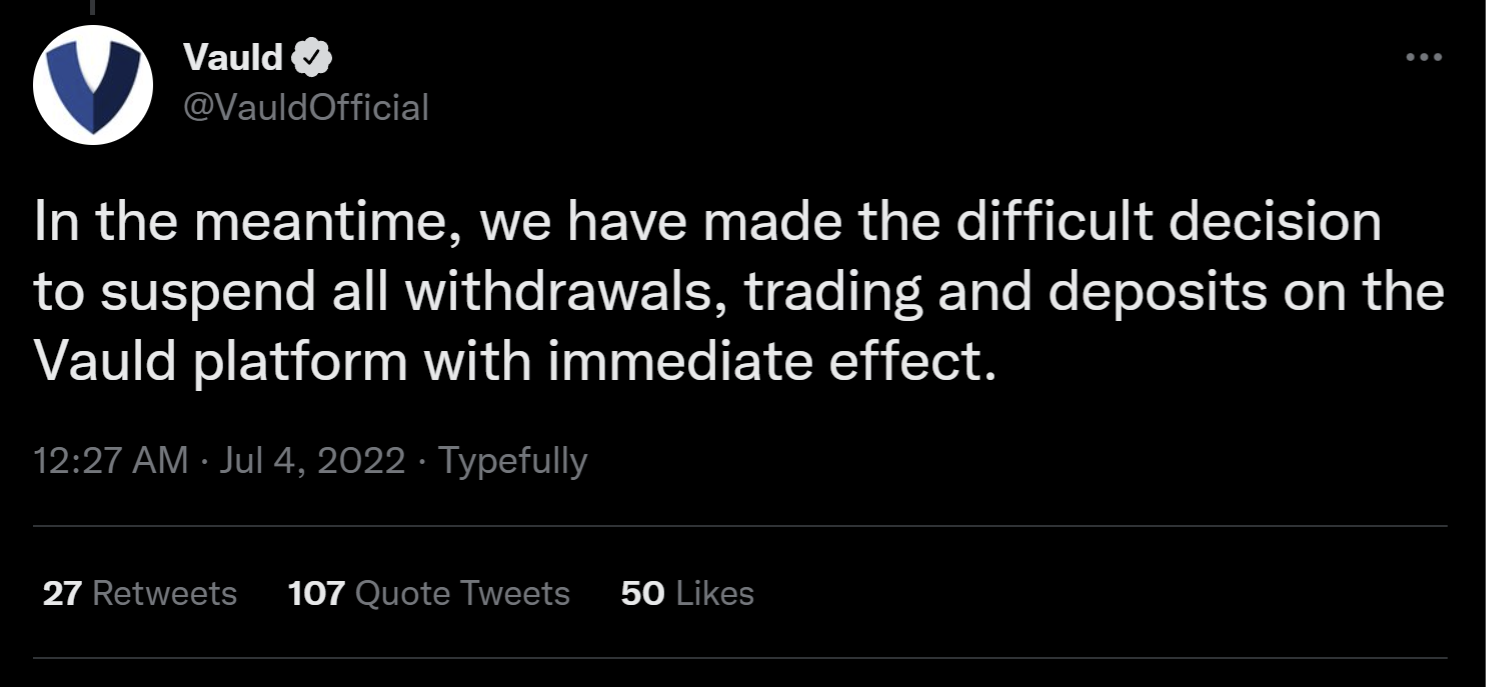

Due to a spate of recent crypto exchange bankruptcies, some might be hesitant to get their capital tied up in bankruptcy hearings, but it’s my job to let readers know this option is out there.

COIN is still a major part of the crypto infrastructure.

Readers just only invest as much as they are willing to lose in crypto due to its higher than median volatility and underperformance the past 10 months.

Let’s get this party started.

1)

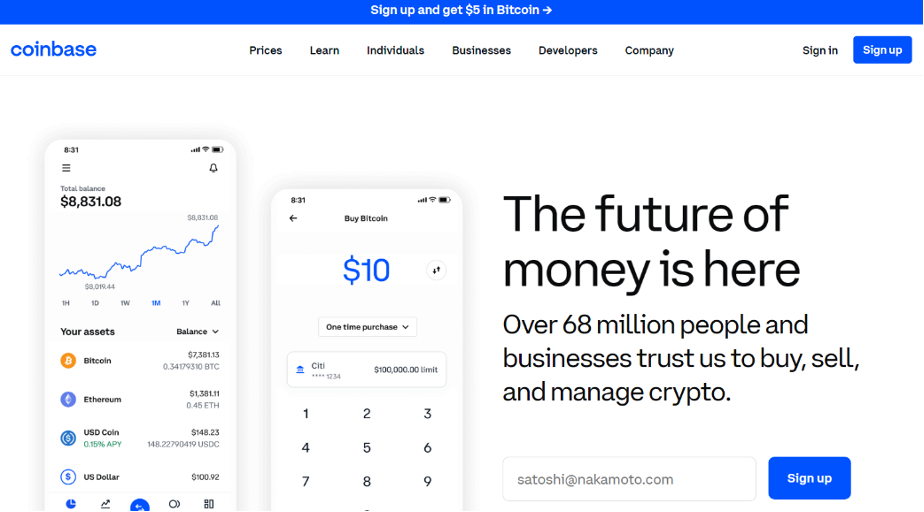

As many might assume, one must open their browser and head to www.coinbase.com to kick off the process. Once there — you’ll be greeted by an interface where the right choice is to click “sign up” in the upper right corner.

2)

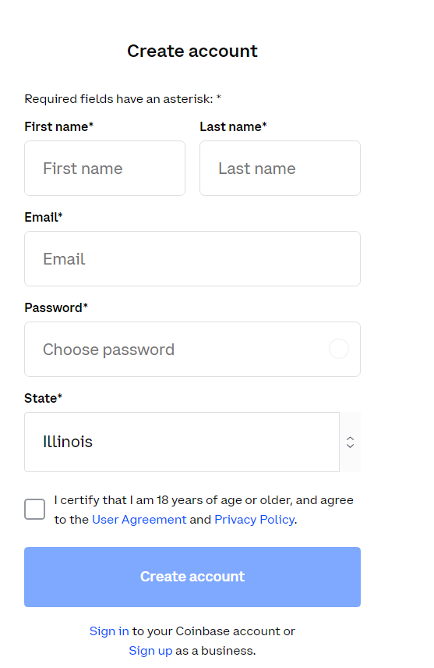

A screen box pops up requiring personal information which is basically a full name, email address, password, and state. I am also assuming the user is from the United States. After clicking the agreement that the user is 18 years or older and consenting to the user agreement, click “Create account.”

3)

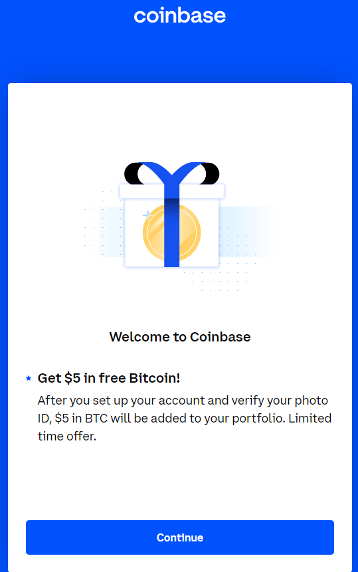

Technically, an account has now been created and a screen pops up offering $5 of Bitcoin if one verifies a photo ID which is completely optional. The screen let me know that it was a “limited time offer” so this offer might be gone when others sign up or it might still be there. Either way, click “Continue.”

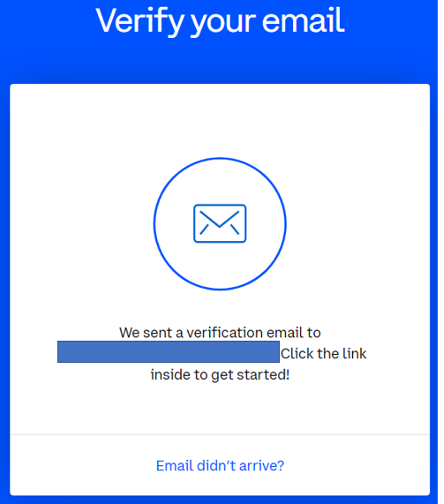

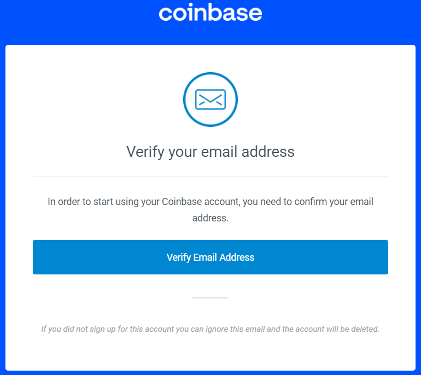

4)

After the creation of the account, the next step is to click the verification link in the email that was provided. Simply go into the email inbox given, open the email, and click “Verify your email address.”

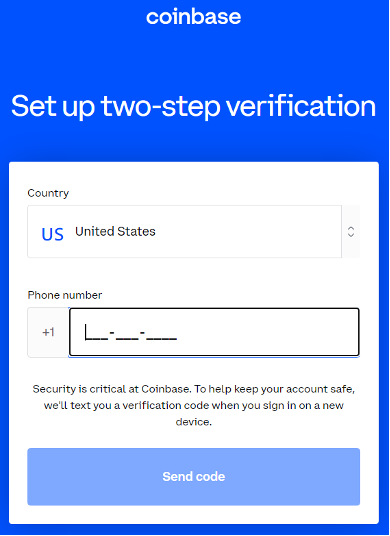

5)

The next step is to provide a phone number for a two-step verification. This added level of security, makes it so it’s difficult to use your account without your phone number. Select the country, enter the phone number, then click “Send code.”

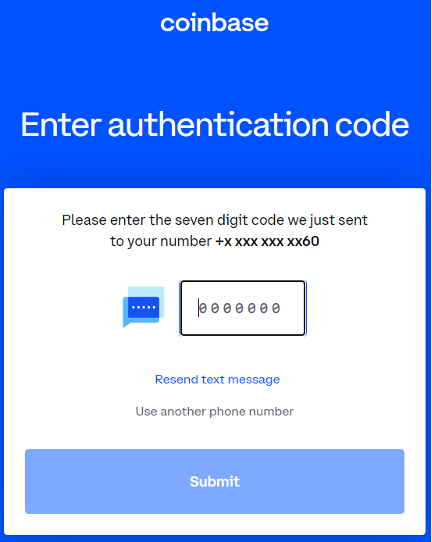

6)

Enter correct authentication code sent to the phone number provided then click “Submit.”

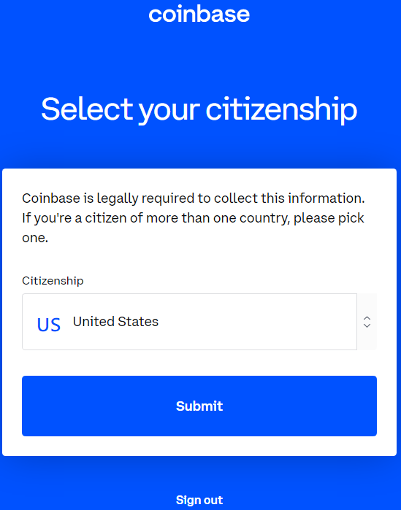

7)

Select citizenship of the account holder then click “Submit.”

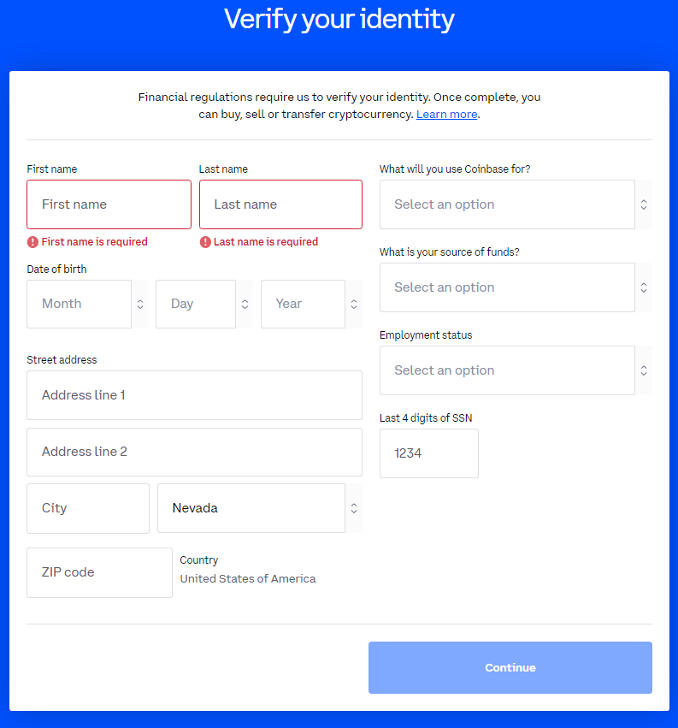

8)

Verify identity by filling in personal information including full name, date of birth, street address, city, last 4 digits of social security’s number, and zip code. Then answer a few more questions about what you will use Coinbase for, source of funds, and employment status then you’re good to go.

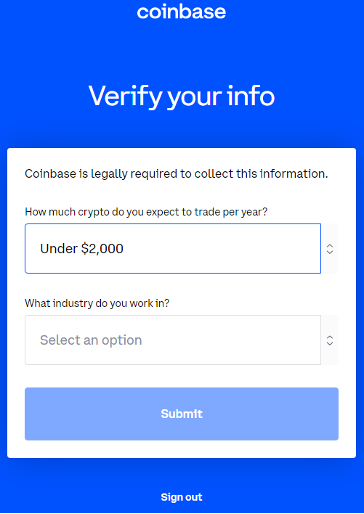

9)

The last step of verifying your info are two questions asking the user “How much do you expect to trade per year?” and “What industry do you work in?”

After you answer these two, then click “Submit.”

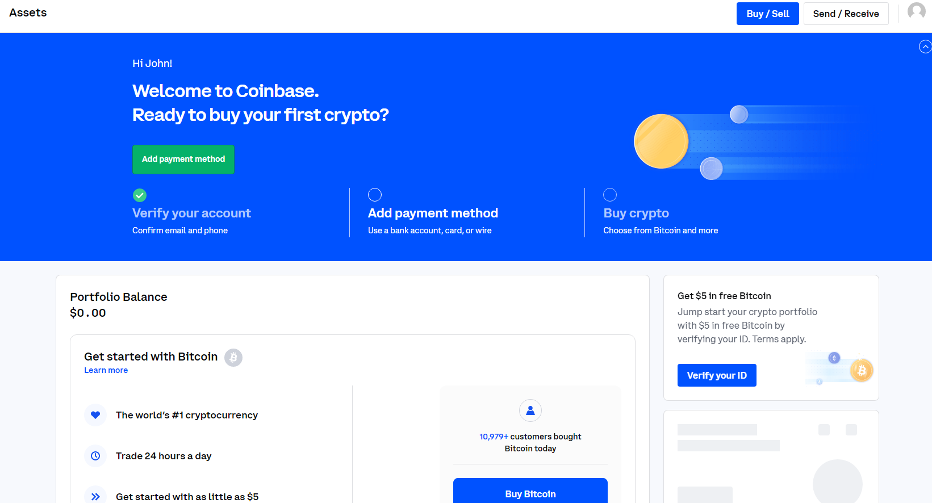

10)

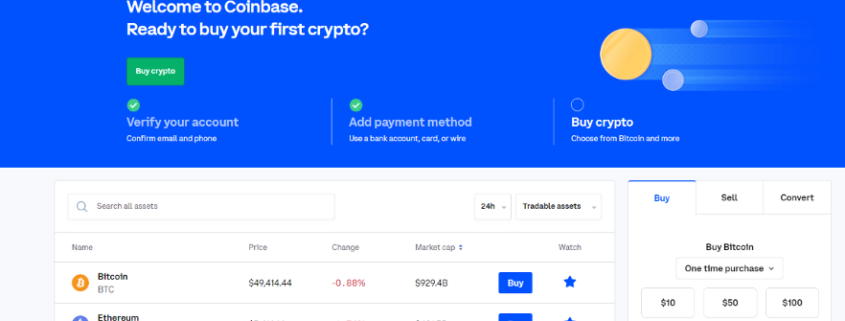

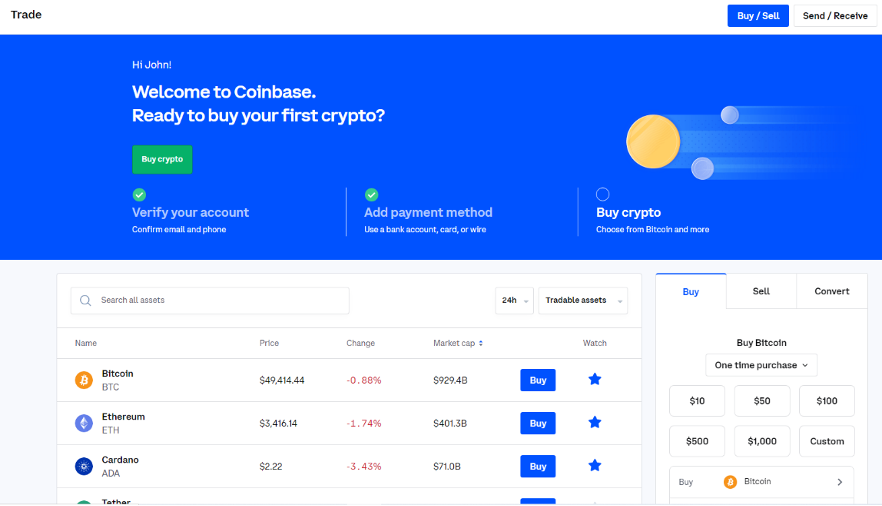

That was the last of the personal questions and after clicking submit, the new user is directed to the trading interface showing a portfolio balance of $0.00. The next step is to click “Add payment method” in order to divert some fiat currency into the Coinbase account.

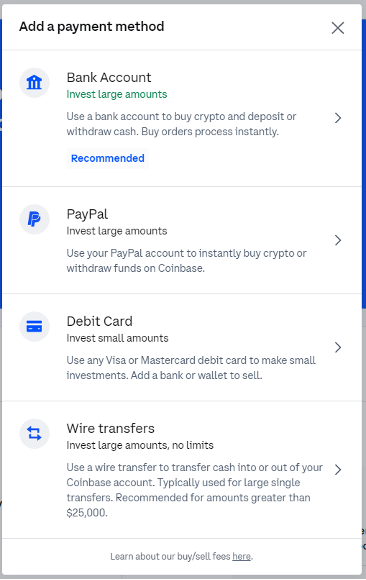

11)

There are different options available, and I personally chose “Bank Account” for its ease of use and free fees.

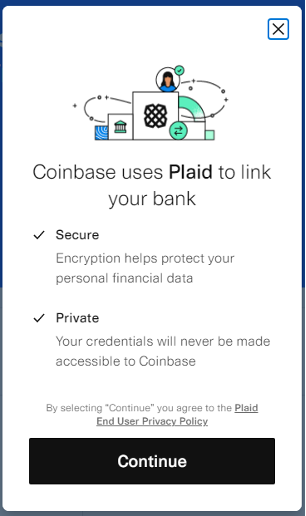

12)

A box pops up asking me to agree to the Plaid End User Privacy Policy. This is software that links Coinbase to your bank account.

For anyone who doesn’t want that linked, I would advise using one of the other three options.

Click “Continue” to proceed.

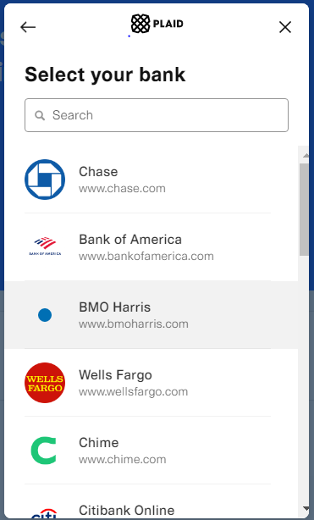

13)

Select your bank — provide your bank information.

14)

Bank Account is now linked — immediately buy any cryptocurrency available on Coinbase. Pat yourself on the back for a job well done!